As I mentioned in my debut Air Miles post a few weeks ago, I’d consider Air Miles to be secondary to the major Canadians points programs like Amex MR, Aeroplan, or RBC Avion in terms of usefulness and versatility. Having said that, they’re still a currency that a huge number of Canadians collect, primarily because of how many easy opportunities there are to earn Air Miles through retail partners, bonus events, and credit card signup bonuses.

While Air Miles won’t be allowing you to sip champagne in fancy business class seats anytime soon, they can still be useful for saving you a good chunk of money on short-haul flights, mid-range hotel stays, and car rentals throughout the year. You can think of it as the “gravy” on top of your earnings in the more powerful points programs.

For more information on the general uses of Air Miles, check out my Guide to Air Miles. In this article, I wanted to take a look at the various Air Miles co-branded credit cards that exist on the market, and identify the best credit card options for Air Miles collectors to supercharge their balances and get more out of the program.

The BMO Air Miles World Elite MasterCard

The best Air Miles credit card on the market is the BMO Air Miles World Elite MasterCard, which offers 3,000 Air Miles (which I’d value at $450) as a signup bonus. Until October 31, 2019, when you apply for this card, you’ll receive:

1,000 Air Miles upon first purchase

2,000 Air Miles upon spending $3,000 in the first three months

Moreover, the annual fee of $120 is waived for the first year, further boosting the value of the signup offer.

However, besides the fact that this card has the highest welcome bonus out of any Air Miles-branded credit card, what really makes the card shine is its Air Miles-related perks and benefits, as well as its very strong travel insurance package.

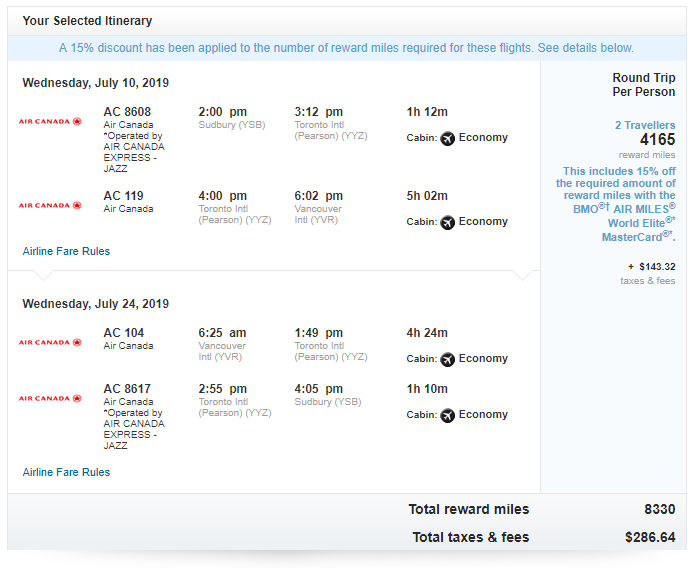

Simply by holding onto the card, you’ll receive a 15% discount when redeeming Air Miles for flights within North America. When we covered the best ways to use Air Miles for flights, most of the value to be found in the program lay in short- to medium-haul flights when the cash price is artificially expensive (such as last-minute flights or during peak travel periods).

The 15% discount gives you even more value when redeeming your Air Miles in this way, and can even make the difference between a run-of-the-mill redemption and one that gets you an impressive value for your Air Miles.

Moreover, the 3,000 Air Miles you’ll earn by signing up for this card will count towards Air Miles status, meaning that you’re already halfway to Air Miles Onyx status simply by opening the card. Air Miles status gets you access to an even wider pool of redemptions, helping you get even more from the program.

You’ll also note that the BMO Air Miles World Elite comes with complimentary membership in MasterCard LoungeKey, which is a similar program to Priority Pass with lounge locations in several airports around the world. You’ll get two annual complimentary lounge passes, which can be useful if you aren’t holding onto a credit card with unlimited lounge access at the moment (like the Amex Platinum or Amex Business Platinum).

Lastly, the BMO World Elite series of credit card is unparalleled in terms of the generosity of its travel insurance coverage, because you’ll be covered under the insurance as long as you charge the full or partial cost of the trip to the card.

It’s therefore a very useful card for those of us who travel frequently on points, since most other credit cards out there require you to charge the full cost of the trip to the card, meaning that they don’t cover award tickets.

With the BMO Air Miles World Elite MasterCard in hand, you can be sure to receive your usual top-of-the-line insurance perks, like emergency medical insurance, flight and baggage delay insurance, and trip cancellation & interruption protection, whenever you’re redeeming miles for travel (whether that’s Air Miles or any other rewards currency), as long as you charge the taxes and fees associated with the booking onto the card.

If you’re interested in this card, I recently partnered with BMO to promote the card with an affiliate link for Prince of Travel readers, and I’d be grateful if you considered using my affiliate link to apply. You can also head over to the card’s information page in the Credit Cards section for more information.

The Amex Air Miles Platinum Card

The other Air Miles credit card that I’d recommend for the purposes of boosting your Air Miles balance is the American Express Air Miles Platinum Card. You’ll earn 2,000 Air Miles upon spending $1,500 in the first three months, and while the annual fee of $65 is not waived, you can apply via Great Canadian Rebates for a $50 cash back.

This brings your net outlay down to $15, which is an excellent deal when you’re getting 2,000 Air Miles (which I’d value at $300) in return.

Compared to the BMO World Elite offering, the Amex Air Miles Platinum somewhat pales in comparison in terms of the additional perks and benefits on the card. The only advantage of the Amex Air Miles Platinum is that you can earn 500 Air Miles as a referral bonus for referring your friends and family members to the card, up to a maximum of 7,500 Air Miles every year.

Otherwise, it’s very much a card to apply for solely for the purpose of using the welcome bonus to boost your Air Miles balance.

What About the Other Cards?

There are several other Air Miles credit card products in the marketplace. But just like how the Air Miles program itself tends to flood the retail market with partnerships and yet leaves a lot to be desired in terms of actual value, so too are the co-branded credit cards quite numerous but rather uninspiring.

On the BMO side, they have a BMO Air Miles MasterCard without the World Elite label, as well as a BMO SPC Air Miles MasterCard geared towards students.

Both come with a signup bonus of 800 Air Miles (which I’d value at $120) with no annual fee, which isn’t really an offer that’s worth using a precious credit inquiry on.

If you don’t meet the income threshold on the World Elite card, you’d be better off skipping the BMO Air Miles card entirely (since you don’t get nearly the same level of ancillary benefits from the non-World Elite version) and focusing on other rewards programs.

Meanwhile, on the American Express side, there’s also an Air Miles Reserve Card and a regular no-frills Air Miles Card. While the signup bonus on the Air Miles Reserve of 3,000 Air Miles through a referral link (which I’d value at $450) is compelling enough, the card’s $299 annual fee wipes out a huge chunk of the value you’re getting. Meanwhile, the basic Air Miles Card only gives you 500 Air Miles (which I’d value at $75) as a signup bonus, so it probably shouldn’t even be in the conversation.

Lastly, keep in mind that among any of these cards (even the two lucrative ones discussed above), it’s not necessarily a good idea to use these cards for your daily regular spending, since there are more valuable points currencies (like Amex MR points or Aeroplan miles) that you could be earning.

Only if you have a potentially lucrative Air Miles redemption in mind, and need to earn just a handful more miles to top-up your balance, should you consider earning those Air Miles through credit card spend.

Like I said, Air Miles should be treated as merely a “nice to have” currency that can help you save some money along your travels, but nothing too groundbreaking that’ll dramatically change the way you travel. We’ve got other points programs for that.

Conclusion

Among the several Air Miles co-branded credit cards on the market, the BMO Air Miles World Elite MasterCard is by far the strongest product, thanks to its generous signup bonus, its wealth of benefits to help you get more out of the program, and its industry-leading travel insurance proposition.

Together with the Amex Air Miles Platinum, you should be able to rack up an easy couple thousand of Air Miles to cover any positioning flights, weekend trips, car rentals, or attraction tickets you’re planning on the horizon.