Head-to-Head: Scotiabank Passport Visa Infinite Card vs. Scotiabank Gold American Express

In this edition of Head-to-Head, let’s compare the two best no foreign transaction fee credit cards in Canada: the Scotiabank Passport Visa Infinite Card and the Scotiabank Gold American Express Card.

If you’re a frequent flyer looking to minimize fees when travelling abroad, which one is right for you? We’ll compare the cards using a range of criteria, including the welcome bonus, earning rates, benefits & perks, and insurance, to help you decide which suits you best.

Scotiabank Passport Visa Infinite Card vs. Scotiabank Gold American Express Card

Welcome bonus: 60,000 Scene+ points

Annual fee: $150

First-year value

$850

Welcome bonus: 45,000 Scene+ points

Annual fee: $120

First-year value

$525

Card Basics

Let’s kick things off by looking at some of the essentials when considering a credit card: welcome bonuses, annual fees, and earning rates.

1. Welcome Bonus

First and foremost, let’s look at the welcome bonuses, which is one of the most compelling factors when deciding between two credit cards.

The Scotiabank Passport Visa Infinite Card and the Scotiabank Gold American Express Card both earn Scene+ points.

Until January 3, 2024, the Scotiabank Passport Visa Infinite Card has a welcome bonus of 25,000 Scene+ points upon spending $1,000 (all figures in CAD) in the first three months. This part of the welcome bonus is worth $250 when redeemed for travel.

The card also rewards an additional 10,000 Scene+ points each year upon spending $40,000; however, this higher-volume spend is quite substantial, and your efforts may be better allocated elsewhere.

In the past, we’ve seen welcome offers of up to 35,000 Scene+ points with an annual fee rebate in the first year, so the current offer is a bit lower than the all-time high.

On the other hand, until July 1, 2024, the Scotiabank Gold American Express Card has a welcome offer of up to 40,000 Scene+ points, structured as follows:

- 20,000 Scene+ points upon spending $1,000 in the first three months

- 20,000 Scene+ points upon spending $7,500 in the first year

We’ve seen the welcome bonus go as high as 45,000–50,000 Scene+ points in the past; however, it’s worth noting that the current offer is quite competitive, especially with a reasonable minimum spending requirement over the course of the first year.

Verdict: The Scotiabank Passport Visa Infinite has a higher welcome bonus upon spending $1,000 in the first three months, but the Scotiabank Gold American Express Card gives another boost of 20,000 points upon spending $7,500 in the first year.

In this category, we’ll give the edge to the Scotiabank Gold. While the initial boost of points is slightly lower, maximizing the total bonus comes with a lower total spend, which averages out to $625 per month for the first year.

2. Annual Fee

The Scotiabank Passport Visa Infinite Card has an annual fee of $150. It’s worth noting that the card has come with an annual fee rebate in the past, but that’s not the case with the current offer.

On the other hand, the Scotiabank Gold American Express Card’s annual fee measures in at $120. We’ve also seen an annual fee rebate on previous offers; however, that’s not the case here either.

Verdict: With neither card currently offering an annual fee rebate, the edge goes to the Scotiabank Gold Amex due to the lower annual fee.

3. Earning Rates

The Scotiabank Gold American Express Card has a four-tier earning structure:

- 6 Scene+ points per dollar spent on eligible purchases at Sobeys, IGA, Safeway, FreshCo, and more

- 5 Scene+ points per dollar spent on eligible groceries, dining, and entertainment

- 3 Scene+ points per dollar spent on eligible gas, transit, and streaming service purchases

- 1 Scene+ point per dollar spent on all other eligible purchases

Every 100 Scene+ points can be redeemed towards $1 in travel purchases, which sets their baseline value at a minimum of 1 cent per point (cpp) when redeemed for travel.

Therefore, you’ll earn anywhere from an effective 1–6% return on spending with the Scotiabank Gold Amex, depending on which category your purchases qualify as.

On the other hand, the Scotiabank Passport Visa Infinite Card offers the following earning structure:

- 3 Scene+ points per dollar spent on eligible purchases at Sobeys, IGA, Safeway, FreshCo, and more

- 2 Scene+ points per dollar spent on eligible purchases at other grocery stores, dining, entertainment, and transit

- 1 Scene+ point per dollar spent on all other eligible purchases

With the Scotiabank Passport Visa Infinite, you’ll earn an effective 3% return at Sobeys-affiliated grocery stores, a 2% return on eligible groceries, dining, entertainment, and transit, and a 1% return on all other eligible spending, including travel.

It’s worth noting that the baseline 1 Scene+ point per dollar spent on purchases outside of Canada applies with the Scotiabank Gold American Express Card; however, the Scotiabank Passport’s category earning multipliers also apply outside of the country.

Verdict: For this category, the Scotiabank Gold Amex has superior earning rates for purchases within Canada, while the Scotiabank Passport Visa Infinite has higher earning rates outside of the country.

Depending on how you plan to use the cards, you’d earn more points outside of the country with the Scotiabank Passport, while the Scotiabank Gold Amex would earn more points in Canada, as long as you’re leveraging the multipliers.

Perks and Benefits

Additional perks and benefits offered by credit cards can make a strong case for choosing one over the other, especially when it comes to travel.

1. Redeeming Points

Many of Canada’s major banks force you to redeem their proprietary points for travel through in-house travel agencies. Some of these travel portals can be quite clunky and difficult to deal with, and can also limit your range of options of what type of travel to book.

Fortunately, with Scotiabank’s Scene+ points, you can book with any travel provider and redeem points to offset the cost.

Therefore, you can book flights, car rentals, hotels, short-term rentals, trains, cruises, or anything else that codes as travel, and then redeem your Scene+ points to partially or completely offset the expense.

What’s more, you have up to 12 months after the charge posts to redeem points against it. Therefore, if you’re short by a few points for a redemption, you can continue to earn points and then offset the cost once your balance is sufficient.

Verdict: It’s great to see both cards offering flexibility when it comes to redeeming points for any travel purchase. Since you can redeem points in exactly the same way, we have ourselves a clear draw.

2. Foreign Transaction Fees

The Scotiabank Passport and the Scotiabank Gold Amex both offer no foreign transaction fees, which is one of the most compelling features to both cards.

Indeed, these two cards are Canada’s two best cards with no foreign transaction fees.

The two products use the American Expresss and Visa mid-market rates, respectively, which are equal or very close to the true mid-market FX rate.

Most other credit cards levy a 2.5% fee on foreign transactions, making these two cards stand out as excellent choices when travelling abroad.

Verdict: Once again, we have a clear tie in this category, with both cards offering excellent value thanks to their 0% foreign transaction fees.

3. Airport Lounge Access

The Scotiabank Passport Visa Infinite comes with a standard DragonPass membership, with six free lounge visits provided annually to cardholders.

Unfortunately, the Scotiabank Gold American Express Card doesn’t offer any lounge access; however, you’ll get a discounted Priority Pass membership as one of the card’s benefits. Just keep in mind that you’d have to pay for any lounge visits.

Verdict: Since the Scotiabank Gold Amex doesn’t offer any free passes, the Scotiabank Passport Visa Infinite Card comes out clearly on top in this category thanks to its six free lounge visits.

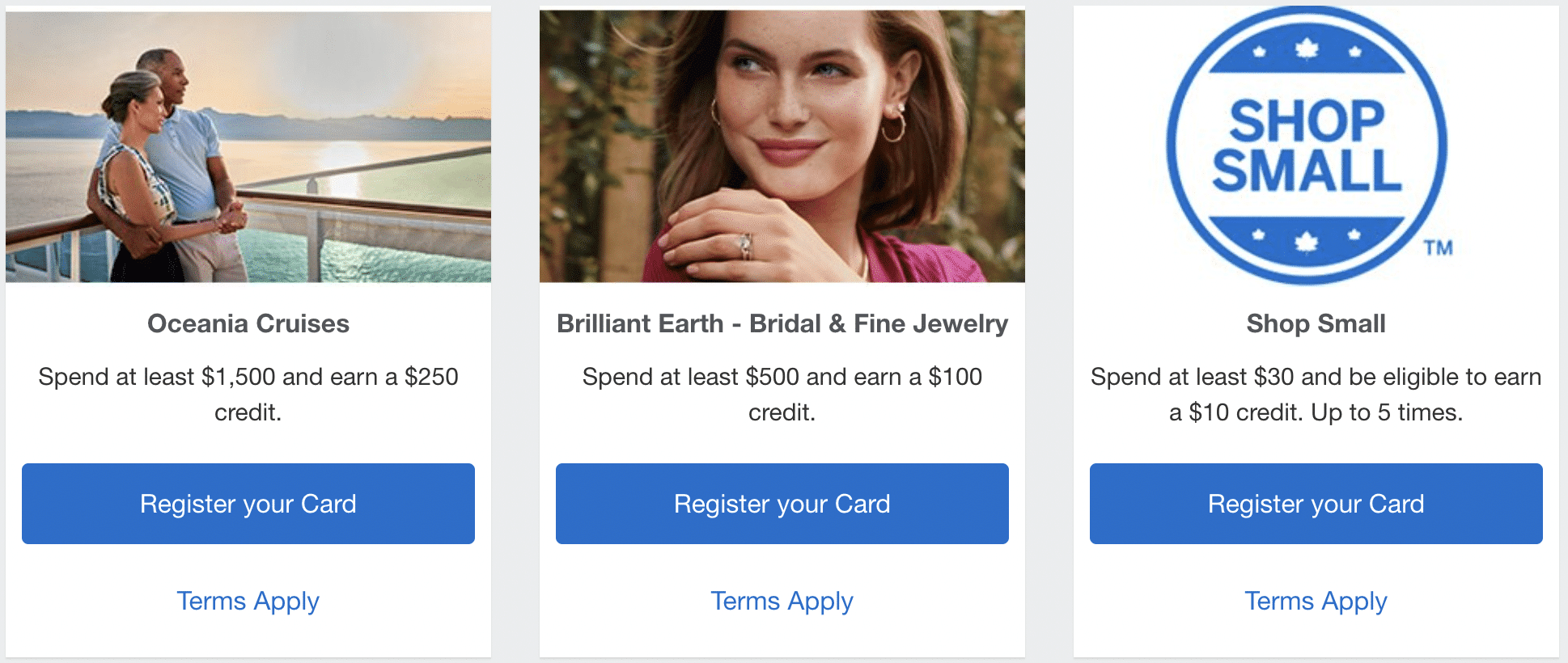

4. Amex Offers

One of the great features available to American Express cardholders is Amex Offers.

You can manually register the Scotiabank Gold American Express Card for Amex Offers on the dedicated landing page for Scotiabank-issued Amex cards.

While the offers rotate throughout the year, it’s not uncommon to find offers that provide hundreds of dollars of value for travel purchases, Shop Small statement credits, and other merchandise.

As a Visa product, the Scotiabank Passport isn’t eligible for Amex Offers.

Verdict: The Scotiabank Gold Amex emerges as victorious in this category, since cardholders have access to Amex Offers and Scotiabank Passport cardholders don’t.

Other Factors

1. Supplementary Cards

The Scotiabank Passport Visa Infinite offers one free additional card each year. Every additional card thereafter will be subject to an annual fee of $50.

The Scotiabank Gold Amex charges $29 for each additional card with no initial free supplementary cards.

Verdict: This is a small win for the Scotiabank Passport Visa Infinite Card due to the free first supplementary card, while every additional card on the Scotiabank Amex Gold costs $29 apiece.

2. Insurance

As travel-oriented credit cards, both cards offer strong insurance benefits, with a few key differences.

Both credit cards offer auto rental collision insurance on cars with an MSRP of up to $65,000.

Furthermore, both cards offer flight delay insurance for delays of more than four hours, up to $500 per person, as well as delayed and lost baggage insurance of up to $1,000.

The insurance offerings differ with respect to emergency medical insurance, trip cancellation insurance, and interruption insurance.

With the Scotiabank Passport, you’re eligible for emergency medical insurance of up to $2 million for you, your spouse, and dependent children on unexpected medical illness or injury when travelling out-of-province for up to 25 days (3 days for age 65 and up). With the Scotiabank Gold, you’re eligible for up to $1 million in coverage.

The Scotiabank Gold Amex offers insurance for both trip cancellation and interruption for up to $1,500 per person, while the Scotiabank Passport offers the same trip cancellation insurance, but up to $2,500 in trip interruption insurance per person.

Both cards also come with Purchase Protection and Extended Warranty coverage; however, the Scotiabank Gold Amex also comes with Mobile Device Insurance, worth up to $1,000.

Verdict: If insurance is a high priority for you, the Scotiabank Passport Visa Infinite Card has better coverage on balance, with more generous amounts on emergency medical insurance and trip interruption insurance.

However, if you value Mobile Device Insurance, then you might side with the Scotiabank Gold Amex.

3. Ease of Approval

The Scotiabank Gold American Express Card has a minimum personal income requirement of just $12,000 to qualify.

On the other hand, the Scotiabank Passport Visa Infinite Card has a minimum income requirement of just $60,000 or a household income of $100,000.

Verdict: The Scotiabank Gold American Express has a much lower barrier to entry, and comes ahead in this measure.

4. Acceptance

Depending on where your travels bring you, you may find that Visa has a wider acceptance than American Express.

If this is the case, then you’d want to have a Scotiabank Passport Visa Infinite with you instead of the Scotiabank Gold American Express Card, since you’d be able to use it at a wider range of businesses.

Verdict: The Scotiabank Passport Visa Infinite Card comes out ahead, with wider global acceptance than the Scotiabank Gold American Express Card.

5. Visual Appearance

Both cards have a similar appearance, as you might expect for cards from the same bank.

The Scotiabank Gold Amex uses pops of gold to align with its name, while the Passport has a design that plays with texture.

Both cards are visually appealing, but neither has an outstanding feature to differentiate itself, such as a metal or a vertical design. Let’s call this one a tie.

Conclusion

Both the Scotiabank Passport Visa Infinite Card and the Scotiabank Gold American Express Card offer excellent flexibility for redeeming Scene+ points, and their standout no foreign exchange fees feature makes them well-suited for those travelling abroad.

Choosing between either card will ultimately come down to the unique features offered on one that aren’t offered on the other.

If you can make use of lounge passes and value enhanced travel insurance and wider acceptance, then consider the Scotiabank Passport Visa Infinite Card.

On the other hand, if you’re looking for a card with excellent earning rates for Canadian purchases, as well as access to Amex Offers, then the Scotiabank Gold American Express Card might be a better choice for you.

No matter which card you choose, you’ll wind up with one that saves you money when travelling abroad, and you’ll be confident knowing that you’re using one of Canada’s two best no foreign transaction fee cards.

First-year value

$1,581

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

Comments

Create a free account or become a member to comment.