The MBNA Alaska Airlines Mastercard, a traditionally low-key credit card in Canada that rarely puts out special offers, is offering a new $100 statement credit along with the usual signup bonus, valid until June 30, 2022.

We had first seen a $100 statement credit on the MBNA Alaska cards appearing in late 2020, then again in the spring of 2021, and then a doubled $200 statement credit in the winter of 2021.

Now, Alaska Airlines and MBNA have once again brought back the $100 statement credit component for the Summer 2022 promotion period.

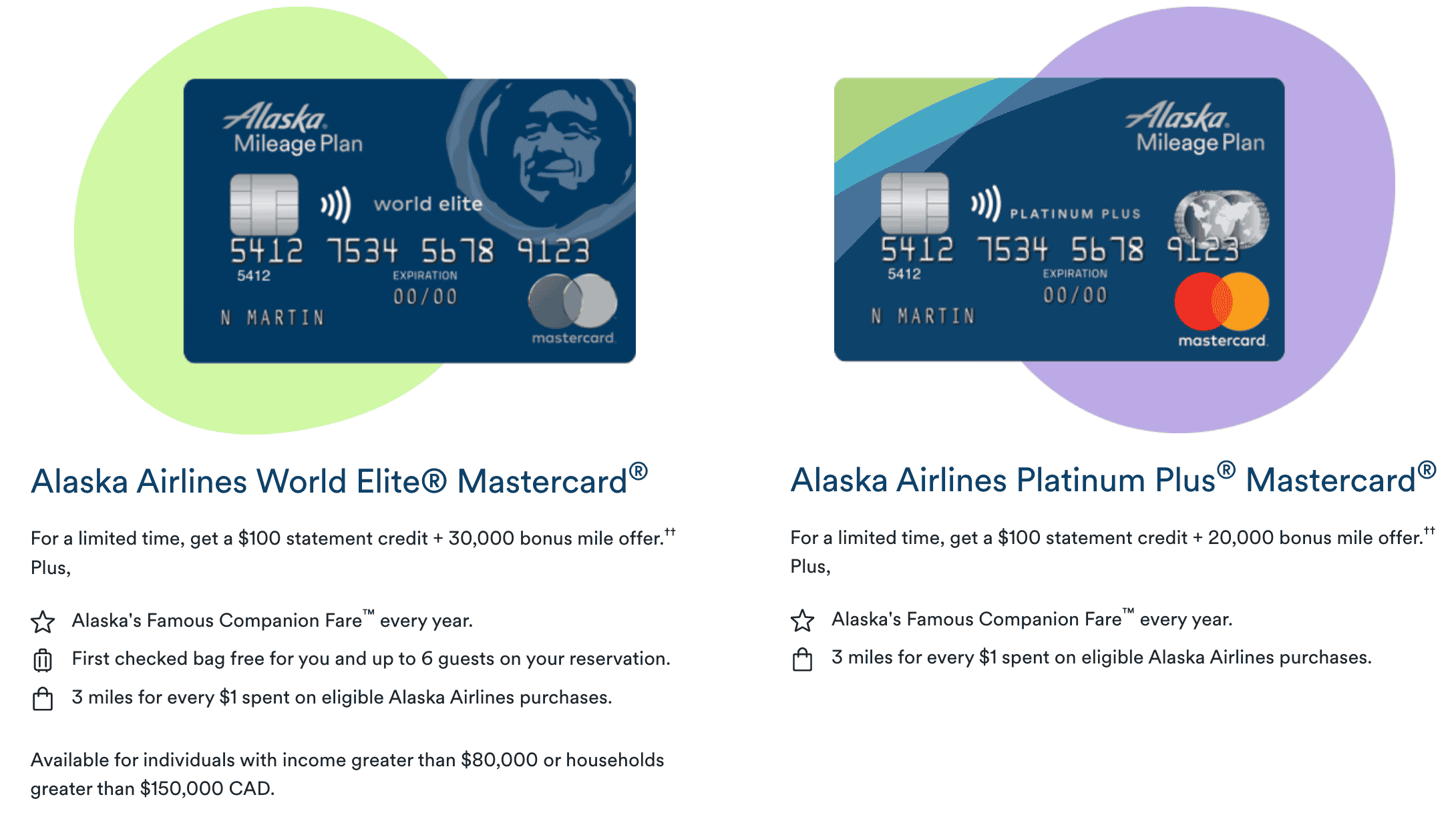

$100 Statement Credit + Up to 30,000 Miles

The $100 statement credit applies to both the World Elite and the Platinum Plus versions of this card.

You’ll now be able to earn the respective welcome bonuses of 30,000 and 20,000 Alaska miles, along with the $100 credit, upon spending $1,000 in the first three months, making the MBNA Alaska one of the easiest “low-hanging fruit” in Canada in terms of attractive credit card offers.

This offer is only available through Alaska Airlines’s direct channel. You can access the offers here: MBNA Alaska World Elite and MBNA Alaska Platinum Plus.

Outside of this $100 statement credit offer, the best way to apply for the MBNA Alaska was through third-party cash back websites, where it was possible to earn cash back rebates of up to $50 upon approval.

However, since these two avenues cannot be stacked, it’s optimal to apply directly through the Alaska Airlines channel and claim the $100 statement credit instead.

Both the World Elite and Platinum Plus versions of the card will offer the $100 statement credit upon spending $1,000 in the first three months.

Recall, however, that the World Elite and Platinum Plus versions of the MBNA Alaska differ in the following ways:

- The World Elite requires a minimum annual personal income of $80,000 or household income of $150,000, while the Platinum Plus has no income requirement.

- The World Elite offers 30,000 Alaska miles upon spending $1,000 in the first three months, while the Platinum Plus awards 20,000 Alaska miles upon meeting the same threshold.

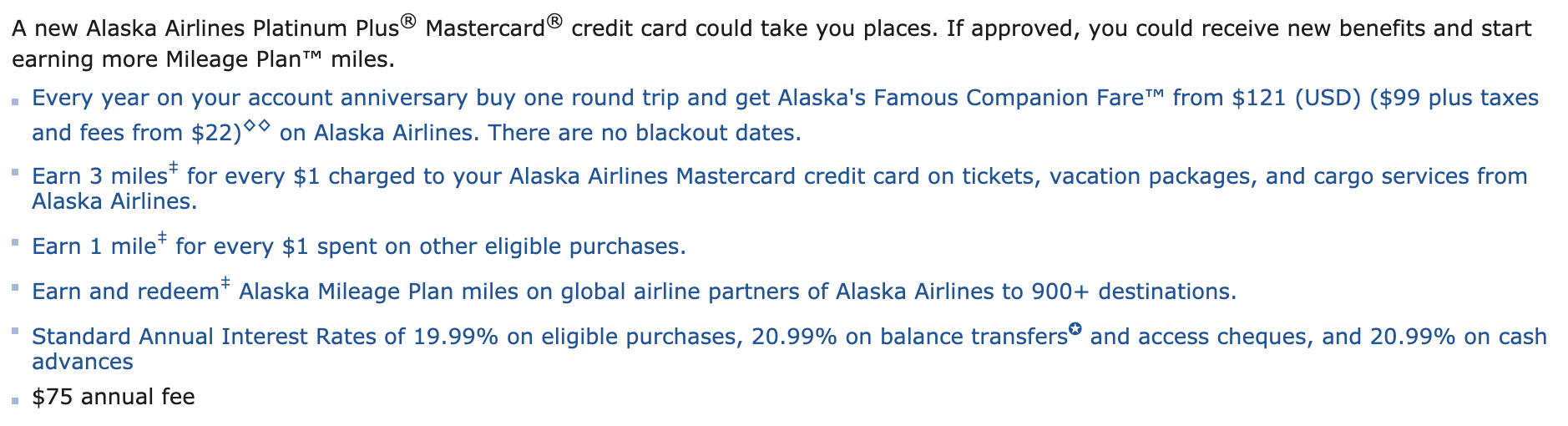

- The World Elite has an annual fee of $99 vs. the Platinum Plus’s $75.

- The World Elite gives a free first checked bag on Alaska Airlines flights for the primary cardholder and up to six passengers on the same reservation, while the Platinum Plus doesn’t offer this perk.

As you can see, the $100 statement credit more than offsets the annual fee on both products: you’d come out ahead in the first year by $1 on the World Elite and $25 on the Platinum Plus, all while collecting the welcome bonus.

Besides the differences listed above, both the World Elite and Platinum Plus cards come with Alaska’s Famous Companion Fare, which lets you book a second passenger on an Alaska Airlines flight for only US$121 (US$99 base fare plus US$22 in taxes) when you pay full fare for the first passenger.

The cards also offer 3 Alaska miles per dollar spent with Alaska Airlines and 1 Alaska mile per dollar spent on everything else, making it a solid choice for your day-to-day non-Amex spending if you see value in collecting Alaska miles for high-value redemptions.

The most popular choices tend to be the aspirational First Class experiences on Cathay Pacific, Japan Airlines, or Qatar Airways, although Alaska’s other partners like American Airlines, Icelandair, and Fiji Airways can make for solid redemptions too.

If you only recently applied for the MBNA Alaska, you can try asking MBNA whether it’s possible to match to this new offer, but I personally don’t think they’ll be likely to grant those requests.

However, also keep in mind the prevailing MBNA Alaska credit card strategy: you can downgrade your MBNA Alaska to a no-fee product after three months, at which point you’d be eligible for another MBNA Alaska since you’re no longer a current cardholder.

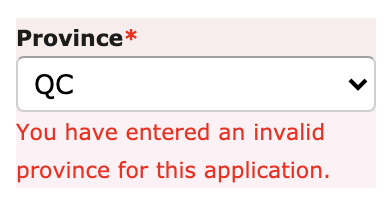

Sorry, Quebecers…

The MBNA Alaska is one of the few credit cards in Canada that specifically excludes Quebec residents from the welcome bonus… on paper, anyway.

On both the ongoing standard offer, as well as this special offer with a $100 statement credit, the verbiage specifically states that “this offer is not available to residents of Quebec”.

(Quebec’s stricter consumer protection rules make it more difficult for banks and financial issuers to offer incentives on spending, which is what a welcome bonus associated with a minimum spending requirement is at the end of the day. Some issuers like TD and HSBC choose to get around this by associating the bonus with a waiting period instead, whereas others, like MBNA, choose to not offer a welcome bonus at all.)

If you enter Quebec as your province, the following warning message is displayed…

…and the applicant is offered to be redirected to an alternative application for Quebec residents, which makes no mention of any signup bonus at all.

Therefore, if you applied for the card as a Quebec resident and didn’t happen to receive the signup bonus upon spending $1,000 in the first three months, then you wouldn’t have any recourse to ask for those bonus miles to be deposited. And of course, nor would you have any recourse to ask for a $100 statement credit either.

Conclusion

The MBNA Alaska Airlines Mastercard is now offering a $100 statement credit along with 20,000–30,000 Alaska miles upon spending $1,000 in the first three months, which will more than offset your first year’s annual fee. This special offer lasts until June 30, 2022.

It’s a great time to sign up for the card as a new customer or incorporate the offer into your ongoing MBNA strategy as you aim to build up your Alaska Mileage Plan balance and book one of their high-value travel.

I just tried to downgrade but the agent said they cannot do it and have to apply separately for the NF card first since Alaska is a different product line.

Applied in Nov or Dec during the $200 credit offer.

Didn’t get approved / receive card until well into Jan.

How does one confirm / obtain their statement credit? Is it supposed to post automatically?

Hi Ricky, the latest TD promotion for Aeroplan cards in Quebec mention (for the first time?) that “Earn 20,000 Aeroplan points when you spend $1,500 within 90 days of Account opening” on the Quebec page of their website. I read the small prints and did not see any exception for Quebec this time. I don’t know, maybe the law has changed. Well, I might try to apply for the MBNA card and maybe I’ll be lucky.

Hopefully the $200 statement credit offer will come back soon, I just missed it this time

Hi Ricky, I have a 16000 credit limit on my MBNA Smart Cash card, can I call MBNA and request the Alaska Card and transfer part of my credit limit from my Smart Cash card to the Alaska Card. If I do that can I avoid the hard credit check and still get all the welcome bonus?

Thanks!

Mike

You can’t initiate a credit split as part of a new application to avoid the credit hit; you can only do it if you were declined and want to split off credit from an existing line to push through the application.

the site now shows January 5th, 2022 as the expiry of this offer

Thanks for the heads up!

If I already have the world elite can I apply for the platinum plus and still get the offer?

You can’t hold the two products simultaneously.

Still unable to apply MBNA, getting auto-declined with messages like “We appreciate your interest in MBNA, but we’re unable to accept your business at this time.” No VPN & No credit check & No records found with MBNA…….

still waiting for the $100 credit from the LAST offer…Not sure how long it takes to process..

Just PS’d this card to the MBNA rewards a few days ago. Is it too early to apply for the card again? I got it 7 months ago.

I’d say give it a few weeks if you can, as the offer goes until January 2022. But if you’re in a rush, you should be fine.

Hi Ricky

So I apply on the Alaska airline site.

Once approved the card is issued by MBNA Canada. Who applies the credit to the card ?

The last time I applied , MBNA Canada will not give me a credit of $100 which Alaska airline insisted I speak to MBNA.

Alaska airlines with not process the $100 credit.. hence I ended paying for the card

Is it Alaska

I am currently have an Alaska World Elite card. Will I be approved for the Platinum Plus if I apply?

Or a better shot would be cancel now and apply at the end of June.

You can’t have both at once. Better to cancel or downgrade now so you can reapply before the $100 offer ends.

Is it possible to apply for both the cards simultaneously?

Apply? Yes. Be approved? No.

Is it possible to apply for both the cards together? or will that be a decline automatically? or just frowned upon?

I cancelled my card a month ago…how long would you suggest I wait to reapply? Thanks

You have a fair shot of going for it again before June 30.

We just reached the $1000 spending threshold and have been credited with the 30000 points on both my card and my wife’s . Interestingly, without the $99 card fee we would not have reached the threshold on either so it would seem that that counts as spending. But we have not received the $100 statement credit yet. Wondering if other people have generally not received the credit and whether we need to spend another $100 or so to have $1000 in actual spending.

I applied for Alaska World Elite in December. Today I got the statement but no $100 statement credit. I chatted with MBNA and they have no clue about this. Is there a way I can get that $100 credit?

Ricky, what do you think of the MBNA Alaska Miles Visa card? I see a current offer of 40K signup bonus with first year annual fee waived.

Seems like you were thinking about the US-issued card by Bank of America. I mean, it’s a great offer! Canadians would need to apply in-branch if they use an ITIN though.

NVM Ricky I got things mixed up …

Do you think if I called in for this offer it would work? I was thinking this might be the offer code – DADI93 – found in the url. I currently have the no fee card from a PS on the Alaska card about 8 months ago and it has a large credit limit. I was thinking it would be easier if I could apply by phone and then have them lower my limit on the no fee version to get the Alaska card approved, if necessary.

Hi George, were you able to PS from the no fee card into the AS card with the $99 fee rebate?

Ricky, I currently have this card. Is the best strategy to change it to a no-fee card (would I get the pro-rata annual fee back), and reapply for it? If the application is declined, would the remedy be to transfer credit from the no-fee card?

Thanks so much Ricky! It is odd though, when I go directly to the MBNA website, I don’t see the $100 credit statement as part of the offer.

Yep, it looks like it’s available only through Alaska Airlines’s channel (the application links were sent in an email, presumably to Mileage Plan members with a Canadian address).

After 90 days and downgrading from the Alaska card to a no-fee card, do you still need to wait 30 days before applying for the alternative Alaska card or are you good to go to apply right away?

Hi Ricky,

I don’t suppose upgrading my Platinum card to Elite would allow me to receive the bonus ? Without cancelling my current card?

Nope, that wouldn’t come with the bonus. It’s only granted on a new application.

Hi Ricky,

Like you I live in Montreal. I was interested recently in getting this card but there seems to be nothing available to Quebecers. The Great Canadian Rebates page also lists the $50 cashback deal as not available to residents of Quebec. In addition, the regular MBNA website for the card, when you choose Quebec as your region, makes no mention of a welcome bonus if you spend $1,000 in the terms and conditions. It seems the MBNA strategy just does not work for Quebecers at all anymore?

It would seem the abscence of evidence is not evidence of abscence.

The Quebec offer makes no mention of a welcome bonus, but it also doesn’t say there will be no welcome bonus. 🤔

Interestingly, the MBNA page in both french and english state that you can get “up to 30,000 points” in the card details further down the page, but doesn’t say it’s a welcome bonus. If you read the terms and conditions in english, there’s no mention of a $1,000 minimum spend, but in the same text in french there is. I chatted online with an agent, but she seemed quite confused. She did conclude that there would be a welcome bonus, but honestly I didn’t really trust what she was saying.

So it would seem there is definitively no GCR rebate or statement credit for Quebecers, and may or may not be a welcome bonus.

But I think you’ve had this card before? Have you had an issue getting a welcome bonus after the $1,000 minimum spend being a Quebecer?

I actually haven’t changed my mailing address from Ontario, as my move to Quebec was likely a temporary one. I’d recommend connecting with fellow Quebecers, who as I understand it have applied for this card with a wide range of outcomes.