If you’ve recently decided to part ways with your American Express Platinum Card or Business Platinum Card, some news has come out that might make you reconsider.

It looks like American Express continues to defend its title as reigning champion of Canadian travel credit cards, and is even surprising us with a new concept of enticing “re-upgrade” bonuses back to their flagship premium travel cards!

Let’s jump right in and take a look.

Targeted Upgrade Offers on the Amex Platinum Cards

I was made aware of this new upgrade offer by my wonderful and talented colleague here at Prince of Travel, Sophie. Full credit goes to her eagle-eyed attention to her promotional email folder (I so often delete mine without reading a thing).

Gold Rewards Card to Platinum Card

This promotion is available to cardmembers who’ve decided to previously downgrade their American Express Platinum Card to its lesser cousin, the American Express Gold Rewards Card.

But why would someone downgrade in the first place instead of cancelling outright? Whilst I admit that the Gold Card’s new Rose Gold configuration is undeniably attractive, I think most such downgrades were due to the relative unattractiveness of paying the $699 annual fee for another year.

It appears that Amex marketing has become aware of this, and has decided to try and get cardholders to un-downgrade by re-upgrading. They’ve offered a tantalizing incentive, which in this case is good from May 25 to June 29, 2022.

80,000 Membership Rewards points could be yours after spending $6,000 in the first three months after your re-upgrade.

The old Gold card typically stays active so that you can start toward that $6,000 spend right away, but American Express Platinum Cards are sent by express FedEx so you’ll have yours within a couple days, anyway.

Business Gold Rewards Card to Business Platinum Card

Better yet, there have also been some anecdotes of similar upgrade offers made to select American Express Business Gold Rewards Card holders to upgrade to the American Express Business Platinum Card.

This upgrade plan promises a delectable 110,000 Membership Rewards points after spending $7,000 in the first three months after receiving the Business Platinum. I’ve not yet seen a published date of expiry for this promotion, but as always, the early bird gets the worm.

Should you wish to cash in on either of these opportunities, you can either click on the link provided at the end of your invitation email or call the American Express contact centre to request an upgrade.

In fact, if you recently downgraded your Platinum Card (personal or business) and are holding a Gold Rewards Card (personal or business), but did not receive a promotional email, I’d definitely recommend giving Amex a ring to inquire.

Is the Juice Worth the Fees?

Now, $499 and $699 per annum are not small chunks of change. Heck, neither are the price tags on the Gold family of cards. But spending the extra dough to re-upgrade could be 100% worthwhile if you’ve received this offer.

The first thing to remember is that the effective annual fee of the personal iteration of the Platinum Card isn’t $699. It’s actually $499, because the $200 annual travel credit is as good as cash, thus reducing your overall out-of-pocket expenses.

The Business Platinum Card’s re-upgrade offer comes with an additional $1,000 in minimum spending required, so be prepared for that, but the additional 30,000 points more than compensates for this limitation.

This brings us to the uses of the 80,000 and 110,000 MR points that Amex is dangling for this promotion.

You could transfer the points to, say, my preferred frequent flyer program Aeroplan, and you can book Swiss’s world-renowned business cabin directly from Montreal to Zurich for a mere 60,000 Aeroplan points.

You can toast your points savings while sipping champagne in comfort and style above the Atlantic.

Using the upgrade offer on the Business Platinum Card would provide just a hair under the points needed to fly this itinerary round-trip, and that’s also worth toasting.

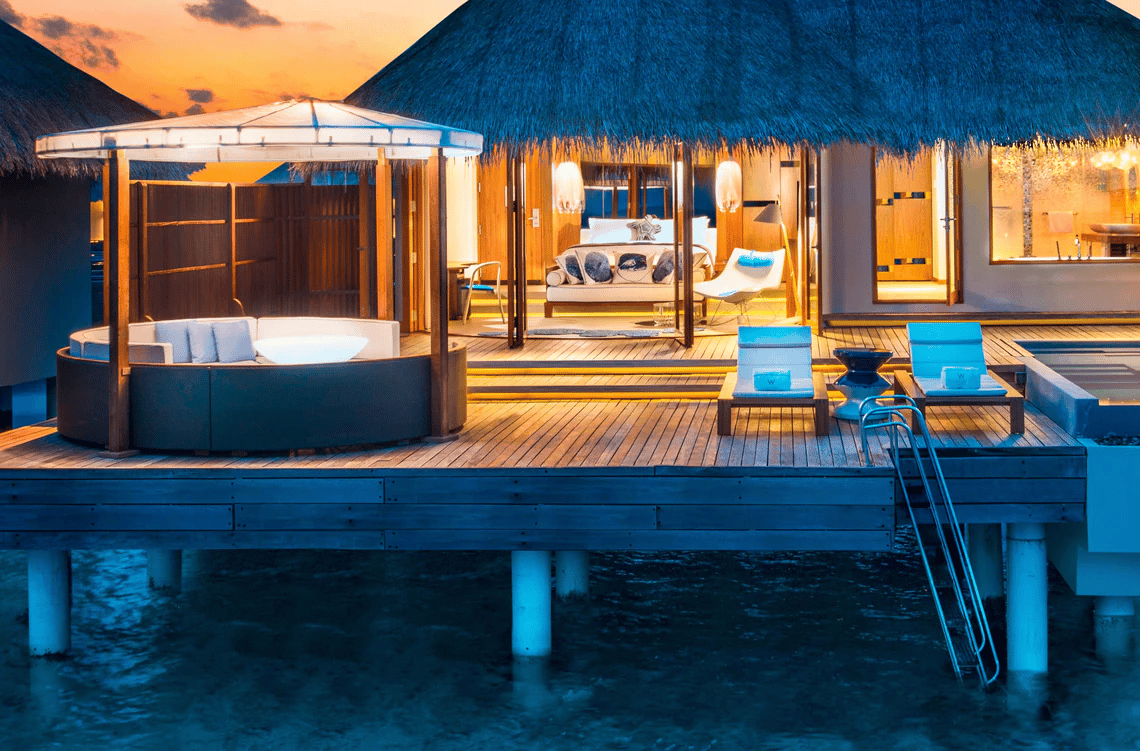

Of course, if flights aren’t what you’re in the market for right now, you can always turn your Membership Rewards points into Marriott Bonvoy points at a ratio of 1:1.2. 80,000 MR points would turn into 96,000 Bonvoy points, while 110,000 would turn into 132,000.

That’s enough for a night at a hyper-aspirational property such as the W Maldives, with about a bundle of Bonvoy points left for 0ne or more nights at a more modest hotel – let’s say the Four Points by Sheraton Edmonton South, for those of you who chase Platinum status.

In addition to being able to use your upgrade bonus on travel like I’ve listed above, you can also supplement your voyages with the Platinum cards’ entire regular suite of benefits.

Marriott Bonvoy and Hilton Honors Gold status (the latter on the personal Platinum only)? Check.

Free global entrance to the American Express lounge collection, including Centurion Lounges? Double check.

For those of you getting the personal version of the Platinum card, you also can receive an additional $100 in NEXUS credit if you’ve already used the NEXUS credit that comes with the Gold Rewards Card.

This lets you effectively reduce the Platinum Card’s annual fee by a further $100 to only $399, which is not half bad at all.

A New Way Forward for American Express Canada?

I’ve been wondering for a while if American Express Canada would bother emulating their southern counterparts by offering upgrade bonuses on their products.

In the US, it’s very common for American Express cardholders to downgrade a premium card, only to receive an offer to upgrade later and receive another welcome bonus.

This is because in America, upgrade offers do not contain “once-in-a-lifetime” language for welcome bonuses, and it’s also possible to hold duplicates of the same credit card.

Here in Canada, I’ve only ever heard of people holding two of the same business cards at the same time (for different small businesses), but would be interested to learn if it became possible for personal Amex products, as well.

Personally, I’d also take the fact that these bonuses are targeted to individual users as a strong indication that they will be awarded upon making the minimum spending requirement, even if you’ve held the card before.

While we haven’t received anything as bold as upgrade offers across all Amex products just yet, I do hope that this is the beginning of a trend, and won’t just be limited to Amex’s premium line of charge cards.

If the company gets a positive response to this promotion, it would be awesome to see them extend upgrade bonuses across their entire portfolio, so that any cardholder with large spends looming can take full advantage.

As there’s no way of predicting the future, if you feel that you could use these points in your account and don’t mind paying the elevated annual fee, I’d act now before we find out if this promotion is just a one-off and never to return.

Conclusion

American Express continues to the reign in the Canadian credit card market for a reason. Once again, they’ve increased their impressive brand expansion efforts by providing a new lucrative incentive toward holding their premium credit cards.

I for one hope that this isn’t the last we’ll see of upgrade offers, and that similar promotions become available to a wider pool of Amex customers.

Until next time, keep on tapping.

My wife with Amex Gold, has receive the plat offer. She plan to upgraded to the Plat because of the 80,000 pts with 6,000 $ spending. But she also receive a link for referral bonus Amex gold to other person. Me, I plan to use her referral to get the Amex Gold. My question: If I use her link and get accepted and after a few days , she upgrade to the Plat, the condition of her referral link that I use will work for me and her ?

I have an upgrade offer but already have the business platinum. Is it unwise to accept and have two of the same card? Never heard of that in Canada

I downgraded 3 years ago and just received the offer. With weekly business travel a thing of the past thanks to Covid, not sure I see the value in upgrading.

And what will Amex offer their existing plat holders? Or is this a case of “screw you” to existing members?

It seems that good offers are only given if you are new cardholder to entice them to join. No offers are given to existing plat holders for their loyalty.

How long after downgrading was the re-upgrade offer received?