When you’re the Prince of Travel budget writer, you get to interact with Canadians from every walk of life. Our audience stretches from students to wizened academics, young go-getters up to high-powered executives, apprentice mechanics to veteran engineers.

This also means there’s plenty of us who don’t quite meet the $60,000 minimum income required for the Visa Infinite family of products. Hell, scant have been the days I’ve been part of that class of German car-driving ballers who make the $80,000 on their lonesome necessary to possess a World Elite Mastercard, either.

There’s nothing more disheartening than realizing there’s an awesome product you don’t qualify for. Today, I want to dive into a few strategies you can use to either get around this, or lessen the sting by offering alternative products that are still very strong.

Why Are There Income Requirements?

The reason there are minimum requirements is because it’s been legislated by the Financial Consumer Agency of Canada. The Credit Card Code of Conduct, section 9, specifies why:

“…Premium payment cards shall only be given to a well-defined class of cardholders based on individual spending, assets under management, and/or income thresholds and not on the average of an issuer’s portfolio.

Premium payment cards have a higher than average interchange rate. They must be targeted at individuals who meet specific spending, assets under management and/or income levels.”

In English: using premium credit cards, with higher rates of rewards and higher welcome bonuses, costs merchants more. As such, the government wants to limit the number in circulation to save businesses money, and thus keep prices for consumers lower.

They do this by ensuring the best credit cards go to the people who make the most money, thus preventing the majority of the populace attaining the best credit cards available.

This doesn’t quite seem equitable to those of us who make less, but before you rush off to tell your bank that your investments in Gamestop turned you into the millionaire owner of a chicken tendies manufacturing empire, consider my next Public Service Announcement.

PSA: Lying Is Gambling

Yes, the best credit cards are behind an income wall. No, this isn’t very much fun for those of us who make less. But you should definitely remember that if you lie on an application, you’re gambling with your accounts.

The algorithm might approve you and you may even get to use your shiny new higher-end credit card for a while, but the bank could at any time call BS on your claims and you’ll find your cards shut down.

I myself know one person who told a major bank that their income was much greater than what they actually earned. Eventually, they ran into an identification issue with one card, resulting in their entire account being frozen and being ordered to provide bank statements and pay stubs to verify their identity.

Needless to say, this person didn’t have the proof, and half a dozen credit cards went to the big blue recycling bin in the sky at the end of that very month.

Remember: a bank calling BS and shutting you down is the usual punishment, but it’s not the only thing that can occur. If that person had engaged in forgery and provided bogus statements, that could have been criminal.

I’m not saying you’re about to be locked up if you rounded up once, but just want to remind you that committing fraud is a capital “B” and “I” “Bad Idea”.

Tap Your Household Income

So the minimum personal income is a bummer. One of the easiest ways to get around this is to combine your household income.

Many banks have a fairly vague definition of “household income”, usually summarizing it as meaning the combined incomes of all persons living at a single address.

This means you can just tally up the incomes of yourself and people at your address, such as your Player 2 or your entire family, and have fun applying with your now-qualifying household income.

This strategy is at its strongest if you’re living with family, as you can put the income of your parents and/or even your siblings as belonging to your household. This will often put you easily above the requirements of the best credit cards, even if you’re a broke philosophy student.

However, there are some banks that do specify spousal income and aren’t interested in every person residing at your address.

(Ricky mentions to me that, back in his days of applying for credit cards as a student, a TD phone agent informed him that household income consists only of oneself and one’s spouse, even though that isn’t clarified anywhere on the online application.)

Once again, don’t engage in fraud, but if you and your Player 2 are about to book your destination wedding next year on points, where’s the harm in counting them as your spouse a little early?

Similarly, some banks specify “family income”, and I may not live with my dad anymore but he’s certainly still my progenitor, and thus family. Just sayin’.

As always, multiple incomes are better than one and will also make you appear less risky to the approval algorithms, heightening your chances of a successful application.

Sign Up in Branch

Let’s say household income isn’t an option and there’s a premium credit card you like the look of, but don’t meet the minimum income to acquire. Don’t fret – apply in branch instead. Inform the credit card specialist that you don’t quite meet the requirements but are still interested in the card.

You’ll be amazed what many managers or tellers can assist you with when applying in branch. Many employees are also on commission to sign up customers for a certain type of credit card.

If you and your credit card applications specialist happen to have interests that align around you getting a certain type of credit card, there’s a good chance the income requirement will poof into smoke.

Alternatively, if you’ve been a longtime and loyal customer at your “main bank”, they may pre-approve you for premium cards or waive the minimum income requirements entirely if you ask them! I had a friend in 2014 making less than $20,000 a year get approved for the BMO Air Miles World Elite card just by talking to the local BMO branch manager.

Register for New Bank Accounts

If you’ve exhausted your other options, you could look into alternative avenues of attack to get your credit score working for you. In addition to credit card signup bonuses, also consider aiming for chequing account bonuses.

My colleague Josh has written an excellent piece on bank accounts with great signup bonuses. If, like me, you hate paying banking fees this might be killing two birds with one stone: getting you away from a bank that charges you, and giving you a little incentive on the side.

Just sign up for the account, meet their criteria, and enjoy your bonus. I feel this is a great strategy for lower income earners because there’s no minimum income required to sign up, and I’ve never heard of someone having their application for a bank account denied.

A little extra cash never hurt anyone’s travel goals, right?

Cards to Consider

As we’ve seen, household income, signing up in a branch, and considering a nice chequing account are all great strategies to maximize your returns from your credit applications.

Occasionally, though, these won’t cut it, and we will have to apply for the less optimal cards which we do qualify for.

Let’s look at a few credit card options that are still fantastic choices for people who earn under the Visa Infinite and World Elite Mastercard requirements.

Even if you are a more fortunate member of society, you should still consider applying for some of these credit cards. A big reason for this is that, unlike premium credit cards, the “Joe Average” family of cards don’t have minimum credit limit requirements (for example, $5,000 on all Visa Infinite cards).

This means your overall credit available won’t be as high if you get these more pedestrian cards. This can make you look more desirable to another lender who might view you as a risky client if you have too much credit available, be it a mortgage or auto lender or another credit card company.

TD Aeroplan Visa Platinum / CIBC Aeroplan Visa

Your first great options for no income requirement credit cards are the TD Aeroplan Visa Platinum Card and the CIBC Aeroplan Visa Card. These have welcome bonuses, at the time of writing, totalling 20,000 Aeroplan points and 10,000 Aeroplan points, respectively.

With a minimum spending requirement of $1,000 and $0.01 respectively, and no annoying minimum income requirements, the potential upsides far outweigh the mediocre earn rates and paltry insurance coverage.

For the full details on the cards (especially their annual fees), check out their links above. On top of the versatility of these cards is another silver lining: if you’re ever declined for one of these cards, you can go in-branch to plead your case. Sometimes the staff can overturn a decline and get you the card, making your credit pull a worthy endeavour.

MBNA Alaska Airlines Platinum Plus Mastercard

The MBNA Alaska Airlines Platinum Plus Mastercard is an excellent choice for any Miles & Points enthusiast, and its lack of income requirements makes it even juicier. If you’re not making big bucks, there’s no reason to not cash in on a good amount of free Alaska miles.

The $75 annual fee is more than offset by the welcome bonus of 20,000 Alaska miles after spending $1,000 in the first three months. As Ricky proves, the Alaska Mileage Plan is one of the most lucrative in the world for would-be cheapskate jetsetters like yours truly.

Of course, be aware that Alaska Airlines recently joined Oneworld. While there don’t appear to be any imminent devaluations on the horizon, this could change with as little as 90 days’ notice.

Unfortunately, as the online-only Mastercard-issuing subsidiary of TD Canada Trust, there is no reconsideration line or branch to go into if you get declined. You would have to split credit from an MBNA card you’re already holding in such a situation.

RBC Avion Visa Platinum

The RBC Avion Visa Platinum card is an underrated gem. For a card with no income requirement, earning 1 RBC Avion point per dollar spent, and a welcome bonus of 15,000 Avion points upon first purchase, this card punches well above its weight.

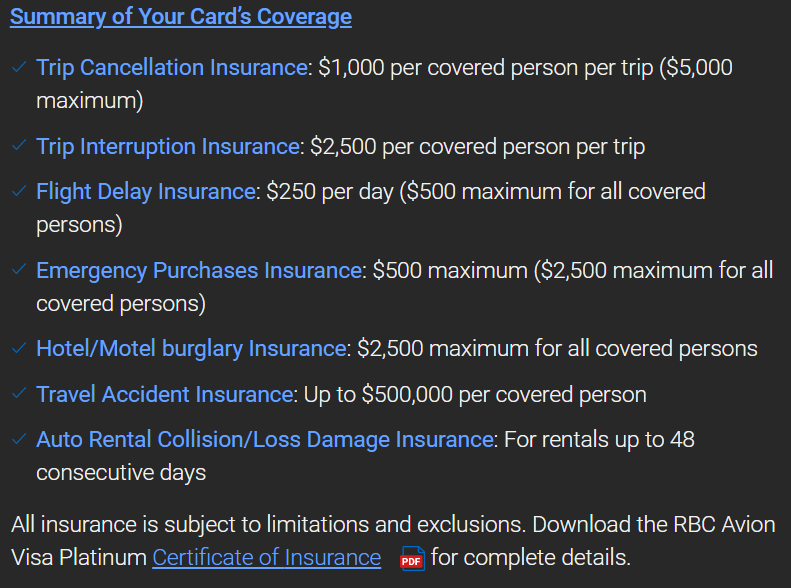

On top of all this, it comes with a suite of complimentary insurance. Take a look:

This card is almost identical to the RBC Avion Visa Infinite, the only differences being the latter’s superior insurance coverages and small 1.25x modifier on travel purchases.

Even the welcome bonuses move in lockstep. When the Avion Infinite card is offering an elevated points promotion or a first-year annual fee waiver, the same offer extends to the Avion Platinum card – your application will just be downgraded if you don’t qualify for its superior counterpart.

Better yet, the Avion points you earn can be used on RBC’s internal travel service, transferred to partners including British Airways Avios at 1:1 (sometimes even with a 50% bonus), redeemed at 1 cent per point on Hotels.com or Fairmont gift cards, or transferred to your RBC Investorline account at 0.8 cents per point.

Lastly, this card is also excellent because you can product-switch to it from any other RBC card you might be holding – no minimum credit limit here. Better yet, if you get sick of the annual fee after the first year, product-switch to something with no fee!

Conclusion

I hope that this article helped people who, like me, find the arcane system of income requirements for credit cards to be irritating.

All Miles & Points enthusiasts should be able to achieve their travel dreams without having impossible hurdles placed in their paths. Even if you make a bit less, you should still be able to follow the guidance here to earn more points and more cash without much fuss.

Until next time, don’t inflate that income box beyond what you can justify.

Investorline is a BMO account. For RBC its called a Direct Investing account.

And it goes without saying, that anyone interested in MBNA’s Alaska Platinum Plus card, should apply through a cashback site to offset that annual $75 fee to a more modest $25.

I think the most underutilised method for receiving premium card approval is making more money/getting a better job. I hear that if you work hard on achieving that, it will improve your quality of life in many ways.

Great article Kirin. This game is available to anyone who wishes to participate. Now matter your salary. It’s too bad, some banks still use an archaic way to determine whether a credit card applicant is suited or not.

AMEX literally doesn’t care about your income, have gotten the Plat for $30,000 and the bizplat for $1k monthly business revenues

At that income, the AF is about 3% of your after tax income. Hard to imagine allocating that much to a card. I find the benefits don’t really stack up unless you spend a lot or travel often to use the lounge access or hotel statues.

Sorry if this has been answered elsewhere, but you mention product-switching an Avion – if we downgrade from an infinite Avion to a no-fee card, what happens to the Avion points?

I recommend you use/transfer them prior. If you can’t then you have 90 days after account closure to expend them in rbcrewards.ca