Stack Prepaid Mastercard Self-Destructs

On November 1, 2022, Stack Prepaid Mastercard holders were jolted with unpleasant news from the groovy fintech.

Going forward, the company which has advertised itself as a “disruptive” David against the oligopolistic Goliath of Big 5 mainstream banking is going to be falling back on the oldest trick in the financiers’ cookbook: levying fees on members.

Let’s look at the changes and ponder how the righteous have fallen so far from grace.

A History of Devaluations

Negative modifications to Stack’s product are nothing new. In hindsight, this prepaid card may have been too good to be true, and perhaps the cutbacks occurring now are a direct result of that.

The reason for this is because Stack truly used to be a trailblazer: it offered no foreign transaction fees on forex purchases and ATM withdrawals.

It had the occasional discount on certain products and services (as many fintechs do) via reciprocal partnerships with specific merchants. And it continues to maintain the useful (but more prevalent) virtual card feature.

But oh, vanity of vanities, how the might Stack has fallen.

The card has had the dreaded 2.5% FX fees since February of 2022. The partnerships, thin as they were, almost completely dried up.

The app would harangue you to load money should you neglect to use it for a few months. And now the worst is coming to pass for Stack cardholders….

Time to Eject

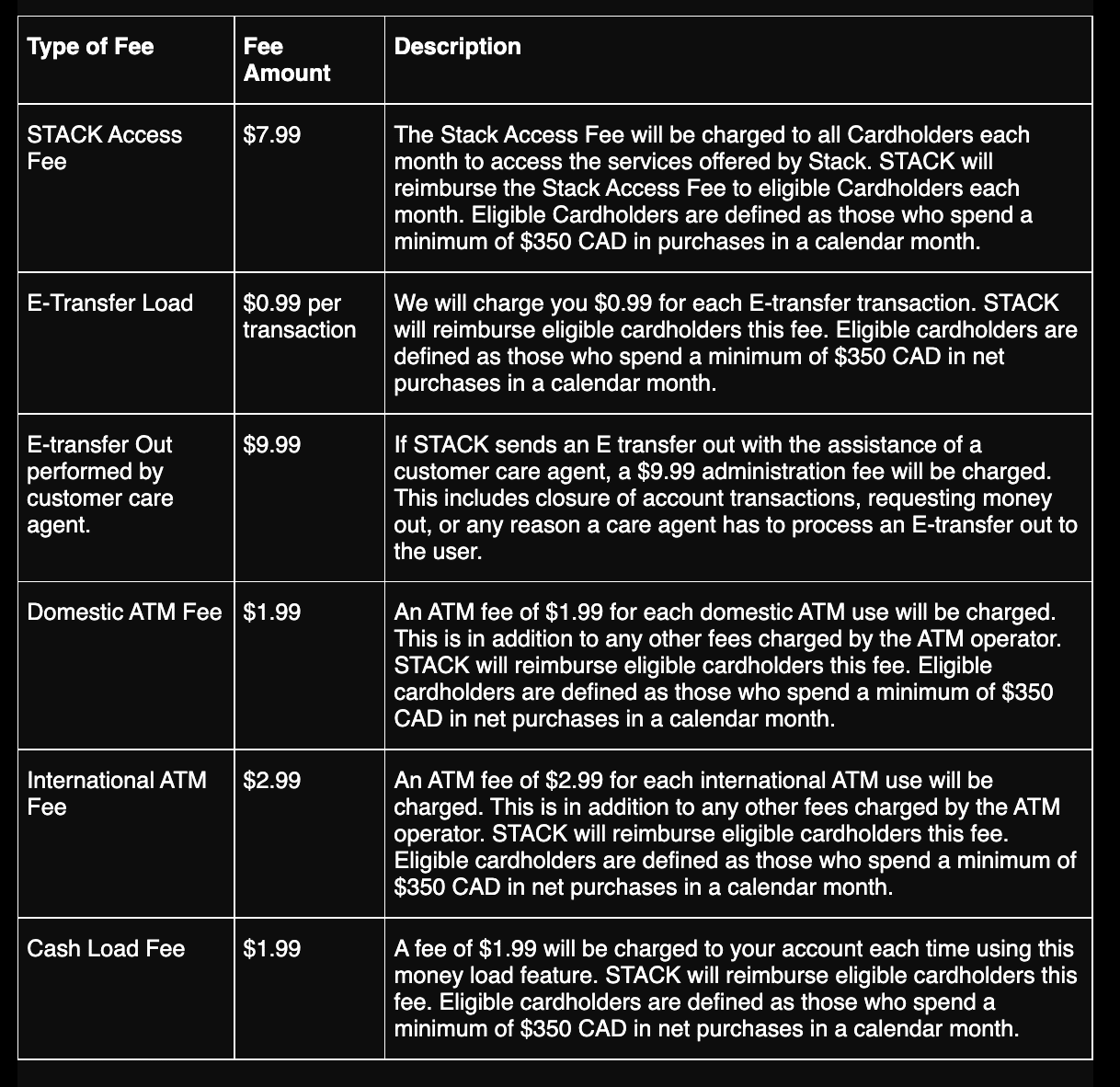

As of December 1, 2022, there are a series of arbitrary fees that Stack users will be subject to, and boy do these look almost exactly like the banking fees the card was specifically designed to disrupt!

(If you applied for Stack between October 1 and November 30, 2022, the new fees will apply as of January 1, 2023.)

As we covered back in February, Stack places a huge amount of its brand cachet on no-fee ATM withdrawals. With these changes, that positive attribute is going to its grave, and domestic ATMs will cost $1.99 per transaction, with foreign ATMs requiring $2.99 in fees.

Previously, e-transfers were free. Now, they’re $0.99 per transaction. Similarly, there’s a monthly subscription fee of $7.99 for the “privilege” of continuing to use this product.

Most of the above fees can be waived if you have $350 in net purchases in month. This is a very key difference from banks, who want you to keep money deposited with them so they then have collateral to give out loans. On the other hand, prepaid products are consumption-based, and so want you to make purchase transactions.

It’s also a key difference: saving money is usually more helpful to a customer as this can then be accessed as any financial needs arise. Spending on Stack – which provides absolutely zero incentive – has no effect other than draining one’s resources.

Most insulting of all is the fact that an Interac e-transfer to close your account costs you $9.99.

This is very obviously a punitive cash grab designed to try and force customers to keep the card, or at least levy an exit tax on those who (rightfully) decry these changes as anti-consumer, and indeed destructive of the entire value proposition of prepaid products like Stack in the first place.

If there is any time for the money-savvy consumer to eject, it is now: there are a plethora of superior prepaid cards on the market.

A Teachable Moment?

When financial services companies introduce fees, or drastically modify their core brand in a sudden fashion such as this, it always raises the core question: why?

Why is Stack, which was once a well-liked brand offering genuine value to its members, going forward with a suite of new fees that they must have known would drive away customers? Why does it need to raise capital from its customer base in such a sudden and crude fashion?

I can only speculate, but I think the following happened: Stack started as a disruptive company. It followed the typical Silicon Valley playbook of trying to follow Steve Jobs’s exultation to “move fast and break things.” This it did with a good amount of investor money, and in doing so it decided to offer customers a great product that wasn’t sustainable without growth.

Eventually, the growth dried up, and in order to stop the hemorrhaging of money, Stack needed to raise some. It did so initially by introducing FX fees; when this proved insufficient, a radical restructuring of cardholder fees (which we are now seeing) was green-lit.

Now we are observing the real-time death of a once-respected fintech, as consumers reject the fees and leave Stack en-masse, which is likely to only hasten its financial woes and possible demise.

This is a teachable moment for the remaining survivors of the Canadian prepaid credit card space: don’t grow beyond what is sustainable, and don’t try to milk customers if you’ve posed for years as a fellow “little guy” trying to fight the banking system.

Conclusion

It’s a shame – but in some ways, not unexpected, to watch the Stack Prepaid Mastercard be reduced to this shadow of its former self. The fintech space, by the very nature of its work, is highly risky, not to mention cut-throat in competition.

However, Stack is choosing to not only double down on its previous devaluations, but to continue to squeeze customers because of its inability to expand. This is is not the fault of customers, this is the fault of bad strategy.

Until next time, vote with your wallet.

Kirin explores the world through the lens of miles and points, sharing insights on premium travel experiences.

First-year value

$336

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Comments

Create a free account or become a member to comment.