South of the border, American Express US is wasting no time in offering cardholders strong incentives for 2021.

With travel still curtailed until later in the year, American Express US will offer its Platinum cardholders US$180 in statement credits on Paypal transactions during the first half of 2021. And compared to some of the other ongoing credits on this card, this one will be much easier for us to maximize even if we’re based here in Canada.

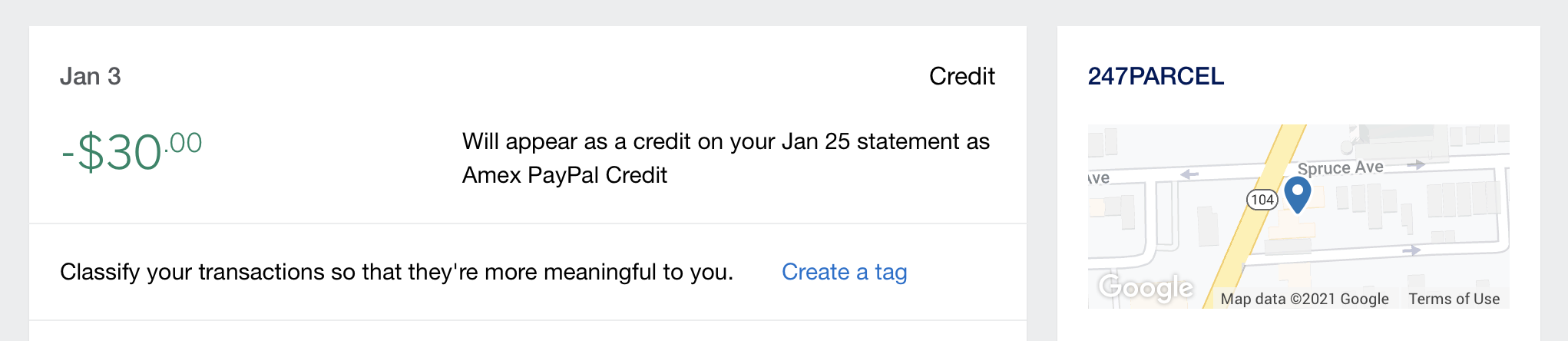

US$30 Credits on Paypal Purchases for January Through June

The Amex US Platinum Card is offering a monthly US$30 credit on Paypal purchases for January through June of 2021. You can find all of the frequently asked questions on this page on the American Express website.

No enrollment is required. Simply link your US Platinum Card to your Paypal account (it has to be a US-domiciled Paypal account, as we’ll discuss below), and then use it to complete payment on any US-based online retailer that accepts Paypal as a payment method.

If you make a single purchase of US$30 or more, or multiple purchases totalling that amount, you’ll get your monthly US$30 statement credit.

Peer-to-peer money transfers, whether it’s friends and family or to merchants in exchange for goods and services, will not be eligible to earn the statement credits.

You Need a US Paypal Account

Many of the ongoing statement credit offers that we see on the US Platinum Card can be difficult to use if you’re based mostly in Canada.

For example, the card offers US$200 in Uber credits, which can only be redeemed on Uber rides or Uber Eats orders within the US. And last year, the temporary US$20 in monthly wireless credits were also difficult to cash out unless you had a US wireless service or could pay off the phone bill for a friend in the US.

On the other hand, these US$30 monthly Paypal credits are much easier to use up here in Canada, although there are still a couple of wrinkles to be aware of.

Pay attention to the following terms and conditions: “Valid only for purchases made in U.S. Dollars using U.S. PayPal accounts. PayPal accounts associated with any non-U.S. country are ineligible.”

One of my biggest pet peeves with Paypal is that they don’t support cross-border transactional needs; instead, each account is associated with a particular country, so you need two separate accounts if you want to use Paypal in both Canada and the US.

If you only have a Canadian Paypal account so far, it won’t work for the purpose of most US transactions, because you won’t be able to associate a credit card with a US ZIP code or transmit a US billing address to the merchant.

You’ll need to set up a separate US Paypal account, which is simply a matter of heading to the Paypal US site and registering for a new account with all of your US billing information.

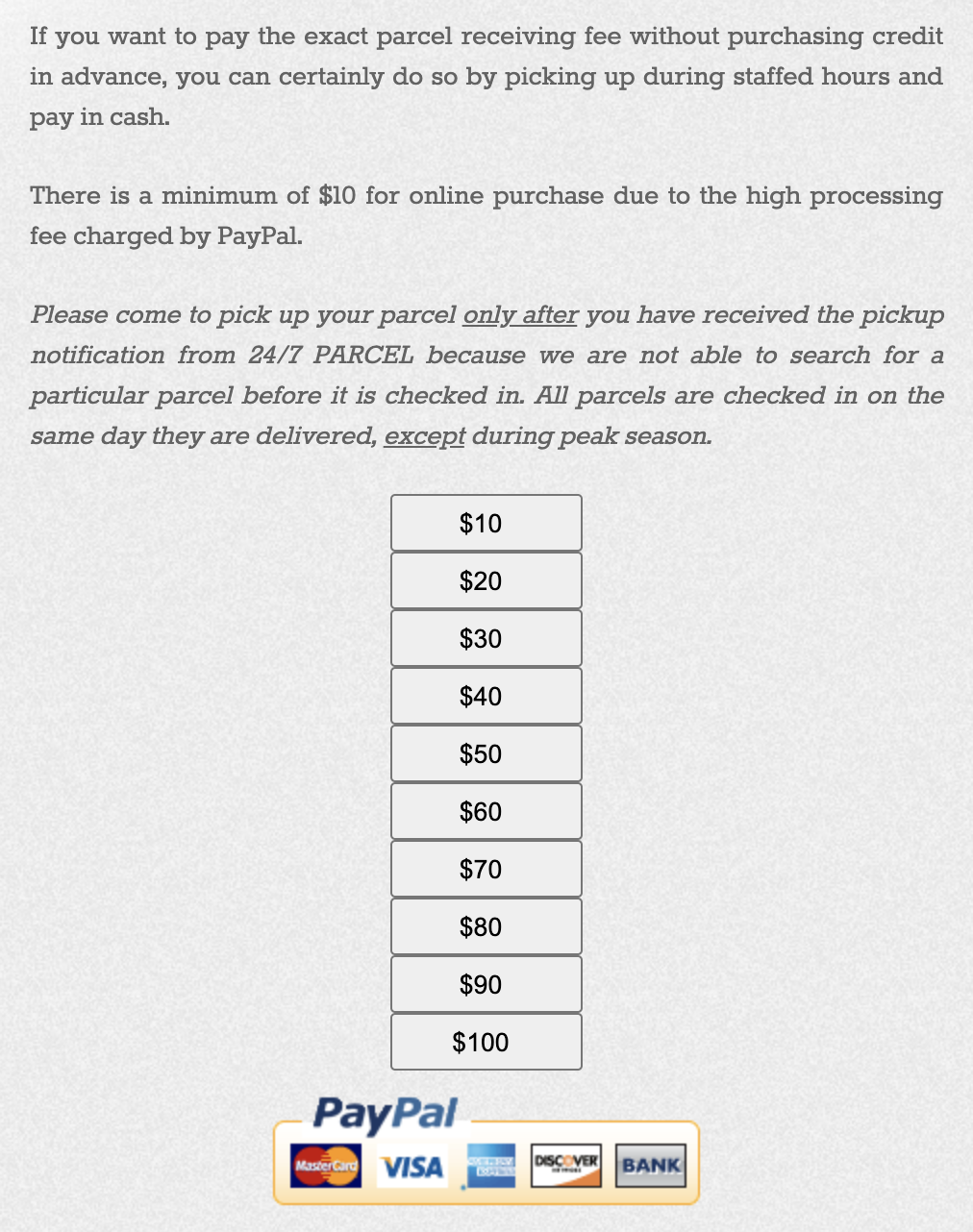

Once you have a US Paypal account set up, it’s just a matter of making your purchase via a US-based online retailer that accepts Paypal transactions. There are a few different options here.

24/7 Parcel might be a tailor-made solution for those of us who’ve used it as our mail forwarding solution for the purposes of getting US credit cards.

24/7 Parcel allows you to use Paypal to reload your account balance online, so you can simply add US$180 to your account balance over the course of January through June and pay for two more years of mail forwarding (at US$90 each) thanks to these credits.

I have a feeling that simply reloading your Starbucks US account balance (which you’d need to register for online through Starbucks.com rather than Starbucks.ca) through Paypal would also work, and then you’d be able to use that Starbucks balance at Canadian locations as well.

(And if you’re a Prince of Travel member on Patreon, then you can set up Paypal as a payment method on your Patreon account and cover up to US$30 on six months of membership!)

Otherwise, you can always think about what other US retailers you’d like to shop at and unlock the US$30 monthly statement credits. Keep in mind that if you’re purchasing physical goods, then they’ll most likely need to be shipped to a US address if you want to use your US Paypal account as a payment method – and that’s why one of the online methods might be easier instead.

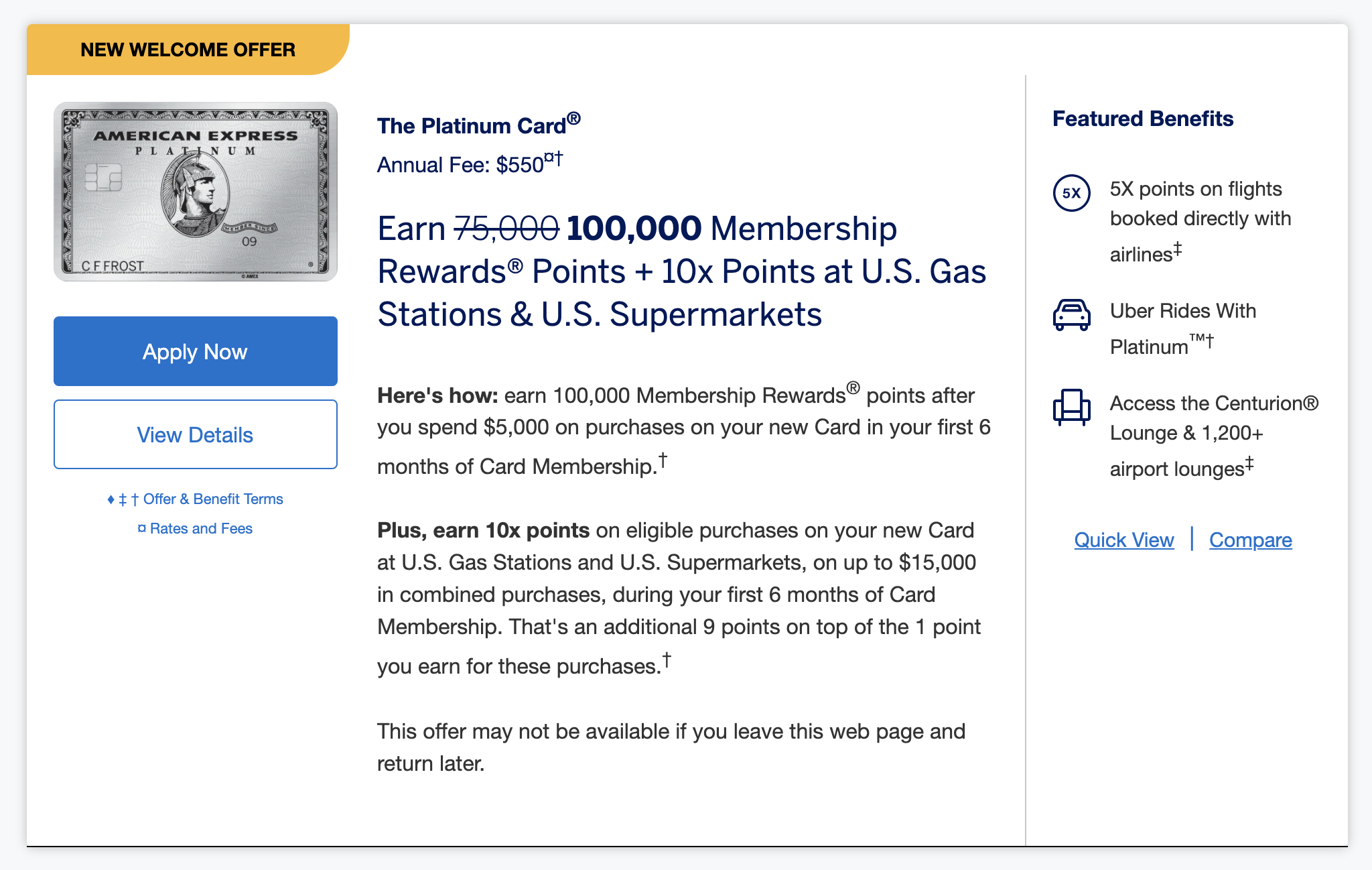

Reminder: 100,000 US MR Points on the US Platinum Card

If you don’t currently have an Amex US Platinum Card, now is a fantastic time to sign up: the card is still offering its historical high signup offer of 100,000 US MR points through incognito mode and select refer-a-friend offers, and the US$180 in Paypal credits only sweeten the deal even further.

The US$550 annual fee may appear intimidating at first glance, but it’s outweighed not only by the initial signup bonus of 100,000 US MR points, but also a series of statement credits:

- The US$180 Paypal credits in the first half of 2021 discussed here

- The US$200 airline incidental fee credits every calendar year; recent data points indicate that these credits (along with other airline fee credits from other Amex US cards) may be redeemed by loading up a united fund towards future travel

- The US$100 Saks Fifth Avenue credits, divided evenly for each half of the year; Canadians may order stuff from Saks Fifth Avenue to a US address and either pick it up or have it forwarded across the border

- The US$200 Uber credits divided across 12 calendar months, which can only be redeemed when physically in the US

Even if you don’t want to go through the trouble of maximizing the Saks and Uber credits, you can still benefit from a total of US$580 in Paypal and airline fee credits during your first year of holding the card (as the airline fee credit is based on the calendar year), thus coming out ahead against the annual fee and earning the 100,000 US MR points effectively for “free”.

The incognito offer for 100,000 US MR points has been around for a few months now with no published end-date, so it may get withdrawn at any time. Check out this post for all the details about the offer, and if you’re interested, take action sooner rather than later!

Conclusion

If you have the Amex US Platinum Card, you can expect to come out ahead by another US$180 over the first half of 2021, thanks to a new offer for US$30 statement credits on Paypal purchases in each month from January through June. If you haven’t jumped on it yet, the welcome bonus for 100,000 US MR points on this card looks even more tempting now.

I hope to see Amex Canada putting in similar efforts to retaining business among premium cardholders in the new year, especially as the annual fee cycle approaches for many of us who might’ve hopped on the Platinum Card hype train last spring. 😉

I was able to redeem the offer with my Canadian PayPal account and my US Platinum card. My charge was billed in US dollars and my order was shipped to Canada.

Is the Business Plat card included in this promotion or only the perosnal card?

Only the personal card.