How to Get Paid to Pay Rent

Like many utility bills, rent is one of the expenses that usually must be paid through the bank, and many of us have long been resigned that it’s an expense you can’t pay with a credit card and consequently can’t earn miles or points on.

However, a service that lets you pay your landlord with a credit card is here, and now, Canadians can actually get paid to pay rent!

In this article, let’s take a look at how you can leverage your rent to earn rewards and to also build your credit.

Paying Rent with Credit Cards

In Canada, rent is typically paid with bank transfers or paper cheques. Very few landlords enable paying through debit or credit cards since, frankly, there’s little incentive for them to do so.

Landlords aren’t competing for your business like supermarkets, restaurants, and other businesses do, since you can’t just choose a different home each day. Plus, card acceptance fees would just eat into their fixed costs, like their mortgage and maintenance fees.

Thus, we in Canada have accepted that this is just how things are – we have to pay our rent through our bank account every month.

However, thankfully there’s now a service that effectively lets you pay rent with a credit card and it’s gaining popularity across the country.

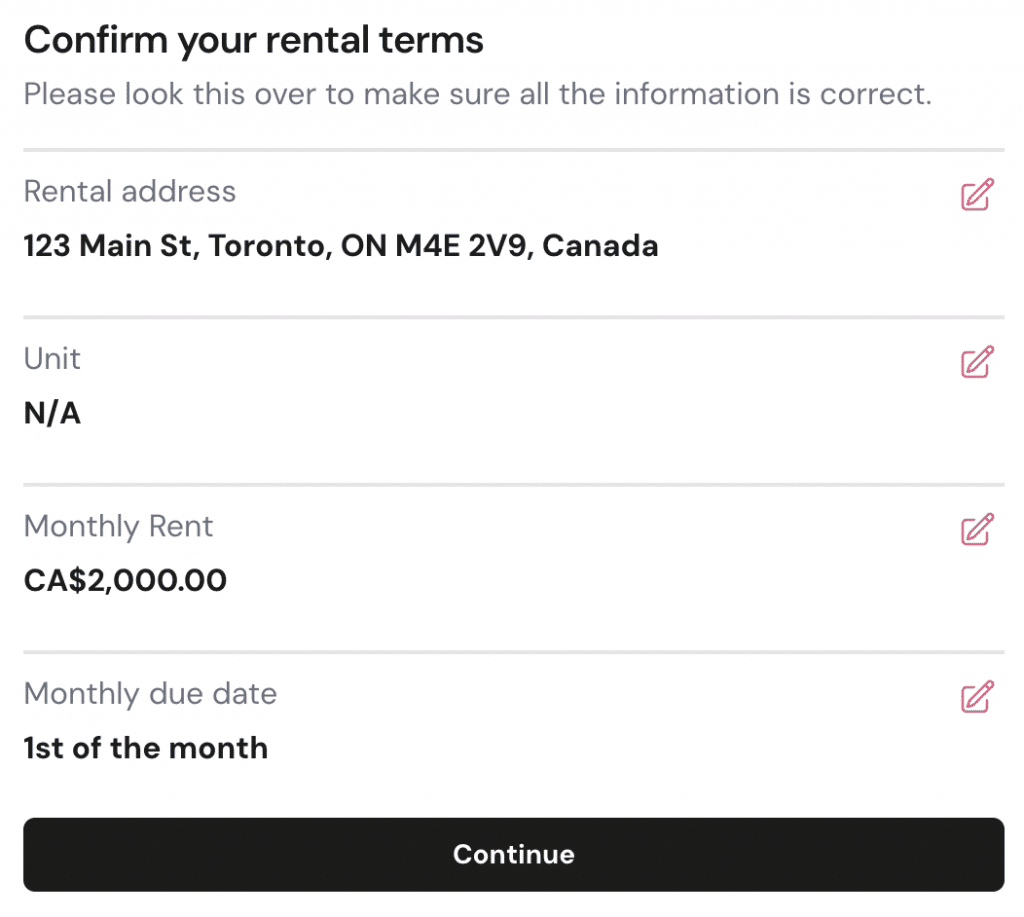

Chexy provides a platform for you to pay your rent with a credit card, thus allowing you to earn rewards on your monthly payments.

Chexy acts as an intermediary between you (the renter) and your landlord, but conveniently, it’s not necessary to get your landlord’s approval to use it. In fact, landlord participation isn’t even required.

The way Chexy’s service works is that they accept your credit card payment for your rent amount, and then they pay your landlord on your behalf with an electronic bank transfer, also known as an e-transfer.

Chexy makes its money on this service by charging renters a fee of 1.75% of their monthly rent. To illustrate this simply, if your monthly rent is $2,000 (all figures in CAD), you’ll pay Chexy $35, bringing your total monthly payment to $2,035.

While the convenience of paying with a credit card may be enough for you to justify Chexy’s fee, there are some ways for you to be strategic about these transactions and actually earn money from paying your rent.

The key to this is choosing the right credit card to use when paying, so that the rewards it provides exceeds Chexy’s fee. In the section below, let’s take a look at three cash back cards that can help you get paid to pay your rent.

Chexy is our favourite Canadian platform for earning credit card rewards on rent, bill payments, and personal taxes.

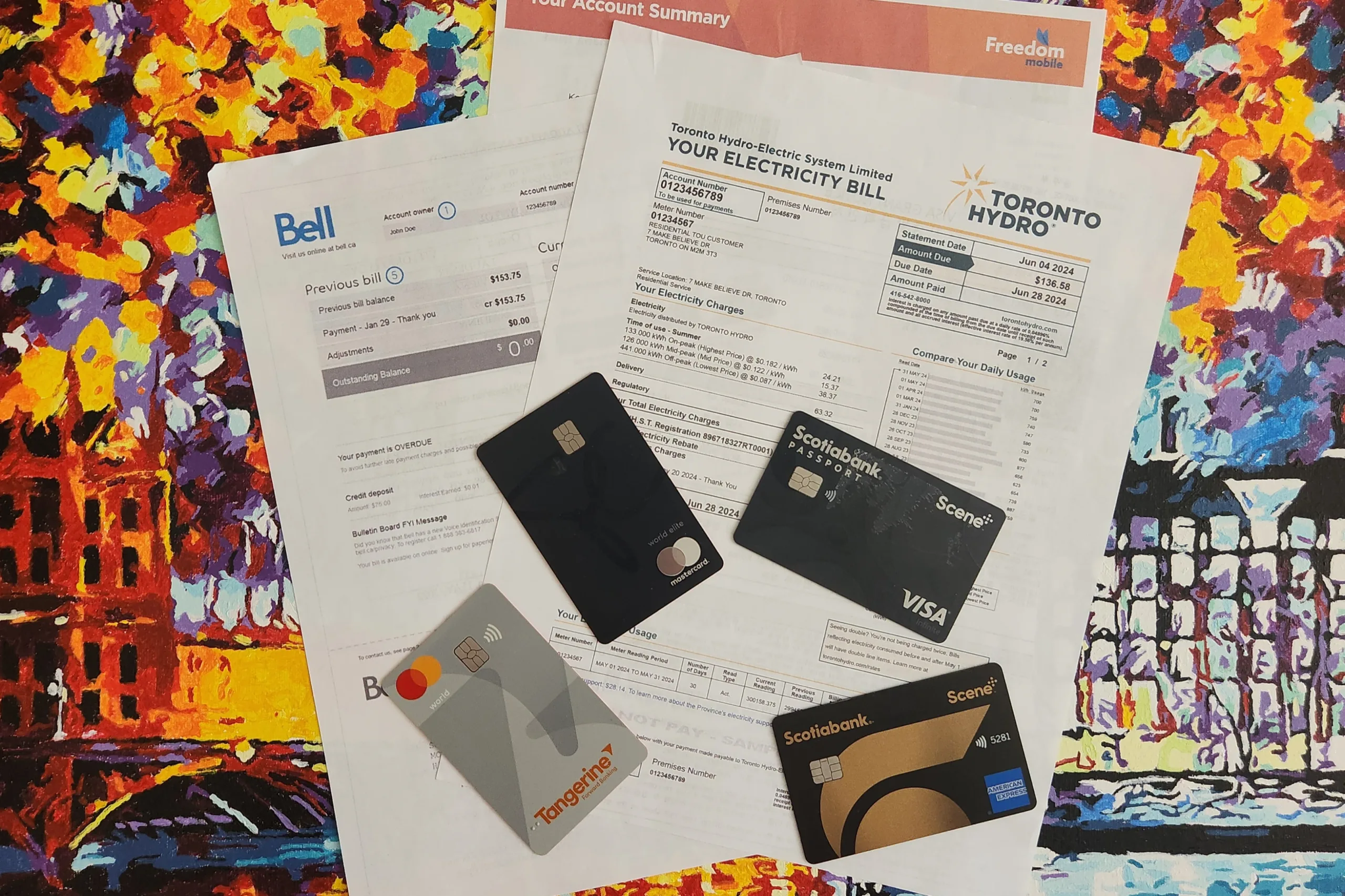

Which Cash Back Cards Are Best for Chexy?

Card networks, including Visa, Mastercard, and American Express, classify merchants by merchant category code (MCC). The charges you incur when paying through Chexy are coded as “recurring bill payments.”

Therefore, your best option for maximizing your rewards when paying rent is to use a credit card that has elevated returns on recurring bill payments, which are also known as pre-authorized payments.

We’ve already created a rundown of the best credit cards for recurring bill payments, so for this article, let’s look more specifically at the best cards you can use to pay your rent with Chexy.

Best Credit Cards for Recurring Bill Payments

Read moreScotia Momentum® Visa Infinite* Card

The first and arguably best choice on this list is the Scotia Momentum® Visa Infinite* Card, which offers cash back rewards as follows:

- 4% cash back on groceries and recurring bill payments†

- 2% cash back on gas and transit†

- 1% cash back on all other purchases†

We believe this is the best card on this list, since it offers 4% cash back on recurring bill payments. Therefore, net of Chexy’s 1.75% fee, you’ll effectively earn an excellent 2.25% cash back on one of your biggest expenses.

Putting this into perspective, if your rent is $2,000 a month, you’d earn $50 cash back each month, equalling $600 over the year.

Plus, that total doesn’t yet account for the welcome bonus you stand to receive from this card, which is usually around 10% cash back on your first $2,000 in purchases.

In addition to earning cash back, this card also comes with a handful of useful perks and benefits.

As a cardholder, you’ll save up to 25% on car rentals at participating Avis and Budget locations in Canada and the US,† and you’ll also have access to Visa Infinite benefits, including concierge service, the Luxury Hotel Collection, and the Dining and Wine Country program.†

The Scotia Momentum® Visa Infinite* Card also comes with strong insurance coverage, which includes emergency travel insurance (up to $1 million) and trip cancellation and interruption coverage (among other coverages).†

50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

First-year value

$220

Annual fee: $120First Year Free

• Earn 0.1x bonus points on purchases (up to $2,000 spend)

Earning rates

Key perks

- Annual fee waived in the first year.

- Discounts on car rentals through partner programs.

Annual fee: $120First Year Free

• Earn 0.1x bonus points on purchases (up to $2,000 spend)

Earning rates

Key perks

- Annual fee waived in the first year.

- Discounts on car rentals through partner programs.

TD Cash Back Visa Infinite* Card

The second card on the list is the TD Cash Back Visa Infinite* Card, which provides elevated cash back rewards as follows:

- 3% cash back† on eligible groceries, gas, and recurring bill payments set up on your account (up to $15,000/year)†

- 1% cash back† on all other purchases†

With this card, net of Chexy’s 1.75% fee, you still earn 1.25% cash back on your rent. This means that if your monthly rent is $1,250 per month, you’ll earn $16 cash back each month for a total of $188 each year.

This is on top of the welcome bonus that’s offered by the card, which is usually around 10% cash back on the first $3,500 in purchases you make on the card, or up to $350 in total cash back.

That said, something you’ll want to keep in mind with this card is that it does come with a $15,000 limit for the 3% return on recurring bill payments, so once you reach this threshold, your cash back rate in that category will drop to the baseline 1% cash back

In terms of perks and benefits, as a Visa Infinite product, the TD Cash Back Visa Infinite* Card comes with access to the program’s concierge service, the Luxury Hotel Collection, and the Dining and Wine Country program. It also comes with a free DragonPass membership, giving you access to over 1,300 airport lounges worldwide; however, you will still need to pay the per visit entrance fee.†

Lastly, one of the card’s most compelling features is its offer of free Deluxe TD Auto Club Membership, which provides 24/7 emergency roadside assistance.†

First-year value

$350

Annual fee: $139First Year Free

• Earn 350x bonus points on purchases

Earning rates

Key perks

- Complimentary Deluxe TD Auto Club membership (~$89 value)

- Troon Rewards Silver (10% off at 95+ golf courses)

Annual fee: $139First Year Free

• Earn 350x bonus points on purchases

Earning rates

Key perks

- Complimentary Deluxe TD Auto Club membership (~$89 value)

- Troon Rewards Silver (10% off at 95+ golf courses)

CIBC Dividend® Visa Infinite* Card

The final card in our rundown is the CIBC Dividend® Visa Infinite* Card, which has the following cash back structure:

- 4% cash back on eligible groceries, EV charging, and gas†

- 2% cash back on eligible transportation, dining, and recurring bill payments†

- 1% cash back on all other eligible purchases†

With the card earning a modest 2% on recurring bill payments, you’ll earn 0.25% cash back, net of Chexy’s 1.75% fee. This means if your rent is $2,000 per month, you’ll earn $60 cash back each year.

While the reward value you earn with this card is, frankly, low, there are two reasons why you shouldn’t automatically disregard this option.

First, the card usually offers a good welcome bonus of 10% cash back on the first $3,000 you spend, and second, getting this premium card will help you build your credit, especially if you’re a newcomer to Canada.

Additionally, the card also comes with a number of benefits, including the ability to save up to 10 cents per litre† at participating Chevron, Ultramar, Pioneer, and Fast Gas gas stations† when you link your card with the Journie Rewards gas loyalty program.†

Lastly, the card comes with decent travel insurance and mobile device insurance benefits which can save you money in these areas.

First-year value

$380

Annual fee: $120First Year Free

• Earn 0.1x bonus points on purchases (up to $3,000 spend)

• Earn 50 points on first purchase

Earning rates

Key perks

- Mobile device insurance

Annual fee: $120First Year Free

• Earn 0.1x bonus points on purchases (up to $3,000 spend)

• Earn 50 points on first purchase

Earning rates

Key perks

- Mobile device insurance

Conclusion

In Canada, rent is traditionally paid through our bank accounts, either by bank transfer or by cheque, and we seem to have resigned ourselves to this fact. However, we’re fortunately seeing the growth of a service that lets you pay your landlord with a credit card: Chexy.

With its modest fee, Chexy not only provides the convenience of paying rent with credit cards, but it also enables you to earn rewards on a major monthly expense. Plus, with the right cards, such as the cash back credit cards we’ve discussed above, you can actually get paid to pay rent.

With the increasing cost of living in Canada, we have more reason than ever to find ways to save money, and thankfully, Chexy provides just that.

Chexy is our favourite Canadian platform for earning credit card rewards on rent, bill payments, and personal taxes.

First-year value

$380

Annual fee: $120First Year Free

• Earn 0.1x bonus points on purchases (up to $3,000 spend)

• Earn 50 points on first purchase

Earning rates

Key perks

- Mobile device insurance

Annual fee: $120First Year Free

• Earn 0.1x bonus points on purchases (up to $3,000 spend)

• Earn 50 points on first purchase

Earning rates

Key perks

- Mobile device insurance