Chexy: Pay Rent, Bills, and Taxes with a Credit Card and Earn Points!

Once you’ve been introduced to the world of Miles & Points, you’ll likely begin looking for ways to earn credit card points on absolutely everything you spend money on.

In Canada, Chexy offers a digital platform that allows Canadians to charge rent, bill payments, and taxes to your credit card in exchange for a nominal fee.

As we’ll explore, Chexy is a key tool for savvy Miles & Points enthusiasts to pad their points balances by unlocking rewards on almost every expense that typically doesn’t allow credit card payments.

Chexy is our favourite Canadian platform for earning credit card rewards on rent, bill payments, and personal taxes.

What Is Chexy?

Chexy is Toronto-based startup that lets you pay your rent, bills, and taxes using a credit card (for a nominal fee).

Chexy not only makes payments more convenient, but also allows you to earn perks and rewards, and even build credit through the Chexy platform.

If you’ve been in the game for a while, you might notice that the concept is similar to RBC Ventures’s GetDigs, which was unfortunately shut down in late 2020. Chexy –which launched in 2022 – is here to stay, though, and it has big ambitions to grow in the rental and payments space.

How to Pay Rent, Bills, and Taxes Through Chexy

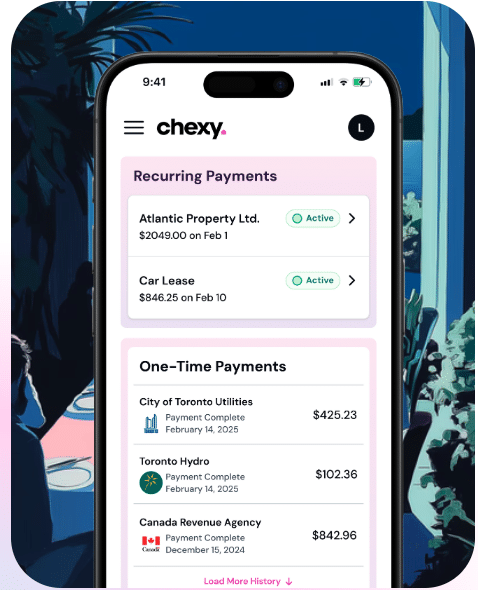

Chexy offers Canadians a user-friendly digital platform for paying rent, bills, and taxes using a credit card. You can set up your account and payments on the Chexy website.

By and large, the process for setting up payments for rent, bills, and taxes on the Chexy platform is the same.

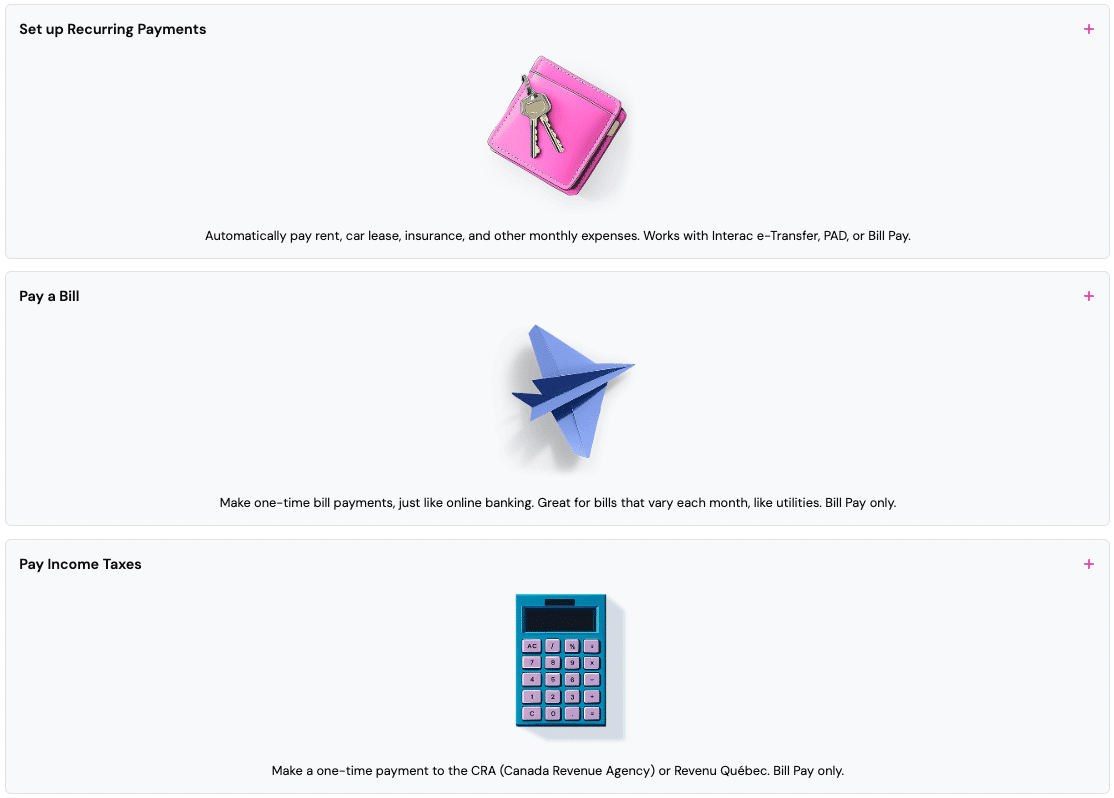

You’ll first need to create an account with Chexy, and then you can choose to set up recurring payments, pay one-time bills, or pay income taxes.

Under the recurring bills feature, you can set up automatic payments each month for rent, car lease payments, insurance payments, condo/strata fees, internet/cable bills, and more.

Under the bill payment feature, you can set up one-off payments to a host of payees, just as you would with online banking. This is a great option for payments with amounts that change, such as utility bills, phone bills, tuition, daycare/childcare, property taxes, and more.

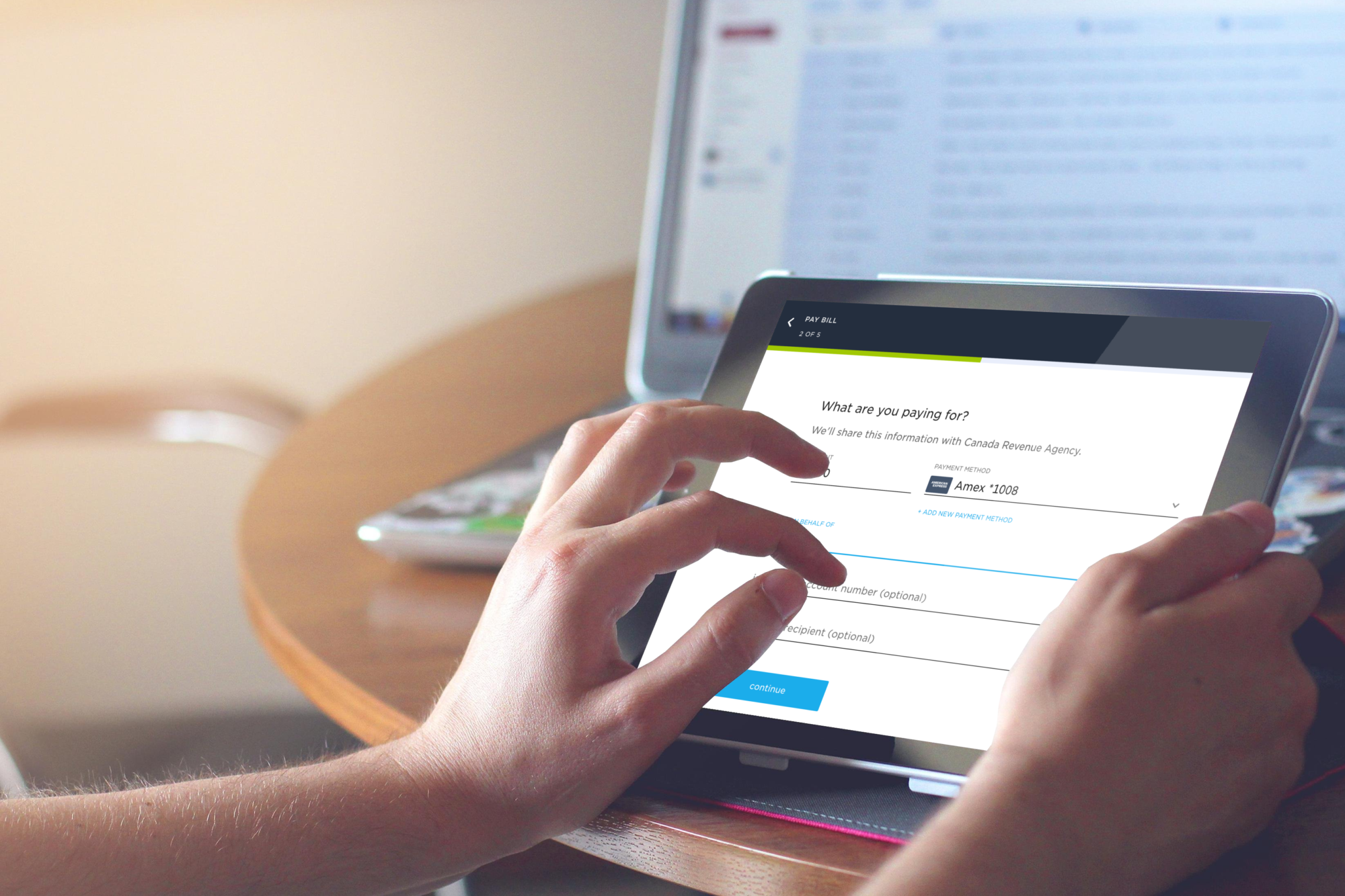

Under the pay income taxes feature, you can make one-time payments to the Canada Revenue Agency or Revenu Quebec.

Officially, Chexy has three products: Chexy Rent (for rent payments), Chexy Wallet (for recurring and one-time bill payments), and Chexy Tax (for tax payments).

Now Live: Pay Bills and Taxes with Chexy!

Read moreSetting Up Rent Payments

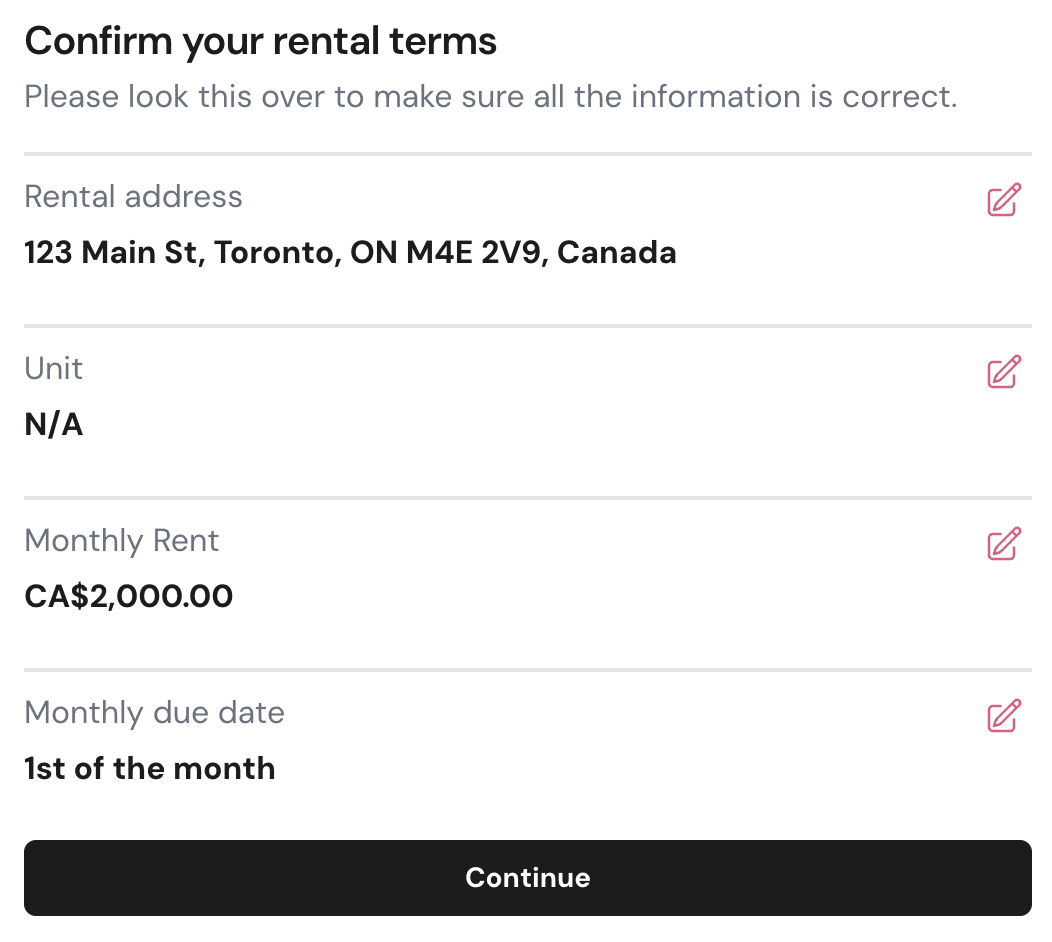

Let’s use the example of setting up a recurring rent payment on your account, while acknowledging that the process for setting up bill payments and tax payments through Chexy is largely similar.

To set up a recurring rent payment, you’d first need to enter your landlord and rental information, including your monthly rent and payment date. Payments can be made via Interac e-Transfer, pre-authorized debit, or Bill Pay, depending on your landlord.

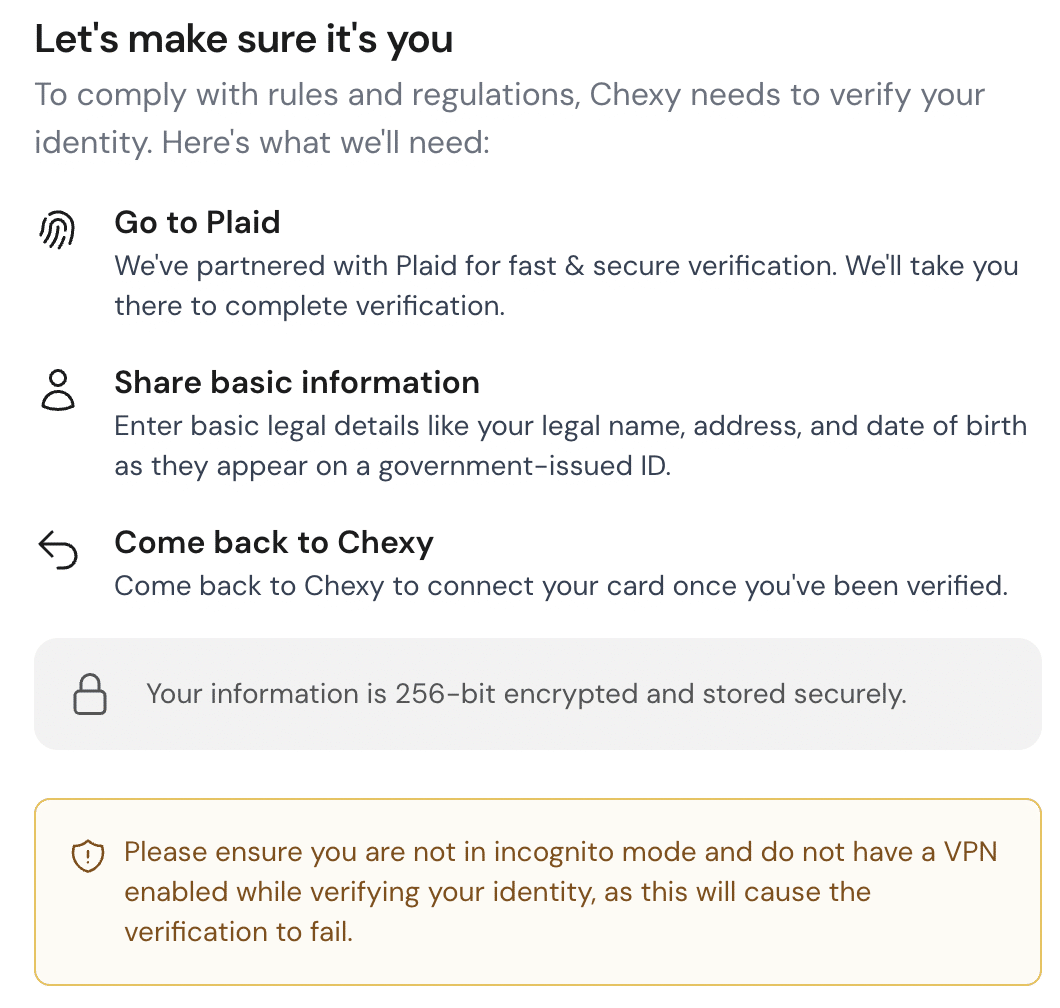

Then, as a verification measure, you’ll need to verify your identity by clicking through to Plaid, an identify verification service that Chexy partners with. The process takes just a few minutes, and you’ll be asked to provide some information and photo identification.

Once your identity has been verified, you’re ready to add your credit card to your account and start paying rent.

Setting up Bill Payments

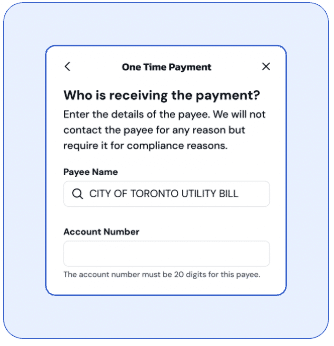

When it comes to setting up recurring or one-time bill payments, you can either manually enter in the payee information, or you can search for many common payees using the Bill Pay feature.

As you’re setting up your payment, simply search for your payee, select it from the list, and add your account number.

How Chexy Processes Your Payments

With rent, bill, and tax payments set up on your account, Chexy will charge your credit card three days before your indicated due date. Then, the funds are added to your Chexy Wallet, where they remain until it’s time for Chexy to issue the payment.

Then, on your payment’s due date, Chexy issues the funds to your payee by way of Interac e-Transfer, pre-authorized debit, or Bill Pay – whichever option you’ve chosen.

Many members of the Prince of Travel team use the service to pay rent, bills, and taxes, and we’re happy to report that the process works seamlessly.

Chexy’s Processing Fees

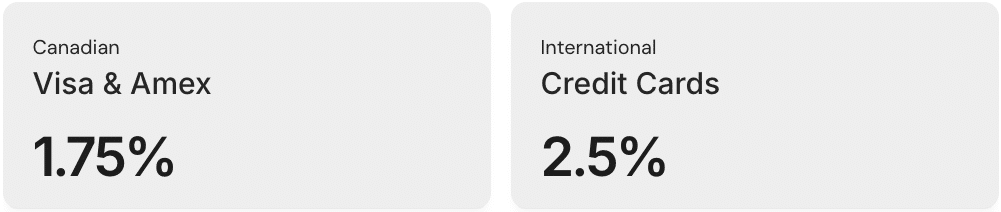

Importantly, Chexy charges a processing fee for each transaction, ranging from 1.75–2.5%.

Canadian-issued American Express and Visa cards are subject to a 1.75% fee, whereas international American Express, Mastercard, and Visa products are subject to a 2.5% processing fee. At this time, Canadian-issued Mastercard products aren’t accepted.

Of all the bill payment platforms in Canada, including PaySimply and Plastiq, Chexy has the lowest processing fees (for Canadian-issued cards). Plus, you can reduce your processing fees by referring others to the Chexy platform (as detailed below).

Chexy, Plastiq, PaySimply, and More: Earn Points by Paying Bills

Read moreBuild Your Credit with Chexy

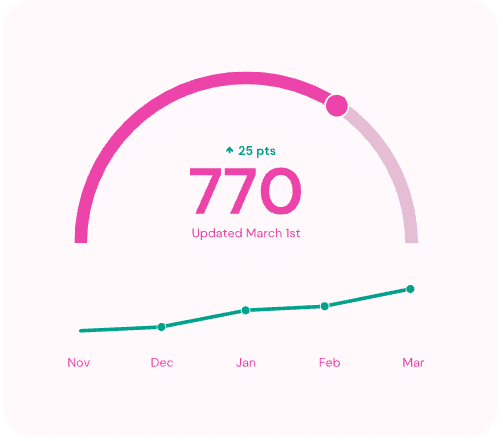

A free add-on available to Chexy members who pay rent using the platform is the Credit Builder, which helps to bolster your credit score by reporting on-time rent payments to Equifax.

Since your rent payments are automated, it won’t take long for your credit score to show positive signs of growth (assuming you’re paying off your credit card in full every month, too).

Plus, you’ll be able to show any future landlords a verified history of on-time rent payments, too.

Chexy’s Referral Program

Another perk of using Chexy is its refer-a-friend program. Upon signing up through a referral link, your friend gets $15 (CAD) and you also get $15 (CAD) in credits that you can use towards your next monthly rent payment.

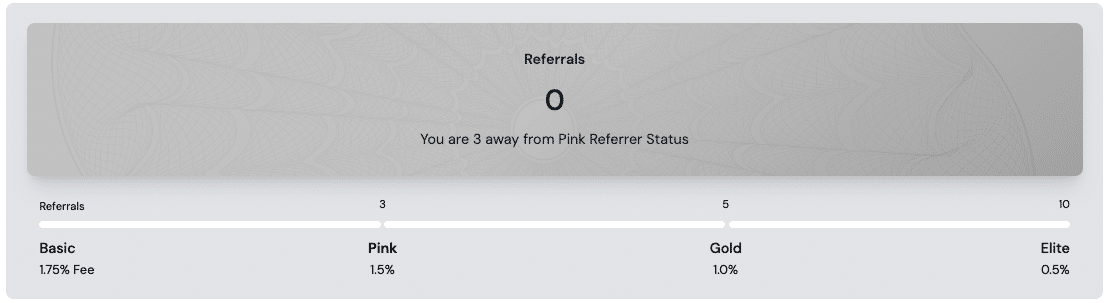

Plus, you can unlock lower processing fees by racking up referrals each year.

Three successful referrals will get you Pink Referrer Status, which lowers your processing fee to 1.5%. Five successful referrals will grant you Gold Referrer Status and a 1% processing fee, and 10 successful referrals comes with Elite Referrer Status and the lowest 0.5% processing fee.

The referral count resets each year in January.

How to Maximize Rent, Bill, and Tax Payments with Chexy

For Canadians, Chexy is a key tool to reach your Miles & Points goals, since it allows you to earn rewards on some of your biggest recurring and one-off expenses.

As we’ll explore below, by pairing the right credit card strategy with the Chexy platform, you’ll soon find your rewards balance overflowing with points, which you can then turn into elevated travel experiences.

Leverage Minimum Spending Requirements

One of the best ways to leverage Chexy’s platform is to use your rent, bill, and tax payments to chip away at minimum spending requirements and unlock large welcome bonuses.

How to Meet Minimum Spending Requirements

Read moreGenerally speaking, credit cards that offer the most generous welcome bonuses come with an equally large minimum spending requirement. For many people, the idea of spending $10,000 or more in three months is too daunting to consider.

However, Chexy’s platform allows you to take large chunks out of any minimum spending requirement, which in turn can help you unlock the best welcome offers out there.

For example, suppose you have your eye on the welcome bonus for the American Express Platinum Card, which offers a welcome bonus of up to 100,000 Membership Rewards points, broken down as follows:

- Earn 70,000 Membership Rewards points upon spending $10,000 in the first three months

- Earn 30,000 Membership Rewards points upon making a purchase in months 14–17 as a cardholder

50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

First-year value

$1,581

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

With Chexy, you can use your American Express Platinum Card to cover your rent, one-off and recurring bills (including sizeable expenses such as car lease payments, daycare, strata/condo fees, and more), and tax payments (including one-off payments, recurring tax instalments, and property taxes).

Throughout most of the year – and especially during tax season or whenever you have a large bill due – the combination of these payments should easily bring you close to (or over) the minimum spending requirement, which then significantly boosts your Membership Rewards balance in a short amount of time.

Again, you’ll have to factor in the processing fee of 1.75% on your expenses; however, since welcome bonuses remain the fastest way to boost your points balance, Chexy’s platform is a key tool for meeting the higher spends.

This same approach works for any card with a high minimum spending requirement and a juicy welcome bonus.

And, if you’re in the Miles & Points world with a significant other, the opportunities abound.

Maximizing Miles & Points in Two-Player Mode

Read moreGet Outsized Value from Your Points

One of the first questions that comes up is whether or not the processing fee charged by Chexy is worth it. After all, earning points this way comes at an additional cost that you don’t typically incur when using your credit card at traditional retailers.

For the most part, the answer simply lies in whether or not you’re earning the right type of points, since not all points are created equally.

In Canada, the best points to earn for travel are American Express Membership Rewards points, RBC Avion points, and Aeroplan points.

Membership Rewards and Avion points offer the most flexibility with how you can redeem them, as you can offset the cost of travel at a fixed rate, boost your value further through the American Express Fixed Points Travel Program or the RBC Air Travel Redemption Schedule, or transfer your points out to airline and/or hotel loyalty programs (which tend to offer the best value).

For its part, Aeroplan is one of the best loyalty programs in the world, thanks to its long list of redemption partners and opportunities to score outsized value.

When it comes to crunching the numbers, we value Aeroplan points at 2.1 cents per point, American Express Membership Rewards points at 2.2 cents per point, and RBC Avion points at 2 cents per point.

Points Valuations

Read moreAssuming that you’ll earn rewards with most travel credit cards’ baseline earning rate of 1 point per dollar spent, we’d estimate that you’re getting a return of 2–2.2% by paying your rent, bills, and taxes using an Aeroplan, American Express, or RBC Avion card with Chexy. If you subtract the 1.75% fee (or less if you’ve racked up some referrals), you’re still coming out ahead.

Plus, if you manage to redeem your points for even greater value by leveraging sweet spots in loyalty programs, you can come out even further ahead.

Pair Payments with the Best Earning Rates

Another important factor to consider when you’re looking to get the most out of your credit card spending and Chexy is to pair your payments with the best earning rates. This is especially important if you’re not working on a minimum spending requirement, since you’ll want to maximize the return on spending.

If you’re looking to earn travel rewards, then your best bet is to pay your rent, bills, and taxes with a card that has the highest baseline earning rate.

In Canada, your best options are the Business Platinum Card from American Express (which offers 1.25 Membership Rewards Points per dollar spent), the RBC® Avion Visa Infinite Privilege† (which offers 1.25 RBC Avion points per dollar spent).

Credit Cards with High Baseline Earning Rates

Welcome bonus: 130,000 Membership Rewards points

Annual fee: $799

First-year value

$1,914

Welcome bonus: 70,000 Avion points

Annual fee: $399

First-year value

$826

Since the rent, bill, and tax payments you make through Chexy can certainly add up over the course of a year, the extra 0.25 points per dollar spent can meaningfully boost your balance, especially if you factor in your spending outside of the platform, too.

For example, for each $2,000 rent payment you make, you’d earn 2,543 Membership Rewards points on the $2,035 payment (factoring in Chexy’s fee). We’d value 2,543 Membership Rewards points at $55.95, which easily outweighs the $35 fee.

Over the course of a year, that extra 0.25 points per dollar spent adds up to an extra 6,096 Membership Rewards points (which we’d value at $133) versus paying with a card that earns 1 point per dollar spent. And again, this is just a single type of payment with the card, and the amount of rewards you can earn certainly adds up over time.

If you’re looking to earn cash back instead of travel rewards, you’ll be happy to know that your rent, bill, and tax payments code as a recurring bill payment.

This means that you could use, say, the Scotia Momentum® Visa Infinite* Card, which earns a 4% cash back on groceries and monthly recurring payments.

Factoring in Chexy’s 1.75% fee, you’d still net 2.25% cash back on your rent, bills, and tax payments.

Suppose you pay $2,000 in rent each month, you’d pay a total of $2,035 including Chexy’s fee, while still earning $81.40 in cash back each month on the Scotia Momentum® Visa Infinite* Card.

Subtract the $35 fee you paid, and you’re still getting a very respectable $46.40 as an effective rebate towards your rent.

First-year value

$220

Annual fee: $120First Year Free

• Earn 0.1x bonus points on purchases (up to $2,000 spend)

Earning rates

Key perks

- Annual fee waived in the first year.

- Discounts on car rentals through partner programs.

Annual fee: $120First Year Free

• Earn 0.1x bonus points on purchases (up to $2,000 spend)

Earning rates

Key perks

- Annual fee waived in the first year.

- Discounts on car rentals through partner programs.

Conclusion

Chexy provides a platform for you to pay with a credit card and earn rewards on your rent, bills, and tax payments. The service charges your card three days before your payment due date and then sends an Interac e-Transfer, pre-authorized debit, or bill payment to your payee on your behalf.

By paying these expenses with credit cards through Chexy with a 1.75% fee, you’re able to factor a major amount of expenses into your Miles & Points goals.

You can use Chexy to help reach a high minimum spending requirement for a new credit card, or you can net a tidy sum of points with another card with a high return on regular spending.

Chexy is our favourite Canadian platform for earning credit card rewards on rent, bill payments, and personal taxes.

T.J. is curious about everywhere he hasn’t been to yet. Exploring countries by foot and connecting with locals guide his love for travel. Earning and redeeming points to jazz up the experience has become the icing on his travel cake.

First-year value

$1,581

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

Comments

Create a free account or become a member to comment.