There have been many changes in the world of one of my favourite pet subjects: prepaid credit cards.

Since last year, several dynamic products have come onto the scene, while others have followed in the paths of their less-illustrious cousins by cutting the benefits available to cardholders.

While some of the devaluations which have occurred might be disheartening, the slew of new prepaid payment products bears consideration. Indeed, there’s a degree of hidden value if you’re willing to think outside the box and look for it.

Commonalities of Prepaid Credit Cards

Before we get into the specifics, let’s revisit what a prepaid credit card is and why we should care about them.

First, as the name would imply, prepaid cards are paid in full in advance. You need to load the card before using it, usually by linking your bank account or by using Interac e-Transfer, Visa Debit transactions, or direct deposit. This makes prepaid cards a bit like a chequing account.

However, unlike a chequing account, you’re not required to follow any kind of ancient and byzantine set of regulations about minimum balances, nor are you required to pay any kind of fees.

Even better, unlike traditional bank accounts, I haven’t once received a hard pull to my credit score to open an account.

Second, prepaid cards still function like credit cards, because they’re still integrated into the Visa or Mastercard networks. This allows them to work with lightning speed.

Prepaid cards differ from regular credit cards because they don’t require the issuer to lend you significant amounts of money. Some, like KOHO, offer services such as funds advances, but only under specific circumstances.

Prepaid cards differ from regular credit cards because they don’t require the issuer to lend you significant amounts of money. Some, like KOHO, offer services such as funds advances, but only under specific circumstances.

Prepaids also acknowledge something many of us don’t want to admit: at some point in our lives, most of us were bad with money. The appeal of the prepaid card is that you can load whatever quantity of money you wish to limit yourself to, be it $1,000 or $15.

To support the theme of budgeting, each prepaid provider has a millennial-oriented app to make you feel groovy about paying your landlord. In the app, you can also track your spending by category in a separate tab, so that you can cut yourself off from Starbucks when it’s eating into your rent.

The major prepaid card issuers go to great lengths to make these apps faster and more user-friendly than their competitors. This is a bit odd, though, as they’re all underwritten by the same company, People’s Trust Bank of Canada.

Lastly, like many new financial products, few prepaid credit cards are available in Quebec. Zut!

EQ Bank Card: The Strongest Prepaid Newcomer

By far the best entry into the prepaid credit card space in 2023 has been the EQ Bank Card.

Launched by the online-only EQ Bank, the eponymous prepaid card is incredibly strong because of its bevvy of no-nonsense features. This card frankly outcompetes many other cards because of its sheer functionality.

Cardholders of the EQ Bank Card can expect to enjoy the following features, earning rates, and bonuses:

- No monthly or annual fees

- 2.5% APR interest on deposits, calculated daily until you spend

- Free withdrawals from any ATM in Canada

- 0.5% cash back on every purchase

- No foreign transaction fees

While 2.5% interest may not be anything to write home about, the fact it comes with no foreign transaction fees in addition to universal cash back is certainly a big reason for most savvy Canadians to have this card in their wallet.

Also interesting is that free ATM withdrawals work very similarly to the Carl Schwab debit card issued south of the border, in that you receive an instant credit for any ATM fees incurred when withdrawing cash in Canada. If this feature were to spread to international withdrawals as well, this would be an excellent constant travel companion.

As always, this card comes with a sleek-looking app that makes it easy to track your spending and benefits.

Overall, this card’s orange colour scheme reminds me of nothing so much as No Frills grocery stores – charmingly non-fancy, but unimaginably convenient and frugal.

Neo Money™ Card: Not Too Shabby

The new product is christened the Neo Money™ card, and its advertised benefits are as follows:

- 2.25% annual interest on all deposits, calculated daily

- Earn instant, unlimited cash back with a free Neo Money™ card attached to your account

- Create bill payments for other credit products or bills, with the option for autopay

- Free domestic and foreign ATM cash withdrawals anywhere Mastercard is accepted

- No monthly fees or minimum balance requirements

- Complimentary Interac e-Transfers

- CDIC deposit insurance, up to $100,000

Interestingly, in line with Neo’s commitment to stability and its focus as an online-first payment solution platform, the Neo Money™ card is designed to be added to your Google or Apple pay wallet as its primary method of use. If you want a plastic card, you’ll have to request one, which you can easily do right from the app.

The ability to gain access to Neo Financial’s partners is a nice bonus, especially for Millennial or Gen-Z customers who may value a more on-the-go, social lifestyle than just earning a flat rate of cash back.

However, I don’t think it outweighs the EQ Bank Card’s waiving of foreign transaction fees. While it’s nice to be able to save on ATM fees when withdrawing cash outside of Canada, it’s even better to have the safety and security of a credit card transaction when abroad, and avoid paying any markups either on cash withdrawals or foreign currency conversion.

Overall, a competitive addition to the market, if not an apex predator in the prepaid space.

The Wise Card: A Powerful FX Solution

The Wise Card is one of the best products currently on the market. It’s a prepaid Mastercard that launched back in 2021.

A recurring theme in the world of prepaid cards is that the products, including the Wise Card, are accessed primarily via apps. Wise also has excellent functionality on its desktop site, unlike some of the other options on its app.

Regardless, the Wise Card’s app interface is user-friendly and fast. All applications for the card must be made either through the app or via the desktop website.

Activate this card and add it to your wallet as the most electric green item you’re likely to carry around, and you’ll also realize it’s rather powerful.

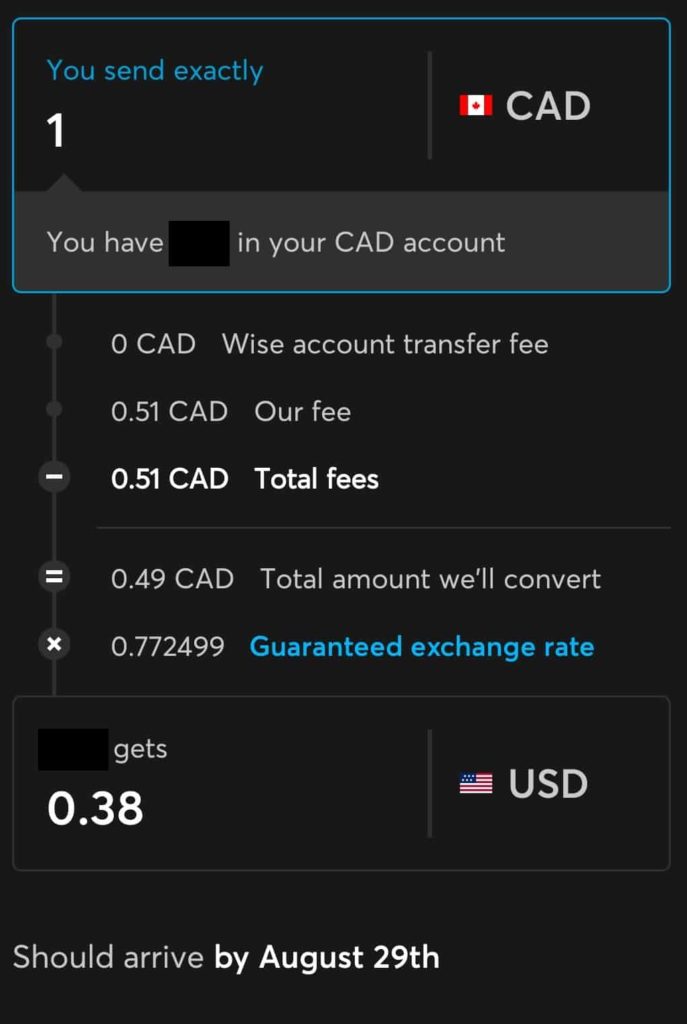

While it doesn’t offer any rewards, it can be loaded in over 50 foreign currencies, and it can be used to wire money directly into foreign bank accounts for either yourself or your friends and family.

While there is a conversion fee between the various currencies, it’s much lower than the typical 2.5% on other Canadian credit products.

Overall, I think the product is very strong, and heartily recommended it as one of the best ways for the average consumer to turn their Canadian dollars into their freedom-loving American cousins.

However, I’m not without my conniptions. With Wise, it’s in the form of fees, fees, and more fees.

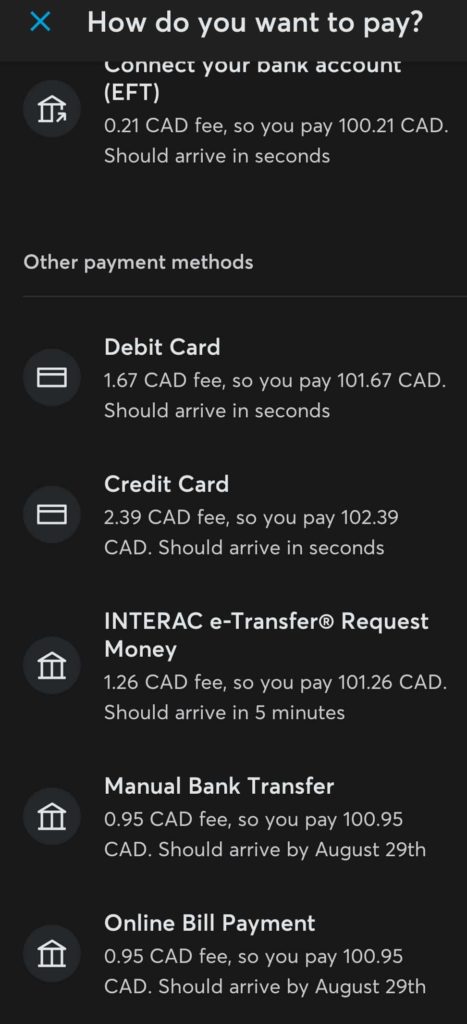

There’s a fee for pretty much everything, from transferring money into the app, to transferring to another bank account, and even for withdrawing from an ATM. Take a look:

While the conversion rates remain strong, the fees mean that Wise is best enjoyed in bulk, so as to mitigate the cost of transfer per dollar sent.

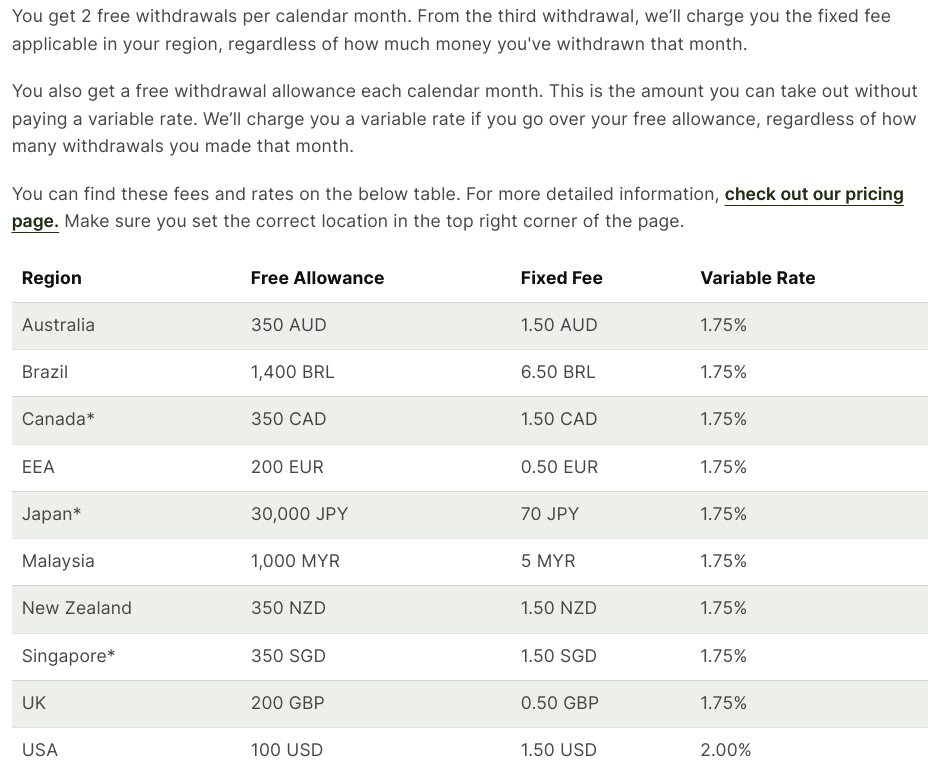

ATM fees were updated in March 2023, and not for the better. The structure is now positively complex, and one can only imagine it was probably by design.

I keep this card in my wallet, but I wish it stopped trying to squeeze around the edges. Then again, perhaps it was inevitable, given their rates.

No Longer a Visa: The Wealthsimple Cash Card

A product I’ve been watching closely is the Wealthsimple Cash Card.

As a prepaid product, the Cash Card is quite typical: it’s integrated into the attractive Wealthsimple app, features pretty black-and-gold design on the physical card, and exclusively loads via bank account linkage (no e-Transfers.)

As a prepaid product, the Cash Card is quite typical: it’s integrated into the attractive Wealthsimple app, features pretty black-and-gold design on the physical card, and exclusively loads via bank account linkage (no e-Transfers.)

For some reason in early 2023, Wealthsimple ditched Visa in favour of transitioning to being a Mastercard. Maybe they were offered a better slice of interchange fees, or just preferred the new network. Regardless, the card has seen a major change.

Wealthsimple’s benefits are still pretty good for a no-fee credit card:

- 1% cash back when placed into pure cash back, stocks, or crypto holdings (note that the latter two options have tax implications if they rise in value, so cash back may be preferable for a general user)

- 1.5% cash back when placed into a Wealthsimple savings account (not ideal given current inflation)

- No foreign exchange fees – a welcome change!

- Send/receive Interac e-Transfers with no fees

While it’s a bit annoying to go through yet another sleek startup app, at least the product itself is user friendly, and the rewards breakdown is simple.

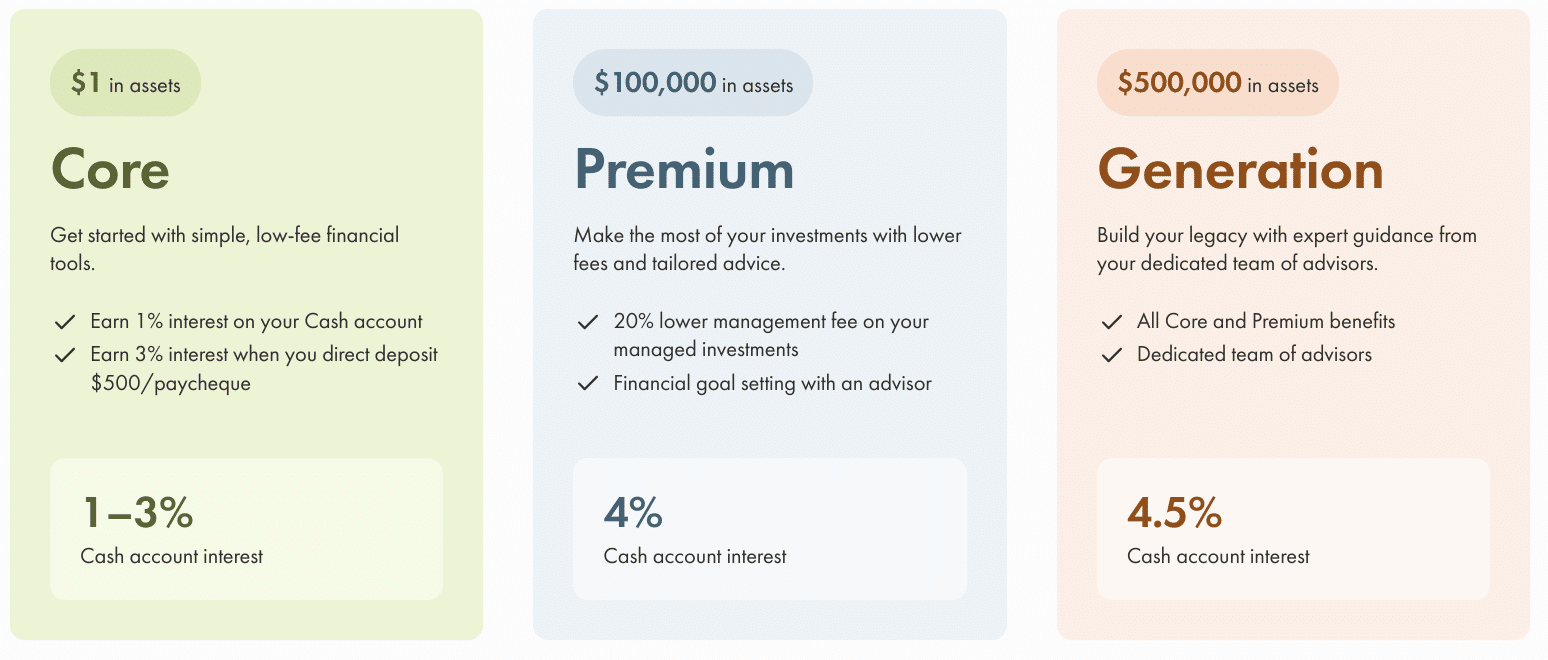

Finally, Wealthsimple expanded its product feature for higher rollers by offering an expanded interest scheme for people who heavily use the Wealthsimple ecosystem, with particularly attractive rates of interest for people with large amounts of invested assets.

Personally, I can’t see investing $500,000+ into a prepaid credit card ecosystem.

Sort of Banking: The PC Financial Money Account

While it doesn’t have any sort of utility in the foreign exchange space, the PC Financial Money Account, a Mastercard product, distinguishes itself in the form of a hybrid prepaid credit card plus a daily banking solution.

While PC Financial doesn’t have the same footprint as the Big 5 banks, it has plenty of ATMs available at most Loblaws-umbrella stores and Shoppers Drug Mart locations, so withdrawing cash shouldn’t be much of an issue.

PC Financial’s call centres also tend to be decent, but the surcharges on making transactions over the phone corral the casual user to, you guessed it, the PC Financial app.

On top of the ATM cash withdrawals, the PC Financial Money Account does many of the standard transactions available to a normal chequing account, such as receiving payroll deposits, setting up preauthorized payments, or paying bills and credit cards.

You can also get your mortgage payments withdrawn from the account, though I don’t know if I’d personally be comfortable with living accommodation payments coming from a prepaid card which could potentially be frozen by fraudulent charges more easily than a traditional bank account.

The card also earns rewards in the form of PC Optimum points, at a rate of 10 points for every $1 spent, a 1% earn rate. Of course, these points can only be used at retail stores owned by Loblaws, but at least it’s providing some kind of additional value to cardholders.

While this may not be much to write home about, it’s a good benefit for a product that acts as a surrogate chequing account. Good luck finding an equivalent Big 5 offering that provides cash back above 0.25%.

A Solid Contender: KOHO Prepaid Visa

The next card on our roundup is the KOHO Prepaid Visa, which provides 0.5% cash back on every transaction. This is nothing to write home about, but it’s unique in the prepaid sphere, as it indicates that the issuer is willing to split their interchange revenue with the customer.

The card can be loaded by Visa Debit and Interac e-Transfer, and I find its e-Transfer loads to be superior. Unlike many of the other companies on this list, KOHO has enabled auto-deposit.

No annoying security questions and answers here: the money loads very quickly.

As I alluded to earlier, KOHO is also alone in offering “funds advances.” If you elect to have your payroll deposit onto your KOHO, you can access up to $200 of that pay in advance of the funds clearing. I don’t really understand the utility of this, but it is a feature.

On the FX side, KOHO charges “only” a 1.5% markup on foreign transactions. That’s better than most cards on the market, but still worse than other credit cards with no foreign transaction fees, such as the HSBC World Elite Mastercard.

Also of note is KOHO Premium. For $9 a month or $84 a year, you can benefit from a number of perks, including:

- Earn a flat 2% cash back on three categories

- Up to 4% interest on deposited balances

- No foreign transaction fees

- Withdraw up to $800 at a time

- Up to 5% cash back at KOHO’s partner vendors

- Complimentary access to free financial coaching from KOHO’ staff

For the fee, I’d like to see more and better features, especially as 2% cash back on three categories is already provided for free with the Tangerine World Mastercard. Still, this is a positive indicator that some of the prepaid issuers are trying to widen their rewards portfolio.

Oh, and you can also buy pre-loaded KOHO cards at Best Buy.

The Walk of Shame: Mogo Card

How the mighty have fallen. Mogo used to be one of my favourite prepaid cards, due to the lightning-fast Visa Debit load times (and open-mindedness around which Visa Debit cards to accept), as well as generous bitcoin cash back.

Unfortunately, the Mogo Card is no more.

Mogo was a typical prepaid card that charged normal FX fees of 2.5% and required loads via e-Transfer and Visa Debit. In mid-2022, the cards began having problems with loading, and in 2023, customers were informed that the service would be shutting down entirely as Mogo focused on its retail investment business.

Load issues aside, the Mogo Card was fairly standard: it had a sleek card design, a neat app with monthly Equifax credit monitoring, and the usual homilies to budgeting. With a great rewards structure, this would have made for a competitive prepaid product.

Alas, Mogo abolished its bitcoin cash back program back in 2021. As originally conceived, this reward program was a neat gimmick, even if your 1–2% earn wasn’t actually in “owned” bitcoins, but in cryptocurrency owned by the company, which would be paid out in cash upon request.

There was no way that this gimmick was going to survive the cratering of crypto prices, and it didn’t.

After replacing the bitcoin cash back with a nebulous promise of “CO2 offsetting” by planting trees in the Amazon (or so the tropical music in their app implied), the Mogo Card team was mostly silent for months at a time. On top of this, no proof was ever given that any trees were planted as the card slipped further and further into obscurity.

As the internet knows: pics or it didn’t happen. We never got the pictures.

We did, however, get an abolished product that is now being replaced wholesale by the far-superior EQ Bank Card mentioned at the very top of this updated list. At least some tragedies end well.

Stack: How to Lose a Prepaid in 10 Days

Last in our prepaid roundup, but first in shame, is the Stack Prepaid Mastercard. We covered this product all the way back at its launch in 2018, and over time, the Stack team has modified its offering at a marginal, but not insignificant, pace.

The Stack card provides the typical prepaid benefits: fast deposits, a sleek app, and a vertically designed card for flexing on all your friends. In lieu of cash back or points, it has Stack Offers, which consist of discounts on everyday purchases at specific retailers.

The amounts aren’t anything to write home about, but it is a nice little bonus.

The reason we used to love the Stack Prepaid Mastercard was simple: no foreign transaction fees. We don’t have nearly enough products like this in Canada.

Alas, all good things must come to an end. On February 1, 2022, Stack introduced a 2.5% foreign exchange fee, the standard on all major Canadian credit card products.

If only the devaluations had ended here. After being sold to Credit Sesame, a major lending firm whose business practices suspiciously resemble those of the Big 5 Banks that Stack was intending to “disrupt,” the entire card self-destructed on November 1, 2022.

Remember banking fees and how Stack was supposed to get rid of them? Remember the indignation Stack levelled upon the idea of being nickel-and-dimed on arbitrary service charges?

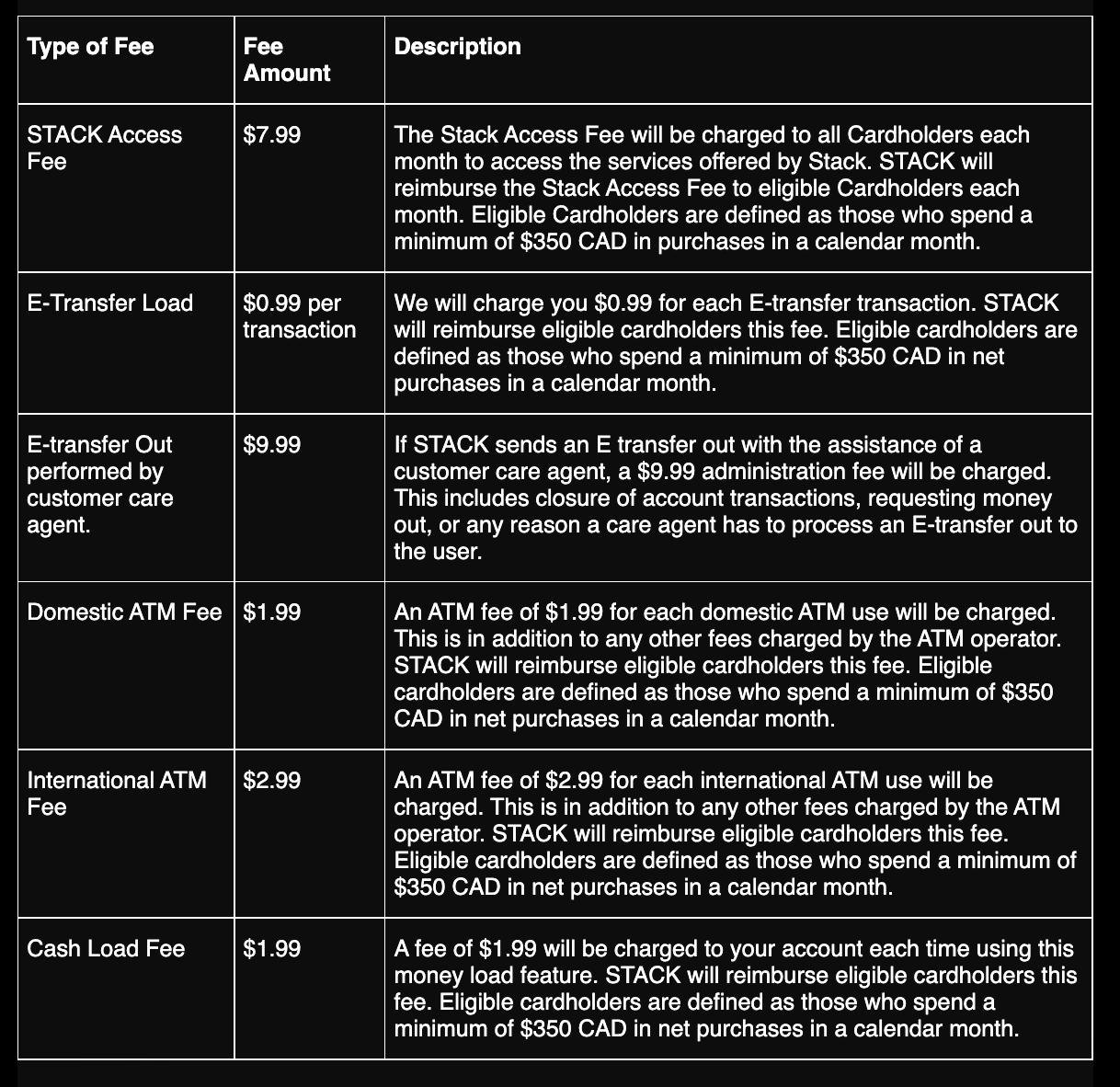

Well those were the exact monetization policies that Stack re-introduced, thus torpedoing its goodwill with customers and even its raison d’être on the entire market.

These are standard-issue in the world of new fintechs, but with the added foreign transaction fees, I’ve seen no reason to retain my membership with this startup.

Blast from the Past: CIBC AC Conversion Card

The Air Canada Conversion Visa Card by CIBC, of ancient mass-points-earning fame, is still around.

I’ve included this card on the list because I think it highlights a failure of these older-school prepaids versus the new ones: this card has no special features, aside from the ability to load in foreign currencies.

For example, if you want Turkish lira, you can load the card in that denomination.

However, this means you’ll be stuck paying the exchange rates set by CIBC, which will be far less competitive than through a No FX card or via a service such as Wise.

Worse yet, you’re obligated to spend in the loaded currency! If you have no use for those lira, you’ll have to convert back at extortionate rates once more. No thanks!

Take a pass on this option, but if any interns at CIBC or Air Canada are reading, this card needs a makeover even more than my grubby wardrobe. No fees on foreign transactions beats loading in foreign currencies any day.

Where to Learn More About Prepaid Cards

If you’re curious to learn more about the growing world of prepaid credit cards, I’d definitely recommend you follow the Canadian Prepaid Providers Organization (CPPO) website.

This is a great place to get news from the industry’s main public relations arm, and you can get a good idea about new products that might be launching soon.

I definitely am thankful for the convenience and flexibility of all the innovative new features that we continually see from prepaid cards, such as instant Visa Debit loads, no foreign exchange fees, payroll direct deposits, and generous ATM withdrawal limits.

Conclusion

Prepaid cards offer an interesting look into the future of the Canadian personal finance market. As traditional banks shrink, will these new products be able to live up to the hype and become a dominant form of payment solution?

It’s still early days for the industry, but I’m looking forward to finding out what tricks prepaid credit cards have in store. Clearly, the products being launched prove that there is still more appetite in the financial services industry to provide more.

Until then, consider picking up a product or two that interest you. You can experiment with how to load them, make use of attractive features like Wise’s flexible foreign currency options, or maximize the other special offers that we often see from prepaids.

“Withdrawing cash, one of the better previous uses for the card, will still incur the 2.5% ding, which is an unfortunate downgrade.”

Are you sure?

I used the web chat feature to ask Stack about this before a recent trip. They seemed to indicate (though their answer was far from crystal clear) that foreign cash withdrawals counted under the refund scheme for monthly totals over $350.

Since Wise provides you with a Canadian bank account number, I’ve been able to avoid the Wise card load fee by triggering an Electronic Fund Transfer from the other end, i.e. via Tangerine.

Is there any actual competition on the pure debit card front? Unfortunately these cards , while marketed as cash alternatives, are not accepted at the small number of places (usually small corner stores) that are debit only.

I’ve used all the mentioned cards and none of them have Interac label (what is typically referred as this so-called debit in Canada). If you want exactly such card, you might need to open full-pledge chequing account at actual bank. Cheapest to come to this area is Tangerine and Simplii. Simplii debit card has Interac label.

Just wanted to clarify potential theory incase you end up with question “why?”. Visa, AMEX, MasterCard, Discover, etc they all introduce merchant fees that typically business have to pay on each transaction. All these bonuses you get are typically part of rebates from those fees. Interac is proprietary in-Canada thing, and to add intentive for merchants to adopt it it has significantly reduced fees. There’s no rebate of those fees, so its waste of money for such internet banking businesses to consider this network.

Thanks for the information, dimon222. I have applied for a Simplii account. I can’t quite figure out if it can be the *sole* chequing account one has. I am seeking to leave RBC after several years.

I think for WS Cash weekly limit only applies to student 10% promos. See the page for main 5% (6% this week)

https://help.wealthsimple.com/hc/en-ca/articles/4402438160663-Earn-5-cash-back-with-your-Cash-Card

My personal FAVORITE prepaid visa Debit card since summer has been the Crypto.com 3% Crypto ‘CRO’ cash back Jade Green (Metal card) which I load easily with fiat wallet in the app and they also give airport lounge access and free rebates on prime and netflix video service.

Any prepaid that can be loaded with Amex credit?