After hearing about the upcoming combined Marriott/SPG loyalty program back in April, one of the most pressing uncertainties that remained was the question of what would happen to the Canadian portfolio of Amex SPG credit cards. Right now, the American Express SPG Card and the American Express Business SPG Card are the co-branded credit cards for the SPG program, while no card is affiliated with Marriott Rewards after Chase pulled out of the Canadian market earlier this year.

Today, American Express has issued an official announcement on the future of their personal and business co-branded card products, confirming that their relationship with the Marriott/SPG loyalty ecosystem will continue onwards, as well as introducing a suite of changes to the credit cards that will take effect in August when the new program officially launches.

Changes to the Earning Rates

Starting in August 2018, a few changes are coming into place to bring Amex Canada’s SPG products more in line with the new combined program. The new program will no longer use Starpoints as its central currency, but instead your Starpoints will be converted to “Rewards points” (that seems to be the generic term that’s being used before a new name is decided) at a 1:3 ratio, and therefore the earning rates on the program’s associated credit cards will need to change as well.

On the American Express SPG Card, you’ll earn:

-

5 points per dollar spent at Starwood and Marriott hotels; and

-

2 points per dollar spent on all other purchases

Meanwhile, on the American Express Business SPG Card, you’ll earn:

-

5 points per dollar spent at Starwood and Marriott hotels;

-

3 points per dollar spent on eligible gas, dining, and travel; and

-

2 points per dollar spent on all other purchases

The discerning points earners among you will have noticed that these updated earning rates represent an overall devaluation compared to the status quo.

Right now, you earn 1 Starpoint per dollar spent on all purchases, which is equivalent to 3 Rewards points per dollar spent. Starting in August, you’ll be able to outstrip the old earn rate only when spending money at Starwood and Marriott hotels (on things like hotel stays, food & drink, incidentals, etc.), while the “all other purchases” category suffers a 33% devaluation as you go from earning the equivalent of 3 Rewards points per dollar spent to only 2 points per dollar spent.

This reflects the changes in earning rates that we’ve already seen in the US with their versions of Amex SPG cards. Consumers who spend heavily on hotel stays will stand to benefit, while those of you who used to derive a significant chunk of Starpoints from your daily spending on the Amex SPG cards will likely be most impacted. Depending on other factors, it may be time to challenge the SPG cards’ previously ironclad pedigree of being one of the best cards to use for daily spending.

It’s also interesting to see Amex introduce some differentiation between the personal and business versions of the card, since previously the two cards were virtually identical. On the Business SPG Card, you’ll be earning 3 points per dollar spent on gas, dining, and travel, which is a perk not afforded to those who hold the personal version.

That’s by no means a world-beating earn rate, since it still remains at par with the 1 Starpoint per dollar we currently enjoy, but it could go some way to justifying the incremental $30 in the annual fee of the Business SPG Card.

Changes to the Card Benefits

There will also be some changes to the benefits associated with these cards, the most significant of which is the Annual Free Night Award. Right now, the Amex SPG Card and Business SPG Card both allow you to unlock a Free Weekend Night Award after making $40,000 in purchases on the card within one calendar year. Beginning in August, you’ll be receiving an Annual Free Night Award on your card anniversary that will not be tied to a spending threshold; you’ll be able to use this free night at Marriott and Starwood hotels that cost up to 35,000 points (i.e., Category 5 in the new hotel reward chart).

The $40,000 spending threshold was onerous for most cardholders, and very few people managed to enjoy this benefit in the past. The fact that everyone will now get a Free Night Award on their card anniversary – echoing one of the most outstanding benefits on the beloved Chase Marriott Visa back in the day – is certainly an improvement.

While we don’t know exactly which hotels will be placed into which of the new categories yet, I don’t think it will be particularly difficult to get enough value out of your Category 5 free night certificate to justify the $120/$150 annual fee.

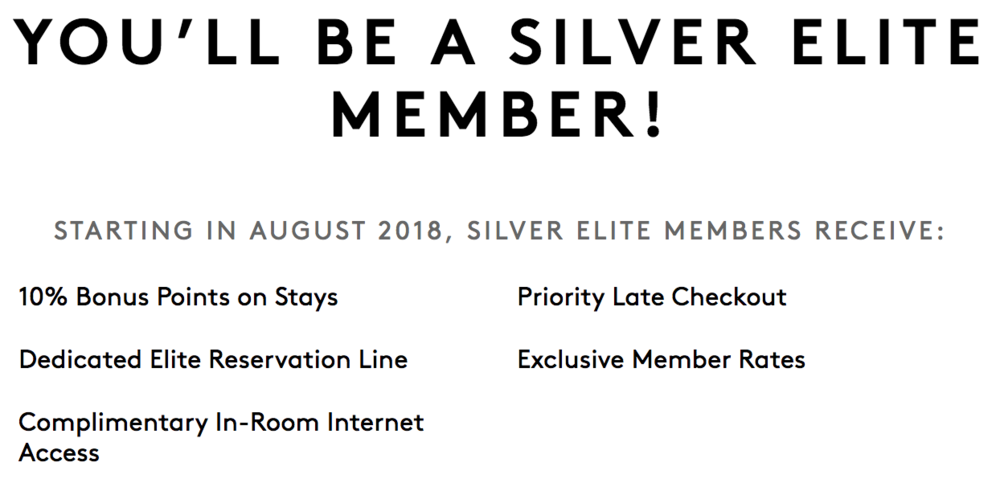

With the introduction of new status tiers in the combined program, the cards’ elite status benefits will be updated as well. Just by virtue of being a cardholder, you’ll receive automatic Silver Elite status in the new program, which gives you perks such as priority late checkout (subject to availability) and a 10% points bonus on hotel stays. Silver Elite is otherwise unlocked after staying at Marriott and Starwood hotels for 10 nights.

Note that as far as I can tell, the card gives you an automatic upgrade to Silver Elite rather than elite night credits of any sort. That means that if you’re shooting for Gold, Platinum, or Platinum Premier status, you’ll still have to earn the required 25, 50, or 75 nights – you don’t get to “use” your Silver Elite status to count towards those thresholds. This is slightly disappointing given that up to 15 elite night credits from co-branded credit cards is something that our neighbours in the US get to enjoy, and also that the late Chase Marriott Visa here in Canada had come with this perk as well.

You will also receive Gold Elite status upon reaching a $30,000 spending threshold within a calendar year. This is a holdover from the current edition of the Amex SPG cards, and Gold Elite status is pretty much equivalent between the old program and the new. You’ll get a 25% points bonus, 2pm late checkout subject to availability, and complimentary room upgrades.

What’s Staying the Same?

At the moment, American Express hasn’t announced any changes to the annual fees, signup bonuses, minimum spending requirements, or referral bonuses for these cards. The $120 and $150 annual fees for the personal and business versions, respectively, will remain in place. Meanwhile, you’ll still earn up to $250 in statement credits for signing up for these cards and spending $1,500 in the first three months, plus a $25 statement credit for each referral.

As per my friend Barry from Money We Have, American Express has confirmed the following in relation to the signup bonus:

There will be a new signup bonus when the new loyalty program is launched that will be engaging and relevant. Until that new program is official, the statement credit for new applicants remains.

To me, it makes sense that we won’t see an improvement from the current paltry offer until the new loyalty program is in place. When August or September rolls around, Amex will definitely be coming up with a more competitive scheme for the welcome and referral bonuses. With Chase gone, the Canadian market for hotel rewards points is now theirs to dominate, and so I fully expect Amex to dazzle us with some juicy bonuses to entice people to take part in the new program.

What’s Happening to Existing Cardholders? Should You Apply Now?

Back when the Marriott/SPG news first dropped, the question was raised as to how to co-branded credit cards would be transitioned. Would the existing Amex SPG cards be phased out, followed by an “Amex Marriott” card being introduced? Or would the Amex SPG card simply be “transformed” into a new product? In light of the information we’ve received today, it’s looking likely that the latter case will materialize.

If you currently hold the American Express SPG Card or the American Express Business SPG Card, you’ll see these changes take effect in August. Indeed, the card itself will continue under the “SPG” brand name until 2019, as Barry over at Money We Have has also confirmed:

Finally, American Express will continue to offer the Starwood Preferred Guest Credit Card as the Canadian Card for the new loyalty program. The card’s name won’t change until 2019 when the new program name is in place. Effective August 2018, Marriott Rewards members and The Ritz-Carlton Rewards members will be able to apply for the SPG Credit Card from American Express for Canada using their loyalty account number.

On the other hand, if you’re not holding the card at the moment but are interested in applying, I’d definitely recommend waiting for an improved signup bonus, since the current offer is decidedly weak. Current cardholders may even want to take a gamble and cancel their cards with a view of reapplying once a better signup bonus arrives, unless of course you find the prospect of the anniversary award night enticing enough to keep the card around.

Of course, we can’t rule out the possibility of a brand-new card being introduced later (for example, in the US, there’s going to be a “premium” Marriott/SPG credit card in addition to the personal and business ones). If that were to happen, everyone would be eligible for the signup bonus on the new card, so I’d expect it to be a great opportunity to start supercharging your points balance in the new program.

Conclusion

There are still many unanswered questions when it comes to what’s happening to the new-and-improved Marriott Rewards in August 2018. We still don’t have the new hotel reward chart, we don’t know what the Amex MR transfer ratio will be, we’re in the dark as to what the new Travel Packages will look like, etc.

But one thing that’s for certain is that news will gradually be filtering through over the next few weeks, beginning with today’s announcements on the future of the Canadian Amex SPG cards. While the updated points earning rates are a negative development, the improvement of the free night award benefit is a promising sign. Later in the year will be the right time for the cards’ signup and referral bonuses to be refreshed, and that’s when we’ll get to see what Amex and Marriott are really made of.

We do know what the transfer ratio will be from Membership Rewards especially concerned about my Cobalt AMEX.

Hey Ricky,

Do you think it would be wise for current SPG Amex card holders to cancel their cards now and reapply once the new signup offer is announced? Or do you think recent card holders would not be eligible for the offer? Thanks

In my opinion, yes. The only benefit of keeping the card around is the ability to earn 1 Starpoint per dollar spent from now until August, which is small potatoes compared to what the new-and-improved signup bonus ought to be. By cancelling now, you’d give yourself some buffer before reapplying for the card and getting the signup bonus when it comes around.