Get the Amex US Bonvoy Business with the First Year Free!

As I elucidated in my post on credit card strategies a few weeks ago, my mindset on US credit cards tends to be quite different from how I approach the credit card offers here in Canada.

Whereas I tend to apply for Canadian credit cards on a regular basis, the stricter eligibility policies on US credit cards means that I generally only act upon them when highly compelling offers come around. And if any of these highly compelling offers also happen to be time-sensitive, I’ll be especially diligent in taking action.

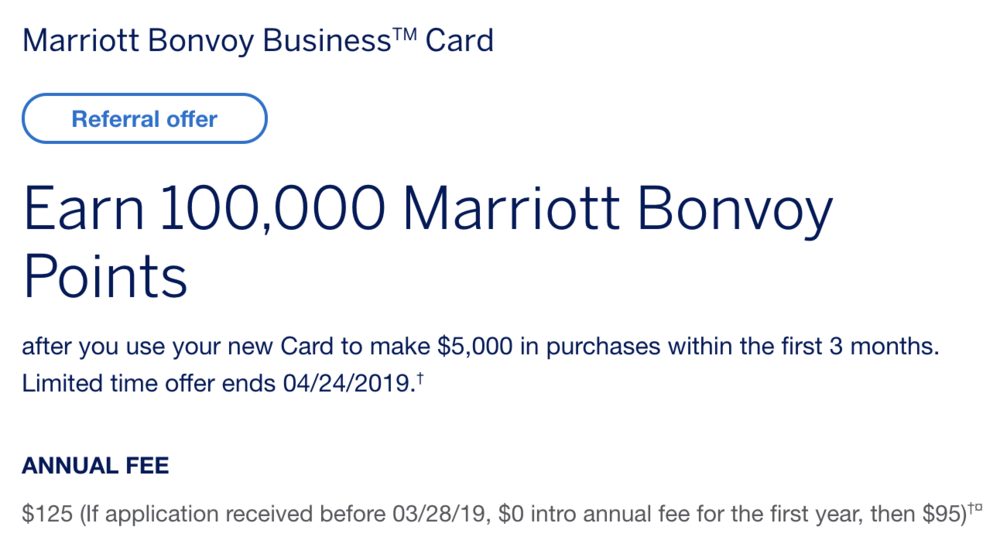

There’s one such offer at the moment that I would certainly be jumping on if I didn’t have the card already, so I figure it’s worth giving you a heads-up in case it’s applicable to your situation. I’m talking about the American Express US Marriott Bonvoy Business Card, which is offering 100,000 Marriott Bonvoy points after spending US$5,000 in the first three months. The signup bonus is valid until April 24, 2019, but the first-year annual fee waiver is only valid on applications received before March 28, 2019.

That gives you just over a week to grab this card (if you don’t have it already) to take advantage of the first-year annual fee waiver and a reduced US$95 annual fee for every year thereafter. After March 28, the annual fee will be rising to US$125, and the first year will no longer be waived. While that’d still be a good deal for the 100,000 bonus Bonvoy points, it certainly pales in comparison to US$95 + First Year Free.

A Great Card to Keep Forever

In the US, American Express enforces the once-in-a-lifetime rule on signup bonuses rather strictly. This means that if you’ve previously signed up for this card (even if it was known as the Amex Business SPG Card back then, which I wrote about last year), you will not be eligible for the bonus points of 100,000 Bonvoy points.

Rather, if you’ve recently established your US credit history but haven’t applied for this card yet, then there’s no better time to do so than prior to March 28.

A side effect of the strict once-in-a-lifetime rule on Amex signup bonuses is that there’s no incentive for cardholders to cancel their cards in the hopes of reapplying and getting the bonus in the future. Therefore, whether or not to keep the card in the long run boils down to a very simple calculation of whether the card is worth keeping for every year’s annual fee.

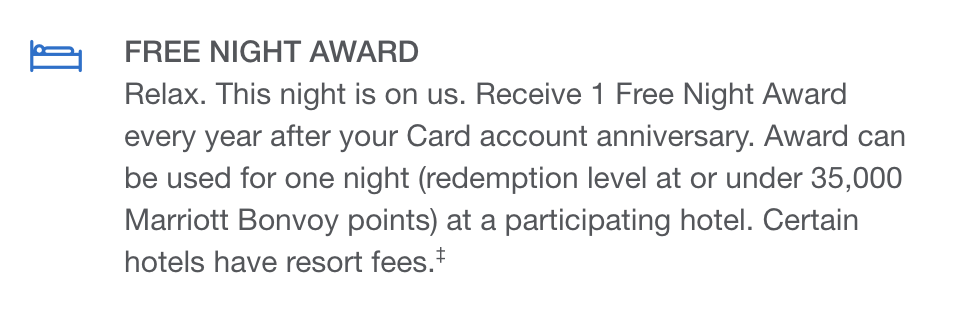

In the case of the Bonvoy Business Card with its annual fee of $0 for the first year, then US$95, the answer is a resounding yes. That’s because one of the benefits of this card is an anniversary free-night certificate valid at Marriott hotels costing up to 35,000 Bonvoy points per night (i.e., a Category 5 hotel or lower).

Generally speaking, I’d say the average retail price of a Category 5 hotel is around $200 per night, meaning you’re already getting great value out of your US$95 annual fee from this anniversary free night certificate alone.

Moreover, if you time your redemption around popular travel periods, it’s not uncommon to see Category 5 hotels retailing for much higher nightly rates. For example, rooms at the Category 5 Le Méridien Munich were going for $900+/night when I stayed during Oktoberfest.

(Having said that, this sweet spot might be somewhat neutralized when Marriott Bonvoy introduces peak/off-peak pricing later in 2019, when the Category 5 peak pricing of 40,000 Bonvoy points per night would render those hotels ineligible for the free night certificate during peak periods.)

Redeem your Category 5 certificate for a free night at the Hotel Bristol Warsaw

Overall, you’d almost struggle not to get your money’s worth if you’re paying US$95 every year in exchange for a free night certificate worth 35,000 Bonvoy points. If you apply after March 28, you must pay US$125 every year instead (including the first year), and while that’s still a good deal, it’s certainly not nearly as compelling. It’s therefore a highly lucrative opportunity to grab the US Bonvoy Business Card before March 28 and hold onto it in perpetuity.

In the US, Business Cards Do Not Build Credit History

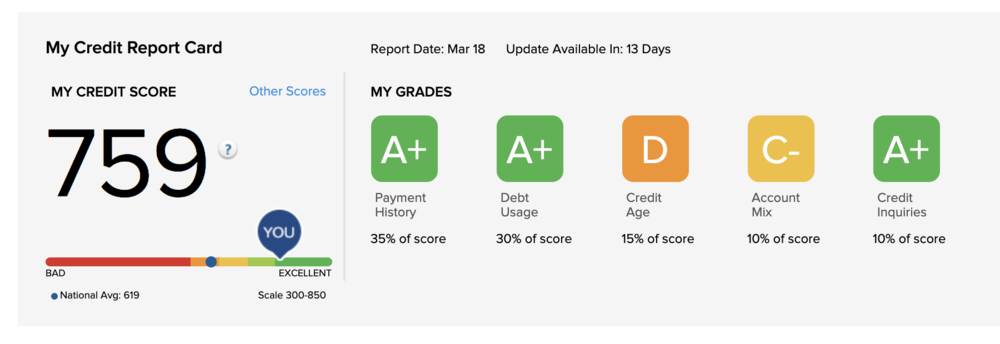

As always with US credit cards, there are a few nuances to talk about when applying as a Canadian resident – the most significant one being that unlike in Canada, US business credit cards don’t report to personal credit bureaus.

When you apply for a business credit card, your personal credit file does receive a credit inquiry to assess whether or not you’re creditworthy enough to be approved. However, once you get approved, the tradeline doesn’t actually get reported to the credit bureaus on a monthly basis. It’s something about the separation of personal and business liability, I’m not exactly sure.

From the perspective of nabbing US credit card bonuses, there are both pros and cons to this. On one hand, applying for Amex business credit cards won’t count towards your 5/24 status when applying for Chase credit cards, so you can power through multiple Amex business signup bonuses while waiting for your credit file to mature long enough to be approved for Chase.

On the other hand, business credit cards also don’t really help you build a US credit history for this very reason! When issuers look up your US credit files, they don’t see the spending and payment activity on your business credit cards, so they can’t use those accounts to judge the robustness of your credit history.

For that reason, I don’t recommend going for this Amex US Bonvoy Business Card as your first US credit card, because it’s not going to help you build your credit history in the long run.

Instead, for those of you who’ve already obtained a US Amex card by way of either Global Transfer or NovaCredit, you should be able to apply for this card on the basis of your existing relationship with Amex US (the longer that relationship has been in place, the better your odds of approval). This may require calling in, since the online application does have a mandatory SSN/ITIN field.

And if you have an SSN or have obtained an ITIN, then you can go ahead and use that to apply directly on the Amex US website. If that’s the case, I’d be grateful if you considered applying via my referral link, which would go a long way towards supporting the website.

Conclusion

While Canadians looking to dabble with US credit cards should be focused on building credit history for the long term, it remains in your best interest to watch out for time-sensitive deals and jump on them if it looks like there won’t be a better opportunity with that particular card in the future.

That’s exactly what’s happening to the Amex US Bonvoy Business Card, which currently offers a fast-closing window to pick up a sweet 100,000 Bonvoy points and lock in the annual fee structure of $0 for the first year followed by US$95. If you’re eligible, make sure to get those applications in before March 28!

First-year value

$1,181

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge