MythBusters: American Express US

Does anybody else remember the show Mythbusters? This was one of my favourite shows in the mid-00’s, when I was a tween-going-on-young-adult. Mostly because it involved blowing stuff up “for science”.

What really stuck with me, and the reason I’m mentioning it now, is the novel format of the show. The hosts would construct Rube Goldberg contraptions that they would detonate with high-end pyrotechnics. This was done to test the veracity of various urban myths and legends.

The final, empirical findings of their experiments would confirm one of three things. First, the myth could be “busted” and so the rigour of the scientific method had proven it false. Second, the myth could be “confirmed” – or established as being as close to fact as an old wives’ tale can be.

Last, and my personal favourite, was the verdict of “plausible”: they couldn’t state with certainty that the myth was true, but neither could they state that it was busted. I loved how the grey area preserved the rumour’s mystique.

And so, in honour of the show that defined a comfortable moment in my life, I’d like to bring their format to something that’s really at the top of the minds of a lot of us Canadian Miles & Points enthusiasts: American Express US cards.

Right now, we are seeing record high offers down south such as 100,000 US Membership Rewards points on the American Express US Platinum Card. If that’s not your cup of tea, you could try 125,000 Bonvoy points plus Platinum Elite status on the Marriott Bonvoy Brilliant instead.

Enticing, no? Well, to paraphrase Spiderman: “with great rewards comes great rumours of ability.” People have a lot of questions about how Canadians can get these cards and bonuses, and there’s all kinds of wild or misleading information floating around.

So let’s pull a Mythbusters. I’m going to list the weirdest assumptions about Amex US floating around our community. Then I’m going to establish, based on my personal experiences and data points from fellow enthusiasts, whether a myth is “busted” (false), “confirmed” (true), or “plausible” (your mileage may vary).

Before going down this rabbit hole, Ricky’s guide to getting US credit cards as a Canuck is pretty much mandatory. Without it, you’ll feel lost. Just read it, OK?!

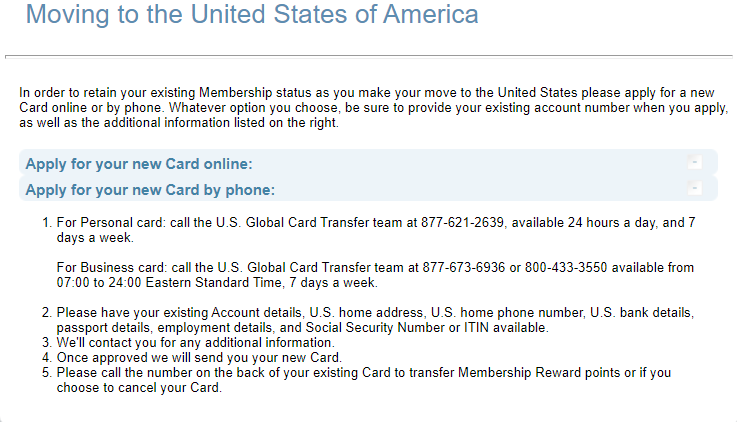

Also, remember the following phone numbers as you read this article. If it’s your first Amex US card, this is the line you need to call first if anything goes pear-shaped.

Myth #0: You Will Always Call into Global Transfer

This is the mother of all Amex US myths, but I consider it to be settled: you’re gonna have to call in.

I’ve heard exactly two data points of people being approved instantly off of Nova Credit or an online Global Transfer. It doesn’t mean it’s impossible, it’s just rare.

When you apply for Amex US cards, be ready to call the number above. There is a 99% chance you’ll have to complete your application via phone.

Verdict: Confirmed (for 99% of applicants).

Myth #1: You Can Attach an ITIN After Applying for an Amex US Card

Time for a little review: an Individual Taxpayer Identification Number (ITIN), as Ricky detailed, is something that a Canadian can get if they have taxable income in the States. It replaces a Social Security Number (SSN) for the purposes of getting credit cards.

The reason that this is relevant is because, just like in Canada, in order to build credit history, one needs to demonstrate responsible credit usage. This is monitored through three credit bureaus (Experian, TransUnion, and Equifax), who maintain a file attached to your ITIN or SSN.

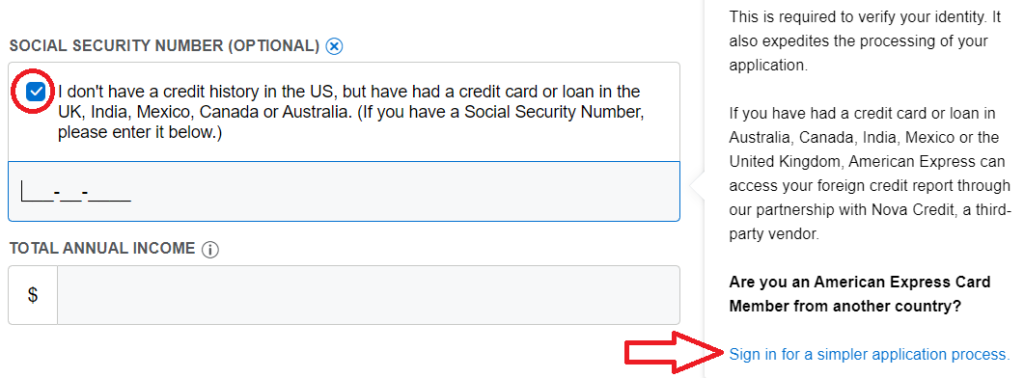

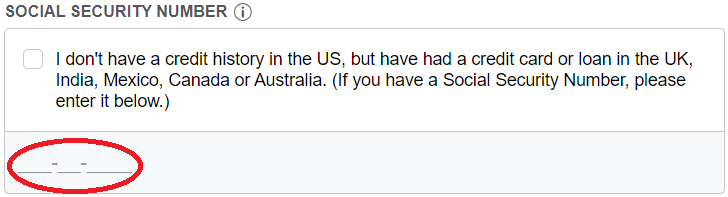

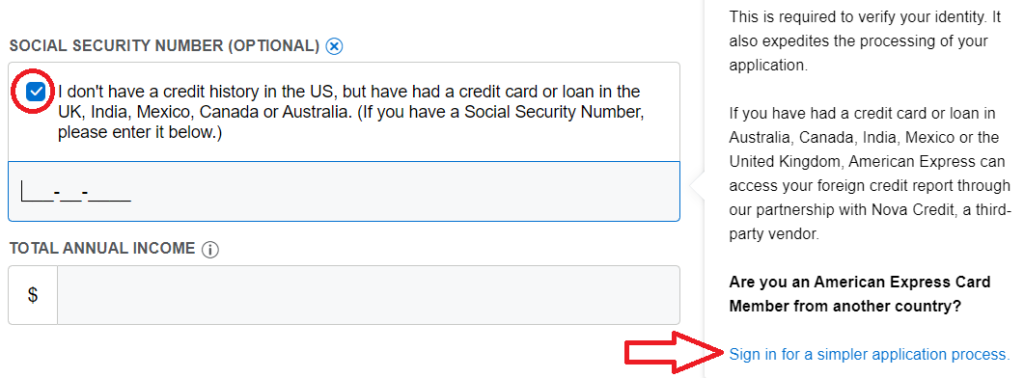

So what’s the holdup? Well, many Canadians follow the guide above and get an Amex US card via Nova Credit or Global Transfer. This involves, in some capacity, ticking the following box:

See that? It means you have no ITIN or SSN. So you might get the card, but it won’t be attached to anything. I want to stress the following:

You cannot, I repeat, cannot, under any circumstances whatsoever, period, between now and Skynet launching Judgement Day on all of us, retroactively attach an ITIN to an Amex US card that you’ve already been approved for, end of story.

This means your first Amex US card, if granted without an ITIN, builds credit history with American Express but not the bureaus. You cannot add an ITIN to this card. Won’t happen.

What you can do after getting your ITIN is apply for a second US Amex card. Simply attach your ITIN in the SSN box on this application.

In fact, this is the simplest way to allow you to construct a US credit history, as after this second application, your new (second) card will be attached to your ITIN, as will the credit history from your old (first) card. These will now be used to calculate your available credit, utilization, etc.

Verdict: Busted.

Myth #2: You Can Have Your New Amex US Card Shipped Directly to Canada

For obvious reasons, this is one of the most abounding questions for new Canadians getting into the US credit card game. There’s many people who think you can call Amex US Customer Service at +1 (800)-528-4800 and ask them to nicely forward your new card to you up North.

Bad news: you cannot, ever, no matter how many times you hang up, ever get Amex USA to budge on doing this for your first card. This is because they want to ensure your US address is legitimate. Going full Karen won’t save you, either.

Good news: once you’ve had your first card delivered to your address, gotten it in your hands, and kept your account in good standing a little while, you’re gold. Subsequent requests to have cards forwarded to your igloo in the Yukon will be granted via two-day FedEx.

Verdict: Confirmed.

Myth #3: You Don’t Need a US Bank Statement to Confirm US Address

OK, let’s be real here: Amex US has gone through lots of crackdowns on people gaming them for welcome bonuses. People engaged in egregious points manufacturing were even charged in federal court.

Basically, American Express US doesn’t muck about. So take what I’m about to say with a grain of salt, as it’s pretty clear they will want to verify your US address.

The way in which they will do this is by verifying the address on your application lines up with the address listed on a document that proves your address, such as a utility bill.

The best thing for you to provide is a bank statement with your US address listed. This should be from the same US bank account you opened after reading Ricky’s advice on getting into the US credit card game.

According to some mixed data points, there have been cases of people being approved without having to provide a bank statement or proof of address. These are scattered and inconsistent. Prepare for the worst, hope for the best.

Always apply for US American Express cards with some kind of proof of US address, just to be safe. If you don’t, you have to deal with the annoyance of the procedures detailed in the next myth….

Verdict: Plausible (but not recommended).

Myth #4: If You “Fail” a Three-Way Call, You Can’t Get a Reconsideration

This is the tandem twin of the previous myth.

One of the most common ways that you will have to verify your address is via a three-party call. American Express US will call you and your bank, and your bank will verify the address they have on file.

If you’ve updated your address at your US bank, and a bank rep picks up and confirms your address to Amex, you should be good to go. However, many hobbyists have reported their bank not responding to the call, or providing incorrect information to Amex.

This unfortunately results in the call being deemed a failure and the applicant being obligated to provide proof of US residency within 30 days.

Usually uploading a bank statement is good enough, but some applicants were told confusing information by customer service representatives, such as that they couldn’t get a reconsideration call, or that a bank statement wouldn’t be considered proof of address.

Don’t panic. Do the following:

Push for a second reconsideration call: I’ve talked to a few people who even got a second three-party call the same day and opened their new card successfully.

If that doesn’t work, wait to be given 30 days to upload proof of address. Then just upload your bank statement, or maybe find a way to bill something to that address.

If you’re told that a bank statement doesn’t qualify, hang up and call again and someone speaking sense will pick up eventually. They’ll let you do either a three-party call or use a bank statement. And if they don’t, find a way to get a utility bill.

The road to US credit card-dom does not end here unless you let it.

Verdict: Busted.

Myth #5: You Must Have an ITIN to Hold Multiple American Express US Cards

Before I answer this question, I want to ask you a hypothetical: Do you have a favourite restaurant or store? Somewhere you’re a regular, and have a good relationship with the staff and owner, as well as buy a lot of stuff there?

Can you remember the last time such a place refused to sell you one of their products?

I’m betting the answer is no.

Amex US is the same way when it comes to applications. They like new customers, and due to interchange fees, they like when you use their products. You do not need an ITIN to get approved for multiple US Amex cards.

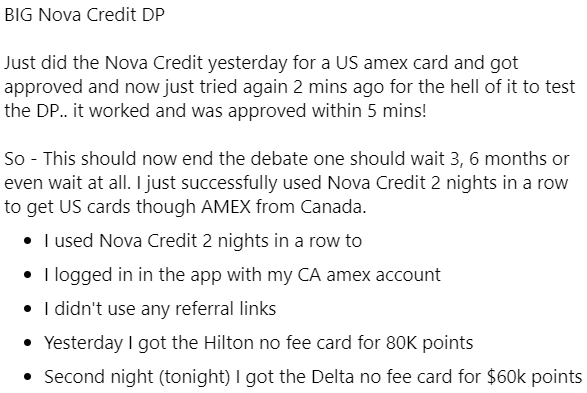

In fact, there are even confirmable data points of people getting approved for multiple American Express US cards through Nova Credit in a very short period of time, no ITIN needed, such as the following from the Prince of Travel Elites Facebook group:

You will, however, need an ITIN if you ever want to play the rest of the US credit card field.

Verdict: Busted.

Myth #6: Amex Has a 2/90 Rule for Multiple Applications

Whilst in Canada, there have been data points of enthusiasts getting lucky and being approved for multiple cards (both credit cards and charge cards) in a short time, in America it’s a bit different.

Down south, you have to follow what’s known as the “2/90 Rule”. You can see from Ricky’s counterpart (and possible doppelganger) Sebastian from Ask Sebby that this means you can only get approved for two credit cards within 90 days.

You can get approved for more products within that timeframe: so long as only two are credit cards, the others must be charge cards. Business cards do count against this limit.

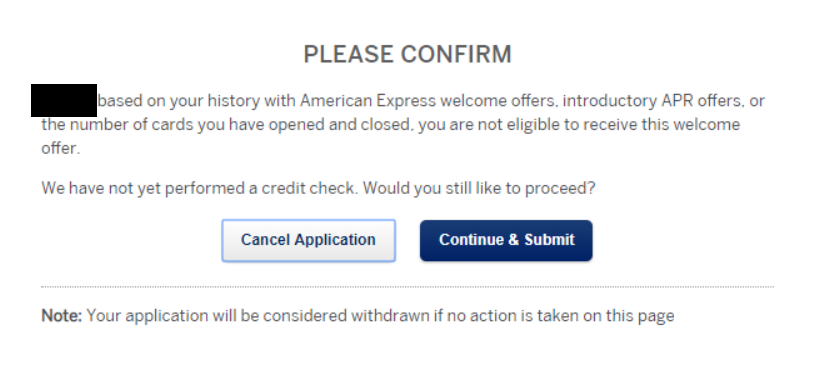

By the way, even if you’re under the 2/90 Rule and are eligible to be approved for a credit card, it doesn’t mean you’ll be immune to the “Pop-up of Death” (which, by the way, would be a great name for a garage band):

(I find the best way to get rid of this is to put a US$200+ spend on all my cards in the same statement period.)

Verdict: Confirmed (for credit cards).

Myth #7: Amex US Offers a Virtual Card Upon Approval for Instant Use

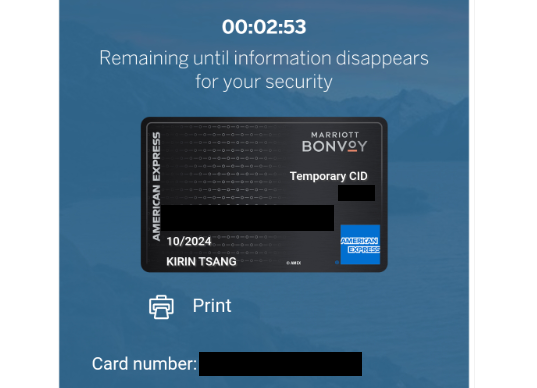

Much like Myth #2, I have good news here for you. Amex US does grant virtual credit cards.

Exactly like myth #2, this is only available after you’ve built a bit of a history with Amex. I didn’t get my instant-use virtual card until I had been approved for my third Amex US card, the Bonvoy Brilliant.

Anyone saying that you can do this on your first card is mistaken, or has existing US card history and so their situation is not the same as yours.

If you’re eligible for this, then when you apply, a popup box will give you the option to select an instant e-card. Then you’ll receive a virtual card number and a four-digit security code with a countdown timer. It’ll look like this:

Copy the info and you’re off to the races! Heck, it even works with PayPal and mobile wallets.

Verdict: Confirmed.

Myth #8: You Can Use Referrals Without an ITIN

Good news! Unlike half the things on this list, you don’t need an ITIN for this, nor do you even need a history with US Amex.

Using your friends’ referral links to apply as part of an Amex Global Transfer is completely possible. I think the reason there’s some doubt about this is that, if you sign in to your Amex Canada account during the application process for an Amex referral offer, you can bust the system.

If you tick the “I don’t have an SSN” box and then choose to “sign in for a simpler application process”…

…you might get the following error message.

Fortunately, you can avoid this issue with referral links by going through the Nova Credit service, which will pull your Canadian credit file directly instead of using your history with Amex Canada (assuming you’ve signed up with Nova and approved them to do so).

Simply apply normally and tick off the “I don’t have an SSN” box, but do not log-in. Once you hit Submit, you’ll be redirected to Nova Credit, who will generate a credit report for Amex US to say yay or nay to.

If it’s your first Amex US card, refer to Myth #0, you’re going to call in. If not, and you have a history with Amex US, I’ve been told data points that this simply goes through successfully.

An added bonus of this is that you can use this to access the infamous Amex US incognito offers by browsing to the American Express website in incognito mode, finding the “secret offer” you’re interested in, and applying via Nova Credit. Really handy for your first card!

Verdict: Confirmed.

Myth #9: Amex US Scrutinizes Business Applications More Heavily

No. They don’t. You can apply for the 100,000 Bonvoy points on the Bonvoy Business with little hassle.

As usual, just don’t commit fraud or make claims you can’t backup. American Express isn’t dumb, they know your Amazon e-books that are thinly-veiled Outlander ripoffs aren’t netting you $40,000 per quarter.

Verdict: Busted.

Myth #10: Mail Forwarders Get Flagged by Amex

The genesis of this myth is that American Express, sooner or later, gets wise to the fact that many customers are using mail forwarders.

Of course, many such forwarders, such as 24/7 Parcel, wish to serve their customers and help them break into the American credit card market as part of their Miles & Points dream.

![]()

Sadly, there’s been data points that some enthusiasts’ US addresses have been rejected from the application process entirely for being mail forwarders. Others have had their credit cards tossed in the trash by unscrupulous forwarders.

Still others have been approved, but had to go through further address verification steps (similar to those in Myths #3 and #4), or even had Amex refuse to ship credit cards to their chosen residence.

Of particular concern is that the location for 24/7 Parcel may have been flagged for some customers’ accounts, with those customers no longer able to receive new credit cards until they had “moved” their bank statements/proof of address to the new address provided. On the upside, 24/7 actively tried to improve the situation for all affected.

It does seem like the trend may be towards more flagging, but we have no official confirmation on this, as the majority of forwarders are still functioning well.

My recommendation: find friends in the US to include in your Miles & Points hobby and form mutually beneficial relationships with them. Failing that, if you’ve been flagged, hedge your bets by digging deeper for a more tacit mail forwarder than the openly-advertised 24/7 Parcel.

Verdict: Plausible (and not in a good way).

Conclusion

It’s evident that American Express US signup bonuses are at an all-time high whilst Canadian bonuses suffer. There’s been no better time in the memory of anyone in the community to try and get into the US credit card game.

At the same time, be wary of myths and urban legends that surround this. The effects of “broken telephone” only get amplified over the internet and, of course, many of us aren’t in situations where we can regularly meet up with other enthusiasts to compare tips and tricks.

That being said, I hope that you enjoyed journeying down the river of my memory. As time goes on and data points trickle in, I’ll be sure to update this list so that the community can remain aware of the “do’s-and-don’t-poke-the-bears” of American Express US.

If you enjoyed this style, I’d really like to continue paying homage to this classic show by continuing to find myths in the Miles & Points community, research them, and bust (or confirm!) them.

Until next time, may your options ever be plausible.

Kirin explores the world through the lens of miles and points, sharing insights on premium travel experiences.

First-year value

$1,581

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge