Blockchain technology is on the rise, and it’s beginning to integrate with our daily lives. While cryptocurrency has a long way to go before replacing fiat money (government-backed currency), there are now more ways to buy and use digital currencies than ever before.

The Crypto.com Visa Card launched in Canada at the end of 2020. It’s the first major cryptocurrency payment card in our market. This is a very exciting development for anyone interested in the arrival of cryptocurrency as an everyday medium of exchange.

A year in crypto is an eon compared to other financial markets and technologies. I’ve had the card since its launch, and it’s high time to review the changes we’ve seen with the card and the overall blockchain space since then.

In This Post

Crypto.com and CRO

Crypto.com is a company that offers a variety of financial services for cryptocurrency, including trading, term deposits, lending, peer-to-peer payments, and of course, the card.

2021 was an exceptionally strong year for the company. They’ve added numerous new products, including a more fully-featured exchange with limit orders, margin trading, derivatives, and a variety of currency pairs. They’ve also added an NFT platform, staying on the cutting edge of what’s hot in the space.

Their technological innovations continue to forge ahead with the launch of Cronos, a decentralized app platform in the vein of the Ethereum ecosystem. They’re also expanding their decentralized finance (DeFi) platform, providing a blockchain to support traditional mechanisms to grow your money but with a modern security mindset.

Meanwhile, they’ve also invested an enormous amount into marketing. They’ve secured the naming rights to the arena formerly known as the Staples Center, home to the NBA’s Los Angeles Lakers and Los Angeles Clippers, and the NHL’s Los Angeles Kings. They’ve also forged partnerships with such A-listers as Matt Damon and LeBron James. Crypto.com is positioning itself to be synonymous with crypto as it enters the mainstream.

Crypto.com’s operations are all on their blockchain. Their utility token, CRO, is primarily used to power the network. CRO is paid to various participants depending on their role: consumers earn CRO as rewards, validator nodes earn CRO for maintaining the integrity of the ledger, etc. It can also be bought and sold on exchanges, including the Crypto.com app.

(Some of Crypto.com’s older branding makes reference to MCO, the Monaco token. This coin has been phased out and replaced by CRO. Newcomers can ignore the old terminology and treat the entire product as Crypto.com and CRO.)

Crypto.com Visa Card: How it Works

Among Crypto.com’s many financial services, the Crypto.com Visa Card is in use by millions of people around the world. It’s a prepaid card: it has no impact on your credit history, and you have to add funds to use it.

Despite the cryptocurrency label, you actually load and spend fiat dollars on the card. You don’t spend cryptocurrency assets, and there’s no conversion at the point of sale.

To load the card, first top up your Canadian-dollar wallet for free in the Crypto.com app. Go to your fiat wallet and select Transfer for e-Transfer deposit instructions You can do this for free via e-Transfer.

Then, transfer funds to the card. You can also load the card with cryptocurrency indirectly, by selling it for Canadian dollars at the market rate in the app.

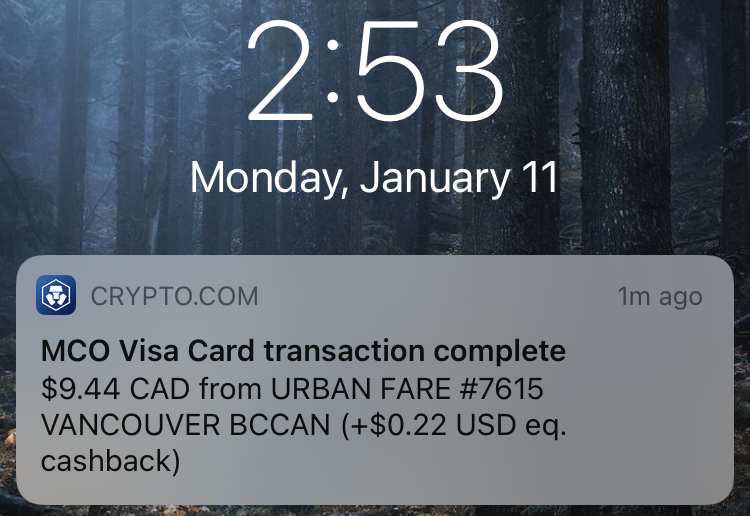

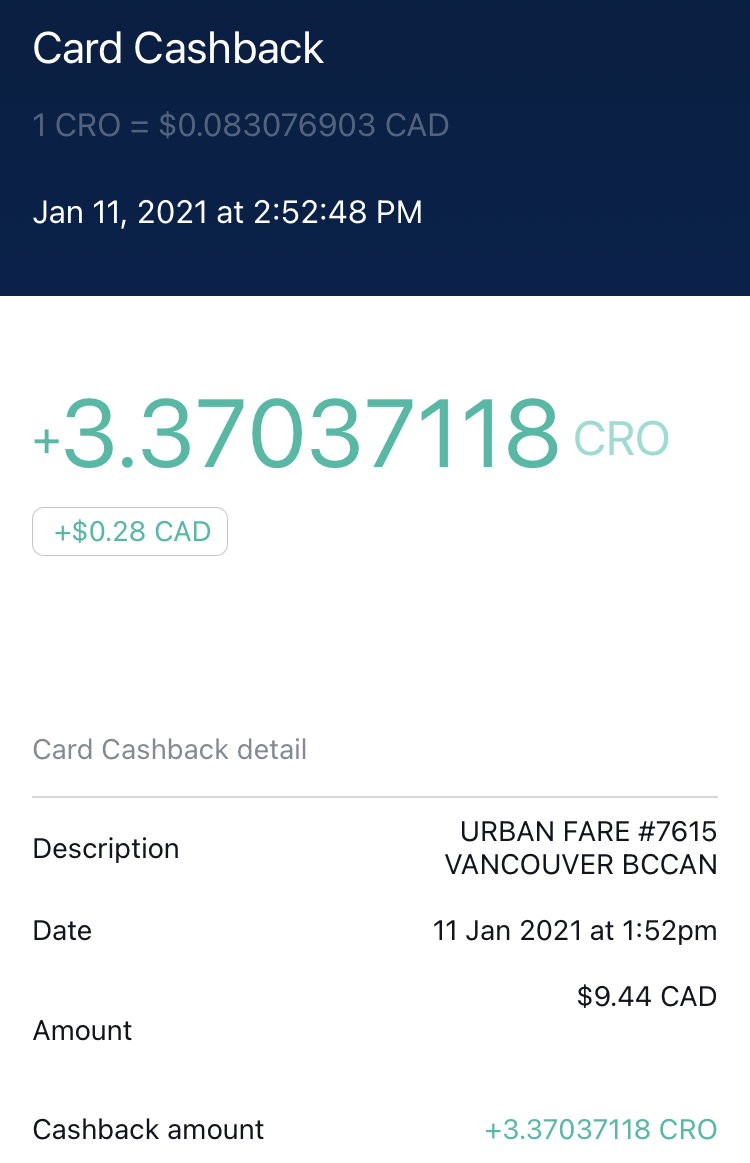

Rewards on spending are earned in CRO, at a rate based on the Canadian dollar price of your purchase. For example, if you make a purchase of $100 and your Crypto.com card earns 5% rewards, you’ll receive $5 worth of CRO. If CRO is worth $1 at the time of your purchase, you’ll earn 5 CRO.

So, to recap: load fiat, spend fiat, earn crypto.

Crypto.com Visa Card: Rewards & Benefits

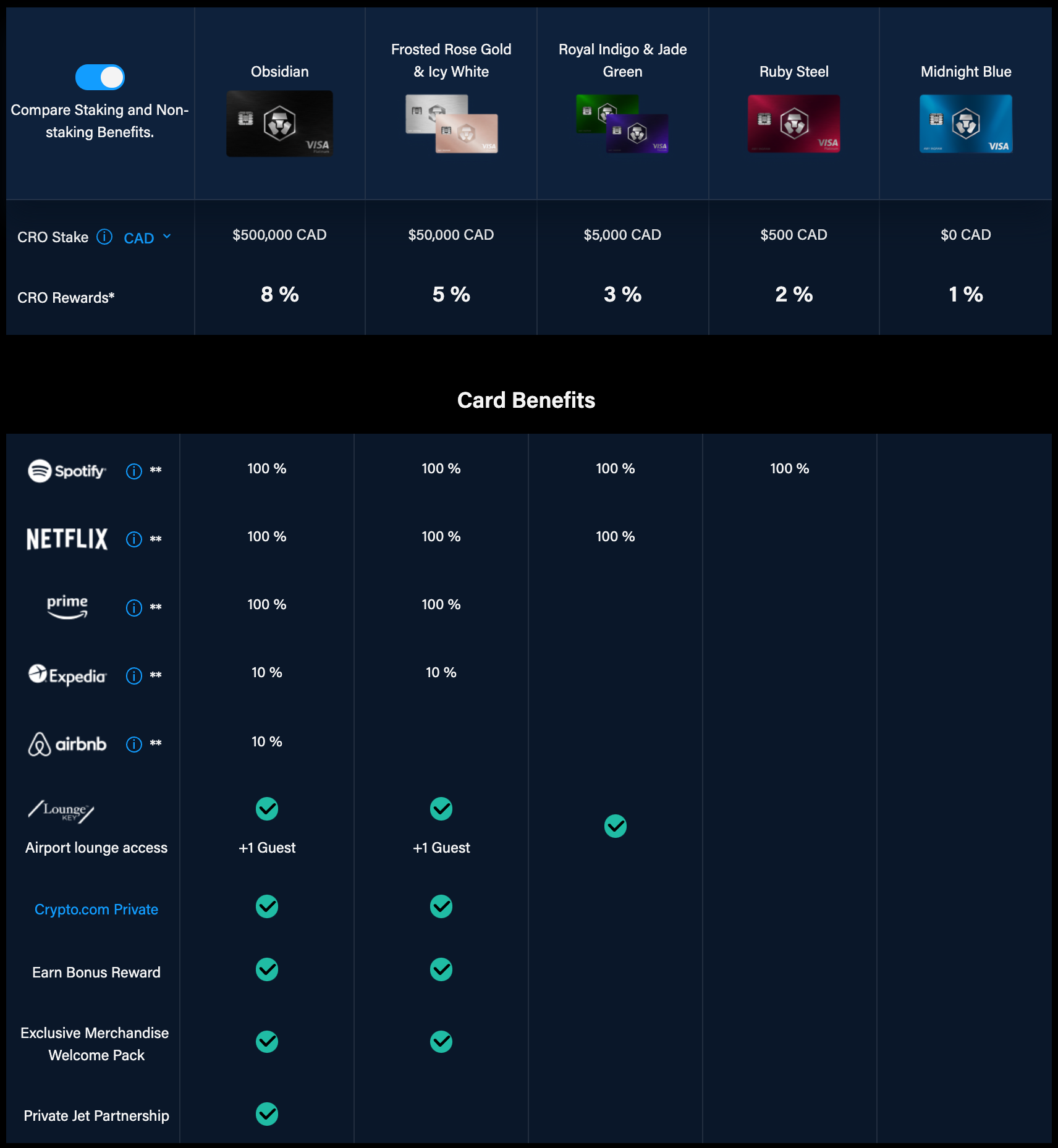

There are five tiers of Crypto.com Visa cards. They earn a flat rate of return on all eligible purchases (with the usual exception of cash-like transactions), offering very compelling rates in lieu of category bonuses:

- Obsidian: 8% back

- Icy White or Frosted Rose Gold: 5% back

- Jade Green or Royal Indigo: 3% back

- Ruby Steel: 2% back

- Midnight Blue: 1% back

Depending on your tier, you can get full rebates on Spotify, Netflix, and Amazon Prime, 10% back on Expedia and Airbnb bookings, or even a private jet partnership! (If you ever find out what that entails, please feel free to invite me along for a ride.)

All of the cards are metal, except for the entry-level Midnight Blue card.

Canadian cardholders have no foreign transaction fees. You’ll be subject to the Visa interbank exchange rate at the point of sale.

Additionally, the cards offer no-fee ATM withdrawals. Depending on your tier, you can withdraw $250–$1,300 per month before a $5 fee per withdrawal kicks in. It’s not an enormous limit, but it’s still useful in case you need cash.

The cards also come with a LoungeKey membership. Cardholders at the Jade Green/Royal Indigo tier get unlimited visits for themselves at all LoungeKey airport lounges. Obsidian and Icy White/Frosted Rose Gold cardholders can also bring one guest per visit for free.

What Is a Staking Requirement?

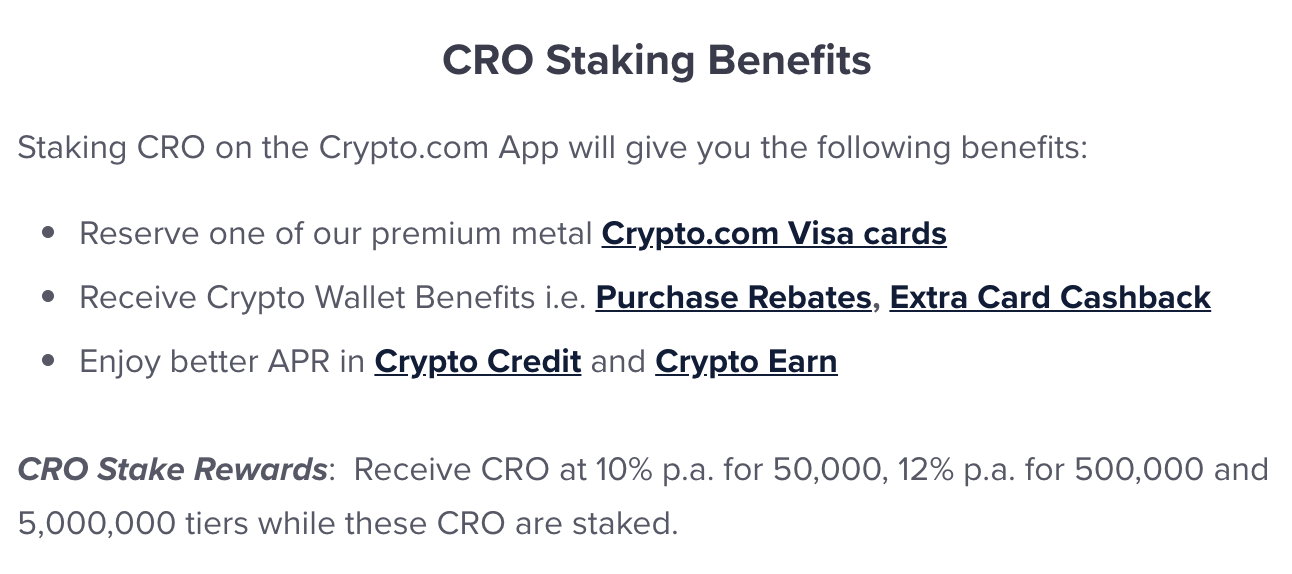

There are no annual fees to use the Crypto.com Visa Card or any of the platform’s services. Instead, they require you to hold a CRO stake to maintain your rewards rates and most of your benefits.

Originally, staking requirements were priced in CRO, meaning the fiat cost of each tier would vary depending on the timing of your entry. In March 2021, Crypto.com adjusted their staking requirements to be pegged to fiat instead:

- Obsidian: $500,000 worth of CRO

- Icy White or Frosted Rose Gold: $50,000 worth of CRO

- Jade Green or Royal Indigo: $5,000 worth of CRO

- Ruby Steel: $500 worth of CRO

- Midnight Blue: No stake

Whereas an annual fee is a cost that you never get back, a stake is an investment. You own your CRO, and you can withdraw or sell it as you wish. (There is a six-month lock-up period after you initially stake for your tier.)

Once you’ve locked your stake, your tier is protected in case of CRO fluctuations. For example, let’s say you buy into Ruby Steel for $500. At a price of, let’s say, 1 CRO = $0.50, you’ll get 1,000 CRO. If the value of CRO drops to $0.40, your stake is only worth $400, but you won’t be downgraded to the Midnight Blue tier.

Likewise, if CRO goes up, you can re-stake and upgrade your tier. For example, if CRO climbs to $5, your stake of 1,000 for Ruby Steel would be worth enough to upgrade to the $5,000 tier, with no need to buy or earn extra CRO in excess of your original stake.

You can think of the stake like the minimum balance to waive fees for premium chequing accounts, but with a few key differences.

You’ll be holding this balance in CRO, not in Canadian dollars. The value of your stake might fluctuate wildly, for better or for worse.

Also, unlike a chequing balance, you’ll earn interest on your stake, paid in CRO – and a significant amount, for that matter. Currently these rates are 10–12%, depending on your tier.

Risks of Using Crypto.com

Now that we’ve gone over the mechanics, rewards, and costs of Crypto.com, it’s important to understand the risks of using the platform. Your stake is orders of magnitude higher than a typical credit card annual fee, so even though you own your investment, this isn’t a decision you should rush into lightly.

Asset Risk

Asset risk refers to the potential for an asset to drop in value based on market conditions.

If and when you choose to retire your Crypto.com Visa Card, you may wish to sell your stake. If the value of CRO has gone down since you staked, you’ll pull out less fiat than you put in.

Also, as you earn rewards in CRO, your return on spending could fluctuate as well. If you prefer to get predictable value back for everyday purchases, you might consider selling rewards for Canadian dollars as you earn them.

Of course, asset risk works both ways: your CRO could appreciate immensely!

Therefore, the card may be better for people who plan on using it long-term. You may even wish to view the stake as a one-time purchase and forget about it – after all, as they say, never invest more than you can afford to lose.

Counterparty Risk

Counterparty risk refers to the possibility that the other party (in this case, Crypto.com) won’t fulfil their obligations to you. In the context of cryptocurrency, that could include a security breach, or a more nefarious exit scam.

You won’t have federally-regulated deposit insurance on any digital assets. Your tier stake must be held at Crypto.com and can’t be transferred out. In other words, it’s like keeping your cash at the bank instead of under your mattress, but the bank is a startup in a volatile industry.

There’s a saying in crypto: “not your keys, not your coins.” In the “under the mattress” scenario, you’re the only one with cryptographic access to your assets. However, when you put your coins on a platform like Crypto.com, they have the keys to your wallet, and grant you access via a secure, user-friendly interface. The assets are yours, but they are held on a “custodial platform.”

This is necessary to fulfil many of the financial services they provide – and indeed this is how traditional banks work – but there’s a security trade-off that might give cryptocurrency purists pause.

That said, modern reputable cryptocurrency institutions take security exceptionally seriously:

- Crypto.com has its own insurance policy to protect its clients’ digital assets.

- Also, Crypto.com has a good history of rectifying fraudulent transactions. I myself have had my card compromised, and they were quick to proactively reverse the charges and issue me a new card.

- Finally, I’ll leave it up to you to evaluate if the company’s trajectory and presence should inspire confidence in its legitimacy. Ultimately, that should underpin your confidence in the above two points.

My Impressions Using Crypto.com

I staked at the Jade Green/Royal Indigo tier a couple of months before the cards launched in Canada. I was easily able to set up my card in the app. It took a little under a month to arrive, although I’m not sure if there was a backlog of pre-orders at the time.

I’ve been loading my Crypto.com fiat wallet via Interac e-Transfer. Deposits are available by the next business day.

I set my card’s PIN in the app. To make my first purchase, I had to reset my original PIN upon failing verification at the point of sale terminal. My new PIN began working immediately thereafter. This is a typical workflow for prepaid fintech cards, in my experience.

My CRO rewards appeared immediately after making my first transaction. I received 3% of the spot rate for CAD/CRO, give or take a rounding error. (Fiat currencies, with only two decimal places, are nowhere near as precise as modern digital currencies.)

It’s been pretty much smooth sailing since I’ve been up and running. Over the past year, I’ve been gradually shifting more of my everyday spending to the Crypto.com Visa Card.

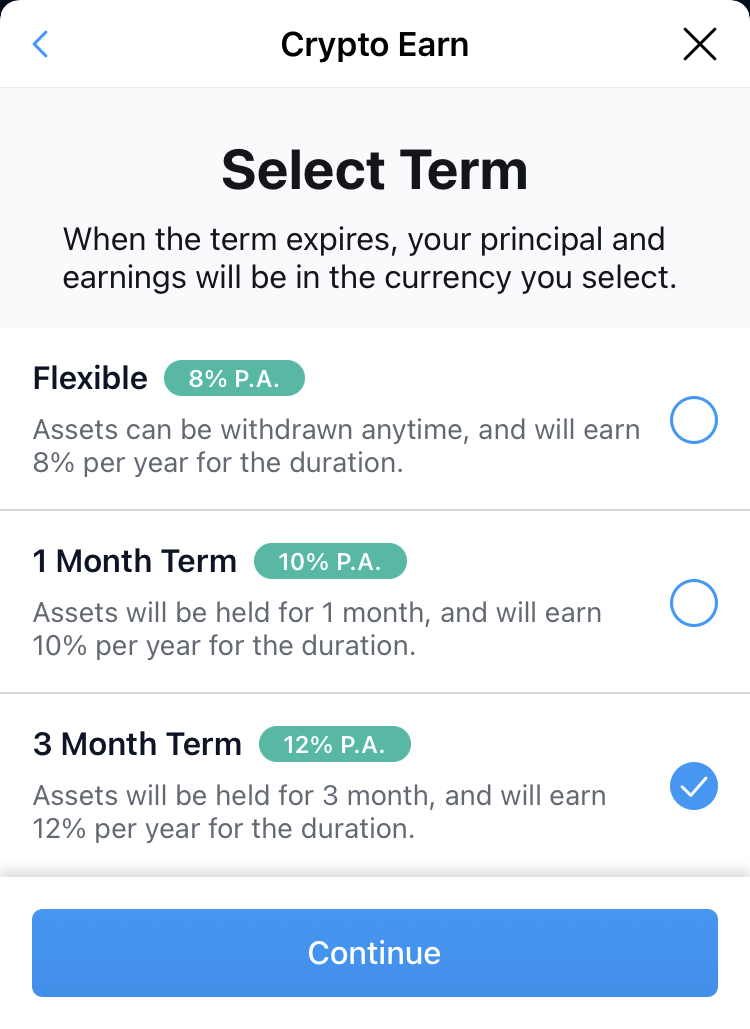

I’ve also been using the platform’s other features. In particular, I’ve been using Crypto Earn, where you can earn interest on term deposits of CRO, other popular cryptocurrencies, and stablecoins (digital assets pegged to fiat). Rates are determined by your card stake tier.

Who Should Get a Crypto.com Visa Card?

The risks and rewards of getting involved with cryptocurrency platforms are much more complicated than just considering the payment card. But even if you aren’t willing to commit a large stake to a volatile investment, there are a number of ways to benefit from a cryptocurrency card.

Cash Back vs. Crypto

I don’t see the rewards on these cards as a substitute for owning cryptocurrency. For all intents and purposes, I’d treat them as cash back at a fixed percentage.

Even if you’re bullish on cryptocurrency, don’t think of it as an opportunity to multiply your rewards, any more so than those assets might rise anyway. If CRO goes up 100x, that doesn’t mean you suddenly earned 100x more on your purchases, it just means that any CRO you kept has risen in value.

If you want to hold cryptocurrency investments, it makes no material difference whether you’re earning cryptocurrency credit card rewards directly, or using a cash back credit card and then buying cryptocurrency with those rewards. And if you’d rather sell your CRO rewards for fiat right away, the short-term fluctuation of CRO won’t significantly impact your average cash back rate.

For the merely crypto-curious, the only advantage I can see of earning it as rewards is if you’re intrigued by the concept of cryptocurrency and want some skin in the game, but you face a psychological barrier in buying it outright.

There’s also an appeal for anyone keen on witnessing the growth of cryptocurrency’s role in our lives. While crypto-to-crypto payments may take some time to catch on, the existing fiat credit card infrastructure is a baby step towards adoption of cryptocurrency as a medium of exchange.

Also, it’s worth considering that cash back rewards are treated as rebates and aren’t taxed, whereas every cryptocurrency trade is a taxable event with regard to capital gains. Therefore, to adhere to proper reporting requirements and to preserve the full value of your rewards, it may be preferable to earn rewards in the currency you plan to keep them in.

Getting Your Feet Wet with Crypto

The Crypto.com Midnight Blue card earns 1% on purchases and has no foreign transaction fees, with no stake requirement. These costs and benefits are on par with the entry-level Brim Mastercard in the Canadian credit card market.

The Crypto.com card would be a fun alternative if you want to dabble in cryptocurrency rewards – I see no reason not to sign up!

For a stake of $500 worth of CRO, you can upgrade to the Ruby Steel card. If you’re looking for a credit card with a 2% base earn rate and no foreign transaction fees, a one-time investment of $500 may be more appealing than recurring annual fees on traditional cards with similar benefits.

Starting at this tier, you get a full rebate (paid in CRO) on an individual Spotify membership. Even without any rewards on spending or asset appreciation, with about $180 (CAD) in credits per year, the card pays for itself within less than three years.

Risk It for the Biscuit

As you climb to higher tiers, the stake requirements increase on a logarithmic scale. These levels are for people with a stronger interest and confidence both in CRO and cryptocurrency in general, and who plan to use the app’s other features.

If you believe in the long-term strength of the underlying asset and the stability of its custodial platform, and you want to make a larger investment for its own sake, you may as well reap the benefits that come with your tier, like higher returns on the payment card and in Crypto Earn. After all, CRO gains value as the services it powers see more activity, so engaging with the project will theoretically be good for the price of the asset, and therefore the value of your investment.

Of course, the card’s earn rates and perks are subject to change. Traditional banks change their products once in a while, and blockchain startups move at light speed in comparison.

Crypto.com’s features have indeed remained stable since it landed on the scene – although it’s worth noting that we’ve been in a bull market ever since. Regardless, the brave ones among us may wish to bet on an emerging industry, rather than a dying breed of regressive, stagnant rewards currencies.

Diminishing Returns on Redundant Benefits

Let’s compare 3% “cash back” in CRO from Crypto.com Jade Green/Royal Indigo cards, and 1.25x Membership Rewards points on the Business Platinum Card from American Express. Let’s assume you usually redeem airline miles for high value, bringing the two earn rates roughly in line with each other.

Assuming you’re here for the utility of the product and you’re indifferent to CRO as an investment, the Jade Green/Royal Indigo stake is like paying for 10 years of Business Platinum up front. 10 years is an eternity for credit card rewards, let alone cryptocurrency – there’s no saying what either landscape will look like that far down the road.

On that long of a timeline, you might prefer to pay annual fees to Amex, for the sake of flexibility. After all, you could always change your mind about the product and decide to cancel the card sometime during those 10 years.

There’s a lot of overlap between LoungeKey with Crypto.com, and Priority Pass with many premium American Express and Visa cards in Canada and the US. It may come down to which basket of benefits you personally prefer.

In fact, I think this is one of the reasons why Crypto.com has done so well in other countries around the world, where credit card rewards are quite a bit lower and perks are far less impressive. For Canadians and Americans, the incremental benefit of the higher Crypto.com tiers, compared to other premium cards, is much less clear.

Conclusion

It’s incredible to see cryptocurrency emerging in our daily lives, with products like the Crypto.com Visa Card growing in the Canadian market. Getting involved at these early stages could be highly lucrative, but the decision to invest should not be taken lightly.

If you have any concerns about the future value of CRO or the security of the Crypto.com platform, I highly recommend doing your own research before making a big commitment.

Naturally, the best rewards are reserved for the biggest backers. Even so, I believe there will always be a place in anyone’s wallet for a cryptocurrency payment card, at least at the entry level, as we continue to discover how these new technologies will change our world.

If you’re interested in exploring what Crypto.com has to offer, you may consider signing up with Prince of Travel’s link.

And if you’ve already been using the card or Crypto.com’s other features, I’d love to hear your experience in the comments below, in the Prince of Travel Elites Facebook group, or in the Prince of Travel Club Lounge on Discord.

Any information or experience on multiple currencies? IE using it with a USD account for use in the States? or EUR in Europe etc?

This is a good review of the CRO coin itself – as mentioned, if you’re staking, knowing the cryptocurrency market and especially this coin, is important: https://www.cryptovantage.com/buying-crypto/cro-coin/

Did they get rid of the monthly foreign transaction limit? Not seeing that on the website anymore. Many Youtubers still mention no foreign transaction fees on the card in recent videos despite the website not showing this though, so I’m not sure who to listen to.

Your referral link does not work anymore.

Actually it works on Safari on my iPhone but not Chrome on my desktop

If you are Canadian but live outside of Canada but have an address can you still get the card?

If you have Canadian ID, I don’t see why not. The card is available in tons of markets worldwide, so see if that’s an easier path for approval for you.

Did you stake via CRO tokens directly? looking to avoid a cash advance charge as most banks will probably do so

I think this Crypto and block chain stuff needs a video!

I think so too — coming soon 🙂

An update CRO coin would be awesome!

It’s a pretty old article Murry Nonetheless, Josh good article. I’m generation X, and I have a hard time getting my head around this stuff. Maybe in a few years it will become easier?

I just read an old article on Milelion a few days ago which presents an interesting counterpoint.

https://milelion.com/2019/10/22/why-i-wouldnt-touch-the-mco-visa-and-neither-should-most-people/

Good read. I think I raised a lot of the same concerns, but with a more balanced perspective, leaving it up to the reader to dig deeper and decide if it makes sense for them to take the plunge.

I’d like to emphasize that the article you linked was written over a year ago – eons in the crypto industry. So I’d take any concerns that capture the “moment,” like marketing strategy, with a grain of salt (although I agree it’s absolutely important to be aware of the company’s vision if you plan to invest).

So all of the normal esoteric quirks of ‘rewards’ cards, except one day you log in and find that the value of your stake is down 40% for no reason as happens often with crypto currencies. Neat.

if you stake your CRO, you are up 7x now lol. Stop hating on crypto or HFSP