Many of you might be familiar with the “Chase 5/24 rule” in the United States, where Chase won’t approve your credit card application if you’ve opened more than five new credit card accounts over the past 24 months.

It’s a move designed to combat unprofitable behaviour among individuals who repeatedly open credit cards for the signup bonus alone, and has drastically altered the optimal credit card strategy in the US ever since it was introduced.

By and large, we haven’t seen Canadian issuers implementing any such policies, although there does seem to be a similar pattern with MBNA credit card approvals that’s worth knowing about, even though it’s in place more from a risk assessment perspective than merely to target people who apply for lots of credit cards.

The MBNA “5/6 Rule”

Based on many people’s experiences, it can be deduced that MBNA implements a rough “5/6 Rule” when assessing credit card applications, in the sense that if you have five or more hard inquiries on your TransUnion credit report over the past six months, then your application is likely to be denied due to having too many recent inquiries.

I say it’s a “rough” rule because it doesn’t seem to be uniformly enforced – there are a handful of data points of people receiving auto-approvals even though they have more than five TransUnion hard hits over the past six months, as well as people being denied for having too many inquiries even though they’re under 5/6 – but it does seem to occur often enough for a general pattern to be established.

(Perhaps it should be called a “5/6 Guideline” in that sense, but that doesn’t roll off the tongue quite as well.)

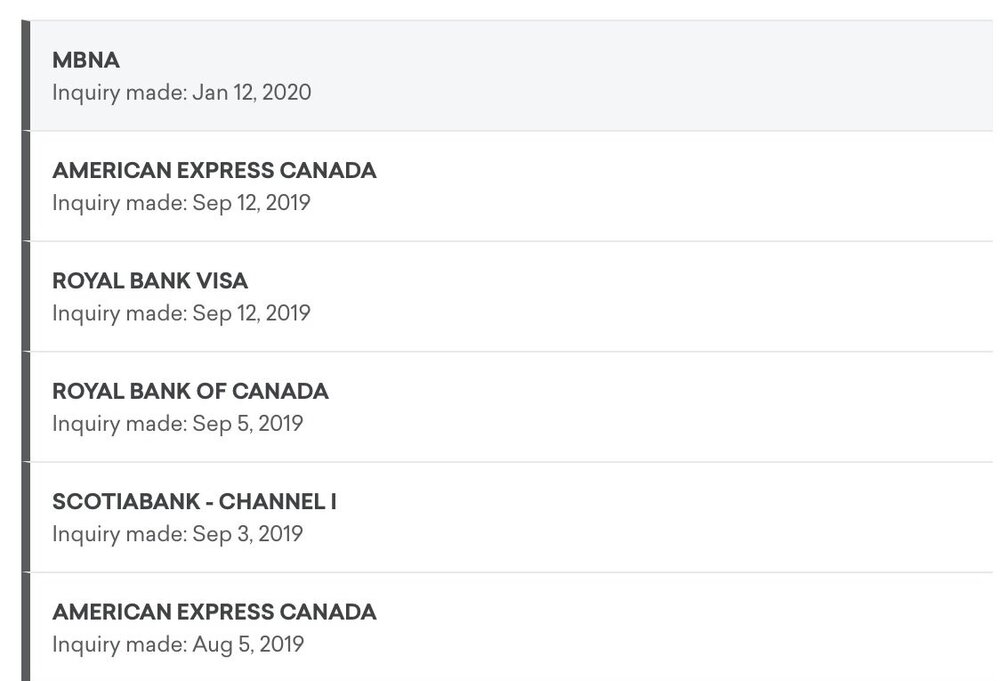

Note that MBNA usually pulls data from your TransUnion credit report, not your Equifax one, and so it’s the number of recent inquiries on TransUnion that matters. As a reminder, the major Canadian credit issuers generally pull from the two major credit bureaus as follows:

-

Equifax: BMO, CIBC, HSBC, TD

-

TransUnion: Amex, MBNA, RBC, Scotiabank

You can therefore avoid falling into 5/6 territory by being mindful of how many credit card applications you’ve submitted to Amex, MBNA, RBC, and Scotiabank, and only applying for a new MBNA product when you have fewer than five hard hits on your TransUnion file over the past six-month period to maximize your chances of instant approval. Use a service like CreditKarma or Credit Verify to keep up with your TransUnion file.

There’s a subtle difference from Chase’s 5/24 rule here too: whereas Chase looks as the number of newly opened accounts, MBNA looks at the number of recent inquiries, which remain on your credit file even if that application was eventually declined. If you’re looking to cycle through MBNA’s cards, then, a declined credit card application from an issuer that pulls from TransUnion could potentially carry more weight than usual (although there are still ways to mitigate this, as we’ll discuss below).

If you’ve already reached 5/6 and are struggling to get approved by MBNA, you might wish to lay low on TransUnion inquiries for a little while and focus on the issuers that pull from Equifax instead, like TD or CIBC and their suite of travel credit cards.

Meanwhile, if you’re a newcomer to the game, it’s also a great idea to make the MBNA Alaska Airlines MasterCard one of the first cards you apply for so as to avoid being denied under the 5/6 Rule, especially seeing as Amex and RBC (both of which pull from TransUnion as well) also have many credit cards that are worth getting when you’re first starting out.

Does the MBNA 5/6 Rule Matter?

The 5/6 Rule may appear draconian on the surface – after all, among all the Amex, MBNA, RBC, and Scotiabank products out there, it’s easy to imagine the more dedicated points collectors among us racking up five or more hard inquiries over a six-month period.

However, just as MBNA is unique in implementing such a rule, so too do they offer the unique ability to push through applications by splitting off credit limits from existing MBNA credit cards.

The idea is that when MBNA denies your application, they’re denying your request for new credit, but they’re happy to use any existing credit limits you may have with them to approve you for a new product. And since we’re primarily interested in the new product (and the signup bonus that comes with it), that works to our advantage.

The particular strategy with MBNA Alaska cards is that, instead of cancelling your Alaska card after you’re done with it, you product-switch to a no-fee product in order to keep that credit limit around in case you need to split it off on a future application that gets denied.

In practice, you might product-switch to, say, the no-fee introductory MBNA Rewards Platinum Plus Card after three months of holding an MBNA Alaska.

Then, let’s say you’re interested in applying for the MBNA Alaska again, but you find yourself with over five TransUnion inquiries over the past six months.

You submit the application anyway, but – aw shucks! – you get declined under the 5/6 Rule on the basis of having too many recent inquiries. But then you give the credit department a call at +1 (888) 898 1620 and say that, instead of requesting new credit, you’d like to split off the credit limit from your existing card in order to push through the application.

(Some agents may not be familiar with the process, so it may take a few calls to find the right agent.)

As you can see, even though MBNA is very conservative with regards to how many hard inquiries you can have before they’ll decline you for having too many, that only means that they aren’t comfortable with extending you any more credit than you already have.

If you split off your existing credit limits with them, you aren’t requesting any new credit, so you aren’t asking them to take on any additional risk by pushing through your application for approval.

With the MBNA Best Western credit card having remained dormant for many years now in terms of elevated welcome offers, these strategies really only apply to shortening to cycle on the MBNA Alaska’s signup bonus of 20,000 or 30,000 Alaska miles. Be sure to check out my full post on MBNA Alaska strategies for some more in-depth discussion.

Conclusion

MBNA is one of the more conservative issuers in Canada when it comes to the number of recent inquiries on your credit file, and is unique in implementing a “5/6 Rule” in which they’ll likely deny your application if you have five or more TransUnion inquiries over the past six months.

While the enforcement of the 5/6 Rule doesn’t seem to be uniform, enough people have run into it that we should all keep it in mind. However, as long as you’re holding another MBNA product, the denial of your application doesn’t have to be final, since the credit department and their unique credit-splitting powers are only a phone call away.

The existence of the 5/6 Rule is based on anecdotal evidence across the community, so if you’ve recently applied for an MBNA credit card and been approved or denied with X number of TransUnion inquiries over the past six months, feel free to share your data point in the comments below.

We are going to escalate Mbna problem to the ombudsman . Great credit over 50 years then cancelled an Mbna card after phoning in to confirm nothing more was owed- confirmation provided. Next I found out TD refused to add to my L.O.C so I called Transunion and they stated the Mbna was the problem! Next contacted two Mbna agents one a supervisor and both told me they would fix this issue immediately and it would be totally wiped off of Transunion. Nothing was ever done! This is an ongoing nightmare preventing us from getting any new credit products. Any thoughts?

My first experience with MBNA was a nightmare. I am on a work visa (some banks are very conservative to non-PRs or non-Canadian citizens). I had 2 cards with 5-8 years of credit history when I was a student, made payment on time every month. But I had 2 closed derogatory accounts w/ $0 owning from speeding tickets that I did not receive due to relocation (paid immediately after I found out, thus the $0).

In January this year, I received a Tangerine card. Around the same time, I applied and was denied for the MBNA Amazon card. When I called the credit card department to inquire, they simply approved it with $1000 credit on the phone.

However, for some reasons they performed another inquiry on the card in March, and froze my card on “potential fraudulent activities”. I was asked to call in from work to verify my identity. I work at a big insurance company, my outgoing work number is different from the actual work number that people call me at. They would not unfreeze my account because of the different number.

I was not able to access my credit card for a few months, in the meantime, we transitioned to work from home. I called again to let them know that there is no way I can call from work now. They proceeded to ask why I had so many inquiries (well, you did 2 pulls on me). I said that I just wanted different cash back categories. They instead called HR at work and was able to verify my identity.

I finally got to use my MBNA card. But the low credit limit and the hindrance caused by their fraud investigation left a bad taste in my mouth. I want to apply for the Alaska WE, but I think I will take a break for now.

This helps to answer my question on why I got denied!

The same thing happen with a new TD application. I was refuse because of too many card even if my credit score was very high. They ask me to cancel some card, wait 6 month and apply again and maybe…. But your rule of splitting the credit limit was offer to me with BMO about 6 month ago. It BMO that tell me to do the splitting and the demand for the new credit card would pass. I did forget that ‘rule’ so thank to remind me with your post Ricky !

I think something like that happened to my wife, she was denied because she has sufficient unused credit on her other credit cards. At the time, she did have two Amex, one RBC aswell as a PC open which are all but one just laying around unused after we claimed the sign up bonus.