Maximizing Your First Two Years of US Credit Cards

If I remember correctly, getting US credit cards only really started becoming a popular part of the Miles & Points strategy for Canadians about three or four years ago, when it became apparent that all the tools needed to establish US credit history – a US bank account, a US address, and an ITIN if you didn’t have an SSN – were all easily within reach north of the border.

In that time, I’ve witnessed countless individuals successfully embarking on the US credit card journey, so in this post I wanted to share a rough outline of the optimal US credit card strategy during your first two years, taking into account the many significant differences from the Canadian side and also the challenges associated with having a brand-new credit file.

I’ve written in detail in the past about how my own US credit card journey played out, so feel free to go back and read up on that as well. The strategies outlined here are in part informed by my own experiences, but also draw upon things that I wish I had done differently when I first started out.

In This Post

- Months 0–6: Getting Started

- Month 6–12: Focusing on Amex US

- Months 12–18: Playing the Chase 5/24 Game

- Month 18 Onwards: Finishing Off Amex US + Other Issuers

- Conclusion

Months 0–6: Getting Started

Getting US credit cards for Canadians involves a fair bit of upfront cost in terms of the time and effort involved in getting everything set up. At the bare minimum, you’ll need a US address (either a family or friend’s place or a mail forwarding service), a US bank account (the cross-border banking arm of your favourite Big 5 bank should do), and a Canadian-issued Amex card that’s been open for at least three months and in good standing.

These key ingredients will allow you to initiate an Amex Global Transfer to your first Amex US credit card, which will allow you to begin building your US credit history. Even if you don’t have an SSN or ITIN at the moment, your credit file will simply include your name, date of birth, and address.

Indeed, I know many individuals find the process of applying for an ITIN somewhat intimidating, so the Global Transfer route is a relatively easy way to get started with only a few steps involved.

You can complete the Global Transfer online by launching the Amex US credit card application and then selecting the “I’m a cardholder in a different country” option, which will allow the Nova Credit service to transmit your Canadian credit information to Amex US for assessment. Often, a quick follow-up phone call may be required to verify your identity before you get approved for the card.

Which Amex US credit card should you choose for your first one? I’ve addressed that question in this post, but long story short, you would ideally start with a credit card that has no annual fee, or at least a card that you’re almost certain you’ll want to keep around forever in the long run, because you don’t ever want to cancel your oldest credit card in order to maintain the longevity of your Average Age of Accounts (AAoA).

The Amex US EveryDay Card is a solid no-fee choice for instantly getting into the US Membership Rewards game, which would allow you to start converting your MR points between the US and Canada and taking advantage of the much wider range of transfer partners south of the border.

Meanwhile, the Amex US Hilton Honors Card, also with no annual fee, gives you an instant pathway into the Hilton Honors program and allows you to diversify your hotel rewards game beyond being limited to Marriott Bonvoy, as we are in Canada.

Both of the above options have their merits, so it’s up to you which one you prefer. While you could also theoretically go for a higher-value Amex US card as your first (like the Amex US Gold Card or the Amex US Hilton Aspire Card) I’d still generally recommend starting with a no-fee card, because you never know how much you’ll continue to find value out of a card with a higher annual fee many years down the road.

Month 6–12: Focusing on Amex US

There are mixed data points as to how long you should wait before applying for your second Amex US card. Note that an SSN/ITIN still isn’t technically required for this, since you can apply on the basis of your existing relationship with Amex US, but it may help to smoothen the process if you happen to have obtained one already.

Some people report success applying for their second Amex US after three months, others after six. Some were able to repeat the same process of doing a Global Transfer from a Canadian card online using Nova Credit, while others (including myself, way back when) had to call in to submit the application in the absence of an SSN/ITIN for the online application.

Either way, there’s a little conundrum to think about when it comes time to obtain your second Amex US card. Specifically:

-

The first few years of US credit card history need to be planned out with Chase’s “5/24” rule in mind, in which Chase won’t approve you for any credit cards if you’ve opened more than five cards over the past 24 months

-

On the other hand, Chase also won’t approve applicants with too new of a credit history; they typically like to see at least one year’s worth of credit history with reliable payments over multiple tradelines

There is a need to strike a balance here: you don’t want to load up on too many Amex US personal cards, because that’ll cut into your 5/24 allowance when you apply for Chase cards. On the other hand, if you keep a very light credit file with only a single Amex US card, then Chase may well reject your applications when the time comes.

In my experience, getting two Amex US personal cards is a happy middle ground: you’ll be able to sign up for three of Chase’s premium products while remaining within 5/24, and also gives you a fair shot at being approved for your first Chase card too.

Notice that I mentioned limiting yourself to two Amex US personal cards, and that’s because of the very convenient fact that Amex US business credit cards do not get reported to the credit bureaus, and therefore won’t count towards your 5/24 allowance!

Therefore, in the first year of US credit history, you can load up on as many Amex US business cards as you get approved for (and they’re generally pretty lenient in granting these approvals) – the US Bonvoy Business, the US Hilton Business, and the US Business Platinum are all potentially worthy candidates.

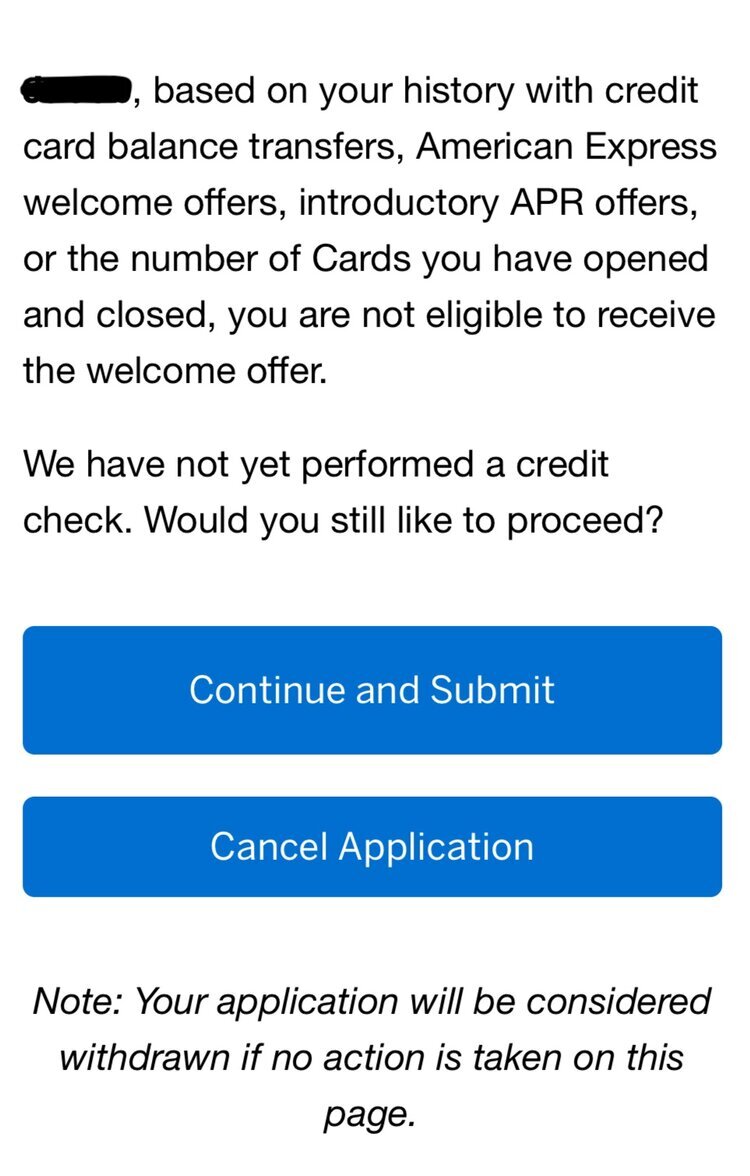

Finally, remember that once you’ve gotten an Amex US card, you should be putting some spending on it on a regular basis, even if it’s only a hundred dollars per month. That’s because Amex US has systems in place to detect unprofitable behaviour (such as signing up for a card, getting the bonus, and then never using it again), and will hit you with the “dreaded pop-up” denying you the signup bonus on future applications if the system detects that you fall into this category.

Months 12–18: Playing the Chase 5/24 Game

By the time you’ve established about one year’s worth of credit history, you should be eligible to be considered for Chase’s premium credit cards. That’s not to say that they’ll definitely approve you: they may still decline applications on the basis of too new a credit history, and you may have to ask for a reconsideration quite a few times (like I did back in the day) in order to push for an approval.

Opening a Chase bank account, which can be done on any visit to the United States with only a Canadian passport in hand, may help to build your relationship with the bank and fast-track your credit card approval by a few months. It also helps that Chase regularly offers bank account signup bonuses of several hundred US dollars, so a trip across the border to open a bank account could easily pay for itself.

Before you apply for a Chase credit card, though, you’ll need to seek out the last piece of the puzzle – the SSN or ITIN – if you haven’t done so already. If you’re only obtaining an ITIN after you’ve already gotten started on the Amex US side, there’s no way to ask Amex to “attach” your ITIN to your credit file; instead, what you must do is simply include your ITIN on your next US credit card application, and it should automatically get attached by the credit bureaus.

If you’ve obtained two Amex US personal cards thus far, that leaves you with three open slots for Chase cards before you’re running up against 5/24. So, which three Chase products should you apply for?

My personal picks here would be the Chase Sapphire Preferred, the Chase Ink Preferred, and then one of the hotel cards – either the Chase Hyatt Visa or the Chase IHG MasterCard.

You’re only allowed one card within the Sapphire family, and with the Chase Sapphire Reserve increasing its annual fee to US$550 recently, I don’t see enough value in that card, especially for Canadians who might not be able to use up all the perks, to justify choosing the Reserve over the Preferred’s much more reasonable US$95 annual fee (not to mention a higher signup bonus of 60,000 Chase UR points vs. 50,000).

The Ink Preferred is mainly attractive for its outstanding signup bonus of 80,000 Chase UR points, although Chase is generally stricter on business card approvals than Amex US, so you may need to be prepared to jump through a few hoops for this one, especially if you’re applying as a sole proprietor. I personally had applied three separate times for the Ink, and eventually only got it approved upon visiting a branch and speaking with a business representative.

Choosing between the Hyatt and IHG hotel cards is a matter of personal preference. Hyatt hotels are generally of higher quality, and you’ll typically enjoy better treatment than an IHG hotel if you book via Hyatt Privé. Meanwhile, IHG has a much larger global footprint of hotels, and the current signup bonus of 140,000 IHG Rewards points is very impressive indeed.

I had personally chosen the Chase IHG MasterCard, although I do regret this decision somewhat, since I think I would find much greater enjoyment out of staying with Hyatt’s more luxurious portfolio of hotels compared to IHG. No matter which one you choose, though, both cards offer an annual free night certificate that makes it highly worthwhile to keep the card around for the long term.

Beyond these products, the United MileagePlus and Southwest credit cards are also widely discussed in US credit card circles, but I’m not sure how valuable they are for Canadians. You can transfer your Chase UR points to United anyway, and as a Canadian traveller I’ve rarely had a need to fly Southwest, and I’m not sure how eager I’d be to do so if I had the choice.

In addition to the 5/24 rule, keep in mind that Chase also has what’s known as the “2/30” rule, where you can only apply for two of their credit cards within a given 30-day period, so make sure to plan your applications out accordingly.

Month 18 Onwards: Finishing Off Amex US + Other Issuers

If you’ve followed the optimal plan thus far, you should find yourself with two Amex US personal cards, three Chase cards, and a handful of Amex US business cards.

You’re now “over 5/24”, meaning that you can either wait patiently without applying for more cards to go back under 5/24 and become eligible for more Chase cards, or simply apply away for all the other strong credit card offers on the US market.

In my view, the latter option is definitely more favourable, since there are quite a number of cards still to be obtained, and you can always slow down and wait to dip back under 5/24 at some point in the future if you wish.

At this point, the door is wide open for the remaining Amex US personal cards – as long as you’ve been putting regular spending on your existing Amex US cards, you shouldn’t have any problems with the “dreaded pop-up” by the time you apply for more of the personal products.

One thing to note here is that if you don’t plan on keeping an Amex US product beyond the first year, you should never actually cancel within the first year, since that has gotten many individuals in trouble for “gaming” in the past.

Instead, wait until the second year’s annual fee has posted, and then either cancel during the 13th month and ask for a refund on the annual fee, or downgrade the card to a no-fee Amex product and keep it around forever for the positive credit history contribution.

You’ll also be looking beyond Amex US and Chase at this point – for example, I was recently approved for the Citi Premier Card (which offers 60,000 ThankYou points after spending US$4,000 in the first three months, with a US$95 annual fee) after submitting an online application and then sending in a scanned copy of my ITIN. Other issuers, like Bank of America and its Alaska Airlines Visa Signature Card, are also fair game, but may require an in-branch visit to apply using an ITIN.

Conclusion

Unlike in Canada, where you can basically apply for any of the cards in the marketplace in whatever order you wish, the US credit card game requires a little bit more thought and planning in terms of the newcomer’s strategy, due in large part to the pesky Chase 5/24 rule.

During your first year, you’ll be working to build up your US credit history through Amex while also keeping an eye on your Chase 5/24 eligibility, and after you’ve knocked out a few of Chase’s cards in your second year, you’re free to go forth and conquer the remaining signup bonuses down in the land of opportunity.

First-year value

$336

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners