RBC’s flagship credit card in the Avion family, the RBC® Avion Visa Infinite†, offers a consistently high welcome bonus, strong insurance, and a flexible, valuable points currency, all for a reasonable annual fee.

In fact, we consider the RBC® Avion Visa Infinite† as RBC’s best overall credit card product.

At the same time, there are some areas in which the RBC® Avion Visa Infinite† falls behind competitors, which we’ll go over in detail in this review.

At a Glance | |

Annual fee: | $120 |

Supplementary cardholders: | $50 |

Minimum annual income: | $60,000 (personal), $100,000 (household) |

Estimated credit score: | Good to excellent |

Rating: | 4/5 |

In This Post

Consistently High Welcome Bonus

One of the most attractive features of the RBC® Avion Visa Infinite† is the consistently high welcome bonus.

The welcome bonus tends to fluctuate between 35,000 and 55,000 Avion points, with 55,000 points being the card’s all-time high offer.

Typically, a large portion of the welcome bonus is awarded upon approval or upon making your first purchase, which is an easy way to quickly boost your balance. Sometimes, the entire welcome bonus is awarded upon approval, which is even better.

If there’s a second allotment as part of the welcome bonus structure, it’s usually earned after meeting a reasonable minimum spending requirement of $5,000 or so within the first three-to-six months as a cardholder.

- Earn 35,000 Avion points upon approval^

- Earn 1.25x Avion points on qualifying travel purchases

- Transfer Avion points to British Airways Executive Club and other frequent flyer programs for premium flights†

- Redeem Avion points for flights with the RBC Air Travel Redemption Schedule†

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $120

- Supplementary card fee: $50

We value Avion points at 2 cents per point. Using this valuation, we estimate that a welcome bonus of 35,000 points would be worth around $700, and a welcome bonus of 55,000 points would be worth around $1,100.

Depending on how you choose to redeem your points, they could be worth more or less than these estimates, and we’ll speak to some of the different (excellent) redemption options in detail below.

Straightforward Earning Rates

The earning rates on the RBC® Avion Visa Infinite† are quite simple, and are structured as follows:

- Earn 1.25 Avion points per dollar spent on qualifying travel purchases†

- Earn 1 Avion point per dollar spent on all other qualifying purchases†

Indeed, perhaps the biggest downside of the RBC® Avion Visa Infinite† is the card’s lack of elevated earning rates on common purchases, such as groceries, gas, and restaurants, which often have 2–5x multipliers on other travel credit cards in the Canadian market.

Once you’ve fulfilled the requirements to unlock the welcome offer, building up your Avion points balance is a slow-and-steady process with these 1–1.25x earning rates, especially if you’re not a big spender.

One way to finesse your way to a faster earning rate is to build what we’ve termed as “The Optimized RBC Credit Card Portfolio“.

Briefly, the RBC® ION+ Visa offers an excellent category earning rate of 3 Avion points per dollar spent on grocery, dining, food delivery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming and digital subscriptions.† This makes it a great card to use for any of these purchases, as the earning rate is up to 3x higher than the RBC® Avion Visa Infinite†‘s.

If you happen to hold both an Avion product (such as the RBC® Avion Visa Infinite†) and the RBC® ION+ Visa, you can easily pool your points together into a single account, getting the best of both worlds (great earning rates on the RBC® ION+ Visa, and excellent redemption options as an Avion cardholder).

Flexible & Valuable Avion Points

Compared to similar credit cards offered by other Canadian banks, redeeming points is where the RBC® Avion Visa Infinite† really shines.

In fact, in Canada, Avion points is the only rewards currency other than American Express Membership Rewards (and Marriott Bonvoy) that offers the ability to transfer points to external loyalty program partners.

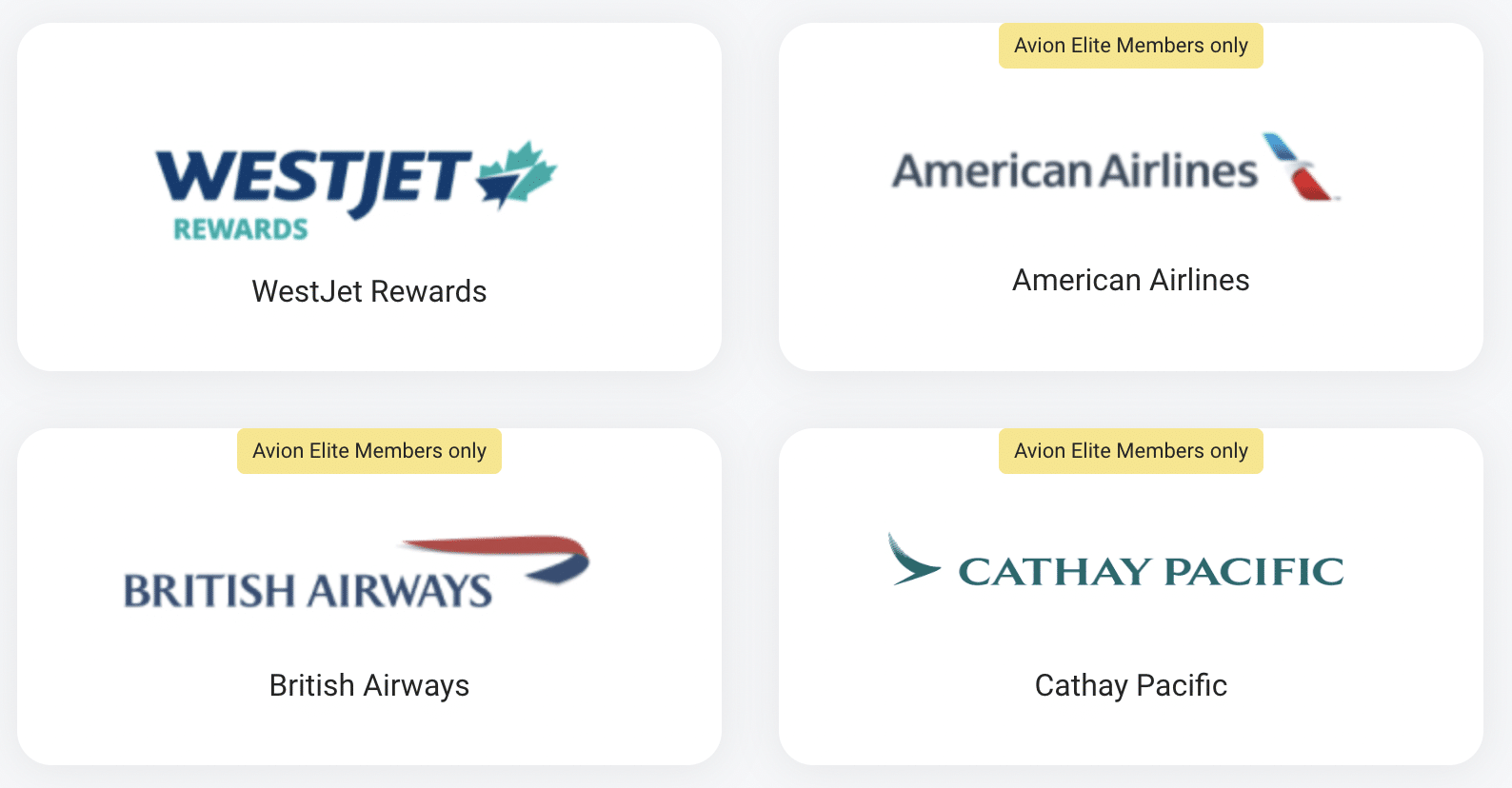

As an Avion cardholder, you’ll enjoy membership in the Avion Rewards program at the Elite tier, which means that you can transfer Avion points earned through the welcome bonus and on daily spending to the following loyalty programs:

- The British Airways Club at a 1:1 ratio

- Cathay Pacific Asia Miles at a 1:1 ratio

- American Airlines AAdvantage at a 1:0.7 ratio

- WestJet Rewards at a 100:1 ratio

Plus, RBC often offers transfer bonus promotions throughout the year, during which the transfer ratio is boosted by 10–50%.

By transferring Avion points to one of the above airline loyalty programs – ideally when there’s a transfer bonus – you’ll be able to unlock value from a whole range of award flights in economy, premium economy, business class, and even First Class.

Of the four programs available to you, we’d recommend focusing on The British Airways Club, Cathay Pacific Asia Miles, and American Airlines AAdvantage. All of these programs offer excellent access to airlines in the oneworld alliance and opportunities for outsized value.

Meanwhile, we value WestJet points at 1 cent per point, and Avion points at 2 cents per point. Therefore, if you transfer Avion points to WestJet Rewards, you’d be leaving value on the table.

If you don’t want to worry about finding award space or navigating loyalty programs, RBC offers a great in-house option called the RBC Air Travel Redemption Schedule, which also provides a great return for your points.

With the RBC Air Travel Redemption Schedule, you can redeem Avion points for economy flights close to home or around the world and get an elevated value of up to 2.3 cents per point, depending on the route.

Alternatively, if you’re looking for the most straightforward redemption possible, you can also redeem Avion points at a rate of 1 cent per point against any eligible travel expenses charged to your RBC® Avion Visa Infinite†.

Strong Insurance Coverage

Overall, the insurance coverage on the RBC® Avion Visa Infinite† is fairly strong, and it stands out in a few ways compared to competitors.

For example, the emergency medical insurance on the RBC® Avion Visa Infinite† is unlimited in terms of its dollar amount.† This coverage applies for up to 15 days for eligible travellers who are under 65 years old, and for three days for eligible travellers who are 65 years and older.†

Comparatively, other cards usually cap this insurance benefit at $1 million or $2 million in coverage. However, many other cards also have more generous coverage periods and age categories than those offered by the RBC® Avion Visa Infinite†.

A second standout part of the RBC® Avion Visa Infinite† insurance offerings is the purchase security insurance that covers loss or accidental damage for up to 90 days following the purchase of eligible items with your card.†

Notably, this coverage is for up to $50,000 each calendar year,† making the RBC® Avion Visa Infinite† a great choice for larger purchases.

Lastly, the mobile device insurance on the RBC® Avion Visa Infinite† will cover up to $1,500 if your phone is lost, stolen, suffers accidental damage, or experiences mechanical failure for up to two years from the date of purchase.†

This provides you with the reassurance that you won’t be left with out-of-pocket expenses if anything unfortunate happens to a new device that you purchased with your RBC® Avion Visa Infinite†.

What Else Does the Card Offer?

The RBC® Avion Visa Infinite† comes with some other perks and benefits worth highlighting.

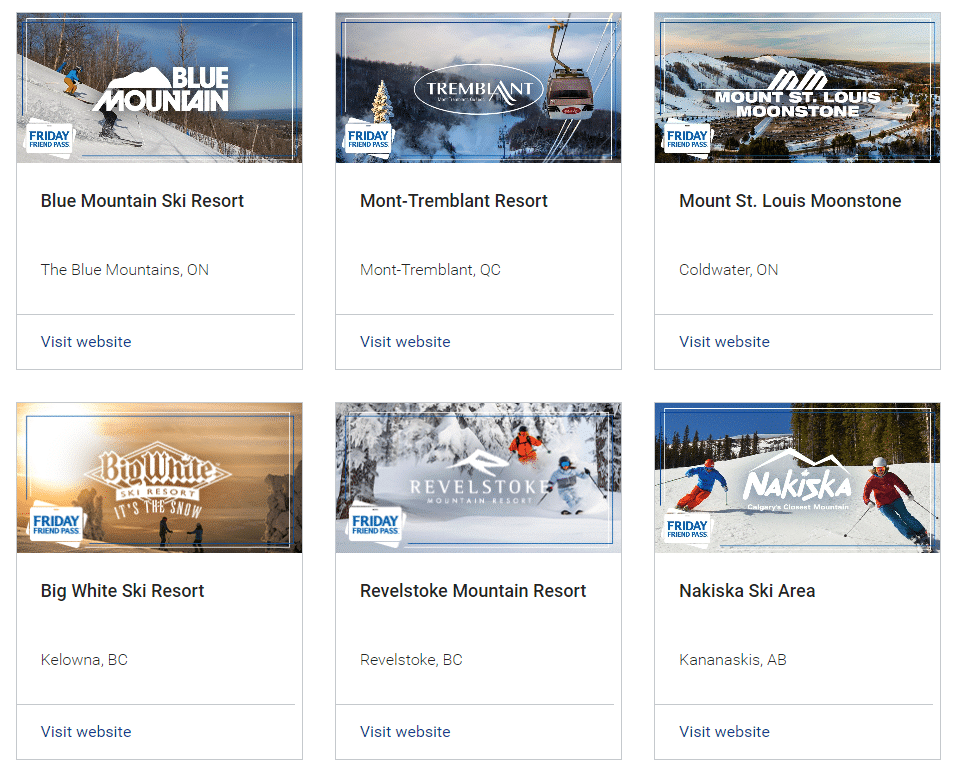

For the past few years, RBC has offered the Friday Friend Pass, which gives cardholders a free second lift pass when purchasing a full-price lift pass at many major ski resorts in Canada.†

If you’re able to make use of this benefit, it’s a great feature that can wind up saving you money when you hit the slopes with a friend or family member.

Additionally, on the Avion Rewards dashboard, you’ll also find a series of RBC Offers for earning bonus Avion points or saving you money on travel and experiences.

For example, one offer that has popped up before is the opportunity to earn extra Avion points when spending at Canadian Marriott Hotels.

With this type of offer, simply charge your hotel stay to your RBC® Avion Visa Infinite†, and you’ll earn bonus points.

The card also comes with other features that can help you save on some daily purchases.

By linking your RBC® Avion Visa Infinite† to a Petro-Points card, you’ll save 3 cents per litre on gas at Petro-Canada, and you’ll also earn more Petro-Points.†

You’ll also receive a complimentary DoorDash DashPass subscription for 12 months, which gives you $0 delivery fees with DoorDash.†

Alternative Cards to Consider

While the RBC® Avion Visa Infinite† offers a generous welcome bonus and access to flexible Avion points, there are other cards worth considering, too, depending on your priorities.

For example, the American Express Cobalt Card also earns flexible rewards points that can be transferred to even more partners, and its earning rates are much stronger than those of the RBC® Avion Visa Infinite†.

Recall that with the RBC® Avion Visa Infinite†, you’ll only earn 1–1.25 Avion points per dollar spent, depending on the purchase.

With the American Express Cobalt Card, you can earn 5 Membership Rewards points per dollar spent on dining and groceries, 3 Membership Rewards points per dollar spent on streaming services, 2 Membership Rewards points per dollar spent on gas, public transit, and travel purchases, and 1 Membership Rewards point per dollar spent on all other purchases.

If you have a high volume of spending in any of the accelerated categories, you’ll wind up with a boosted points balance much faster than making the same purchases on the RBC® Avion Visa Infinite†.

Note that it’s a good idea to consider the RBC® ION+ Visa as an option to use wherever you can’t use the Cobalt Card for dining or groceries, too.

If you’d like to add a card for spending outside of Canada and some complimentary lounge visits, the Scotiabank® Passport Visa Infinite* Card is a great choice.

While the welcome bonus generally isn’t as high as the RBC® Avion Visa Infinite† and the Scene+ points you earn aren’t transferable to airline or hotel partners, the Scotiabank Passport Visa Infinite Card comes with no foreign transaction fees and six complimentary airport lounge visits per year.

Consider this card as a good alternative if you spend a lot outside of Canada, don’t see yourself transferring points to airline partners, and can make use of the complimentary lounge visits.

Conclusion

The RBC® Avion Visa Infinite† is a great credit card, and has earned our pick as the best overall RBC credit card product.

However, the RBC® Avion Visa Infinite† falls behind the competition in terms of earning points on daily spending given the card’s straightforward earning rates.

It’d be nice to see some more travel benefits added to the card’s features, such as complimentary airport lounge access and no foreign transaction fees, in addition to increased category earning rates.

However, if you’re looking for a travel credit card with a constantly high welcome bonus and flexible points for a reasonable annual fee, the RBC® Avion Visa Infinite† is one of the best.

†Terms and conditions apply. Refer to the RBC website for up-to-date offer terms and conditions.

P2 is adamant about shopping at Superstore and getting gas at Petro Canada (which don’t take Amex). So our best strategy was to get the Ion+, which earns double the points on those categories and combined with this card, let’s us redeem the “elite” points.

Petro Canada does accept American Express, however you are correct in that the RBC ION+ is about as good as it gets in Canada for multipliers at gas stations. At Petro Canada specifically, you also save 3 cents per liter and earn 20% more Petro points when you link your eligible RBC credit card with your Petro Points membership. The American Express Business Edge card also earns 3x at gas stations, if you prefer transferability to other partners like Aeroplan.

How would you rank the one that the HSBC customers got with grandfathered no foreign transaction fees

There’s no welcome bonus points for those who got transitioned from HSBC.