Aside from accumulating points that can be used for travel, you’ll need to make sure your cash reserves are healthy, too. Cash back credit cards can be a good option, but there’s another often-overlooked avenue offered by the same institutions: bank account bonuses.

Banks occasionally run promotions in which they give welcome bonuses when you open a new chequing account. These promotions are a good way to keep the awards flowing in from many different avenues.

In This Post

What Are Bank Account Bonuses?

Chequing bonuses mirror the familiar model for credit card offers: receive a lump sum award upon fulfilling a set of conditions. Bonuses are typically in the $300 range, almost always as cash.

Instead of a minimum spending requirement, chequing accounts might ask you to make a bill payment, set up a pre-authorized payment, or set up a direct deposit. Most promotional offers ask you to complete more than one of these tasks, often on a recurring basis. Generally these are the “big three” requirements, although there are sometimes other conditions.

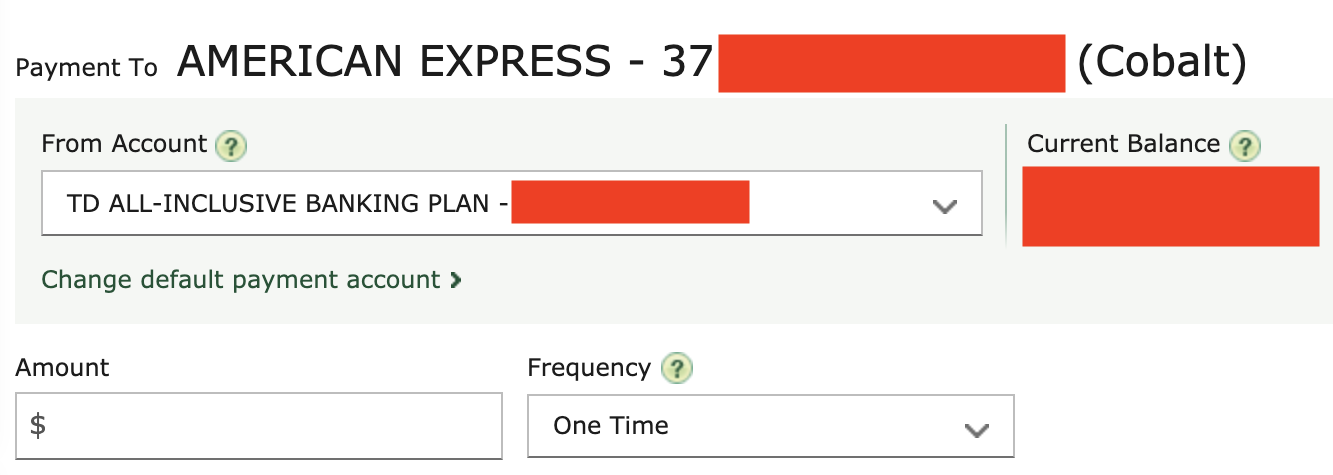

Bill payments are “push” payments, initiated from your online banking. To make a bill payment, enter the account number for the payee on the bank’s interface. They’re the easiest condition to meet – if you’re collecting credit card rewards, a payment to any of those cards would qualify.

Note that internal transfers from chequing to a credit card at the same bank don’t count. For example, paying your Scotiabank Gold American Express® Card statement from your Scotiabank chequing account wouldn’t meet the bill payment requirement.

Pre-authorized payments are “pull” payments, initiated from the external body receiving the payment. To set this up, enter your chequing account’s transit number and other information on the external payee’s interface.

Some billers that allow this include utility providers, telecom companies, and American Express credit cards. Any of these can also be “pushed” via bill payment as well.

Sometimes, there’s a minimum amount for pre-authorized payments. For instance, a BC Hydro bill of $17/month can’t be used to qualify for banking offers that require at least $50 per pre-authorized payment.

Direct deposit specifically refers to a type of incoming payment that your bank recognizes as a payroll deposit. Income that serves a similar purpose, such as a pension or government benefits, would also register the same way.

Other deposits, like interbank transfers from your own account at another institution or Interac e-Transfers, won’t work.

Payroll is the hardest condition for most people. Mechanisms for self-employment or income for contracted work, like physical paycheques, don’t count. Depending on your job, it might be a hassle to change your banking information with human resources every time you want to take advantage of a new promotion.

Other tasks may include things like debit card purchases, e-Transfers, or opting for paperless statements, but these are usually for low-value bonuses on entry-level accounts.

Don’t expect the instant gratification that we’re used to with credit cards. Sometimes the bonus takes a few months to arrive after meeting all of the conditions. It’s not as fast as credit card bonuses, which in most cases show up on your next statement after meeting the minimum spend requirement, if not sooner.

Bank Account Bonuses vs. Credit Card Bonuses

Although bank account bonuses can offer comparable value to mid-range cash back credit cards, they’re certainly not as popular for a number of reasons.

Qualifying Actions

Because the qualifying actions are quite restrictive, it’s harder to earn bank account bonuses as fast as credit card bonuses. With credit cards, you’re only limited by your spending, so you can set your own pace.

With bank accounts, there’s a limit to the number of pre-authorized billers or payroll depositors available to you. Especially if the chequing promotion requires recurring payments, it’s hard to do more than one every few months.

Rewards Currency

Generally speaking, you can’t earn travel rewards with bank account bonuses, only cash back or merchandise. If your priority is booking with loyalty programs to stretch the value of your rewards, bank account bonuses won’t get you closer to that goal.

Of course, there are exceptions to this, but for the most part, expect cash instead of points for bank account bonuses.

Strict Terms & Conditions

Also, unlike credit cards, bank account bonuses are known for a strict interpretation of the terms and conditions.

Don’t bother if you fall under any of the listed exclusions. At your main bank, you can kiss chequing promotions goodbye before you even get started – existing clients are never eligible.

(This makes sense in my opinion, as bank accounts are rather simple, only differentiated on a scale from basic to premium. On the other hand, credit card issuers offer a wider breadth of rewards options to appeal to different and changing consumer needs.)

Also, chequing offers usually contain phrasing about revoking the bonus if you close your account within a year. This practice isn’t mentioned for credit cards, but for chequing accounts it is explicit and will definitely be enforced.

Fees & Opportunity Cost

Promotions worth pursuing are only available on premium chequing accounts – top-tier and sometimes also mid-tier. These accounts all have monthly fees which eat into the bonus.

Most premium bank accounts have monthly fees around $30. Assuming the bonus is $300, and you have to keep the account open for a year, that’s a net loss of $60. Therefore, the only way a chequing promotion makes sense is if you keep a minimum balance to waive monthly fees.

In that case, you have to consider the opportunity cost of parking several thousand dollars in a chequing account. For example, a premium account with a $4,000 minimum balance requirement and a bonus of $300 would have an annual rate of return of 7.5%.

Compared to other investments, this is very strong for a no-risk guaranteed rate of return. However, you can also earn even more from premium credit card welcome bonuses.

Credit Inquiries

Speaking of which, as credit cards often present better deals, you should be careful that the bank doesn’t do a credit inquiry for a low-to-moderate reward on a chequing offer.

If you apply online, you’re at the mercy of the automated system, so you should expect a hard pull. You could dodge the inquiry for some chequing accounts, but only with the inconvenience of visiting a branch.

For that reason, you can try opening a chequing account and a credit card in person at the same time. That way, you’ll know they’re doing a credit inquiry anyway, but since they’ll do only one, and you can be confident that the trip to the branch will be worthwhile. When it comes to the value you get for a credit inquiry, the banking offer should be dessert, not the main course.

Overall, while credit cards have a decisive advantage, not everyone is able to maximize them for rewards all the time. In that case, bank account bonuses are a good backup plan.

If you have enough cash to cover the minimum balance requirement, but you’re still building a healthy credit file or don’t have enough income to qualify for credit cards with high welcome bonuses, you can get a head start on earning rewards while you await bigger prizes.

What About Other Banking Products?

In addition to chequing accounts, banks often run incentive programs to get new customers for their other types of products as well.

For savings accounts, the bonus is usually straightforward: a promotional interest rate for several months. All you have to do is open the account, and you’re set.

However, the incremental rate hardly compares to other investment opportunities. If your balance is big enough to notice the difference, it’s probably better invested elsewhere. It’s usually not worth the hassle of chasing a temporary savings rate unless you’re already going for a chequing promotion at the same bank.

Banks also offer cash bonuses for investment accounts. Bonuses are on a sliding scale based on the size of your investment.

While you may see numbers like $1,000 or more being advertised, these are only achievable with an exponentially large investment (as you can see in the following chart of a previous offer for new clients).

No matter the size of your investments, it may not be worth the upheaval of your nest egg. Rather than being drawn by a one-time incentive bonus, consider prioritizing a platform that provides you with your preferred assets, satisfactory fees and commissions, and an interface you’re comfortable with.

Always check if you might be eligible for a bonus for a group you’re a part of, such as students, seniors, military, or new immigrants. Many banks offer packages or special accounts for these populations, and you might find that you can earn a little extra for completing a few easy banking chores.

Notable Bank Account Promotions

If you’re curious whether you might benefit from a bank account bonus, here are a few notable promotions currently available. All of these are mid-tier accounts – the same offers are also available on top-tier accounts, but with higher fees or fee waiver requirements.

- BMO Performance Plan

- $450 bonus, with a $4,000 minimum balance to waive fees

- Additional $50 bonus upon adding a family member through the Family Bundle

- Complete the following two requirements:

- Provide a valid email address at the time of opening a chequing account

- Make a deposit of any amount by July 2, 2025

- Complete two of the following three requirements by August 29, 2025:

- Set up one recurring direct payment

- Make two pre-authorized payments from different payees (at least $50)

- Make two bill payments to different payees (at least $50)

- Offer ends July 2, 2025

- CIBC Smart Account

- $450 bonus, with a $4,000 minimum daily balance to waive fees

- Within two months, provide your email address when you open an account, and then set up ongoing direct deposits totalling $500 or more

- Within two months, complete at least one of the following three requirements within the same calendar month:

- Set up two different pre-authorized payments

- Make five eligible online Visa Debit purchases

- Make two online bill payments at least $50

- The direct deposit and the pre-authorized debit must remain in effect for at least a year

- No listed end date

- Scotiabank Preferred Package

- $500 bonus, with a $4,000 minimum daily balance to waive fees

- Complete two of the following requirements

- Set up and receive one eligible automated recurring direct deposit (like a payroll or pension). It must recur for at least six months.

- Set up and make two eligible pre-authorized transactions for things like your mortgage, insurance or rent. Each transaction must be at least $50, separate, and recur for six months.

- Make one eligible bill payment (like a phone or utility bill) of at least $50 with online or mobile banking.

- You can earn up to $200 more by completing separate requirements

- Offer valid May 1–July 31, 2025

- Simplii Financial No Fee Chequing Account

- $300 bonus

- No-fee account, which means no minimum balance required

- Add an eligible direct deposit of at least $100 for three straight months

- Offer ends June 30, 2025

- TD Unlimited Chequing Account

- $450 bonus, with $4,000 minimum balance to waive fees

- Earn $450 by opening an account by May 28, 2025 and completing two of the following three requirements by July 29, 2025:

- Set up one automated recurring direct deposit from your employer, the Government, or pension provider

- Set up a recurring pre-authorized debit payment of at least $50

- Make an online bill payment of at least $50 online or with the TD app

- Offer ends May 28, 2025

When considering the above offers, choose the ones with easier tasks, rather than gunning for the biggest bonuses.

Conclusion

Bank account bonuses are an under-utilized way to boost your rewards. However, they’re trickier and slower than earning credit card rewards, and should be pursued sparingly.

Generally speaking, the best practice is to only chase these bonuses as part of a package deal with opening a new credit card.

Even if chequing promotions don’t form the core of your rewards strategy, it’s important to be aware of them so you can capitalize when the opportunity arises.