Recently, American Express has announced generous credits for premium personal cardholders. There’s an offer on the Platinum Card for $200 of free essentials, and similarly on the Aeroplan Reserve Card for $150 of free groceries.

Not to be forgotten, now they’ve issued some new offers on the Business Platinum Card: an all-round $100 statement credit for any type of purchase, and bonus Membership Rewards points at mobile service providers. Both offers are live until July 31, 2021.

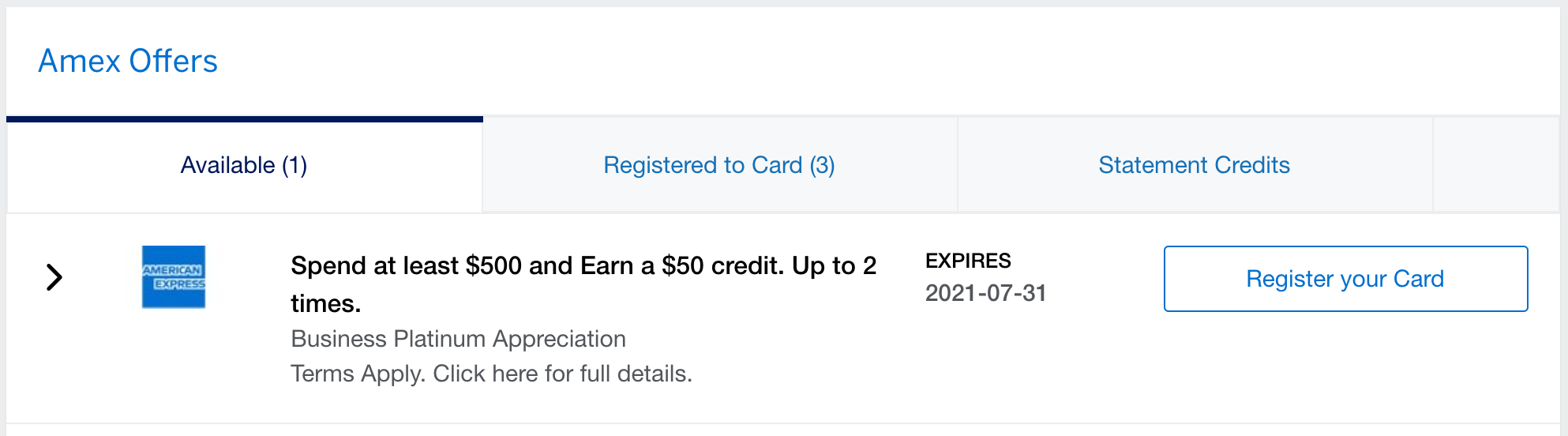

Business Platinum Appreciation Offer: Spend $500, Get $50 Twice

The Business Platinum Appreciation offer has just appeared today, and it looks like it’s available for all current Business Platinum cardholders.

You’ll get a $50 statement credit when you spend $500, and you can use the offer twice from now until July 31, 2021, for a total of $100 in credits for spending $1,000.

There’s good news and bad news. First, the good: you can trigger the offer with any purchase. You’re not tied to using it for groceries, or using it for a business purchase from a popular supplier. I’m glad to see that added flexibility, as it saves us from having to jump through hoops to cash in.

While a $100 credit isn’t quite as juicy as the offers on the personal cards, or as the $680 in credits for Business Platinum cardholders in the summer of 2020, it’s a relief to see generic offers like these making the rounds to business cards. Usually personal cards get first dibs, and I’ve found the offers on my business cards tend to be tailored specifically to business expenses which I simply don’t have.

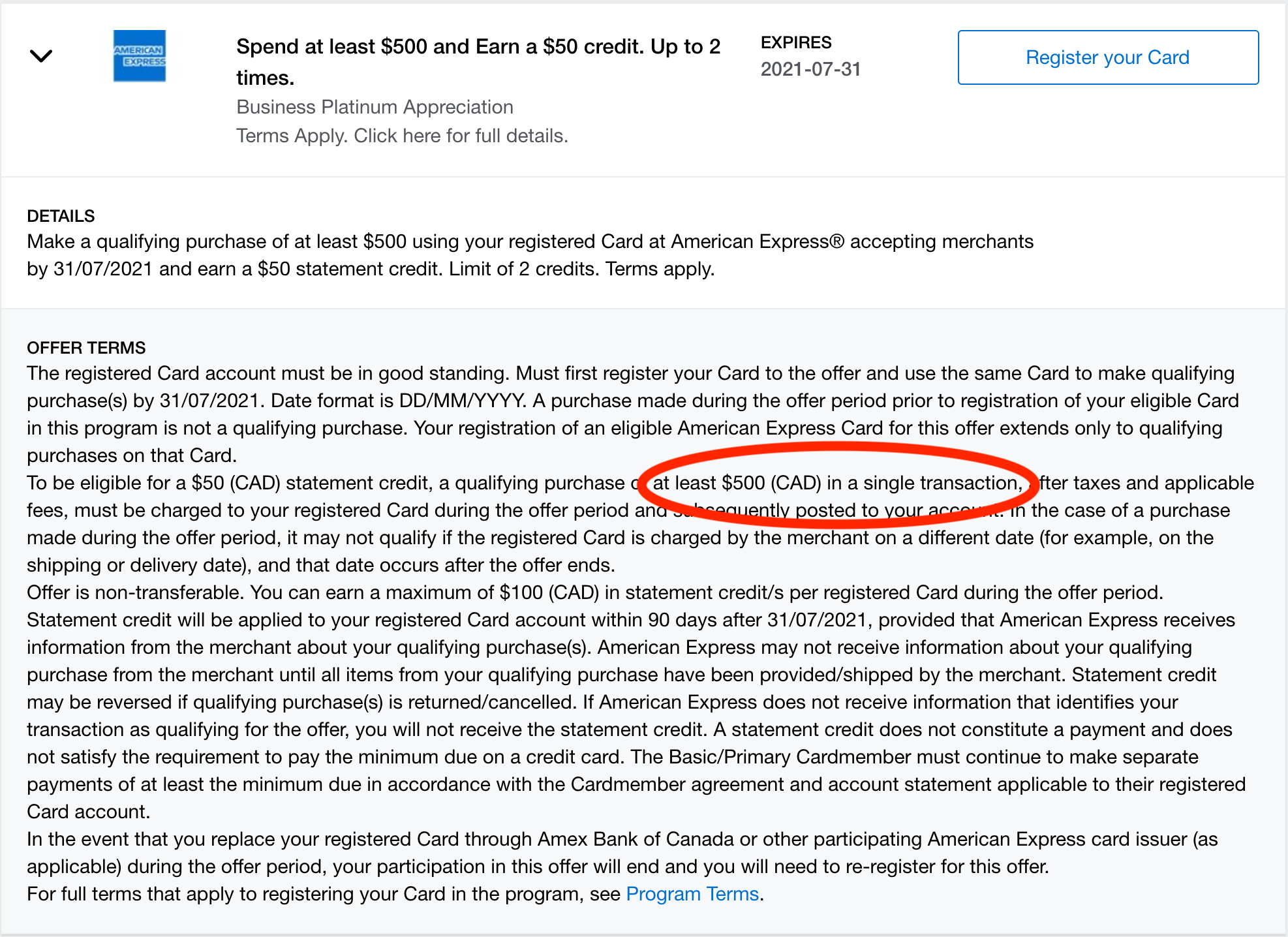

Now for the bad news: you have to spend $500 in a single transaction to trigger the $50 rebate. That’s certainly doable, but it dampens the flexibility of an “anywhere” credit. Ideally you’d be able to accumulate many smaller purchases up to $500.

Personally, I’m long past the welcome bonus period on my Business Platinum Card, and I’m currently working on a few other minimum spend requirements on new cards.

A $500 purchase can make a big dent (and every penny counts when we’re talking about big US card spending thresholds), and I’m a little annoyed that I’d have to divert my focus to cash in on this offer. I’ll probably wait until closer to the end of the offer period and nab this bonus once my plate is less full.

Also, even though the offer isn’t grocery-specific, you can still trigger it by buying gift cards at grocery stores if that’s your preference. That’s a clean way to knock out $500+ in a single transaction, but it may not be ideal, as the Business Platinum card doesn’t earn a grocery bonus.

If you have other $500 expenses that would be “uncategorized” on other cards, it would be better to make those purchases with your Business Platinum Card to redeem this offer, and save your gift card purchases for cards with a grocery bonus. After all, the Business Platinum’s strength is its earn rate for uncategorized purchases, earning 1.25x MR points where no other card comes close in terms of the value you’ll get back for every dollar spent.

Still, $50 back on $500 is a 10% return on spend – so while this may not beat making progress towards a welcome bonus, it’s better than the everyday earn rate for any other card out there.

Plus, for your trouble, you’ll get the regular MR points for spending, good for 1,250 MR points once you’ve redeemed the offer twice.

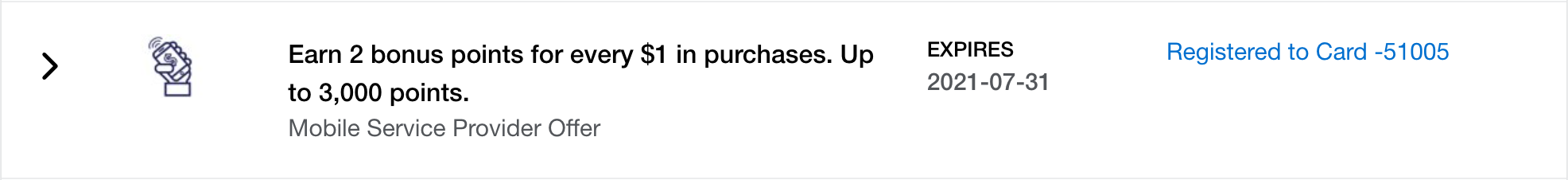

Mobile Service Providers: Bonus 2 MR Points Per Dollar

There’s another offer, in which you can earn bonus points for making purchases from mobile service providers. You’ll earn 2 bonus MR points for every $1 spent at mobile service providers, up to a total of 3,000 bonus points, from now until July 31, 2021.

Previously, the offer was targeted, but it sounds like it’s now circulating more widely, perhaps on all Business Platinum cards. Check your account in case you didn’t have it before.

To maximize this offer, you’d have to spend $1,500. Despite the Canadian telecommunications industry’s best efforts, thankfully my cell phone bill is a mere fraction of that sum. For a single individual, that’s about two years of prepaying my mobile bills!

If you’re happy to prepay an amount of that size, you could double dip on your spending, and hit the Business Platinum Appreciation offer with the same transactions. Just pay $500 twice into your mobile service account, and you’d get $100 in credits, plus you’d be most of the way to maximizing the mobile offer as well.

Luckily for the rest of us, you don’t have to spend it all in one shot. It’s more akin to a boosted earn rate. Effectively, for as long as the offer is active, you’ll earn 3.25 MR points per dollar spent at mobile service providers.

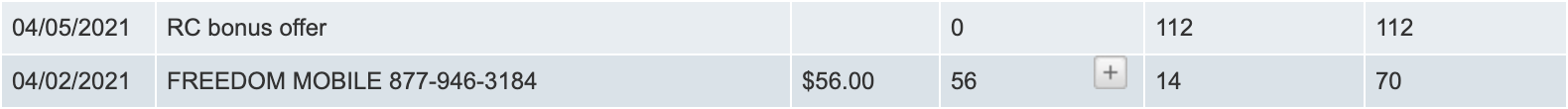

I’ve had this offer active for a couple of months. The bonus points post separately a few days later, but the math checks out:

I’m glad that I don’t have to go out of my way to trigger this offer. My cell phone bill isn’t big enough to be a distraction from pursuing a minimum spend requirement.

For smaller recurring expenses, I prefer to keep them on my “set-and-forget” long-term credit cards, as I focus my Miles & Points housekeeping chores on new cards that demand more active attention. (And as something that I could plausibly write off as a business expense, I was paying my mobile bill with my Business Platinum card already!)

In any event, if that doesn’t work for your strategy, it’s not a huge loss if you choose to let this offer pass you by. Indeed, it’s a far cry from the $160 in mobile credits offered last year. But if you can conveniently automate it, it’s an easy extra little treat to grab.

Conclusion

American Express has two offers available to holders of the Business Platinum Card. With up to $100 in statement credits and 3,000 bonus MR points, it’s nice to see that Amex is making an effort to take care of not only their personal clients but also their business customers.

It’s always satisfying when you can accumulate enough offers on a premium credit card to fully offset the annual fee. Last year I was able to do so with my Business Platinum, mostly thanks to the mobile credits and the Dell credit, as well as Shop Small. I’ve just renewed the card for the coming year, and I’m excited to get a quick start towards that milestone again.

As the world continues to recover from the pandemic, we’ve finally seen credit card acquisition offers bounce back, with the Cobalt Card at a record-high and the Platinum Card back to its normal levels.

But I expect that we’ll continue to see a slow and steady stream of offers like these that aim to engage existing cardholders, and I’m optimistic that it’ll be worth the annual fee to keep premium cards like the Business Platinum card this year, even if our ability to use the travel benefits is still a bit limited.

Be sure to activate both offers as soon as you can, and use them before July 31, 2021.

I have the Bus. Platinum and don’t have this $50 credit for $500 spend offer. Maybe just a DP that it may not be universal. I have had the mobile offer for months, but haven’t bothered with it.

Has anyone found a way to prepay a Telus Bill more than 20 percent of the amount owing? Whenever I try to more than what I owe, a message comes up that says I can only prepay 20 percent more than what I owe. Thank you

Telus seems to be the one telco that doesn’t allow users to overpay their bills by a huge amount.