If you’d like to earn TD Rewards Points to put towards flights, hotels, short-term rentals, vacations, and more, be sure to check out the current offer on the TD First Class Travel® Visa Infinite* Card.

Currently, there’s a record-high welcome bonus of up to 165,000 TD Rewards Points† up for grabs, and beyond that, there are many reasons to keep the card in your wallet year after year.

Let’s look at 7 reasons why the TD First Class Travel® Visa Infinite* Card should be part of your overall credit card travel strategy.

- Earn 20,000 TD Rewards Points upon making your first purchase†

- Earn 145,000 TD Rewards Points upon spending $7,500 within 180 days of account opening†

- Plus, earn a Birthday Bonus of up to 10,000 TD Rewards Points†

- Plus, earn 8x TD Rewards Points† on eligible travel purchases when you book through Expedia® for TD†

- Get an annual TD Travel Credit† of $100 when you book through Expedia® for TD†

- Use your rewards for any travel bookings available on Expedia® for TD†

- Four complimentary lounge visits through the Visa Airport Companion Program†

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $139, rebated for the first year†

- Offer effective as of September 4, 2025†

1. Record-High Welcome Bonus

The current welcome bonus on the TD First Class Travel® Visa Infinite* Card matches the highest we’ve ever seen.

If you apply and are approved for the card on or after September 4, 2025,† you can earn up to 165,000 TD Rewards Points in the first year.†

To unlock the full welcome bonus, you’ll need to meet the following conditions:

- Earn 20,000 TD Rewards Points upon first purchase†

- Earn 145,000 TD Rewards Points upon spending $7,500 in the first six months†

In other words, you’ll need to spend an average of $1,250 on eligible purchases in each of the first six months as a cardholder to earn the full welcome bonus.

Plus, you’ll benefit from earning more points along the way, thanks to the card’s category earning rates, which we’ll discuss below.

When it comes time to redeem, you can redeem 165,000 TD Rewards Points for up to $825 worth of travel booked through Expedia® for TD, or for up to $726 for travel booked directly with its recently introduced feature “Pay off purchases”.†

The structure of the current offer is such that you have a sizeable welcome bonus paired with a reasonable minimum spending requirement, and a full six months to complete it.

With a record-high welcome bonus up for grabs, there’s no better time to apply for the TD First Class Travel® Visa Infinite* Card; however, there are many other compelling reasons to have this card, which we’ll discuss below.

2. First-Year Annual Fee Rebate

The TD First Class Travel® Visa Infinite* Card normally comes with an annual fee of $139.†

In tandem with the historically high welcome bonus, the current offer includes a first-year annual fee rebate, which applies to both the primary cardholder and the first supplementary cardholder.†

While the TD First Class Travel® Visa Infinite* Card would certainly be worthwhile even with a $139 annual fee, the first-year annual fee rebate really makes this offer even more compelling.

Plus, if you have a TD Unlimited or All-Inclusive banking account, you can have the annual fee waived on one TD credit card of your choice, including the TD First Class Travel® Visa Infinite* Card, on an ongoing basis.

3. Elevated Category Earning Rates

The TD First Class Travel® Visa Infinite* Card also has a four-tier earning structure, which allows you to earn more points on many eligible everyday purchases.

These category multipliers are useful as you work to meet the minimum spending requirement, as well as when you continue to pad your TD Rewards Points balance over the long-term.

Currently, the earning rates on the TD First Class Travel® Visa Infinite* Card are as follows:

- Earn 8 TD Rewards Points per dollar spent on eligible travel booked through Expedia® for TD†

- Earn 6 TD Rewards Points per dollar spent on eligible groceries and restaurants†

- Earn 4 TD Rewards Points per dollar spent on eligible recurring bills†

- Earn 2 TD Rewards Points per dollar spent on all other eligible purchases†

It’s worth noting that there’s an annual spending cap for the elevated earning rates in the groceries, restaurants, and recurring bill payment categories.

After you’ve spent $25,000 within the year, the earning rates in these categories will be lowered to 2 TD Rewards Points per dollar spent.†

If you redeem TD Rewards Points for a value of 0.5 cents per point by booking travel through Expedia® for TD, these rates are equivalent to a 4%, 3%, 2%, or 1% return, respectively.

These are solid earning rates, which will help you quickly earn points to offset the cost of travel throughout the year.

Plus, on your cardholder anniversary date, you’ll get a further boost to your balance with one of the card’s other hallmark features.

Feel free to use our rewards calculator below to estimate how many TD Rewards Points you can earn based on your monthly spending:

4. 10% Annual Birthday Bonus

In addition to the strong earning rates on day-to-day spending, you’ll also receive a 10% Birthday Bonus in the form of TD Rewards Points.†

Each year on your cardholder anniversary date, you’ll earn an additional 10% bonus on all the TD Rewards Points you’ve earned over the past 12 months, up to a maximum of 10,000 points.†

To maximize this benefit, which is worth up to $50 if you redeem the points for travel booked through Expedia® for TD, you’d need to earn a total of 100,000 TD Rewards Points organically throughout the year.

To put this into perspective, you’d need to spend around $1,380 per month on eligible groceries and dining purchases†, or any other combination to bring you across the threshold of 100,000 points.

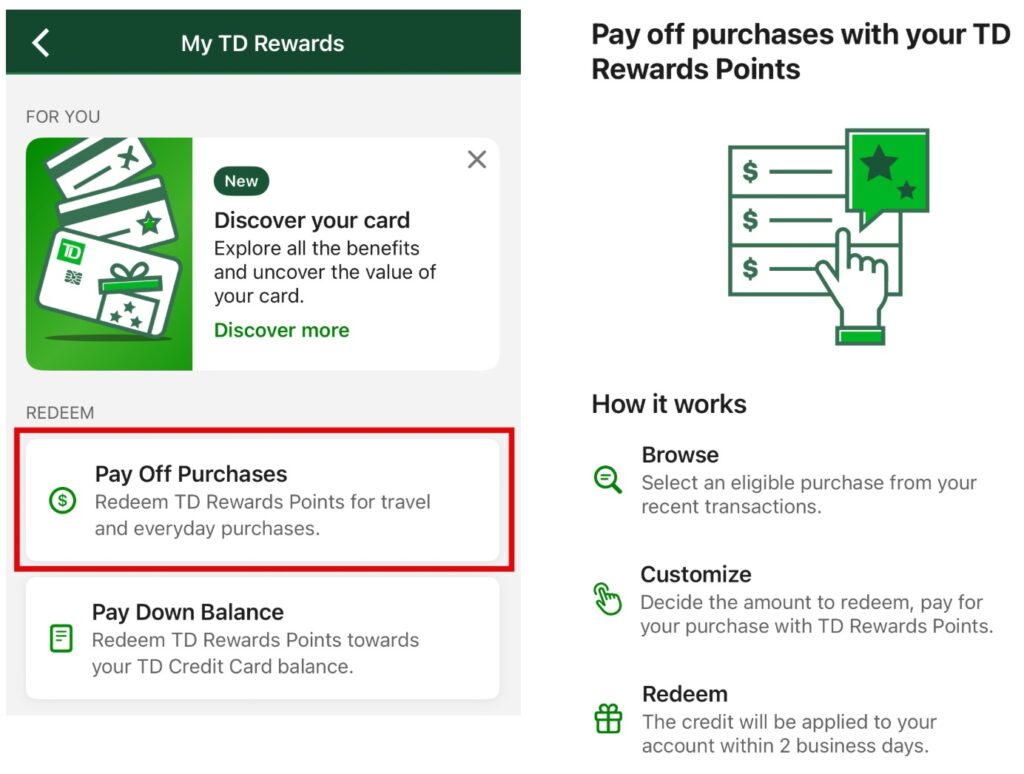

5. Flexible Redemptions with TD Rewards Points

When it comes time to redeem your points, you’ll be happy to know that TD Rewards Points are fairly flexible.

While you can’t transfer your points to any external airline or hotel loyalty programs, the best (and most valuable) way to redeem TD Rewards Points is for travel, either booked through Expedia® for TD or directly with any vendor.

In fact, TD Rewards Points are particularly useful to have on hand when it comes to filling the gaps for travel that can’t be booked through other loyalty programs.

The most valuable way to redeem TD Rewards Points is through Expedia® for TD, which will give you a value of 0.5 cents per point.

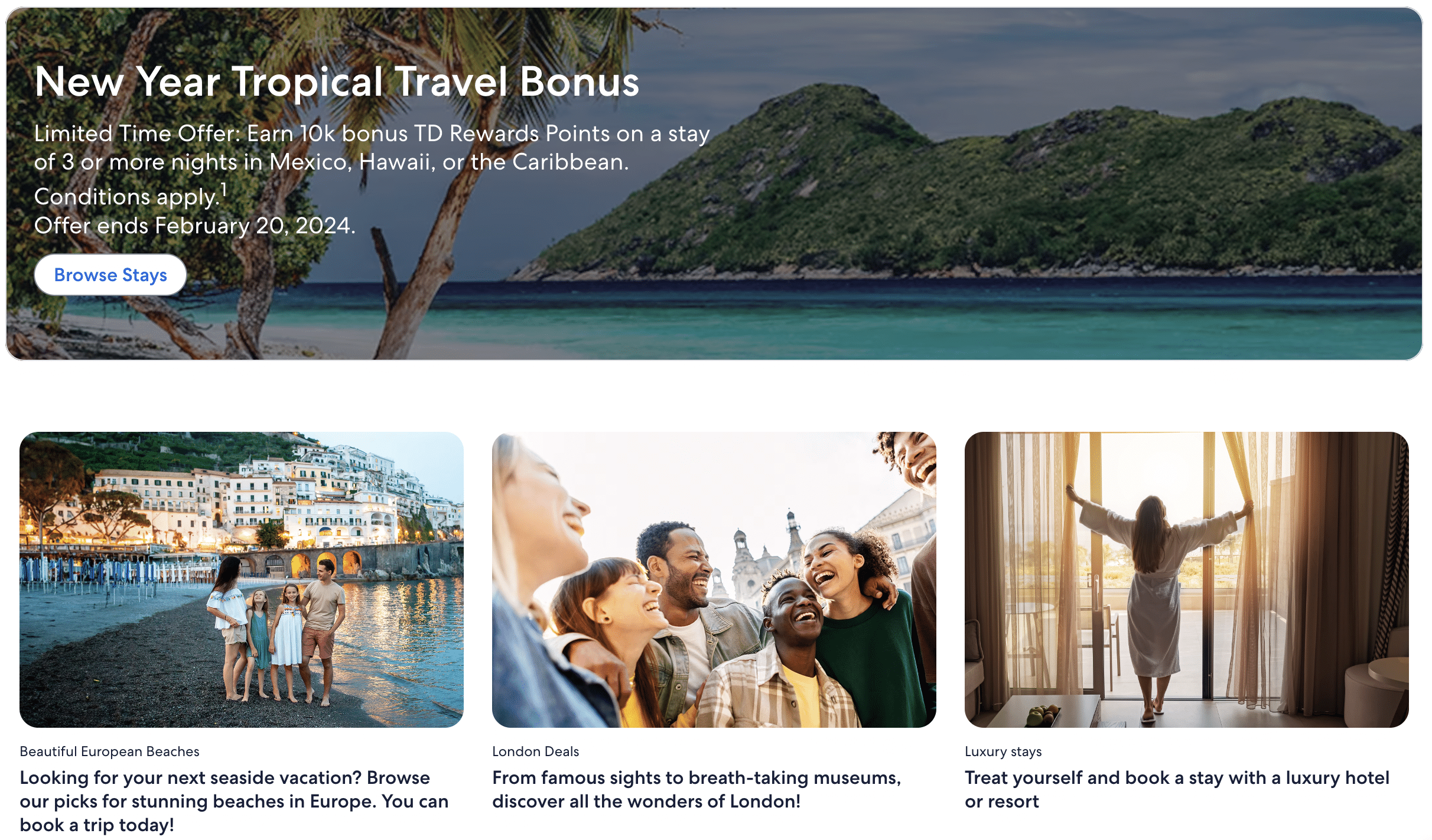

On the platform, you can book flights, hotels, car rentals, cruises, tours, and even Disney tickets, among other things, and get the maximum possible value from your points.

Since many of these expenses are typically difficult to book with other points currencies, using TD Rewards Points to book travel at a fixed value of 0.5 cents per point is an excellent redemption opportunity, and could end up saving you a significant amount of cash on your next trip.

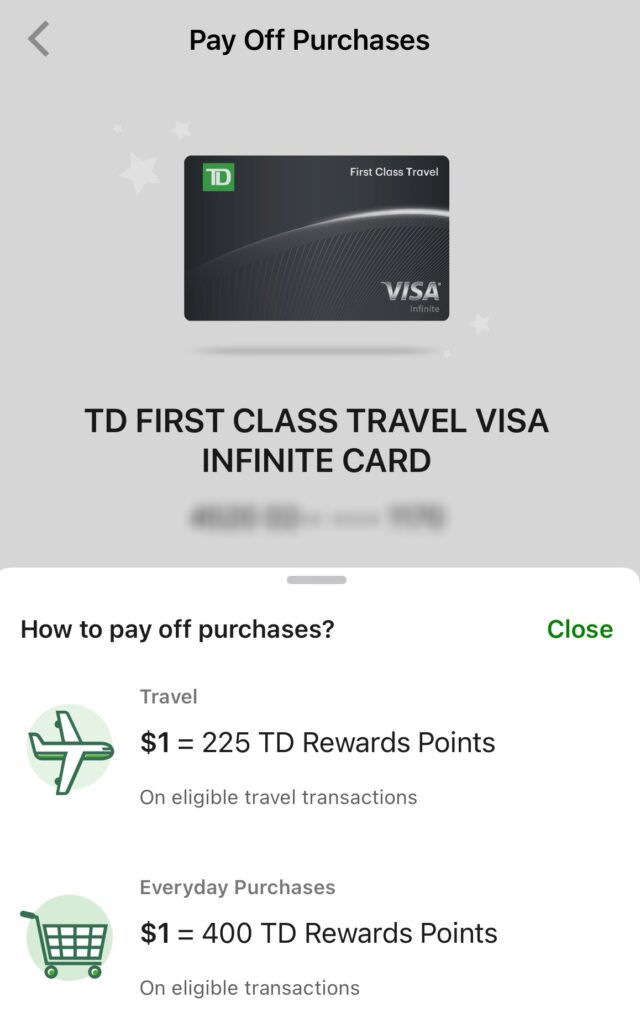

On the other hand, if you want to book travel directly with vendors, you can still redeem TD Rewards points for those purchases by exchanging the points for a statement credit at a fixed rate of 0.44 cents per point against eligible travel purchases charged to the card.†

For example, with the Pay Off Purchases feature, you can book directly with an independent hotel and then apply your TD Rewards Points as a statement credit to offset the cost.

This method also lets you keep and enjoy your loyalty status perks, since you’re booking directly rather than through an online travel agency.

To redeem TD Rewards Points against travel purchases booked directly, simply log in to the TD app and apply your points toward any eligible travel transactions made within the past three statements.†

6. Annual Travel Credit and Lounge Access

One of the other features on the TD First Class Travel® Visa Infinite* Card that makes it worthwhile to keep for the long-term is the $100 annual travel credit.†

The $100 annual travel credit helps to offset the card’s $139 annual fee, bringing it down to an effective $39 annual fee year-after-year. However, with an eligible bank account, you’ll enjoy an annual fee rebate anyway, which makes the $100 annual travel credit even more attractive.

Beginning in the second year of card membership, you’ll earn a $100 travel credit each year on your cardholder anniversary date, which can then be used towards accommodations and vacation packages booked through Expedia® for TD.

Importantly, the credit applies to eligible purchases of $500 or more. Therefore, you can also think of it as up to a 20% discount on accommodations or vacation packages on one of your next trips.

On top of that, the card comes with four complimentary annual lounge passes through the Visa Airport Companion Program.

These passes grant access to participating lounges around the world, letting you relax in comfort before your flight.†

With the recent news that American Express Platinum cards will limit lounge visits starting in 2027, this card serves as a great way to supplement your extra visits — ensuring you still have access to airport comfort even when other cards begin tightening entry.

7. Strong Insurance Coverage

Lastly, the TD First Class Travel® Visa Infinite* Card comes with competitive insurance coverage. This is a key feature for a strong travel credit card, and one that you’ll certainly want to be aware of as a cardholder.

The comprehensive insurance coverage offered by the card can best be divided between travel insurance and retail insurance.

In terms of travel insurance, the card provides the following:

- Emergency medical insurance: Up to $2 million for trips up to 21 days for those aged 64 and under, and up to four days for those aged 65 and older†

- Trip cancellation: Up to $1,500 per person (maximum of $5,000 per trip)†

- Trip interruption: Up to $5,000 per person (maximum of $25,000 per trip)†

- Common carrier travel accident insurance: Up to $500,000 of coverage for losses while travelling on a common carrier (bus, ferry, plane, train, or car rental)†

- Flight delay: Up to $500 per person for delays of four hours or longer†

- Baggage delay: Up to $1,000 per person for delays of six hours or longer†

- Car rental: Up to 48 days of insurance on a vehicle with an MSRP of up to $65,000†

- Hotel/motel burglary insurance: Up to $2,500 of coverage per occurrence of stolen personal items that belong to the cardholder or eligible family members travelling with the cardholder†

With the exception of emergency medical insurance, you’ll need to charge the full cost of your trip to be eligible for the other benefits.†

Not only can the included travel insurance coverage on the card save you money, but you’ll be assured that you won’t incur any additional expenses in the event of disruptions to your travel plans.

When it comes to retail insurance benefits, cardholders can benefit from the following:

- Mobile device insurance: Up to $1,000 in the event of loss, theft, accidental damage, or mechanical breakdown for eligible mobile devices.†

- Purchase security: You’ll be protected if an item is stolen or damaged within 90 days of purchase.†

- Extended warranty protection: If you purchase an item that comes with a manufacturer’s warranty, you’ll receive double the warranty up to a maximum of 12 additional months.†

Of these, mobile device insurance and extended warranty protection can be particularly useful if something happens to an eligible product purchased on the card.

As always, it’s important to read the insurance booklet to fully understand what’s covered and eligibility criteria for your unique situation.

Conclusion

The TD First Class Travel® Visa Infinite* Card is an impressive card that comes with strong travel benefits and competitive earning rates.

If you’re in the market for a new credit card, you should certainly consider the TD First Class Travel® Visa Infinite* Card, especially with its record-high welcome bonus and first-year annual fee rebate.

There’s no announced end date for this record-high offer, but these promotions rarely last long, so be sure to apply sooner rather than later.

† Terms and conditions apply. Refer to the card issuer’s website for complete, up-to-date information.

I am a regular expedia user and books about 100 trip elements a year on there for myself and colleagues. What’s the expedia for TD system look like? is it similar to regular expedia? Also worthy of note is that if I book hotels through Expedia I earn about 2% return. By using this credit card I’m forfitting 2% return to get 4% return. Not bad but not great either. But flights are a different story. You earn next to nothing on flights through expedia but 4% through this card? Wow!

Can you ad your hotel reward number (and receive the benefits) when booking via Expedia

I don’t think so, even if it does allow you to, most hotels won’t honor your status as 3rd party travel agencies like expedia charges 30% from the room rate, most hotels don’t want that. To encourage guests from booking indirectly, they don’t honor your status with the hotel and won’t be providing any elite status benefit when you book with 3rd party travel agency. Airlines are different as they charge very little little, so elite stauts benefit usually applies still

it should be mentioned in order to get the $100 travel credit, you need to make purchase of $500 or more made with Expedia for TD for hotel or vacation packages only.

Hello,

Thank you for your comment. I took a 2nd look, and we did mention it:

“Importantly, the credit applies to eligible purchases of $500 or more. Therefore, you can also think of it as up to a 20% discount on accommodations or vacation packages on one of your next trips.”

It’s below the photo so perhaps it’s easily overlooked.

Hope that helps 🙂

If you use the TD Reward points you earn with this card to make a flight purchase on Expedia for TD, does the strong insurance cover your trip?

Hi, yes they do 🙂