A major positive change took place in the US points landscape over the weekend: Citi ThankYou Points, the points currency issued on the Citi Prestige and Citi Premier credit cards, added the limited-time option to transfer at a 1:1 ratio to American Airlines AAdvantage.

Canadians who have entered the US credit card game would do well to pay attention to this opportunity if any of American AAdvantage’s sweet spots align well with your travel goals. Who knows, you might just be swayed into using your Citi Premier for your grocery shopping at home, too.

Citi ThankYou Points: The “Third” Major Transferable Currency

The three big players in the US credit card market are American Express, Chase, and Citi, who issue Membership Rewards, Ultimate Rewards, and ThankYou Points, respectively.

Most of the attention goes to American Express for their wide range of credit cards and huge signup bonuses, as well as Chase thanks to the perceived difficulty of getting their cards as a result of the “5/24 Rule”. With a more streamlined product lineup and less of a scarcity factor, Citi tends to get less attention as a result.

However, Citi ThankYou Points do have some potentially exciting transfer partners, such as Virgin Atlantic Flying Club for flying ANA First Class or Emirates Skywards for booking Emirates First Class.

They even have a few exclusive airline partnerships that neither Amex nor Chase offer, including Turkish Airlines Miles & Smiles for cheap intra-North America redemptions or Qatar Airways Qmiles for unique sweet spots to the Middle East.

We can now add American Airlines AAdvantage to that list, at least temporarily. Until November 13, 2021, Citi ThankYou Points can transfer at a 1:1 ratio to American AAdvantage, making it the first US transferable currency that can be converted into AAdvantage miles.

(It’s a bit surprising that we Canadians have had RBC Avion conversions to AAdvantage at a 1:0.7 ratio for many years now, but the Americans themselves haven’t had a transferable option until now, isn’t it?)

American AAdvantage Sweet Spots

Historically, American AAdvantage hasn’t been the easiest program for Canadians to participate in.

As mentioned above, we’ve had the option to transfer RBC Avion points at 1:0.7, but the less favourable transfer ratio has meant that many Avion collectors have preferred to move their points into British Airways Avios or Cathay Pacific Asia Miles instead.

Therefore, if you’re going to put in the effort to earn AAdvantage miles, there has to be a specific high-value sweet spot unique to AAdvantage that you’re aiming for.

Previously, both Qatar Airways and Etihad Airways might’ve fit this bill, but the launch of Etihad’s partnership with Aeroplan means that it’s really only Qatar Airways redemptions that’s worth going out of your way to rack up AAdvantage miles for.

Some of AAdvantage’s best sweet spots for Qatar Airways include:

- 42,500 miles for one-way business class from Europe to the Middle East or Indian Subcontinent

- 70,000 miles for one-way business class from North America to the Middle East or Indian Subcontinent

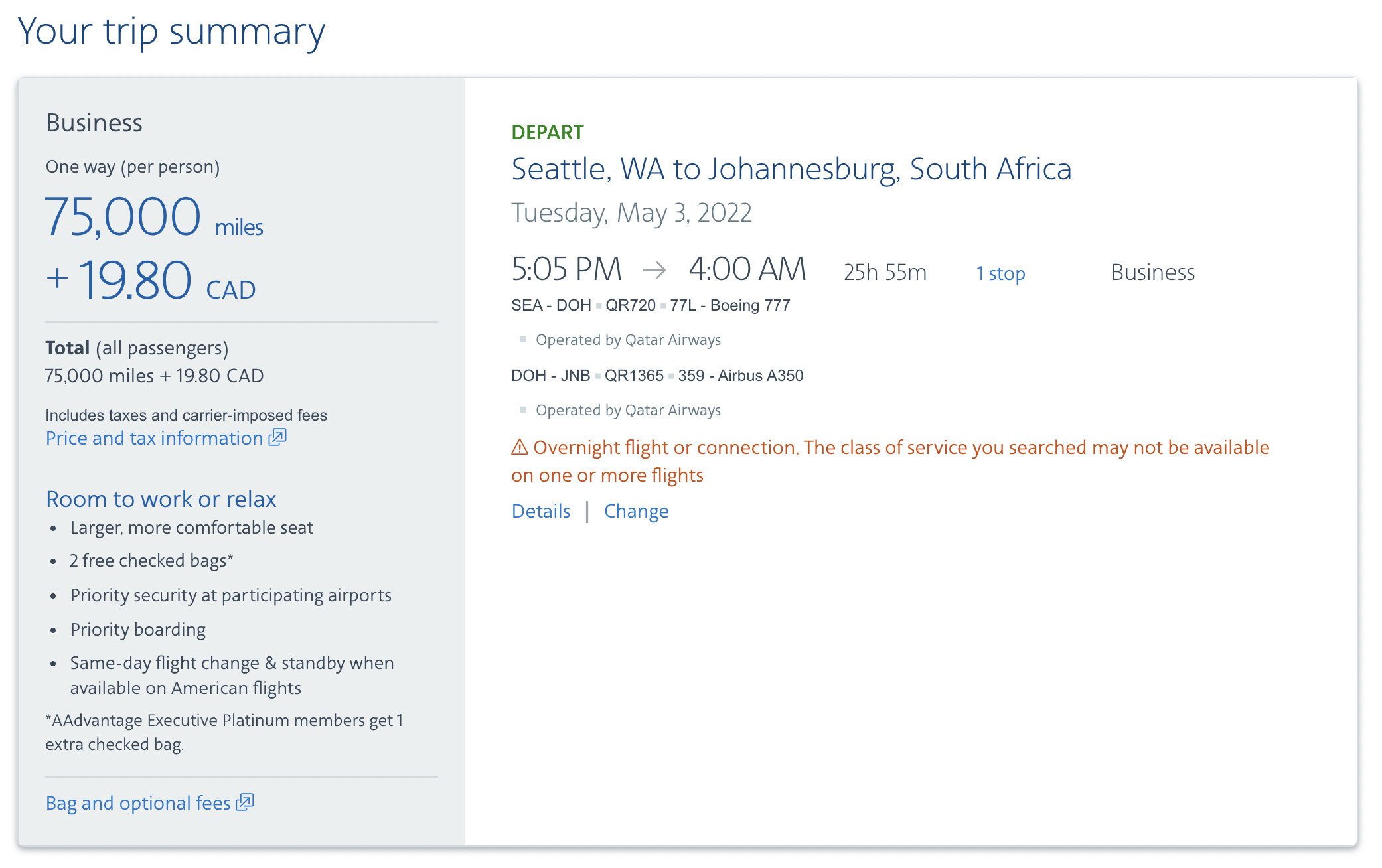

- 75,000 miles for one-way business class from North America to Africa

(Unfortunately, American’s strict routing rules mean that you can’t fly Qatar Airways from North America to Europe, Asia, or Australia on a single award. AAdvantage also doesn’t allow you to add stopovers on an award booking.)

Compare, say, a Montreal–Doha–Johannesburg one-way redemption in Qatar Airways Qsuites between AAdvantage and the other major Oneworld programs: it would cost you 154,500 Avios or 90,000 Asia Miles compared to 75,000 AAdvantage miles.

And the best part? AAdvantage doesn’t pass on fuel surcharges on Qatar Airways redemptions, while the other programs do.

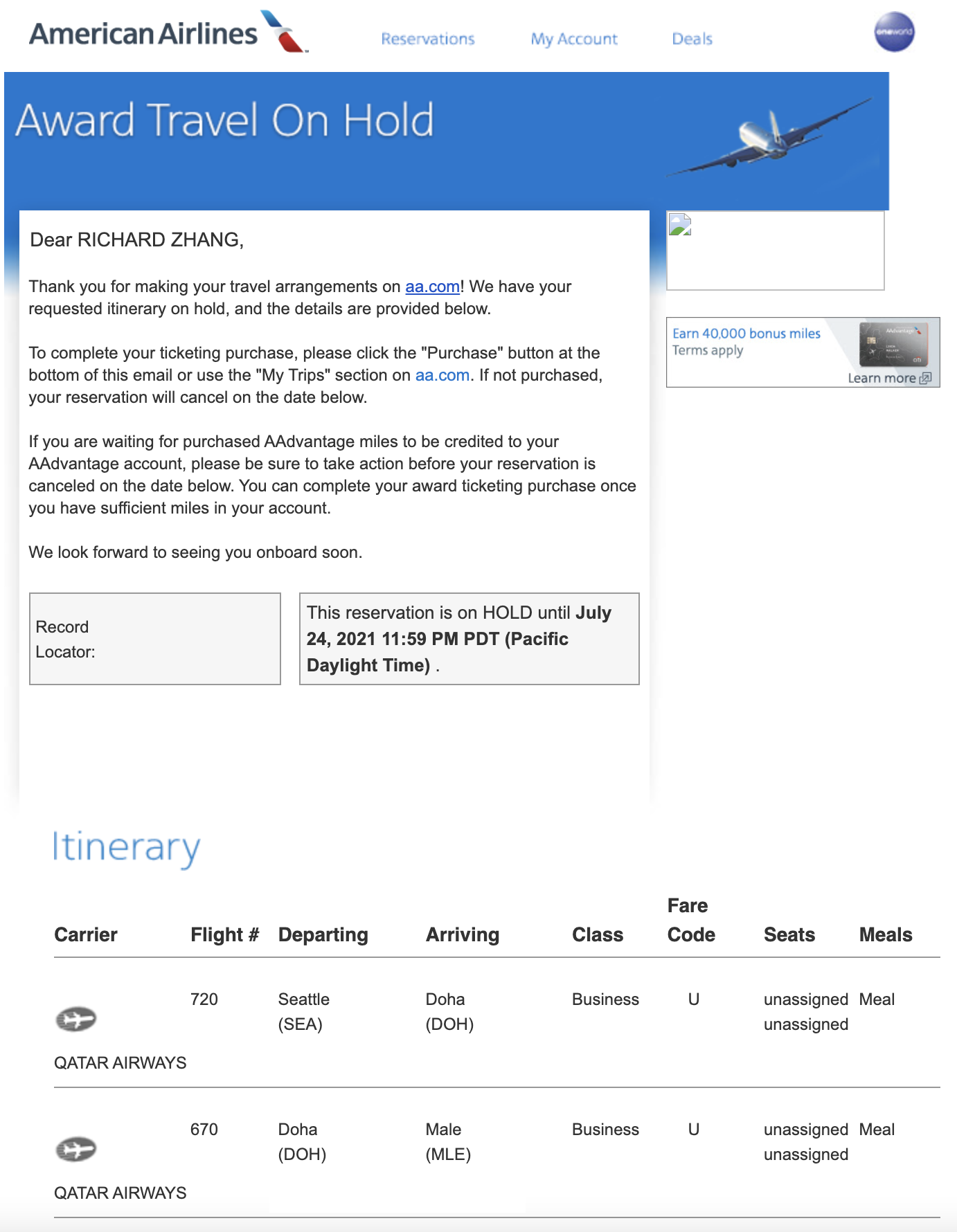

Another strength of the program is the ability to put awards on hold for up to five days. You can hold the award space and transfer in miles (whether it’s from RBC Avion or Citi ThankYou) before completing payment and issuing the ticket. That’s an incredibly generous and flexible feature that very few programs offer.

(I’ve personally just put a Seattle–Doha–Maldives award on hold for next year, and I’m delighted to be able to lock in this journey for only 70,000 AAdvantage miles one-way.)

The program does have a few other sweet spots, too. For example, its pricing for one-way transpacific business class and First Class awards are fairly competitive at 60,000 or 80,000 miles, respectively.

But given the extra effort involved in earning AAdvantage miles, I’d recommend that you keep things simple and focus on the program’s greatest comparative advantage: if you want to fly Qatar Airways Qsuites, which is widely considered the world’s best business class, en route to the Middle East, Indian Subcontinent, or Africa – collect AAdvantage miles.

Citi Premier Card: 80,000 ThankYou Points + 3x on Groceries

If you haven’t gotten involved with the Citi ecosystem just yet, the best place to start would be the Citi Premier Card, which comes with an annual fee of US$95 and currently offers a welcome bonus of 80,000 ThankYou points upon spending US$4,000 in the first three months.

Citi’s approval criteria are stricter than American Express’s and on par with Chase. If you’ve gotten into US credit cards for about a year’s time and have built up your credit history with a few American Express US products, you should be in with a chance to get approved for Citi.

Note that Citi will require a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for your application, and will most likely want to see proof of the ITIN delivered via fax or a secure upload before approving you.

If you can meet the minimum spending requirement before November 13, your 80,000 ThankYou Points will be convertible into 80,000 AAdvantage miles, which would already be enough for a one-way Qsuites journey all the way to Africa.

And if you needed to top-up your balance, you could always convert RBC Avion points over to AAdvantage and pool your miles together.

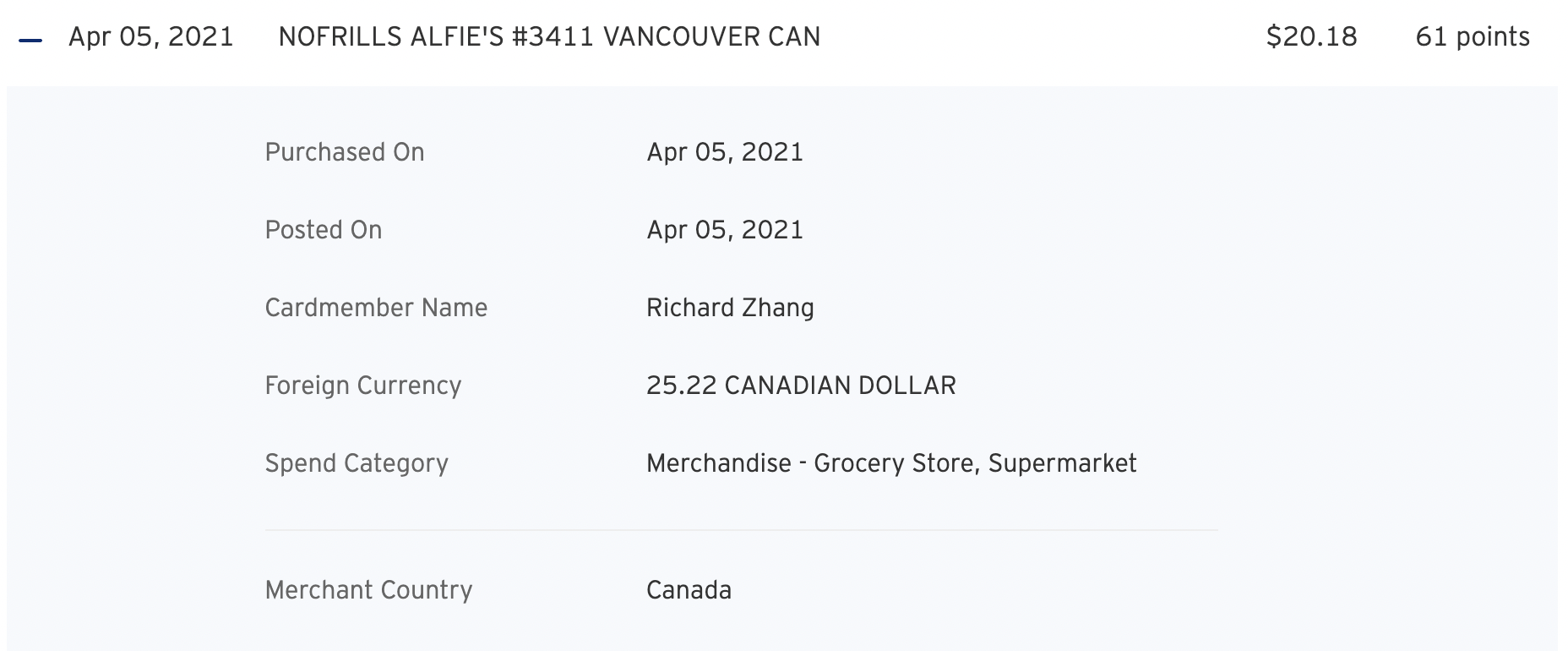

In terms of earning rates, the Citi Premier Card offers 3x ThankYou points on dining, gas, supermarkets, and travel. By all accounts, these multipliers work outside of the US too, making the card a great choice for any grocery shopping you do in Canada where the merchant doesn’t accept American Express.

Since it’s a Mastercard product, the Citi Premier would be a great fit for any shopping at Mastercard-exclusive chains like Costco or No Frills, allowing you to earn effectively 2.36 ThankYou Points per Canadian dollar spent on your groceries.

(Hell, with a Qsuites redemption on the line, that would be an impressive return on your reoccurring expensive banana purchases, too.)

Personally, I picked up the Citi Premier a few years ago and have been using it for any Mastercard grocery purchases ever since. The signup bonus was only 60,000 ThankYou Points back then, and I haven’t redeemed any of the points yet, although I’m certainly thinking about whether I want to transfer them to AAdvantage under this limited-time conversion opportunity.

On one hand, it seems like a great chance to secure many more Qsuites flights in the future, which is an experience that will never get old.

The Qsuites seat is one of the best ways for couples to fly together, and I’d love to book myself and Jessy on the convenient and availability-laden Qsuites options out of either Seattle or Montreal whenever we travel together.

On the other hand, Citi ThankYou’s other transfer partners are quite appealing as well: the Virgin Atlantic + ANA sweet spot has been well-documented, but I’m also interested in exploring some of the niche airline programs like Turkish Miles & Smiles or Qatar Qmiles when we get back to flying frequently in the future.

I’ll probably leave it to the last minute to decide, although I’m certainly hoping that the temporary transfer option proves to be a success for Citi and American Airlines, and that they decide to keep it around on a more permanent basis.

Conclusion

Citi ThankYou has added American Airlines AAdvantage as a temporary transfer partner until November 13.

If you’ve collected ThankYou Points or are well-positioned in the US game to do so via the record-high bonus on the Citi Premier Card, it’s absolutely something to consider if you’d like to book one of AAdvantage’s sweet spots – chiefly, Qatar Airways Qsuites to the Middle East, Indian Subcontinent, or Africa.

If you haven’t gotten in the US game yet, this unexpected development is another example of the wider range of possibilities that you unlock by diversifying your cross-border game.

AAdvantage has a lower price for North America – Middle East on Qatar Airways, but only by 5,000 points. I’m seeing 75000 Qmiles + CAD$110, Montreal – Jeddah, 3 weeks before travel. I’m seeing more availability on Qatar’s site than on American’s. For those, like me, who book in the final weeks/days before departure, Qatar might be a better transfer partner than AA for MiddleEast/Maldives/Seychelles. For SE Asia, AAdvantage is fantastic. All the Alaska unavailability and the Avios surcharges simply vanish. Consistent availability, online bookability, for Japan Airlines, Cathay Pacific. I’ve never regretted using AAdvantage miles, even when it was more points than an Alaska booking.