In the United States, American Express issues two personal and one business Marriott Bonvoy co-branded credit card, each with its own unique set of perks and benefits.

As it stands, there are some excellent welcome offers available on all three cards, which makes it a great time to add one (or more) to your wallet.

Let’s take stock of the currently available welcome offers on the trio of cards so you can assess if now’s a great time to add one to your wallet.

In This Post

- Marriott Bonvoy Brilliant American Express Card: 185,000 Bonvoy Points

- Marriott Bonvoy Bevy American Express Card: 155,000 Bonvoy Points

- Marriott Bonvoy Business American Express Card: Three Free Night Awards

- Conclusion

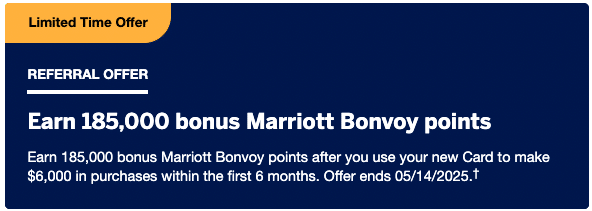

Marriott Bonvoy Brilliant American Express Card: 185,000 Bonvoy Points

The Marriott Bonvoy Brilliant American Express Card, which is a premium personal co-branded credit card, is currently offering 185,000 Bonvoy points upon spending $6,000 (all figures in USD) in the first six months as a cardholder.

We value Marriott Bonvoy points at 0.6 cents per point, and using this, we’d estimate the value of the current welcome offer at $1,100. This is an excellent offer on the card, on par with the historical highs.

Aside from the juicy welcome offer, the Marriott Bonvoy Brilliant® American Express® Card offers the following earning rates:

- 6 Marriott Bonvoy points per dollar spent at Marriott hotels†

- 3 Marriott Bonvoy points per dollar spent at restaurants worldwide and flights booked directly with airlines†

- 2 Marriott Bonvoy points per dollar spent on all other eligible purchases†

The card comes with an annual fee of $650, which can certainly be justified by the welcome offer and with the card’s ongoing slew of benefits.

By just being a cardholder, you’ll enjoy Marriott Bonvoy Platinum Elite status and all the perks that come along with it, including free breakfast, early check-in, late check-out, upgrades, and more.

Each year, you’ll also get a Free Night Award worth 85,000 points, which you can then top up with 15,000 points for a higher-priced stay. You can then earn another Free Night Award worth 85,000 points upon spending $60,000 in a calendar year, and then selecting it as your Earned Choice Award.

If you tend to dine out often, the card also comes with monthly $25 dining credits, which can be used at restaurants worldwide.

The Marriott Bonvoy Brilliant® American Express® Card also rewards you with a complimentary Priority Pass Select membership with unlimited lounge access for yourself and two guests.†

When you put the above perks together, you’ll see why the Marriott Bonvoy Brilliant® American Express® Card can be such a powerful credit card to hold onto for the long term, year after year.

This offer is set to expire on May 14, 2025.

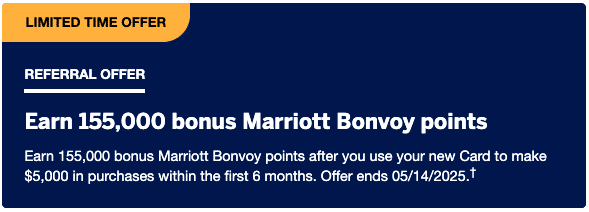

Marriott Bonvoy Bevy American Express Card: 155,000 Bonvoy Points

The Marriott Bonvoy Bevy American Express Card, which is a bit of a step down from the Marriott Bonvoy Brilliant American Express Card in terms of ongoing perks and benefits, is offering an excellent welcome bonus of 155,000 points.

You’ll receive the welcome offer upon spending $5,000 in the first six months as a cardholder.

With our valuation of Bonvoy points at 0.6 cents per point, we’d value the current welcome offer at $930. This is an outstanding deal for the card, and if you’re eligible for the welcome bonus, there’s no better time than now to apply.

In terms of earning rates, the Marriott Bonvoy Bevy American Express Card offers the following:

- 6 Marriott Bonvoy points per dollar spent at Marriott hotels

- 4 Marriott Bonvoy points per dollar spent at US supermarkets (on up to $15,000 in combined purchases at restaurants and US supermarkets per calendar year, then 2x points)

- 2 Marriott Bonvoy points per dollar spent on all other eligible purchases

The Marriott Bonvoy Bevy American Express Card has a lower annual fee than the Marriott Bonvoy Brilliant American Express Card coming in at $250 – though it also comes with fewer meaningful perks as a result.

That said, if you’re able to spend $15,000 on the card in a calendar year, you’ll earn a Free Night Award worth up to 50,000 points. That works out to be an average spend of $1,250 per month in spend, which isn’t an unreasonable amount; however, your day-to-day spending may be better targeted elsewhere, depending on your travel goals.

Recently, Amex put in “family language” restrictions on the Marriott Bonvoy Bevy American Express Card, and this means that you may not be eligible for a welcome offer on the Marriott Bonvoy Bevy American Express Card if you’ve ever held the Marriott Bonvoy Brilliant American Express Card.

Therefore, if you have your eyes set on the Marriott Bonvoy Brilliant® American Express® Card as a long-term keeper card, your best bet may be to consider for the Marriott Bonvoy Bevy™ American Express® Card first, and then work your way up to the Marriott Bonvoy Brilliant® American Express® Card further down the line.

This offer is set to expire on May 14, 2025.

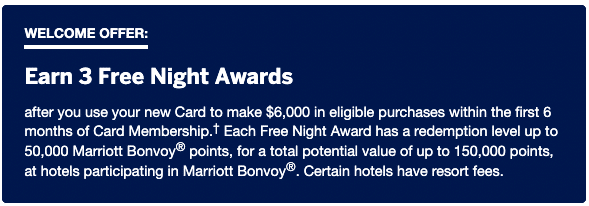

Marriott Bonvoy Business American Express Card: Three Free Night Awards

The Marriott Bonvoy Business American Express Card, which is the sole Marriott co-branded credit card geared towards small business owners in the US, is currently offering three Free Night Awards worth 50,000 points apiece as its welcome bonus.

To unlock the offer, you’ll need to make $6,000 in eligible purchases on the card within the first six months as a cardholder, which averages out to $1,000 per month.

In terms of regular earning rates, the Marriott Bonvoy Business American Express Card offers the following:

- 6 Marriott Bonvoy points per dollar spent at Marriott hotels

- 4 Marriott Bonvoy points per dollar spent at restaurants worldwide, US gas stations, and on wireless telephone purchases directly from the US service providers and on US purchases for shipping.

- 2 Marriott Bonvoy points per dollar spent on everything else

Compared to the Marriott Bonvoy Brilliant American Express Card, which comes with numerous perks for its $650 annual fees, the Marriott Bonvoy Business American Express Card has a much lower annual fee of $125, and its accompanying perks and benefits are also less robust.

However, you’ll get an anniversary Free Night Award worth up to 35,000 Bonvoy points, which can be topped up with up to 15,000 points for a redemption.

After earning this solid welcome offer, you can keep the card around as a long-term keeper card due to its relatively low annual fee and the annual Free Night Award.

With this card, you’ll also earn 15 elite qualifying nights per year, which can be stacked with another 15 nights from the Marriott Bonvoy Bevy American Express Card† or 25 from the Marriott Bonvoy Brilliant American Express Card.

There’s no listed expiration date for this offer.

Conclusion

The Marriott Bonvoy Brilliant American Express Card and the Marriott Bonvoy Bevy American Express Card currently have welcome offers of 185,000 and 155,000 Bonvoy points, respectively. These are outstanding offers, so be sure to capitalize on them if you’re eligible.

Meanwhile, the welcome offer on the Marriott Bonvoy Business® Credit Card is three Free Night Awards worth 50,000 points each.

If you’re in need of a boost to your Marriott Bonvoy balance, be sure to consider the aforementioned offers and apply for the card that best suits your needs by the listed expiry date.

The link to the Bonvoy Brilliant card seems to be down.

Thanks for that! It has been fixed.

If I apply for Bevy first then apply for Brilliant after a few weeks, will I get both SUB?

I already have the Bonvoy Brilliant and would now like to add the Bonvoy Business so I can get 40 elite nights, what’s the process to get the biz card? As a Canadian you can’t apply online as it requires a SSN

AMEX keeps popping up with a window saying you’re not eligible for the sign up bonuses now. I’ve tried building over 1 year’s credit history and spending a few hundred each month on the card, but it doesn’t seem like these sign up bonuses are eligible anymore.

If you already had personal SPG card 3 years back and cancelled (march 2020), does these personal and business bonvoy cards are eligibile for the full SUB?

i am aware that canadian side 2 years cool off period but US cards seems to have lifetime enforcement. But not sure if any one had SPG cobranded card and cancelled and go sub again on bonvoy cobranded..

appreciate any DP

Nova Credit is now requiring an ITIN for Canadian customers. They sent everyone an email about the change.