It’s been a wild summer. A nation that had grown claustrophobic under lockdown regulations began to reopen country-wide. Families and friends could once again be spotted on patios, and shopping centres experienced booms in foot traffic and sales.

We Miles & Points enthusiasts were rewarded for our perseverance and patience with some of the highest American Express Canada offers in history. I sincerely hope our appetites won’t be spoiled for years to come!

There have been points available to harvest by the bushel – unfortunately, they’ve often come at the cost of Amex’s infamous annual fees. And you all know exactly how I feel about annual fees and having to pay them every year.

That’s why today, I want to treat everyone with a list of five no- and low-fee cards that will cost you $0 in their first year that you can begin benefitting from today. These offers may not be as generous as what American Express has been serving up, but they all deliver outsized value at the low, low cost of nothing.

Let’s dive in!

1. Best Welcome Bonus: Tangerine Money-Back Mastercard

At present, the Tangerine Money-Back Mastercard offers one of the most competitive cash signup bonuses on the market: an even $100 in the form of 10% cash back on up to $1,000 spent.

This isn’t as high as the Visa Infinite or Mastercard World Elite families of the Big 5 banks, but do remember that this card comes with neither an annual fee nor any kind of prohibitive income requirement. Anyone making $12,000 or more annually may apply.

However, you’ll have to deal with the quirks of Tangerine as an online-only bank. First off, you’ll need to get a Tangerine chequing and/or savings account – the chequing often comes bundled with a $200–250 signup incentive, while the savings account is necessary to maximize your gain from the Money-back Mastercard.

Next, you’ll need to apply for the Money-Back Mastercard. You have a couple of options here:

- Apply via Great Canadian Rebates for a further $100 cash rebate, available until September 30

- Apply via our affiliate link to support Prince of Travel

(Note that your Tangerine bank account application will trigger a hard pull from Equifax, whereas your Tangerine credit card application will trigger a hard pull from TransUnion.)

Once your card is approved, you’ll need to spend $1,000 in net purchases within your first two statement periods. You’ll then be credited your $100 in bonus cash-back 60 days after your second qualifying statement.

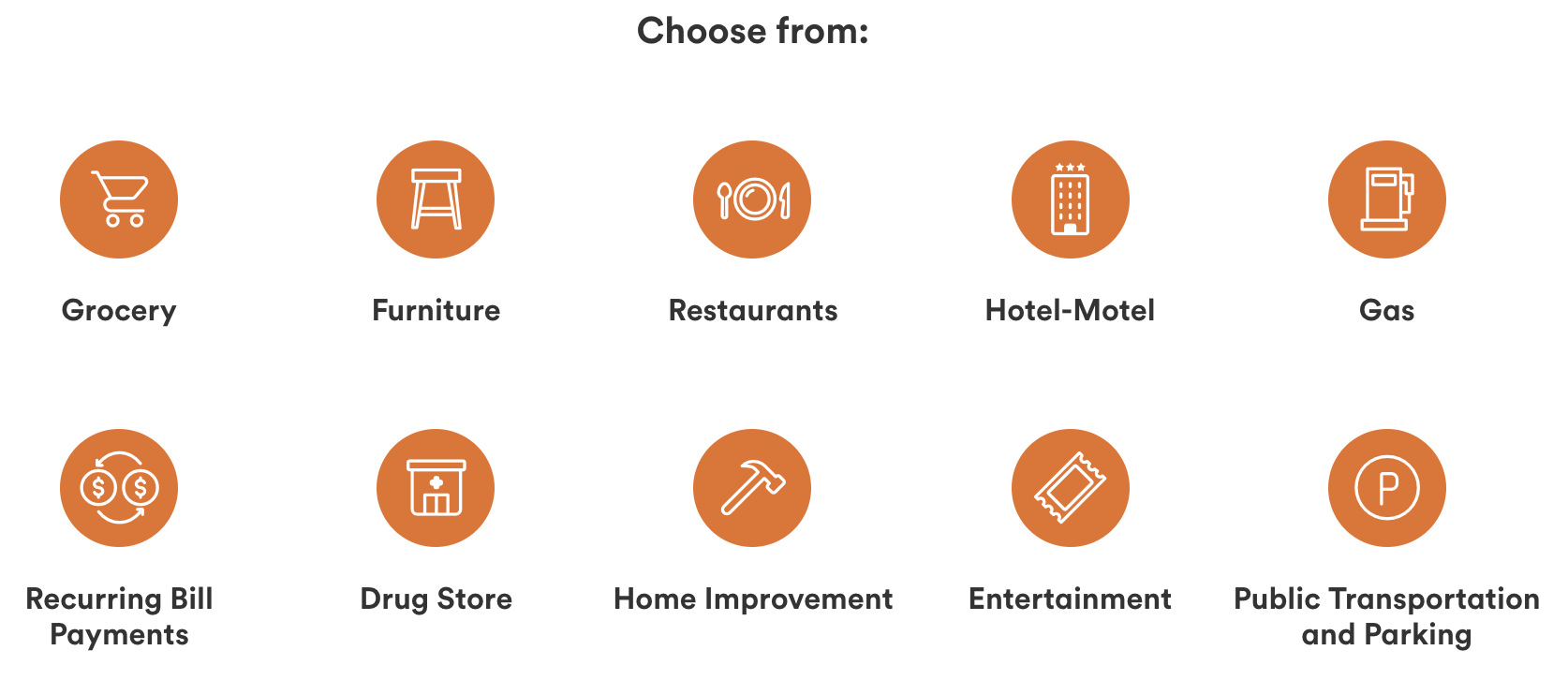

If you’ve opened a Tangerine savings account, you’ll be able to earn 2% cash back on any three categories of your choice, including rare ones such as furniture. This will deposit your cash back directly into your savings account.

If you don’t opt for the savings account, you’ll be limited to two 2% cash back categories, and your cash back will be deposited as a statement credit. You’ll earn 0.5% cash back on all other categories.

2. Best Referral Bonus: Simplii Financial Visa

Online-only banks must be stepping up their game. Simplii Financial, the online subsidiary of CIBC, is offering a cash back referral boost from $50 for their Simplii Financial Visa.

This is a great offer because there is a $50 bonus for both the referrer and referee. Sometimes, Simplii will even offer a $75 promotional referral rate!

The card offers a straightforward 4% cash back at restaurants, making it my mom-and-pop shop card of choice, as well as 1.5% back at gas, grocer, and pre-authorized payments. All other transactions earn 0.5%.

It also has 10% cash back for the first $500 you spend on restaurants in the first four statement periods – a cool $50 if you enjoy eating out. On the downside, cash back is only paid out on your December statement. Christmas turkey on Simplii, I guess?

To use this referral, both you and your friend will need to already have Simplii bank accounts, which shouldn’t be too hard if you took advantage of their $200 chequing welcome bonus. If you haven’t, you can still use your friend’s chequing account link and open the Visa later.

When you stack up all the available cash back, you’re looking at a $50 welcome bonus from restaurant spend, plus $50 from the referral bonus – a solid $100 for you, plus another $50 for the referrer. Even better, Simplii members can refer up to ten friends. Not too shabby!

3. Best Lower-Income Premium Card: CIBC Aventura Gold Visa

One of my least favourite facets of the Canadian credit card industry are its income requirements.

It seems as if income discrimination is outlawed everywhere in Canada except credit cards: even the Ritz-Carlton can’t turf my pauper behind on the curb based solely on my T4; on the other hand, a big bank can decline to give me a World Elite Mastercard if I’m not in the top 20% of households.

So for those of us who don’t make the cut to apply for Visa Infinite products, I feel that the CIBC Aventura Gold Visa Card is a suitable substitute.

Boasting a welcome bonus identical to the Visa Infinite product, you’ll earn 20,000 Aventura points after your first purchase, followed by 1,250 Aventura points for each of the first 12 months that you spend at least $1,000 on your card, for a total of 35,000 Aventura points.

Better yet, the card’s $120 annual fee is waived in the first year. Overall, you’re looking at a decent product for lower-income Canadians.

Aventura points can only be used for travel at approximately 1 cent per point on CIBC’s Aventura website, so you’re looking at a minimum of $200 in travel redemptions, up to $350.

CIBC advertises “up to $800” in value, although this would only be achievable by redeeming your 35,000 Aventura points for a flight with an $800 base fare through the Aventura Airline Rewards Chart.

Personally, I forecast that the biggest value of this card is in its four complimentary Priority Pass lounge passes.

Despite recent lounge woes, free lounge passes are a benefit sorely lacking in other credit cards available to people in households earning under $100,000 annually. I’d also note that Visa has worked out a deal with Plaza Premium until June 2022, so these are actually usable within Canada.

Unlike its Aeroplan co-branded cousin, this card doesn’t suffer from a reduced (0.66%) earn rate. It will earn at least 1 Aventura point per dollar spent, with a 1.5x gas, grocery, and pharmacy accelerator, and 2x points at the CIBC Travel Rewards Center (although you should consider shopping around instead of chasing this final multiplier).

Hasta la lounges, baby.

4. Best Offer Expiring Soon: TD Platinum Travel Visa

The next card in our low-fee lowdown is the TD Platinum Travel Visa.

The $89 annual fee is waived in the first year, and the card offers a cool 40,000 TD Rewards points in its first year: 15,000 after your first purchase and 25,000 after spending $1,000 in your first three months.

Redemptions are easy, and I strongly prefer TD’s in-house points to all other banks’, save Scotia, because of the ease of use of the Expedia for TD platform.

Expedia for TD allows for an easy 0.5-cents-per-point redemption of your TD Rewards points whenever convenient. That means the 40,000 TD Rewards points are worth an easy $200 in travel rewards for your first year.

As a Visa Platinum card, there’s no minimum income requirement for this product, albeit at the cost of a less robust insurance package. I’m sure you, like me, will be able to survive that.

This offer expires on August 16, and TD has been known to revamp their seasonal offerings drastically. If you’re looking to lighten the cost of an upcoming travel itinerary that includes an indie hotel or car rental bill, this might be the card for you – whether you apply before or after August 16.

And if you’ve been hitting Amex hard, don’t worry: TD pulls Equifax!

5. Best Obscure Benefit: Desjardins Cash Back Visa & Mastercard

I would consider myself bereft in my duty if I didn’t inform you of at least one esoteric and mildly bizarre low-fee credit card offering.

I’m a deal hunter, so there’s nothing I’ve hated more than paying a hefty premium for cell phone insurance.

Worse yet, I can remember one time when I broke my ageing mobile and tried to use said insurance, only to find out I was still on the hook for hundreds of dollars in deductibles and bogus fees.

Well today, salvation comes in plastic rectangular form: the Desjardins Cash Back Visa and Mastercard.

You read that right, Desjardins issues cards with identical benefits on both networks. Why? I have no idea, maybe it’s something they do as a credit union to stick it to the big banks.

The 0.5% cash back is pretty lousy, but if you’re in the market for a new phone and don’t want to buy the insurance your mobile dealer is hawking, this is the ideal no-fee product for you.

If you charge the entire value of your new phone outright, you’ll be eligible for up to $1,000 in compensation if it’s lost, stolen, or breaks. This should be more than enough coverage if you don’t require the newest flagship.

If you prefer to finance your phone, then you must make your full down payment and all your monthly phone bill charges on the new device on your Desjardins card.

On the upside, you’ll get 1% cash back if you pre-authorize those payments. Personally, I’d rather collect the paltry 1% than pay $10–20 monthly on insurance that won’t have my back when push comes to shove.

Conclusion

I’d like to wrap up by saying that it’s been a wild summer of love for us points enthusiasts. Some of us may have been so busy diving headlong into the crazy good Amex offers that we may have overlooked some of the credit cards I’ve mentioned above.

I’m also certain that more than a few of us have tried getting friends and loved ones involved in our Miles & Points addiction, only to be stonewalled the moment they set eyes upon the American Express Platinum Card’s stupefying $699 annual fee.

Today, I hope I was able to show you a card you may not have considered before, but which will help you or a new apprentice on your respective journeys as you cool off from the wild offers we’ve been spoiled with lately.

And that’s the lowdown.

Ahhhh Kirin! « even the Ritz-Carlton can’t turf my pauper behind on the curb ».

I appreciate the effort you put in your writing. Who uses the word « pauper » nowadays?

🙂