Which Credit Cards Have the Best Insurance for Seniors?

Travel insurance often gets overshadowed by flashy welcome bonuses or airport lounge access, but for seniors, it’s arguably the most important credit card benefit of all.

Once you turn 65, most cards shrink their coverage windows, impose stricter health requirements, or stop covering you altogether. And after 75, the landscape becomes even more challenging.

In this guide, we break down the best credit cards for Canadian seniors, splitting coverage into two clear age brackets: 65–75 and 75+.

Whether you’re planning a quick winter escape or travelling into your golden years with confidence, there’s a card that can help protect you.

Emergency Medical Care Outside of Your Province of Residence

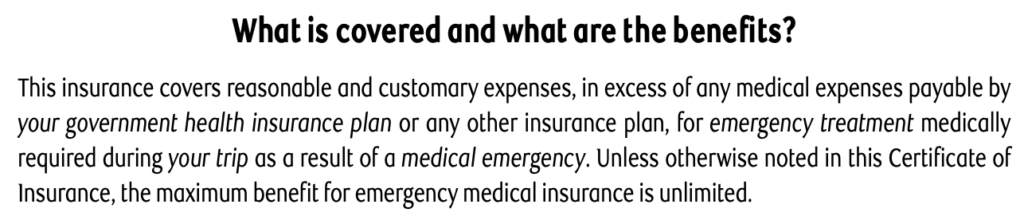

Before delving into the cards themselves, it’s important to go over what this insurance covers, and to establish a baseline of what you can expect in terms of coverage.

Emergency medical care insurance coverage is designed to reimburse you for a certain dollar amount in the event that you’re injured or experience a medical emergency while travelling outside your home province.

This coverage becomes even more relevant if you’re travelling internationally, where it may be more difficult to navigate and understand the local medical system and its costs.

With proper coverage, you’re able to focus on getting care right away without worrying quite as much about the invoice that might otherwise ruin your vacation, or your retirement plans.

Unfortunately, most credit cards drastically reduce coverage once you turn 65. Premium cards that offer 21–60 days of coverage for younger travellers often drop to just 3–15 days for seniors (although most credit card insurers allow you to purchase additional days of coverage before your departure).

After age 75, coverage usually disappears altogether.

For example, the American Express Cobalt Card, offers emergency medical coverage for the first 15 consecutive days of your trip if you’re 64 years old or under; however, once the cardholder turns 65, there’s no coverage at all.

Therefore, you’ll want to consider a credit card that provides the best insurance for anyone travelling in their golden years.

As always, be sure to read the card’s insurance booklet to understand what’s covered in your specific situation. If you ever have any questions, reach out to the card issuer to confirm what’s included.

With that in mind, let’s look at the best options — starting with travellers aged 65–75.

Best Credit Cards for Seniors Aged 65–75

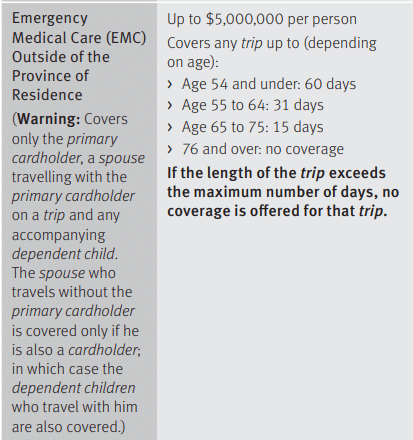

National Bank® World Elite® Mastercard®

- Annual fee: $150

- Coverage: 15 days (ages 65–75), up to $5,000,000

- Coverage ends at age 76

In Canada, the gold standard of senior-friendly insurance coverage is set by the National Bank® World Elite® Mastercard®. Travellers over 65 years old are covered for up to 15 days when travelling out of province. The coverage lasts until you turn 76, at which point you’re no longer covered.

It’s also important to note that if you have a pre-existing illness or injury or if there have been changes to your health within six months of your departure date, you won’t be covered if you suffer an accident directly or indirectly related to the pre-existing condition.

If you qualify for coverage, National Bank will cover you up to $5,000,000 (all figures in CAD) for emergency medical care if you end up needing it.

With an annual fee of just $150 which is effectively offset by the card’s $150 annual travel credit, we consider the National Bank® World Elite® Mastercard® as the best credit card for insurance in Canada.

Even If you make a booking with points, you’ll also be covered which is another one of the card’s mainstay features.

Annual fee: $150

Earning rates

Key perks

- Airport lounge access

Annual fee: $150

Earning rates

Key perks

- Airport lounge access

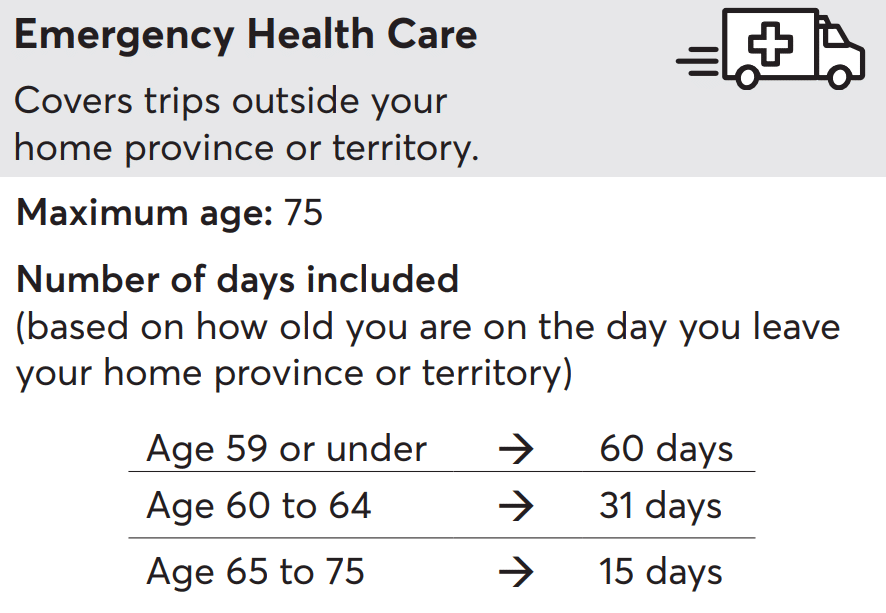

Desjardins Odyssey® Visa Infinite Privilege*

- Annual fee: $295 (members) / $395 (non-members)

- Coverage: 15 days (ages 65–75), $5,000,000 limit

- Coverage ends at age 76

A less talked about card that deserves a spot on this list is the Desjardins Odyssey® Visa Infinite Privilege* Card, which has a similar insurance structure to the National Bank® World Elite® Mastercard®.

If you’re 65 or older, you’re eligible for emergency medical coverage for up to 15 days from when you leave the province in which you reside. However, once you turn 76, you would no longer be eligible for any coverage.

You’ll be covered up to a maximum of $5,000,000 per person, excluding situations where you have a pre-existing condition.

Note that your pre-existing condition window goes back 182 days from date of departure.

Unlike the other cards on this list, the Desjardins Odyssey® Visa Infinite Privilege* is a cash back card, rather than a travel-focused card. It has an annual fee of $295 for members, or $395 for non-members, which is a fairly steep fee to pay.

Annual fee: $395

Earning rates

Key perks

- Airport lounge access

- Priority security at Toronto Billy Bishop, Montreal, Ottawa

- Visa RSVP Diamond at 60+ Sandman/Sutton hotels

- Troon Rewards Platinum (20% off at 150+ golf courses)

Annual fee: $395

Earning rates

Key perks

- Airport lounge access

- Priority security at Toronto Billy Bishop, Montreal, Ottawa

- Visa RSVP Diamond at 60+ Sandman/Sutton hotels

- Troon Rewards Platinum (20% off at 150+ golf courses)

Meridian Visa Infinite* Cash Back Card

- Annual fee: $99 (often first year waived)

- Coverage: 15 days (ages 65–75), $5,000,000 limit

- Coverage ends at age 76

The Meridian Visa Infinite* Cash Back Card is one of the strongest budget-friendly insurance options available.

Seniors aged 65–75 receive 15 days of emergency medical coverage, up to $5,000,000, matching the two premium cards above at a fraction of the price.

The trade-off is a stricter six-month pre-existing condition stability requirement for travellers aged 55+, which may limit eligibility for those with recent medication changes.

Still, for Ontario residents, the value proposition is outstanding: excellent coverage, low cost, and simple cash back rewards.

No annual fee

Earning rates

Key perks

- Comprehensive insurance coverage

No annual fee

Earning rates

Key perks

- Comprehensive insurance coverage

50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

Best Credit Cards for Seniors Aged 75 and Older

Once you turn 76, the field narrows dramatically. Only a small handful of Canadian credit cards continue offering emergency medical coverage past age 75 — and these cards differ significantly in both value and coverage requirements.

Below are the three strongest options.

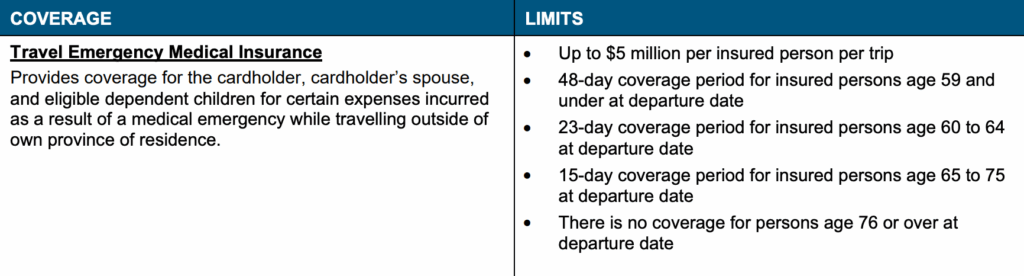

Scotiabank Platinum American Express® Card

The Scotiabank Platinum American Express® Card is another strong contender for seniors looking for travel insurance benefits, especially for shorter trips.

If you’re 65 or older, you’re eligible for emergency medical coverage for up to 10 days from the day you leave your province of residence.

You’ll be covered up to a maximum of $2,000,000 per person, excluding situations where you have a pre-existing condition.

The coverage extends even when you turn 75, but the stability requirement window changes from 180 days from the date of departure for travellers under 75 years of age, and 365 days for 75 years of age or older.

The Scotiabank Platinum American Express® Card is travel-focused and earns points in Scotiabank Scene+ Rewards program, which is one of the most flexible points program to redeem points towards any sort of travel expenses.

It has a slightly higher annual fee of $399 per year, which may be offset by its premium perks, including Priority Pass lounge access and no foreign transaction fee.

First-year value

$601

Annual fee: $399

• Earn 60,000 points upon spending $3,000 in the first 3 months

• Earn 20,000 points upon spending $10,000 in the first 14 months

Earning rates

Key perks

- 31-day travel medical insurance

Annual fee: $399

• Earn 60,000 points upon spending $3,000 in the first 3 months

• Earn 20,000 points upon spending $10,000 in the first 14 months

Earning rates

Key perks

- 31-day travel medical insurance

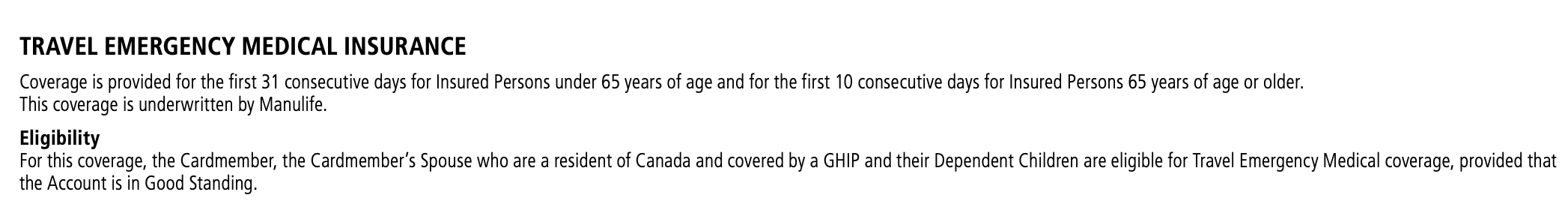

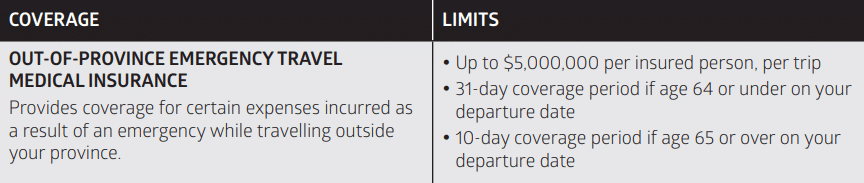

CIBC Aeroplan® Visa Infinite Privilege* Card

- Annual fee: $599 (reducible with a CIBC Smart Plus Account)

- Coverage: 10 days if age 65 or over, up to $5,000,000

- Age cap: None stated – coverage continues past 75

The CIBC Aeroplan® Visa Infinite Privilege* Card offers 10 days of out-of-province emergency medical coverage for anyone 65 or older, with a coverage limit of $5,000,000 per insured person, per trip.

Importantly, the certificate simply says “age 65 or over” and doesn’t impose an upper age limit, meaning the 10-day coverage applies even once you’re well past 75, as long as you meet the usual eligibility criteria and stability requirements.

As usual, pre-existing conditions exclude you from coverage if your emergency is related or indirectly related to your existing condition.

From a pure insurance standpoint, there are cheaper cards that offer similar or longer coverage. However, for frequent Air Canada flyers who will actually use the premium perks: unlimited Maple Leaf Lounge access, priority services, preferred pricing, and boosted Aeroplan earn rates.

This card can still make sense as a “do-it-all” premium option that also quietly covers you into your late 70s and beyond.

First-year value

$582

Annual fee: $599

• Earn 10,000 points upon spending $1,000 in the first 2 months

• Earn 40,000 points upon spending $5,000 in the first 4 months

• Earn 50,000 points on card anniversary upon spending $25,000 in the first 12 months

Earning rates

Key perks

- Unlimited Maple Leaf Lounge access + 1 guest

- 6 Visa Airport Companion lounge visits per year

- Priority check-in, boarding, and baggage handling for cardholder + up to 8 companions

- Priority security at Toronto Billy Bishop, Montreal, Ottawa

- Free first checked bag for cardholder + up to 8 companions

- 1,000 SQC per $5,000 spend toward Aeroplan Elite Status (up to 25,000 SQC/year)

Annual fee: $599

• Earn 10,000 points upon spending $1,000 in the first 2 months

• Earn 40,000 points upon spending $5,000 in the first 4 months

• Earn 50,000 points on card anniversary upon spending $25,000 in the first 12 months

Earning rates

Key perks

- Unlimited Maple Leaf Lounge access + 1 guest

- 6 Visa Airport Companion lounge visits per year

- Priority check-in, boarding, and baggage handling for cardholder + up to 8 companions

- Priority security at Toronto Billy Bishop, Montreal, Ottawa

- Free first checked bag for cardholder + up to 8 companions

- 1,000 SQC per $5,000 spend toward Aeroplan Elite Status (up to 25,000 SQC/year)

RBC® British Airways Visa Infinite‡

- Annual fee: $165

- Coverage: 7 days (ages 76+), unlimited coverage amount

- Stability requirement: 180 days for ages 75+

Best known as an Avios-earning card, the RBC® British Airways Visa Infinite‡ Card also stands out as one of the very few credit cards in Canada that continues offering emergency medical coverage once you reach age 75.

If you’re age 76 or older, you still receive 7 consecutive days of emergency medical coverage, with no maximum dollar limit beyond what your provincial health plan covers. This puts the card in rare territory: it’s one of the cheapest ways for seniors over 75 to retain any credit-card-based medical protection at all.

Seven days isn’t enough for a long winter getaway, but for short trips across the border or quick warm-weather breaks, this card offers exceptional value — especially considering its modest annual fee and full suite of travel insurance benefits.

First-year value

$1,135

Annual fee: $165

• Earn 30,000 points upon spending $5,000 in the first 3 months

• Earn 30,000 points upon spending $5,000 in the first 6 months

Earning rates

Key perks

- Companion eVoucher upon $30,000 annual spend (companion flies round-trip on BA)

- 10% off BA roundtrip fares via ba.com/RBC10

- Automatic BA Executive Club enrollment

Annual fee: $165

• Earn 30,000 points upon spending $5,000 in the first 3 months

• Earn 30,000 points upon spending $5,000 in the first 6 months

Earning rates

Key perks

- Companion eVoucher upon $30,000 annual spend (companion flies round-trip on BA)

- 10% off BA roundtrip fares via ba.com/RBC10

- Automatic BA Executive Club enrollment

Conclusion

While most credit cards don’t offer travel insurance coverage for travellers over the age of 65, and even fewer cover those who are 76 and older, there are still a few standout cards that extend emergency medical protection to travellers in their golden years.

Having emergency medical coverage while you’re travelling is an important way to stay safe and healthy, and to provide yourself and your loved ones with peace of mind.

No matter your age, there’s a card out there that will extend some sort of coverage to you, so make sure to keep that in mind before embarking on your next adventure.

Jason thrives on connecting with the heart of a destination, seeking out experiences that go beyond the guidebooks.

First-year value

$582

Annual fee: $599

• Earn 10,000 points upon spending $1,000 in the first 2 months

• Earn 40,000 points upon spending $5,000 in the first 4 months

• Earn 50,000 points on card anniversary upon spending $25,000 in the first 12 months

Earning rates

Key perks

- Unlimited Maple Leaf Lounge access + 1 guest

- 6 Visa Airport Companion lounge visits per year

- Priority check-in, boarding, and baggage handling for cardholder + up to 8 companions

- Priority security at Toronto Billy Bishop, Montreal, Ottawa

- Free first checked bag for cardholder + up to 8 companions

- 1,000 SQC per $5,000 spend toward Aeroplan Elite Status (up to 25,000 SQC/year)

Annual fee: $599

• Earn 10,000 points upon spending $1,000 in the first 2 months

• Earn 40,000 points upon spending $5,000 in the first 4 months

• Earn 50,000 points on card anniversary upon spending $25,000 in the first 12 months

Earning rates

Key perks

- Unlimited Maple Leaf Lounge access + 1 guest

- 6 Visa Airport Companion lounge visits per year

- Priority check-in, boarding, and baggage handling for cardholder + up to 8 companions

- Priority security at Toronto Billy Bishop, Montreal, Ottawa

- Free first checked bag for cardholder + up to 8 companions

- 1,000 SQC per $5,000 spend toward Aeroplan Elite Status (up to 25,000 SQC/year)