Credit cards offer more than just a way to spend money and earn points. One major benefit of many cards is insurance on travel bookings and high-ticket purchases.

Don’t be surprised if you find insurance to be a very dry and dense topic – after all, the devil is in the details, and comparing different policies isn’t always that simple. This guide should help you understand the nature of what you’re covered for as a cardholder, and what to look for as you research your options.

You’ll see careful language throughout. Policies differ by issuer and card, so always read the actual certificate of insurance (COI) attached to your card.

In This Post

Credit Card Insurance Overview

Why Do Credit Cards Offer Travel Insurance?

You’ll notice that many cards’ insurance policies place an emphasis on travel. That’s because premium credit cards tend to target travellers, and travel insurance is a valuable perk to help justify high annual fees.

Travel has so many moving parts: ticketing, transportation, baggage, accommodation, unique civil conditions, not to mention things that can happen at home like accidents or medical emergencies. It’s no surprise that things can and often do go awry, and it’s good to be insured for peace of mind so you can relax and enjoy your trip.

You only “use” travel insurance when travelling, which makes it easy to forget until you really need it. Without embedded coverage, you’d be buying a standalone policy for each trip (or an annual plan).

Don’t expect to find home, automobile, or life insurance on credit cards. You’re on your own for those. If you have a home, car, or (obviously) a life, you do need these to be protected daily. You wouldn’t want those types of coverage to be tied to a credit card account, which is temporary in the grand scheme of things.

How to Use Credit Card Insurance

It’s good to designate a long-term keeper card for any bookings or purchases for which you’re counting on the insurance policy. Your coverage will lapse when you cancel the credit card or if your account is no longer in good standing.

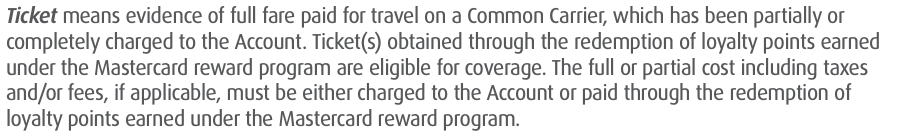

Many policies require you to charge part—or sometimes all—of the eligible expense to the card. The wording varies:

- Some require the “full cost” to be charged to the card (bad news for award travel).

- A few specify a minimum percentage of the trip cost (e.g., 75%) must be paid with the card.

- Others cover award tickets as long as you charge the taxes/fees to the card (better).

If you fly on award bookings, the cost of the ticket will have a points component, and a (hopefully small) cash component which you’d pay with a credit card. It’s important to know which credit cards extend insurance on award tickets.

Any card that requires the full cost of the trip to be paid on it wouldn’t be valid for insurance, because the points component is paid separately – it comes out of your frequent flyer account, not your credit card.

If you have any doubts at all, always review the insurance certificate yourself. It’s important not to rely on an insurance policy under the assumption that you’re covered, only to later find out that you’ve misinterpreted the fine print.

Insurers are not your friend and will fight tooth and nail not to have to pay out – and you can’t sweet-talk your way through a misunderstanding like you can with a credit card annual fee waiver.

When it comes to getting a claim started, the sooner the better – perhaps even while you’re still travelling. Before your trip, prepare a list of the phone numbers to call for each type of incident. The list may become quite unwieldy if you’re using different credit cards for different types of coverage, so it’s best to be organized in advance.

And of course, you’ll need to provide proof of any losses you’re claiming. Keep your receipts, and take photos of any damage as soon as you can.

Who Is Covered?

Obviously, the primary cardholder is covered.

Some policies extend coverage to the primary cardholder’s spouse or dependent children. Spouse is pretty straightforward. Dependent children basically refers to minors, undergraduate students, or adults with a permanent disability.

Some credit cards also provide insurance for secondary cardholders. Some of those cards may provide it for the secondary cardholder’s spouse and children, on some types of coverage.

Often, coverage for the spouse and children is only valid if they’re travelling with the cardholder, but with some credit cards they may be insured if they’re travelling separately.

Each policy has maximum payable benefits. There tends to be a separate limit for each insured person, as well as a total limit for the entire incident.

Types of Credit Card Insurance Coverage

In this Section

- Emergency Medical Assistance

- Common Carrier Accident

- Trip Cancellation & Trip Interruption

- Flight & Baggage Delays

- Car Rentals

- Personal Effects & Burglary

- Extended Warranty & Purchase Protection

- Mobile Device Protection

- Price Protection

Emergency Medical Assistance

As Canadians, we’re all too familiar with our worldwide reputation for affordable health care. On the other hand, we often hear horror stories of medical bills abroad.

Emergency medical assistance is designed to fill that gap, so that you’re more or less supported just as you would be if the injury happened at home.

These policies cover charges like hospital services, emergency dental expenses, early return (if obliged by a physician), or the return of your remains in the worst-case scenario. Some policies also offer a per diem if your return is delayed by your injury. You may also be covered for some medical care when you return home.

Emergency medical assistance is for accidental and unforeseen events. Pre-existing conditions, routine care, injury resulting from illegal activity, high-risk adrenaline sports, and elective procedures are not covered.

On the bright side, this is the only insurance policy that kicks in just by being a cardholder. You don’t have to pay for any portion of your trip with the card, since most policies cover you as soon as you leave your home province, and until your return.

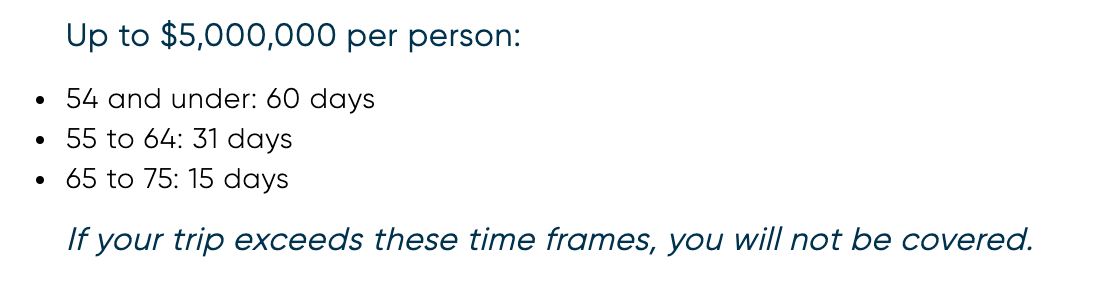

Coverage is only valid for a certain number of days of travel, after which you’d need to buy additional days of insurance. If a card covers trips up to 15 days and you take a longer trip, you might be covered for the first 15 days, or you might need to buy insurance for the rest of your trip in order for the first 15 days of coverage to be valid at all – it varies by credit card.

Seniors over 65 years of age typically aren’t covered by these policies, although some credit cards offer coverage for older people on shorter trips.

Common Carrier Accident

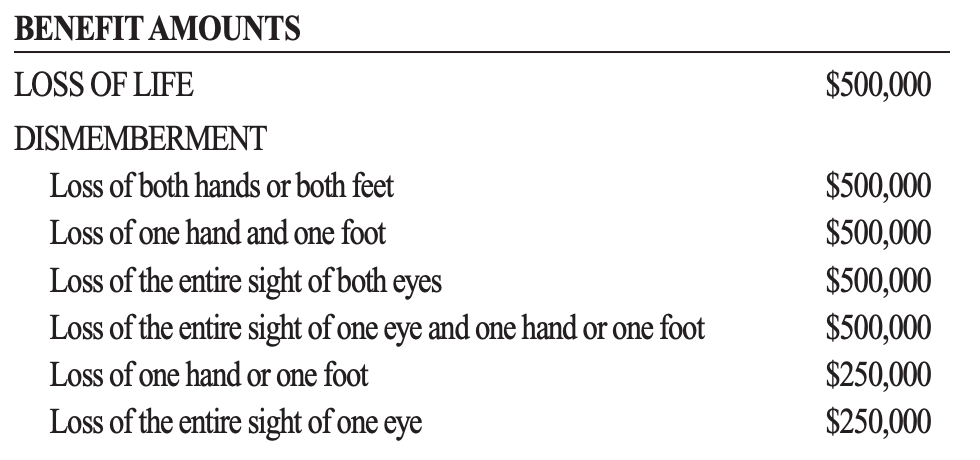

Common carriers are public vessels that transport ticketed passengers. Common carrier accident policies protect you in case you suffer a permanent physical injury in an accident while on a plane, train, bus, or boat.

This is a bit different than emergency medical assistance, which is for your medical expenses. Common carrier accident insurance pays a lump sum as compensation depending on the specific nature of the injury. Each insurance certificate has a detailed breakdown of the benefits for each type of loss.

Trip Cancellation & Trip Interruption

Now we’re getting into some situations that you’re more likely to face.

Trip cancellation is when you’re unable to begin your trip as planned. Trip interruption refers to situations when you are delayed in getting to your next destination (take note if you book multi-stop tickets), or when you have to come home early.

Under these policies, you’ll be eligible to recoup the costs of any non-refundable prepaid bookings that you’ll be unable to enjoy. Travel that can be rebooked on another date or refunded as a voucher won’t be covered.

You may also be reimbursed for transportation costs if you need to make alternate arrangements to return home or continue your trip. For example, if you had a three-stop trip, and a civil war broke out at your second destination while you were at your first, the insurer would pay any surcharges to route you directly to your third stop and bypass the second (although not necessarily in business class or on your preferred airline).

Additionally, some policies may provide a per diem for meals, local transportation, accommodation, and communication (essential phone calls) while you scramble to salvage your interrupted trip.

Travel insurance doesn’t cover discretionary decisions – you can’t just change your plans and get a refund. There are specific reasons that have to cause your cancellation or interruption, but they are pretty broad.

These may include illness (yourself or a family member), jury duty, a government travel advisory, if your airline or accommodation goes bankrupt, damage to your home, involuntary loss of employment, a surprise pregnancy… you get the idea.

In any event, you’ll still have to know how to make alternate travel arrangements yourself. Insurance just gives you the freedom to ensure a smooth trip without worrying about the cost.

Flight & Baggage Delays

Flight delay insurance is a bit different than trip interruption. It specifically refers to a missed connection due to a late incoming flight, whereas trip interruption has a wider range of causes not directly related to the flight itself.

In this case, you’d be covered for the costs of accommodation, local transportation, and essentials like clothing, toiletries, and other sundry items that you need as a result.

Nothing quite ruins a vacation like showing up without your luggage. Delayed baggage insurance covers the costs of any essentials, like clothing and toiletries, that you need to replace. These could be things you need to enjoy your trip or upon your return home, depending on when your baggage is delayed. However, accommodation and local transportation costs are not covered.

These coverages don’t kick in until your onward travel or baggage has been delayed for a minimum amount of time, usually four to six hours. Typically they’ll only apply for overnight delays, where sorting out alternate plans for the night is a real inconvenience. But depending on the timing of your delay, you might at least score a free meal!

There’s also separate coverage for lost, damaged, or stolen baggage. If the incident occurs while the baggage is in transit on a common carrier, you may be insured for the value of its contents, up to a specified maximum.

Car Rentals

There are a few different types of insurance on rental cars:

- Collision insurance is the most common. This insures the value of the car in the event of physical damage sustained in an accident. These policies are all extremely similar, and are valid on rentals up to a certain number of days and cars up to a certain value.

- Theft insurance is usually covered under collision insurance. This refers to the theft or loss of the entire vehicle or any of its parts, rather than damage to it.

- Accident insurance is less common. It’s similar to common carrier accident insurance, which doesn’t cover private car rentals.

Collision and theft policies are almost always the same on all credit cards that offer them. You get coverage for rentals up to 48 days, and you can buy extra days for longer trips. Cars are insured for a retail price up to $65,000, or $85,000 with some premium credit cards.

For the credit card’s collision insurance policy to kick in, you’ll need to decline the rental company’s collision damage waiver when you pick up the car to begin the rental.

Also, these policies typically don’t include third party liability insurance, which would cover personal injury to the other driver or damage to the other car in the event of an accident. You may be covered by your car insurance policy at home, but if you don’t own a car, you’d have to buy this separately.

Finally, these policies have a number of exclusions. They don’t cover luxury cars, antiques, off-roading, motorcycles, trucks, RVs, or other non-standard passenger motor vehicles. You also won’t be covered if unlawful speed or intoxication are factors in a crash, or if an uninsured driver is at the wheel.

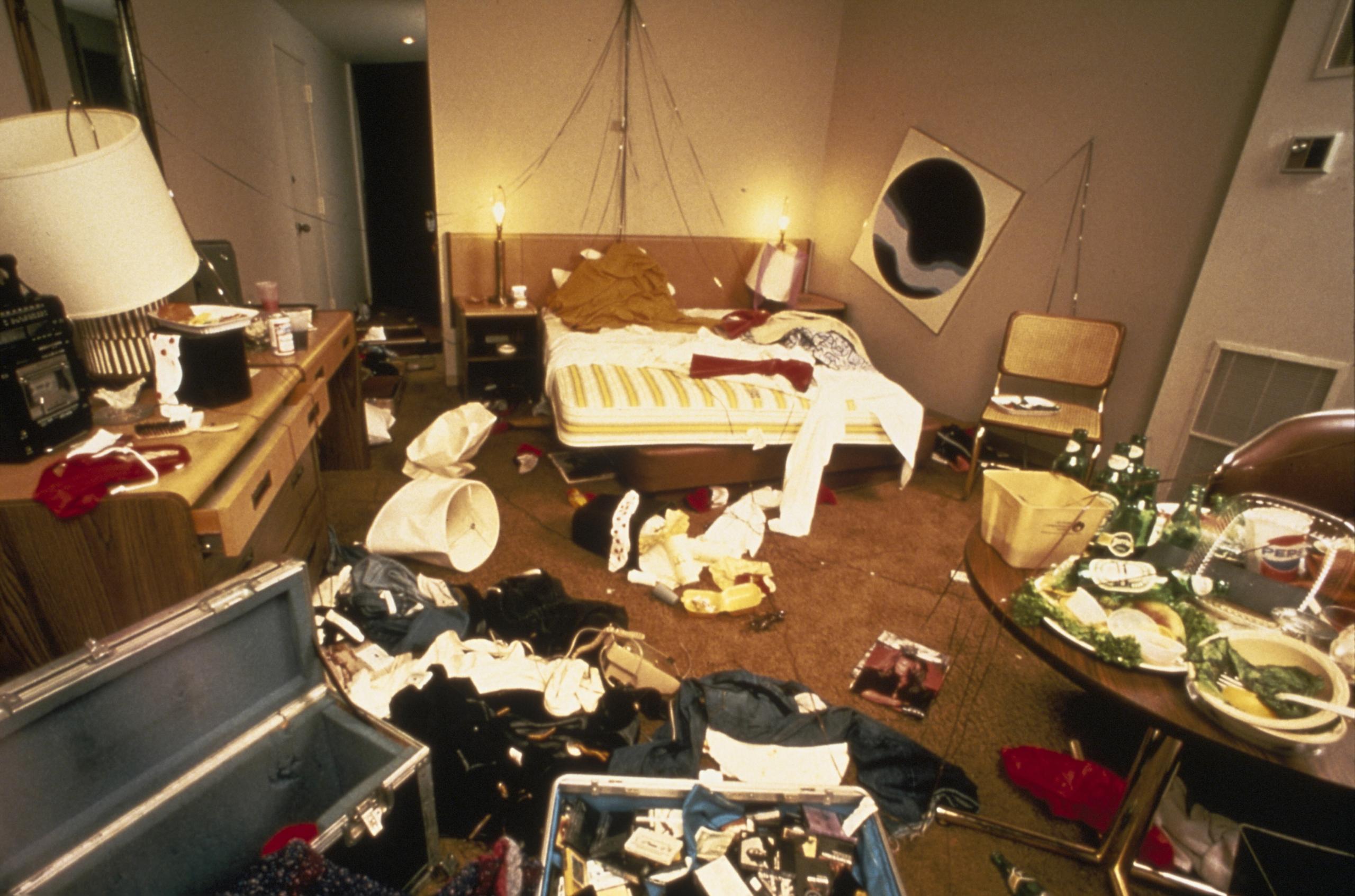

Personal Effects & Burglary

Some credit cards protect the value of your personal belongings in case they are stolen or damaged by a bad actor. There may be separate policies for rental car burglary, hotel room burglary, lost luggage (as described above), or an all-around policy, depending on the nature and location of the loss.

Rental car burglary in particular is interesting. Even if a rental car is insured against damage or theft, your possessions in the car won’t be protected unless you also have this type of insurance.

Certain high-value items may be excluded or limited, like jewelry or furs.

Extended Warranty & Purchase Protection

Getting away from travel now, many credit cards offer protection for items you’ve purchased using the card. These policies also appear on mid- and top-tier cards that don’t necessarily target the travel market, such as cash back Visa Infinite or World Elite cards.

Many items come with a manufacturer’s warranty for defects and premature wear and tear, good for a certain amount of time after your purchase. If your credit card has this coverage, it’ll extend the manufacturer’s warranty, on the same terms.

Usually, these policies double the length of the manufacturer’s coverage, up to one additional year (some premium cards may triple the length, up to two years). There are a few quirks, like if the original warranty is longer than five years, you may need to register the extended warranty with the insurance provider.

For other issues like loss, theft, or accidental damage not covered by the warranty, credit cards offer purchase protection for a shorter period of time, usually 90 days.

There are generally limits on the number of claims you can make, or total lifetime benefits, per account.

Mobile Device Protection

Think of this as an enhanced version of purchase protection, but specifically for mobile phones and tablets.

Most policies cover your device for up to $1,000, for two years after purchase. This is usually based on the depreciated value of the device, not the cost of repairs or replacements.

More and more credit cards are offering mobile device protection. We use our phones on a daily basis, and for whatever reason they’re more likely to break. It’s nice to see an improved policy for the very things that many people would actually benefit from having insured.

If you buy your phone outright, you need to make the purchase with the credit card. If you’re on a contract instead, you need to pay your monthly instalments with the credit card, as well as any upfront fee.

Price Protection

If you buy an item with your credit card, and find it at a lower price shortly thereafter, you’re eligible to claim the difference if you can provide evidence. Some stores themselves offer a price-matching policy, but this can be handy for everything else.

Perhaps because it’s so generous and relatively easy to claim, price protection is not a very common policy to see offered by credit cards.

What About Balance Protection Insurance?

When you activate a new credit card, many banks give you the option to accept or decline balance protection insurance. This is completely different than the travel and purchase insurance automatically granted to all cardholders.

Balance protection insurance is a small charge you pay each month, in exchange for limiting your liabilities in case you’re ever unable to pay your credit card balance. It’s charged as a percentage of the daily balance of your credit account, so paying down your statement early won’t reduce the fee.

But it just amounts to an unnecessary cost. You shouldn’t be using a credit card if you don’t plan on paying your balance in full every month. And you can’t default on your debts if you never carry a balance, so there’s nothing for you to insure.

I always decline balance protection insurance, and you should too! It’s simply not something you’ll ever need or benefit from.

Conclusion

When you’re excited for a big trip, it’s never fun thinking about what could go wrong in case the worst happens. But it’s better to be safe than sorry, and it’s important to be aware of how you can use credit card insurance to navigate issues both big and small.

If you have an active credit card strategy, it’s useful to be aware of how you can build travel insurance into your award travel system. Be sure to review our recommended credit cards for travel insurance on award tickets.

Josh, you say (in your “Liability” section): “You may be covered by your car insurance policy at home, but if you don’t own a car, you’d have to buy this separately.” I struggle to imagine any scenario where this is true. Surely car rental companies include liability insurance on vehicles they own, as required by law. I’ve seen options on car rentals, where one can increase (“enhance”) the liability coverage, but uninsured rentals?

Josh is correct. You as the driver of a rental vehicle have primarily liability to others and things you hurt through your negligence when you drive the car. The owner of the car, the car rental company, has vicarious liability in the event the innocent party can’t recover from you. But you are primarily at fault and will suffer if you don’t have liability insurance in place.

It’s a very complicated topic and Josh did a masterful job.

Does anyone have any experience / issues using U.S. credit card insurance as a Canadian? For example rental car coverage?

Can’t imagine taking the risk, unless you actually sleep at the address you enterred in your credit application for the US card. If the claim is substantial, the insurer will do some due diligence. This whole area is way more fraught than Welcome Bonuses and 5/24 rules.

Great article. That must of been a lot of research. Perhaps in the futur we can get a comparison between cards. Thank you.

There are many taps and tricks to further consider.

Many of us have primary coverage for health claims outside of Canada through our EHC plan at work. So if you have a health claim while travelling, you may have to submit your claim first to the provincial health care program, then to your employer’s EHC plan, then to your spouse’s EHC plan, and only then to the credit card insurer. It takes patience and persistence but figuring out who is primary on the claim and who us secondary helps you figure out the correct

order of your claims.

You may have additional coverage with CAA, your home policy on contents away from the house and an Umbrella policy.

A Company Car you use may have an endorsement for rental cars, even personal use rental cars.

If your booked trip based on your itinerary exceeds the total days of coverage, the whole trip may be an excluded event. Check policy wording.

When you have an event leading to a claim, call the claims hotline right away. You may learn that a police report must be filed. You may learn that only certain medical facilities can be used. The claims person may help you from being taken advantage of by locals who see you as an open wallet.

For emergency insurance coverage age 65-75 take a look at Desjardins Odyssey card. It covers up to 15 days with 5 million in coverage. The card is only 130 per year.

Just to share my experiences with American Express Canada: They were great!

1. Last year I got my flight from Hanoi, Vietnam back to Toronto cancelled because the transfer flight from Hanoi to Hongkong was cancelled. We were able to cancel and get full refund of the original flight, bought new tickets, and AmEx paid the differences.

2. I rent a car with Enterprise CarShare and got pretty bad scratches from previous renter that I didn’t report, so the charge went to me with a $1200 bill. I called RSA (AmEx Insurance), provided all of my paperwork and I was fully covered, didn’t have to pay anything out of pocket.

Lesson learned: Always use credit card with good insurance 🙂

Also CIBC Aventura basic card is a very good no annual fee card but cover Car Rental insurance (this is rare for no annual fee card). The card is super easy to get approve, so I often suggest my international students friends to get this card before they rent a car.

In practice, American Express isn’t handling anything on the insurance side, they just pay the premiums.

AMEX Insurance lines are run by RSA (Royal / Sun Alliance), and any credit card insurance run by the same insurance company is going to be the same, minus any variations in certificates of insurance.

Are there any credit card insurances that cover hostels theft/burglary?

If a credit card has a hotel burglary policy, you’d be covered for any type of accommodation, but I wonder if the insurer would consider it “forced entry” if, say, your locker was robbed by another guest staying in the same room.

Some credit cards cover rental cars regardless if the additional driver is on the rental agreement. This is particularly helpful when you have two drivers and doesn’t want to pay the additional drivers fee which is per day.

My capital one aspire world elite and the aeroplan Amex reserve seem to cover anyone driving the vehicle even if they are not listed on the agreement.

For flight delay coverage that covers expenses after a certain delay period any receipts have to show a time that is after the delay period. Years ago we were flying home the day after the “Shoe Bomber” incident and our flight was delayed 6 hours, the airline did not notify passengers of the delay until after the scheduled departure time. We bought lunch 3 hours into the delay but our insurance claim was denied because it was within 4 hours of the scheduled departure, even though we knew the delay was going to be more than 4 hours.