TD Canada Trust is one of the biggest players within the Canadian travel rewards credit card marketplace; they’re also one of the more generous credit card issuers in terms of offering several different products with enticing welcome bonuses.

In this post, let’s take a look at the overall state of play in TD’s neck of the woods, as well as draw upon some data points to see if we can figure out a few optimal strategies for making the most of the many TD offers out there.

The Main TD Credit Card Series

Broadly speaking, TD’s premium travel credit cards can be divided into two different series of products: the Aeroplan-branded cards, which issue Aeroplan miles as a rewards currency, and the “TD Travel” series, which issue the bank’s proprietary TD Rewards points as a rewards currency.

The flagship product in the Aeroplan series is the TD Aeroplan Visa Infinite, while the flagship product among TD Travel cards is the TD First Class Travel Visa Infinite. Both series then also have a few other flavours of these credit cards for lower-income folks (with an annual income lower than $60,000/year), bigshots (with an annual income higher than $200,000/year), and small business owners as well.

Among these two card families, I’d definitely prefer to earn Aeroplan miles over TD Rewards points, since you can unlock far higher value out of Aeroplan miles by redeeming them towards business class and First Class flights.

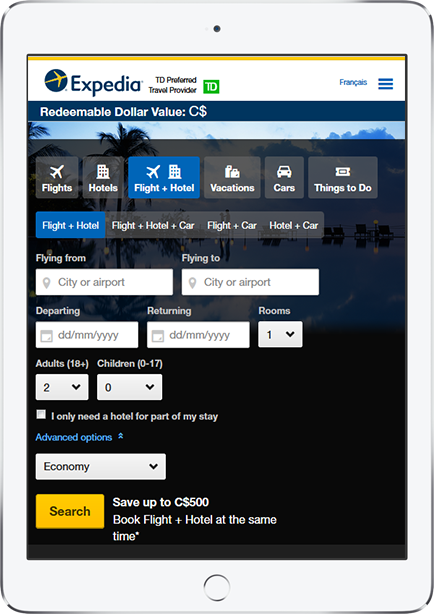

On the other hand, the value of TD Rewards points is capped at 0.5 cents per point when redeemed via a service known as ExpediaforTD, which allows you to use TD Rewards points towards anything that you can book on Expedia.ca.

Having said that, whereas the value may not be quite as high, TD Rewards points offer the flexibility and convenience of redeeming for whatever flights you want via ExpediaforTD (without having to worry about award availability), and moreover, you can even use them towards any other type of travel purchase you can make via Expedia.ca, such as car rentals or theme park tickets.

The best overall strategy for TD credit cards will therefore involve going after both the Aeroplan and TD Travel families, and we’ll focus on those cards for the purpose of this article.

Beyond that, though, the TD Cash Back Visa Infinite could also be worth your attention, depending on how much you care about cash back – the card currently offers an introductory 10% cash back offer during the first three months on the first $2,000 spent, which certainly looks quite enticing.

TD Credit Cards’ Quarterly Signup Offers

Like many of its fellow Big 5 banks, TD tends to rotate the signup bonuses on its credit cards once every quarter. The current round of offers is set to end in about a week’s time on December 1, 2019, so there will likely be some new offers after that date.

Recently, TD seems to have been tinkering around with its credit card offers quite a bit from quarter to quarter. For example, on the TD Aeroplan card, they’ve hopped from a record-breaking bonus of 30,000 Aeroplan miles delivered after an easy $1,000 minimum spend two quarters ago, to a lower bonus of 25,000 miles after a $2,000 minimum spend last quarter, to the current offer that’s advertised as 40,000 miles – but in reality only consists of 20,000 miles at first, with the remaining 20,000 miles delivered as “double miles” on your purchases during the first three months.

I’d expect the tinkering to continue next week after December 1, as TD presumably looks to find out which types of offers resonate with customers the most in advance of the new Air Canada loyalty program launching in 2020.

Having said that, while some offers are certainly stronger than others, you shouldn’t worry too much about which specific offer you sign up under, because as we’ll discuss below, you’ll always have the opportunity to product-switch to different offers further down the line.

The TD All-Inclusive Banking Annual Fee Waiver

One piece of the strategy in maximizing your earnings from TD credit cards could be to sign up for a TD All-Inclusive Banking Plan, which comes with a $120 annual fee waiver on one premium credit card every year. This means that the annual fee on, say, either the TD Aeroplan or the TD First Class Travel credit cards would be waived simply by having an All-Inclusive Banking Plan.

Now, the All-Inclusive Banking Plan charges a monthly fee of $29.95, which would quickly eat into the savings you get from your credit card fee waiver. A much better way to approach the All-Inclusive Banking Plan would be to maintain a minimum balance of $5,000 at all times in your account, which would waive the $29.95 monthly fee.

Of course, one must also consider the opportunity cost of parking $5,000 in a chequing account instead of some kind of savings or investment account – one way to think about this $5,000 balance could be to treat it as an emergency fund for $5,000 in cash that you might need to withdraw at a moment’s notice, which also happens to help you earn $120 annual fee waivers on your credit cards as well.

One important caveat, however, is that whenever TD’s credit cards are offering first-year annual fee waivers as part of the current promotion (as they are at the moment), then the annual fee waiver benefit on the All-Inclusive Banking Plan is effectively rendered useless, since you would get the First Year Free just by applying under the current offer anyway.

Conclusion

As the primary bank for the Aeroplan co-branded credit card here in Canada, TD is an issuer that you’ll deal with sooner or later as you rack up the points, and so it’s good to be aware of the bank’s particularities as you look to do so.

In particular, the TD All-Inclusive Banking Plan gives you a no-questions-asked fee waiver on one premium travel credit card account.