The New Scotiabank Passport® Visa Infinite Privilege* Card

Scotiabank has officially launched the Scotiabank Passport® Visa Infinite Privilege* Card, a premium travel credit card designed for high-spending travellers who want a combination of strong earning rates, elevated perks, and no foreign transaction fees.

With a juicy welcome bonus, 10 complimentary airport lounge visits, and an annual travel credit, this card is positioned as one of the best premium fixed-value travel credit cards in Canada.

Let’s take a closer look at this card, and see how many features it boasts to help justify its $599 annual fee.

Welcome Bonus & Annual Fee

As an introductory welcome bonus, the Scotiabank Passport® Visa Infinite Privilege* Card is offering up to 80,000 Scene+ points, awarded in three stages:

- 30,000 Scene+ points after spending $3,000 in the first three months.

- 30,000 Scene+ points after spending $20,000 in the first six months.

- 20,000 Scene+ points after making at least one purchase in the 14th month after account opening.

Since Scene+ points have a fixed value of 1 cent per point, this welcome bonus alone is worth up to $800.

The annual fee for the card is $599, and supplementary cards cost $199 per year. However, Scotiabank offers a $150 rebate on the annual fee for those who hold a Scotiabank Ultimate Package banking account.

While $800 in travel value sounds impressive, it’s important to note that maximizing the full bonus requires $20,000 in spending within the first six months — which isn’t feasible for everyone.

First-year value

$351

Annual fee: $599

• Earn 30,000 points upon spending $3,000 in the first 3 months

• Earn 45,000 points upon spending $20,000 in the first 6 months

• Plus, earn 25,000 points upon spending in month 13

Earning rates

Key perks

- No foreign transaction fees

- 10 Visa Airport Companion lounge visits per year

- Priority security at Toronto Billy Bishop, Montreal, Ottawa

- Visa RSVP Diamond at 60+ Sandman/Sutton hotels

- Troon Rewards Platinum (20% off at 150+ golf courses)

- $250 annual travel credit via Scene+ Travel

Annual fee: $599

• Earn 30,000 points upon spending $3,000 in the first 3 months

• Earn 45,000 points upon spending $20,000 in the first 6 months

• Plus, earn 25,000 points upon spending in month 13

Earning rates

Key perks

- No foreign transaction fees

- 10 Visa Airport Companion lounge visits per year

- Priority security at Toronto Billy Bishop, Montreal, Ottawa

- Visa RSVP Diamond at 60+ Sandman/Sutton hotels

- Troon Rewards Platinum (20% off at 150+ golf courses)

- $250 annual travel credit via Scene+ Travel

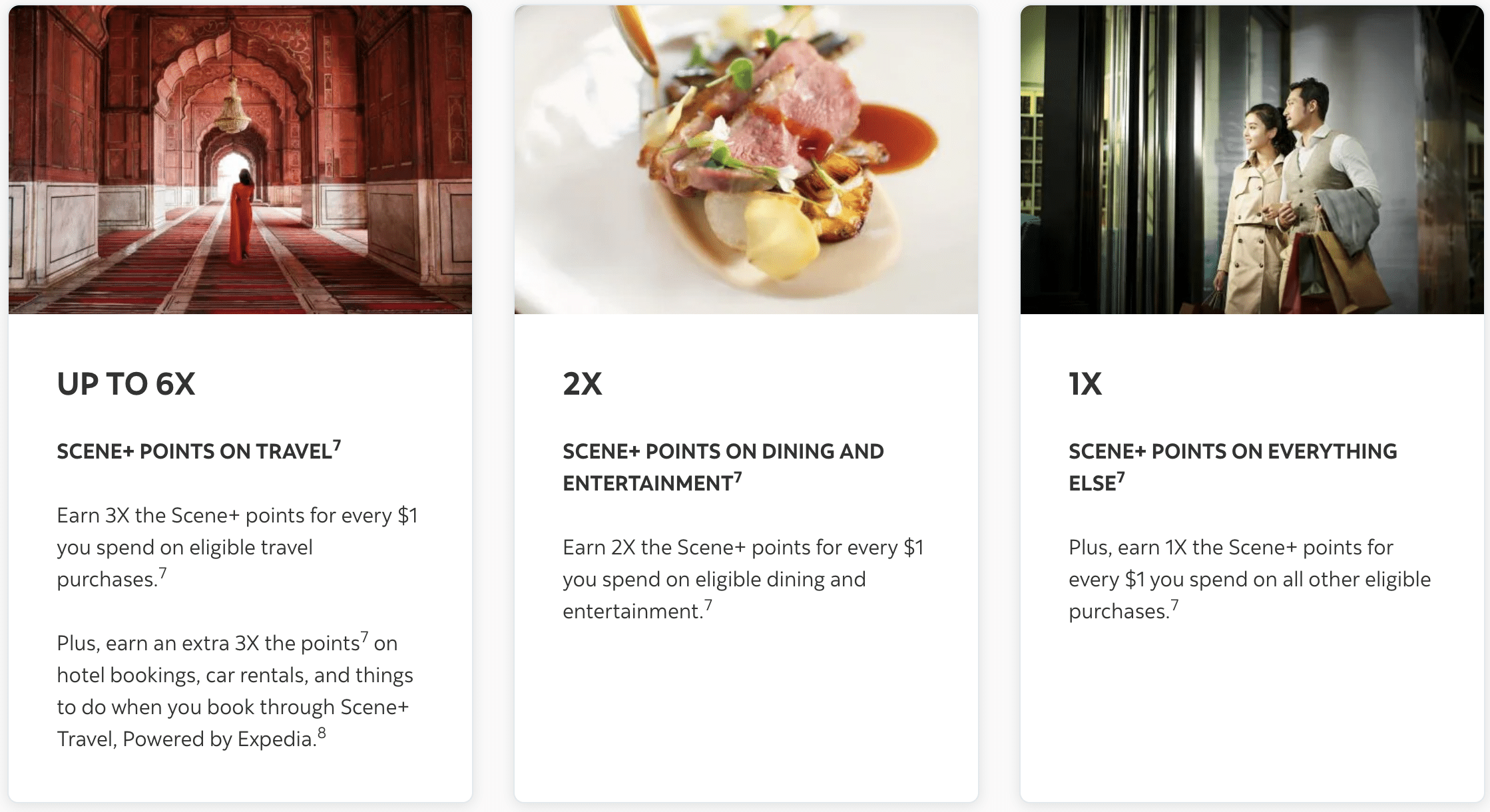

Earning Rates on Everyday Spending

The Scotiabank Passport® Visa Infinite Privilege* Card offers offers solid earning rates for travel purchases, but there are also some noticeable gaps that make it less competitive than expected for everyday spending.

Here’s how you’ll earn Scene+ points on everyday spending:

- 3 Scene+ points per dollar spent on all eligible travel purchases, such as flights, hotels, car rentals, trains, and cruises

- 2 Scene+ points per dollar spent on dining and entertainment, making it a solid card for foodies and event-goers.

- 1 Scene+ point per dollar spent on all other purchases.

The card is also marketed as offering up to 6 Scene+ points per dollar spent on eligible travel purchases, and at first glance, earning 6x Scene+ points on Scene+ Travel sounds great — but there’s a catch.

All Scene+ members earn 3 Scene+ points per dollar spent on hotel bookings, car rentals, and things to do booked via Scene+ Travel.

Earning 6x Scene+ points just means that you’ll earn 3x Scene+ points for eligible travel purchases from your credit card, as well as an additional 3x points on hotel bookings, car rentals, and things to do booked through Scene+ Travel.

Furthermore, this elevated earning rate only applies to bookings made through the Scene+ Travel portal, which means that you lose out on valuable loyalty benefits like elite status, points accumulation, and/or qualifying nights that you’d earn if you book directly with the hotel or car rental chain.

This is a major drawback, especially if you prefer to maximize your hotel and car rental loyalty program perks.

Perhaps the most underwhelming aspect of this card is its baseline earning rate of just 1 Scene+ point per dollar spent on non-bonus categories.

Many other premium travel cards in Canada offer a baseline earning rate of 1.25 points per dollar spent, such as the TD® Aeroplan® Visa Infinite Privilege* (1.25 Aeroplan points per dollar spent) or the RBC® Avion Visa Infinite Privilege† (1.25 Avion points per dollar spent).

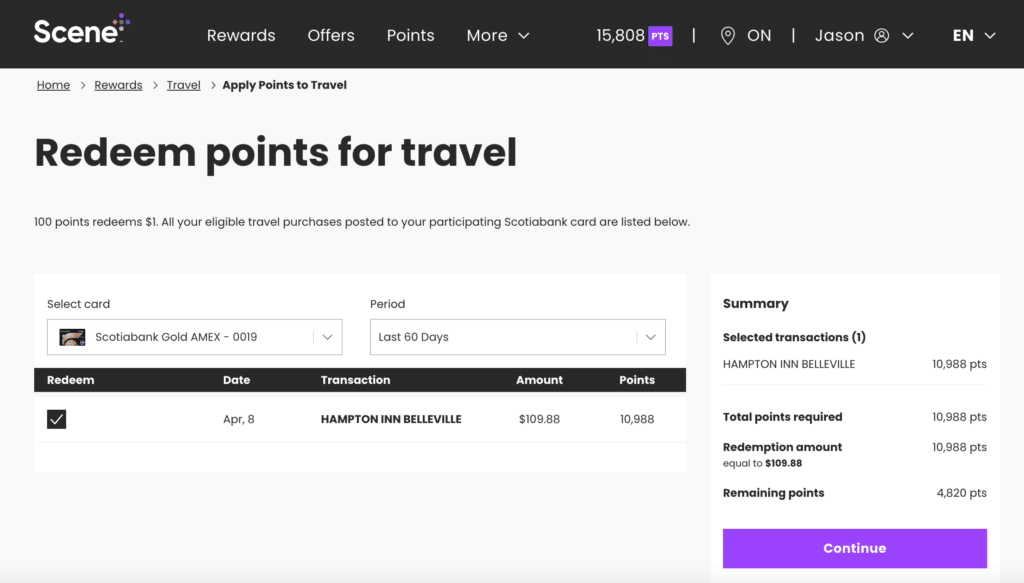

Redeeming Scene+ Points

One of the strongest features of the Scotiabank Passport® Visa Infinite Privilege* Card is the flexible redemption options offered with Scene+ points.

Unlike other fixed-value rewards programs in Canada that require you to book travel through in-house travel agencies, Scene+ points allow you to book any travel the way you want and apply your points later.

- Points are worth 1 cent per point, meaning 10,000 points = $100 in travel redemptions.

- Points can be redeemed for flights, hotels, car rentals, vacation packages, and more.

- Redemptions can be made as a statement credit up to 12 months after the transaction date.

- Scene+ points never expire as long as your account remains open.

This flexibility is especially useful for hotel bookings. Since you can book directly with the hotel chain, you can enjoy elite status perks, earn hotel points, and accumulate qualifying nights—something many other travel rewards programs don’t allow.

Perks & Benefits

One of the biggest advantages of this card is that it waives foreign transaction fees, making it an ideal travel credit card and for international purchases. While most Canadian credit cards charge a 2.5% markup on foreign transactions, this card processes purchases at the Visa mid-market exchange rate with no added fees.

50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

Canada's 5 Best No Foreign Transaction Fee Credit Cards

Read moreThe card also provides complimentary airport lounge access through the Visa Airport Companion Program, offering 10 free lounge visits per year at over 1,200 airport lounges worldwide.

Other key benefits include:

- $250 annual travel credit, which applies to flights, hotels, and vacation packages booked through Scene+ Travel.

- Visa Infinite Privilege priority services, including priority check-in, priority security lanes, and expedited baggage handling at select Canadian airports.

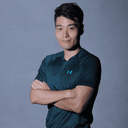

- Complimentary Avis® President’s Club membership, providing free car-class upgrades and priority service.

- Exclusive hotel benefits, including VIP perks at Relais & Châteaux properties and the Visa Infinite Luxury Hotel Collection.

That said, the $250 travel credit is restricted to Scene+ Travel bookings, which isn’t ideal. A truly premium travel card should offer a travel credit that can be used directly with airlines or hotels, rather than limiting it to a specific booking portal.

A full list of benefits and card features can be found on the Scotiabank website.

Insurance Coverage

As a premium travel credit card, the Scotiabank Passport® Visa Infinite Privilege* Card includes comprehensive travel insurance:

- Emergency medical insurance: Up to $5 million for trips up to 31 days (10 days for travellers aged 65+).

- Trip cancellation and interruption insurance: Up to $2,500 per person for trip cancellation and $5,000 per person for trip interruption.

- Flight delay insurance: Up to $1,000 per person for delays over four hours.

- Lost and delayed baggage insurance: Up to $1,000 per person.

- Rental car collision and damage insurance: Covers vehicles with an MSRP of up to $85,000, eliminating the need for rental car insurance.

- Mobile device insurance: Covers up to $1,000 for lost, stolen, or damaged smartphones and tablets.

- Purchase security and extended warranty: Extends manufacturer warranties by up to two years and covers purchases against theft or damage for 180 days.

With this robust insurance package, the card offers peace of mind when traveling or making major purchases.

Should You Apply for the Scotiabank Passport® Visa Infinite Privilege* Card?

The Scotiabank Passport® Visa Infinite Privilege* Card is an upgraded version of the Scotiabank Passport® Visa Infinite* Card, which has long been a favourite among Canadian travellers for its no foreign transaction fees and solid earning structure.

Compared to the Scotiabank Passport® Visa Infinite* Card, this Visa Infinite Privilege version offers higher earning rates on travel, more lounge visits, and stronger insurance coverage. However, despite being a premium card with a hefty $599 annual fee, some aspects of its earning structure fall short of expectations.

For frequent travellers who spend heavily on travel and dining, this card delivers excellent value through strong earning rates, premium benefits, and flexible redemptions.

The biggest advantages of the card include:

- No foreign transaction fees, saving 2.5% on all foreign purchases.

- 10 annual airport lounge visits, ideal for frequent flyers.

- $250 annual travel credit, offsetting a good portion of the annual fee.

- Strong insurance coverage, making it a great primary travel card.

However, there are a few drawbacks that can’t be ignored. It’s a bit surprising to see the lack of a grocery multiplier, a low baseline earning rate of 1 Scene+ point per dollar spent, and the travel credit being limited to Scene+ Travel make this card less competitive than it could be.

If your spending isn’t heavily concentrated on travel purchases, the mid-tier Scotiabank Passport® Visa Infinite Card with an annual fee of $150 might actually be a better choice—offering no foreign transaction fees, six lounge visits, and strong multipliers on grocery, dining, entertainment, and transit.

Alternatively, the Scotiabank Gold American Express® Card has excellent earning rates of up to 6 Scene+ points per dollar spent, depending on the category.

Scotiabank Credit Cards

Welcome bonus: 60,000 Scene+ points

Annual fee: $150

First-year value

$850

Welcome bonus: 45,000 Scene+ points

Annual fee: $120

First-year value

$525

Welcome bonus: 100,000 Scene+ points

Annual fee: $599

First-year value

$351

Conclusion

The Scotiabank Passport® Visa Infinite Privilege* Card is an exciting new addition to the premium travel credit card market in Canada. It offers excellent perks for frequent travellers, but its earning structure could have been stronger given the high annual fee.

If you value high earning rate on travel purchases, no FX fees, and lounge access, this card is certainly worth considering.

However, for those who prioritize higher everyday earning rates, other cards like the Scotiabank Passport® Visa Infinite Card or the Scotiabank American Express® Gold Card may provide better overall value.

Jason thrives on connecting with the heart of a destination, seeking out experiences that go beyond the guidebooks.

First-year value

$525

Annual fee: $120First Year Free

• Earn 25,000 points upon spending $2,000 in the first 3 months

• Earn 20,000 points upon spending $7,500 in the first 12 months

Earning rates

Key perks

- No foreign transaction fees

- Amex Offers & Front of the Line access

Annual fee: $120First Year Free

• Earn 25,000 points upon spending $2,000 in the first 3 months

• Earn 20,000 points upon spending $7,500 in the first 12 months

Earning rates

Key perks

- No foreign transaction fees

- Amex Offers & Front of the Line access