Blockchain is a foundational technology that is widely seen as having the potential to revolutionize every aspect of our lives over the next decade or so.

With blockchain currently making big strides into mainstream consciousness through its primary use-case at this point in time – cryptocurrencies – I wanted to look ahead at how this technology might transform our very own little corner of life: credit cards, points, and travel.

Much of this article is forward-looking and speculative by nature. Still, as someone who has taken an interest in blockchain technology for several years now, I think it’s a highly absorbing subject to explore and I’d be eager to hear any of your thoughts on the topic as well.

What Is Blockchain?

At its core, blockchain is a new way of recording information.

It’s commonly described as an open and distributed ledger (i.e., an ever-growing database of information) that can record transactions between multiple parties in a permanent and efficient way. Let’s break down each of these critical properties one by one.

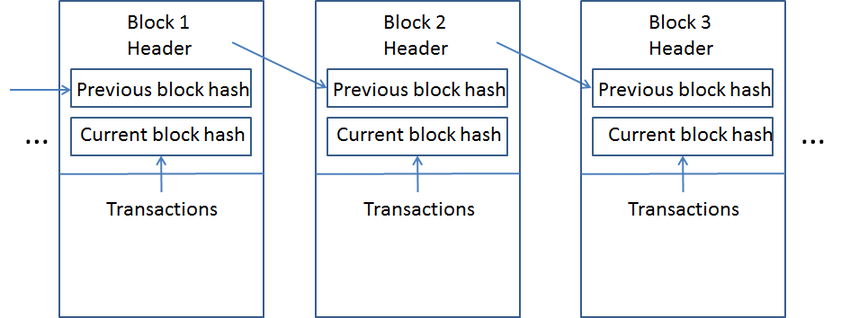

As its name implies, a blockchain’s structure takes the form of a chain of individual blocks, one block after another. Each block contains information about a batch of transactions, contracts, or any other forms of interaction that have taken place among the parties on the network.

The parties (or “nodes”) on the network are connected via the internet. They each maintain their own copy of this chain, and they add new blocks to their chain as the blocks are formed. Therefore, we say that the blockchain is open and distributed.

In addition to the information about transactions, each block also contains a cryptographic hash of the information in the previous block. A hash is essentially a very robust encryption method, or you can think of it as a cryptographic fingerprint.

This encryption ensures that it is not possible for any party to change data in previous blocks without affecting the next block and subsequently the whole chain. Therefore, we say that the information recorded is permanent.

In this fashion, the blockchain allows multiple parties to record transactions without having to place a great deal of trust in any one party on the network.

How do you know how much money you have? Well, you place your trust in your bank to keep accurate records and not run away with your cash. How do you know how many rewards points you have? You place your trust in the loyalty program to track your points balance correctly (and not leave you #Bonvoyed).

On the other hand, every node on a blockchain network maintains their own copy of the ledger, establishing network-wide consensus as to who currently has what.

Trust, instead of being placed in a single entity, is decentralized across the entire network, eliminating the need for intermediaries or middlemen. This reduces transaction costs and processing time, resulting in a more efficient way of securely recording information.

Understanding these properties is central to understanding why blockchain is heralded as so transformational. After all, the concepts of contracts and transactions are fundamental to our society, and yet the distinctly analogue realm that they occupy – the realm of banks, lawyers, real estate agents, automated clearing houses, etc. – seems ripe for digital transformation.

If this all sounds a bit whimsical and far-fetched to you, don’t worry – foundational technologies often appear that way, until a moment goes by and they’ve revolutionized our lives. Indeed, try to imagine what it would be like explaining the concept of the internet to someone in the 1970s.

Our explanation of blockchain has merely scratched the surface; it isn’t all that important to the discussion of how blockchain might transform Miles & Points. To draw a parallel to the internet once again: we all use the internet every single day, but only a few of us actually understand how it works. That’s fine, and that’s how it was meant to be.

If the topic does pique your interest, though, I’d encourage you to spend more time studying the ins and outs of how blockchain works.

I recall feeling blown away by the genius of blockchain back when I had first developed a basic understanding of it, so I’ll leave you with some light reading and viewing material if you’d like to learn more:

- Blockchain – A Short and Simple Explanation with Pictures (Hacker Noon)

- How Does a Blockchain Work? (Simply Explained)

- The Truth About Blockchain (Harvard Business Review)

- How Bitcoin Works Under the Hood (CuriousInventor)

Short-Term Impacts: Limited to Cryptocurrency

You’ll notice that blockchain is often associated with Bitcoin, the world’s leading cryptocurrency. Indeed, blockchain was invented in 2009 as the technology behind Bitcoin. It’s important to emphasize that these are two distinct concepts: Bitcoin is a cryptocurrency, while blockchain is the technology that underpins Bitcoin and all other cryptocurrencies.

In the future, blockchain will almost certainly have many different applications beyond cryptocurrencies as well. But in the present day, cryptocurrencies remain the dominant use-case of blockchain – unsurprising, given that they were invented together, one built upon the other.

Therefore, in the short-term future, blockchain’s impact on our daily dealings at the nexus of personal finance and travel will probably also be linked to the rising prominence of cryptocurrencies.

In fact, we’re already seeing this in the credit card space: the Crypto.com Visa Card has recently launched in Canada, allowing users to carry out day-to-day transactions in Canadian dollars and earn rewards denominated in CRO, a cryptocurrency issued by Crypto.com themselves.

(What exactly is CRO, you might ask? Well, think back to the description of blockchain as a distributed ledger across a network. Anyone can start their own ledger using this technology, and in this case, an entity called Crypto.com started their own ledger and decided that rather than denominating transactions in CAD or USD, they’d denominate things in their own currency named “CRO” instead.)

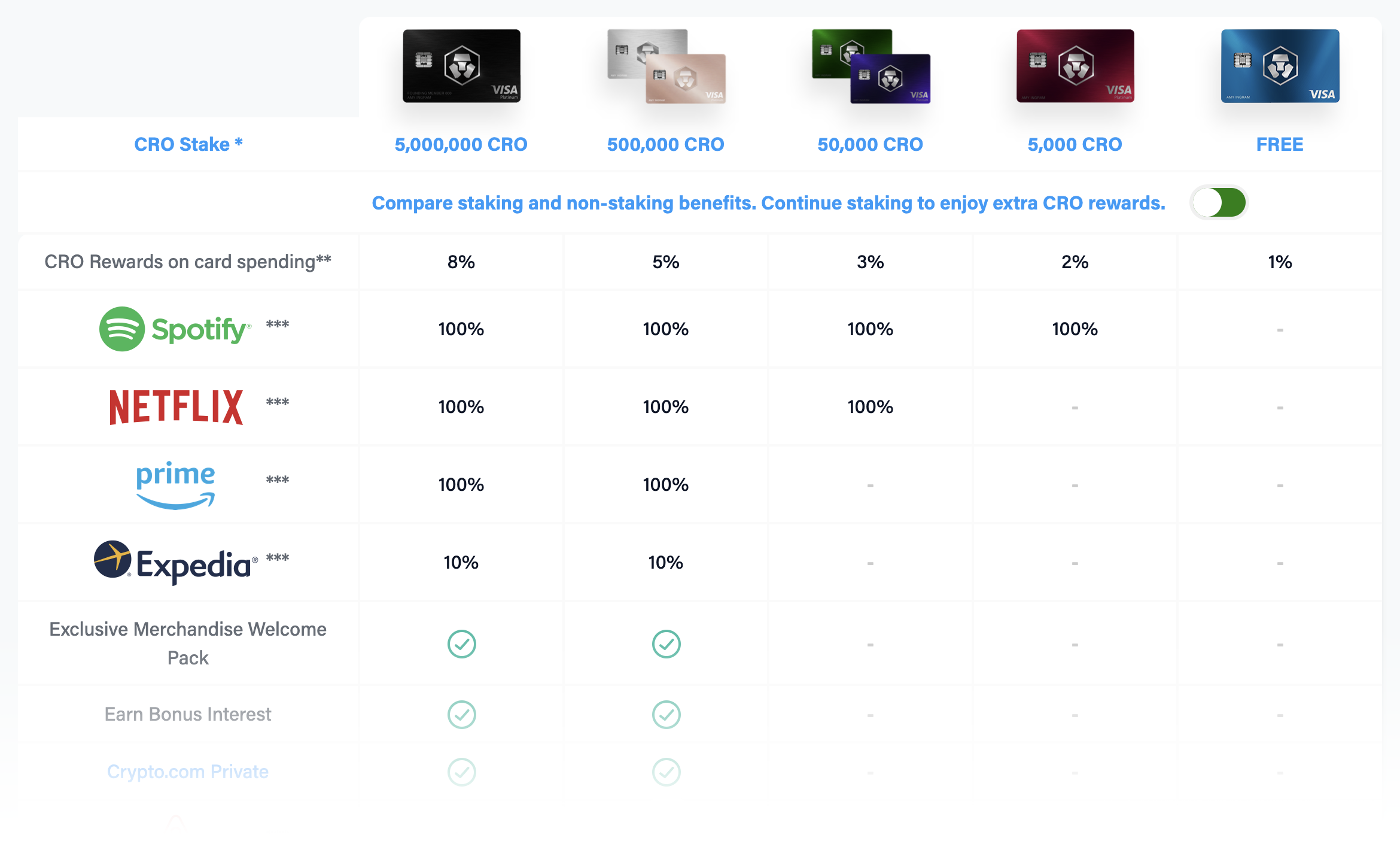

The Crypto.com Visa Card comes with some perks that look pretty awesome on paper – you can earn up to a staggering 8% back on purchases in rewards!

But don’t get too excited. There’s an upfront buy-in required to get a Crypto.com Visa Card, and in order to qualify for the top-tier Obsidian product with 8% back, you’ll need to “stake” 5,000,000 CRO upfront, which is equal to about – wait for it – $500,000 CAD.

Yeah, the Jade Green card with 3% back at a 50,000 CRO ($5,000 CAD) stake might be more reasonable…

Also, note that the stake cannot be withdrawn into dollars for a six-month period (although rewards earned in the form of CRO can be traded any time). This opens yourself up to the risk of fluctuations in the CAD/CRO exchange rate in the meantime – although the expectation is that the value of CRO will rise, and we’ll talk about why in a minute.

For now, I’ll add that Josh has recently gotten a Crypto.com Visa Card for himself, and he’ll be following up with an article on his experiences using the card and more analysis on this brand-new product in the Canadian market.

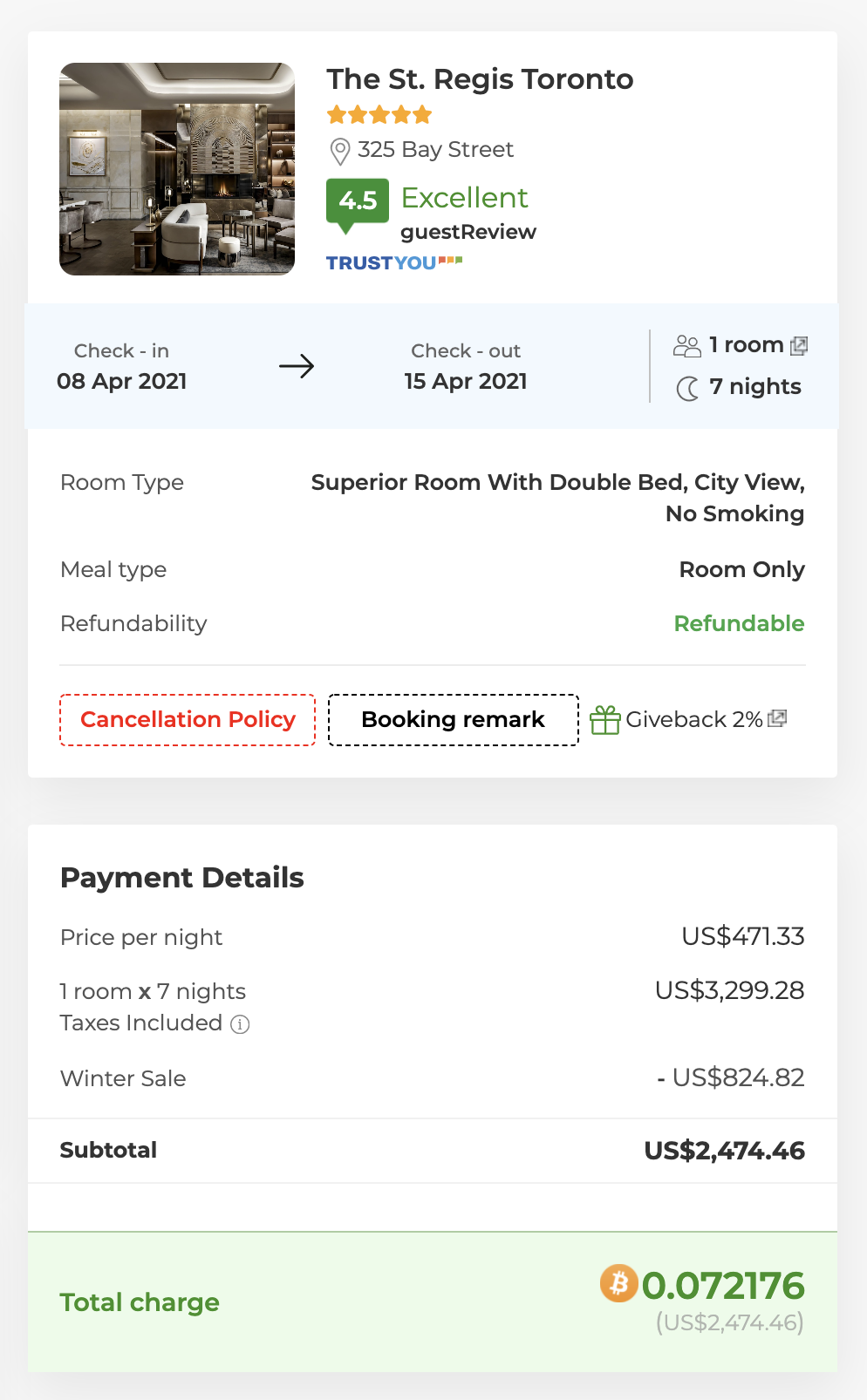

Switching gears for a moment away from credit cards and towards travel, we also have the example of Travala, an online travel booking platform that lets you pay with either fiat currency (i.e., traditional government-backed currencies like USD or CAD) or cryptocurrency.

Similar to the Crypto.com Visa, Travala also offers rewards in the form of its own Travala token (AVA), which users can earn for booking through the platform, leaving reviews of hotels, encouraging others to sign up, or other behaviours that lead to the growth of the platform.

Now, if you think about it, neither Crypto.com nor Travala are really doing anything revolutionary just yet. As a prepaid card and a travel booking platform, respectively, the only thing they’ve done differently to their peers is that they’ve incorporated cryptocurrency into their operations.

And that makes perfect sense, since we’re still in the early days of blockchain, and blockchain is somewhat synonymous with cryptocurrency during these early stages.

Through these early projects, Crypto.com and Travala are aiming for large-scale adoption of their respective CRO and AVA tokens, as more people use their services.

Increased demand for these tokens would drive up their price and essentially fund the growth of these companies, allowing them to research, build, and launch other projects in the future that may leverage blockchain to more fundamentally transform their industries (payments and travel bookings, respectively).

Long-Term Impacts: Transforming Loyalty Programs, And More

What might those more fundamental changes look like? What are some of the impacts that blockchain might have in the long run, when it achieves lift-off from its initial use-case of cryptocurrency?

Let’s explore these questions through the lens of an industry that’s very close to our hearts: airline and hotel loyalty programs. Blockchain’s ability to revolutionize loyalty programs has been the subject of much futurology, and I’d highly recommend reading the white papers by Deloitte and Oliver Wyman on the topic.

Recall the definition of a blockchain as a distributed ledger of transactions among multiple parties. Well, it will be possible for airlines, hotels, and credit card companies to act as individual parties and record their intra-party transactions on a blockchain, effectively connecting all of their loyalty programs into a secure, permanent, and efficient loyalty network.

(Note a technicality here: the banks and airlines would most likely opt for a “closed-source” or “permissioned” blockchain for reasons of privacy and control. Some blockchain enthusiasts may argue that this would simply be a distributed database on the cloud rather than a blockchain, which is meant to be an open and decentralized ledger. Still, the underlying core technology can make a big difference for the industry, as we’ll discuss below.)

Recall as well that a blockchain is also capable of storing contracts, essentially a set of “if this, then that” statements. It will be possible for earning rates, points transfers, transfer ratios, transfer bonuses, points purchases, redemption rules, etc. to be coded directly on the blockchain, allowing all of these transactions to happen seamlessly from the user’s perspective.

Let’s imagine a future in which the current Canadian loyalty ecosystem of American Express, Aeroplan, and Marriott have linked up to form a blockchain-based loyalty network.

You’d be able to collect, say, Aeroplan points from booking a flight, from calling an Uber to the airport, and from buying a coffee at the airport cafe, and then redeem those points instantly for your choice of onboard wifi, a statement credit on your Amex, or for a suite upgrade at your Marriott hotel at the destination. This would all happen instantaneously – no waiting around for points to post – and would all be managed from a central wallet instead of multiple apps with multiple logins.

If Aeroplan wants to put on a promotion that gives you 5,000 bonus points for shopping at certain retailers (whether online, or at physical storefronts based on your location), then you’ll get the points as soon as you’re done shopping – no more waiting around for months on end, as in the Black Friday promotions of yesteryear.

If you’ve earned Aeroplan points but have no use for them, and would prefer to have Marriott Bonvoy points instead? On a blockchain-enabled loyalty network, it would be possible to find other members with the opposite set of preferences and exchange your points accordingly.

(In fact, this all sounds very similar to the future that Aeroplan has already outlined for us in the present day. I’d be very surprised if Aeroplan hasn’t already taken steps to future-proof the program’s infrastructure with the adoption of blockchain in mind.)

On the other side of the coin (pardon the pun), the effects will be keenly felt for those who are looking to build customer loyalty, too.

Major loyalty providers will be able to more easily collect useful data on users’ behaviour, target users with offers accordingly, reduce the friction between earning and redeeming, and add or remove partnerships with other blockchain-enabled entities to help users derive greater value from the program. At the same time, small businesses will also have a much easier time offering their own loyalty programs to the market at scale.

To illustrate, let’s imagine a second loyalty network in Canada based on the current ecosystem of RBC, British Airways, WestJet, etc.

RBC might offer its small business clients the ability to link up with the next-generation form of RBC Avion points; since everything is on the blockchain, it takes mere seconds to set up the connection. Thus, you’ll be able to hit up your local bookstore, florist, or dance studio and earn points that you’ll use towards your next big trip.

Blockchain can effectively replace the antiquated systems that underpin today’s loyalty programs and partnerships. It can herald a world in which every business, big or small, offers the ability to earn and redeem some kind of points currency on a real-time basis, leveraging it to drive their customers’ loyalty.

We’ve done a lot of imagining thus far, but the reality is that even though we’re fashionably late to the game as usual here in North America, the rest of the world has already gotten started on implementing these types of projects.

Singapore Airlines has launched Kris+, an app that operates its own blockchain-based loyalty network with local shopping and dining providers in Singapore. For now, users can convert KrisFlyer miles into Kris+ miles, but not vice versa – it’s still in its early days, so the blockchain component hasn’t fully merged with the airline loyalty program yet, but it’s well on its way.

Similarly, Emirates has recently partnered with Loyyal, a leading player in the blockchain loyalty space, to transform Emirates Skywards into a blockchain-enabled loyalty program, allowing members to seamlessly earn miles on, say, their shopping at Dubai Mall and then redeem for a free flight or an upgrade.

Oliver Wyman predicts, in the long run, “the development of four to six blockchain-based loyalty networks, each anchored by a major airline, a major hotel chain, or a group of smaller travel companies.” Singapore Airlines and Emirates are first-movers in this race for blockchain-powered loyalty, and I could definitely see them as founding members of their own larger-scale global loyalty networks over time.

From a user’s perspective, the truth is that you probably won’t even notice blockchain’s presence unless you’re paying close attention to this stuff.

You’ll simply find that your favourite loyalty programs have become much more frictionless, easier to use and manage, and providing you with a far greater range of earning and redeeming options that are better tailored to your wants and needs. And that’s what really builds loyalty, isn’t it?

If we were to abstract even further – and leave you with some additional reading material – well, we haven’t even considered yet the potential impacts of blockchain on a variety of other industries, such as the payments industry (where Crypto.com is hard at work), airlines’ global distribution systems (where I wouldn’t be surprised to see Travala making inroads), insurance, local tourism, and even our very own digital identities.

As a foundational technology, blockchain’s multifaceted impacts across dozens of interconnected industries, each building upon the other, will bring about changes to the way we live our lives – including the way we earn and redeem points for travel – that we can’t even begin to anticipate in the present day.

Exciting times ahead, isn’t it?

Conclusion

Blockchain is the newest foundational technology that promises to change the way we transact, interact, and do business with one another. It’s a matter of when, not if, its effects will be keenly felt across every industry, including credit cards, loyalty programs, and travel.

With the original use-case of cryptocurrency gradually entering the mainstream, the underlying blockchain technology is also capturing the minds of many very smart people out there, leading them to build new businesses and reimagine existing ones using blockchain in the long run.

As avid travellers and maximizers of loyalty programs, it’s perhaps too early to predict how exactly things will change, but we can expect blockchain to make our lives easier in many ways and expand the range of options and value that we can extract from our favourite programs.

As I mentioned, Josh will be following up this post with a closer look at the Crypto.com Visa Card, and we look forward to covering the many more exciting developments that blockchain will inevitably bring to our space in the years to come.

Thanks for the informative post Ricky! Definitely peeked my interest to read more on the topic.

This is a great article! I’d be interested to see how Josh’s fares with this experiment? I hope he did the 5,000,000 CRO one! 🙂

Did not expect to see an article about Blockchain here. Great article Ricky, excited to see its application further in NA markets.