The Scotiabank®* Gold American Express® Card is one of the best travel cards in the Canadian market, thanks to its generous Scene+ points earn rates, no foreign currency transaction fees, and numerous travel perks.

With an annual fee of $120, the card is certainly packed full of features and benefits, and you might be wondering how you could get the best out of the card.

In this guide, we’ll show you how to maximize the potential of the Scotiabank®* Gold American Express® Card, including earning, redeeming, and everything in between.

- Earn 25,000 Scene+ points upon spending $2,000 in the first three months

- Plus, earn an additional 20,000 Scene+ points upon spending $7,500 in the first year

- Earn 6x Scene+ points at Sobeys, IGA, Safeway, FreshCo, and more

- Plus, earn 5x Scene+ points on groceries, dining, and entertainment

- Also, earn 3x Scene+ points on gas, transit, and select streaming services

- Redeem points for a statement credit for any travel expense

- No foreign transaction fees

- Enjoy the exclusive benefits of being an American Express cardholder

- Annual fee: $120 (waived for the first year)

Get Kickstarted with the Welcome Bonus

You’re off to a great start in maximizing your Scotiabank®* Gold American Express® Card with its welcome bonus offer. By applying and being approved for the card, you can score up to 40,000 Scene+ points,† broken down as follows:

- 20,000 Scene+ points upon spending $1,000 within the first three months†

- Another 20,000 Scene+ points upon spending $7,500 within the first year†

That’s up to $400 in points,† which you could use on travel, groceries, and more.

Grow Your Points Bank with Everyday Purchases

In addition to the welcome bonus, the Scotiabank®* Gold American Express® Card can be used for your everyday purchases to grow your Scene+ balance with the card’s excellent everyday points earn rates, outlined as follows:

- 6 Scene+ points per dollar spent at participating Empire Company grocery stores, including Sobeys, Safeway, FreshCo, Foodland, and more†

- 5 Scene+ points per dollar spent at eligible restaurants, other grocery stores, and entertainment purchases†

- 3 Scene+ points per dollar spent on eligible gas & daily transit purchases, as well as select streaming services†

- 1 Scene+ point per dollar spent on all other eligible purchases (including foreign transactions)†

The Scene+ program allows members to earn and redeem points at a myriad of partners, such as:

- Empire Company Ltd. stores (including Sobeys, Safeway, FreshCo, Foodland, and more)

- Scene+ Travel, Powered by Expedia†, which lets you earn 3 points for every dollar spent on hotel and car rentals

- Scene+ Rakuten†, which lets you earn 20% more cash back in points when you shop online at hundreds of stores, with new offers from different stores each week

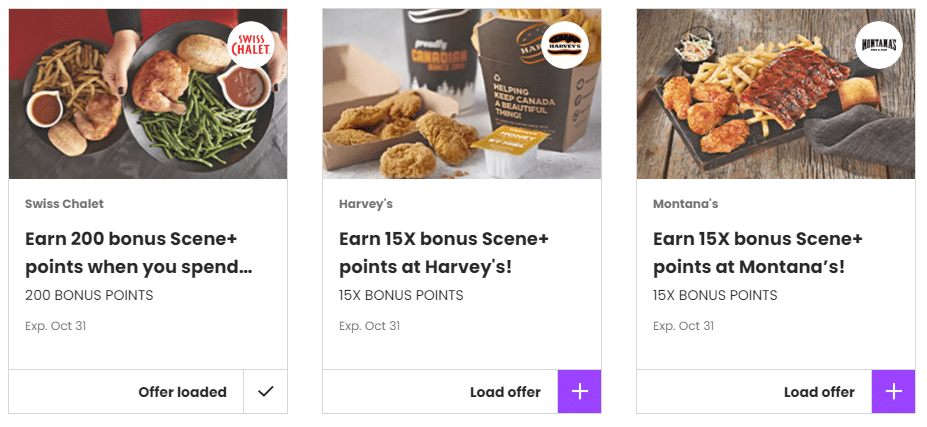

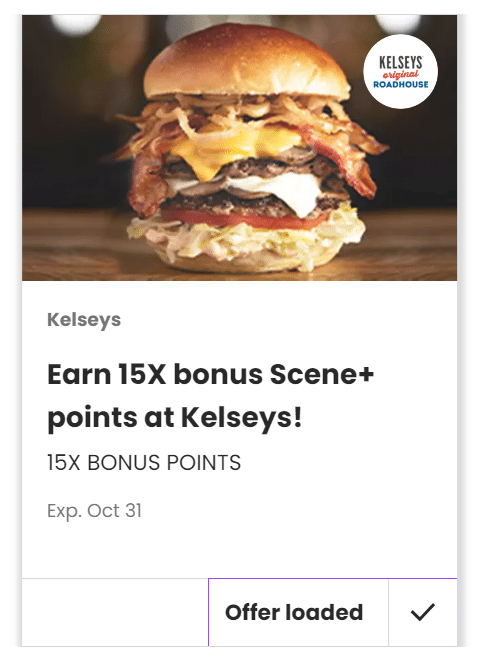

- Recipe Unlimited restaurants (Harvey’s, Swiss Chalet, East Side Mario’s, etc.)

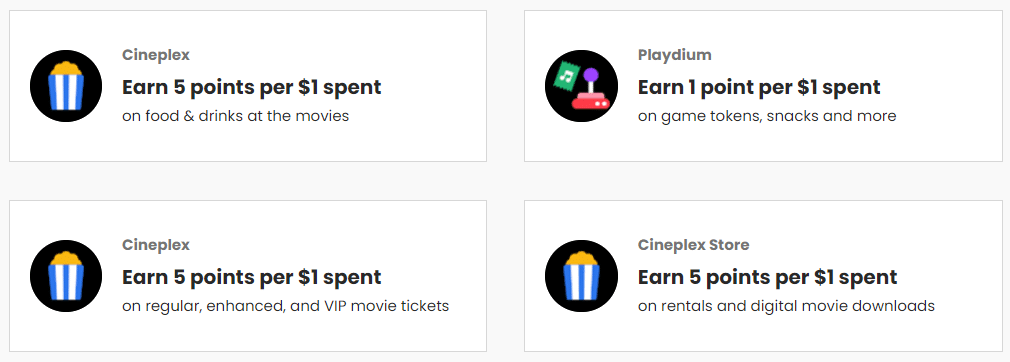

- Cineplex (including The Rec Room and Playdium)

- Home Hardware

Likewise, the Scene+ program gives you the flexibility to redeem your points towards travel purchases, merchandise, and gift cards, among others.

For instance, you can use your points for boutique hotels or low-cost flights that may not be bookable through airline or hotel loyalty programs.

Keep in mind that this card is issued by Scotiabank but operates on the American Express network. In Canada, more and more businesses are accepting American Express cards, thanks to initiatives such as Shop Small.

Earn Up to 6x Scene+ Points on Groceries

The Scotiabank®* Gold American Express® Card offers one of the highest points earn rates on groceries among Canadian credit cards.

By using your card at eligible grocery stores, you’ll benefit from the following earn rates:

- 6 Scene+ points per dollar spent at participating Empire Company grocery stores, including Sobeys, Safeway, IGA, Foodland, FreshCo, and Thrifty Foods†

- 5 Scene+ points per dollar spent at all other eligible grocery stores†

Even better, as partners of the Scene+ program, Empire Company grocery stores let you earn more points with weekly specials and promotions. You may find many of these offers by browsing the digital or print flyer of your favourite grocery store.

For example, you can take part in the weekly Scene+ Stock Up deal at Sobeys, and easily receive thousands of extra points by simply purchasing the weekly featured items.

Keep in mind that you may also redeem your Scene+ points at participating Empire grocery stores at a rate of 1,000 points = $10,† so you can save instantly on your groceries. Moreover, you can earn and redeem Scene+ points on the same transaction and truly maximize your savings.

Earn 5x Scene+ Points on Dining and Entertainment

Another exciting feature of the Scotiabank®* Gold American Express® Card is its accelerated earn rate of 5 Scene+ points per dollar spent on eligible dining and entertainment purchases.†

At Recipe Unlimited restaurants, you can earn up to 15x more points by loading one of the offers on the Scene+ app.†

For instance, if you were to load a Kelseys 15x offer on the Scene+ app and present your Scene+ card at the time of payment, you’d earn 15 Scene+ points per $3 spent.† Plus, with the Scotiabank®* Gold American Express® Card, you’ll get another 15 Scene+ points per $3 spent.†

In total, you’ll earn 30 Scene+ points per $3 spent.† That’s equivalent to a 10% return on spending, which is among the most generous rewards you’ll get from a restaurant in Canada.

On the other hand, your movie nights will be more rewarding when you use your Scotiabank®* Gold American Express® Card in tandem with your Scene+ card at Cineplex.

By using your Scene+ card alone, you’ll earn 5 points per dollar spent on tickets, food, and drinks.† However, when you use your Scotiabank®* Gold American Express® Card to pay, you’ll get another 5 points per dollar spent on the same purchases,† doubling your earnings to 10 points per dollar spent, or once again, up to a 10% return.†

Earn 3x Scene+ Points on Gas and Daily Transit

Another valuable accelerated earn rate on the Scotiabank®* Gold American Express® Card is 3x Scene+ points on eligible gas and daily transit purchases.†

You’ll find this benefit especially valuable these days, since PRESTO, the payment system of many transit agencies in Ontario, now accepts credit cards tapped directly onto its devices.†

That means when you take the bus, streetcar, or subway in Toronto, you can tap your Scotiabank®* Gold American Express® Card directly onto the PRESTO device, and easily earn 3 points per dollar spent on your fares.†

No Foreign Currency Transaction Fees

One of the most compelling features of the Scotiabank®* Gold American Express® Card is that you won’t pay foreign currency transaction fees when you use the card abroad or make online purchases in foreign currencies.†

Most Canadian credit cards charge 2.5% or more on foreign currency purchases (otherwise known as foreign exchange fees or foreign currency conversion fees) in addition to the exchange rate, and if you tend to spend a lot of time outside of the country, these extra fees can really add up.

Plus, by using your Scotiabank®* Gold American Express® Card, you’ll earn 1 Scene+ point per dollar spent on all foreign currency purchases converted to Canadian dollars.†

Complimentary Concierge Service

While the Scotiabank®* Gold American Express® Card is attractive for its high earn rates, it’s also supplemented by a slew of features that can help you maximize your travels.

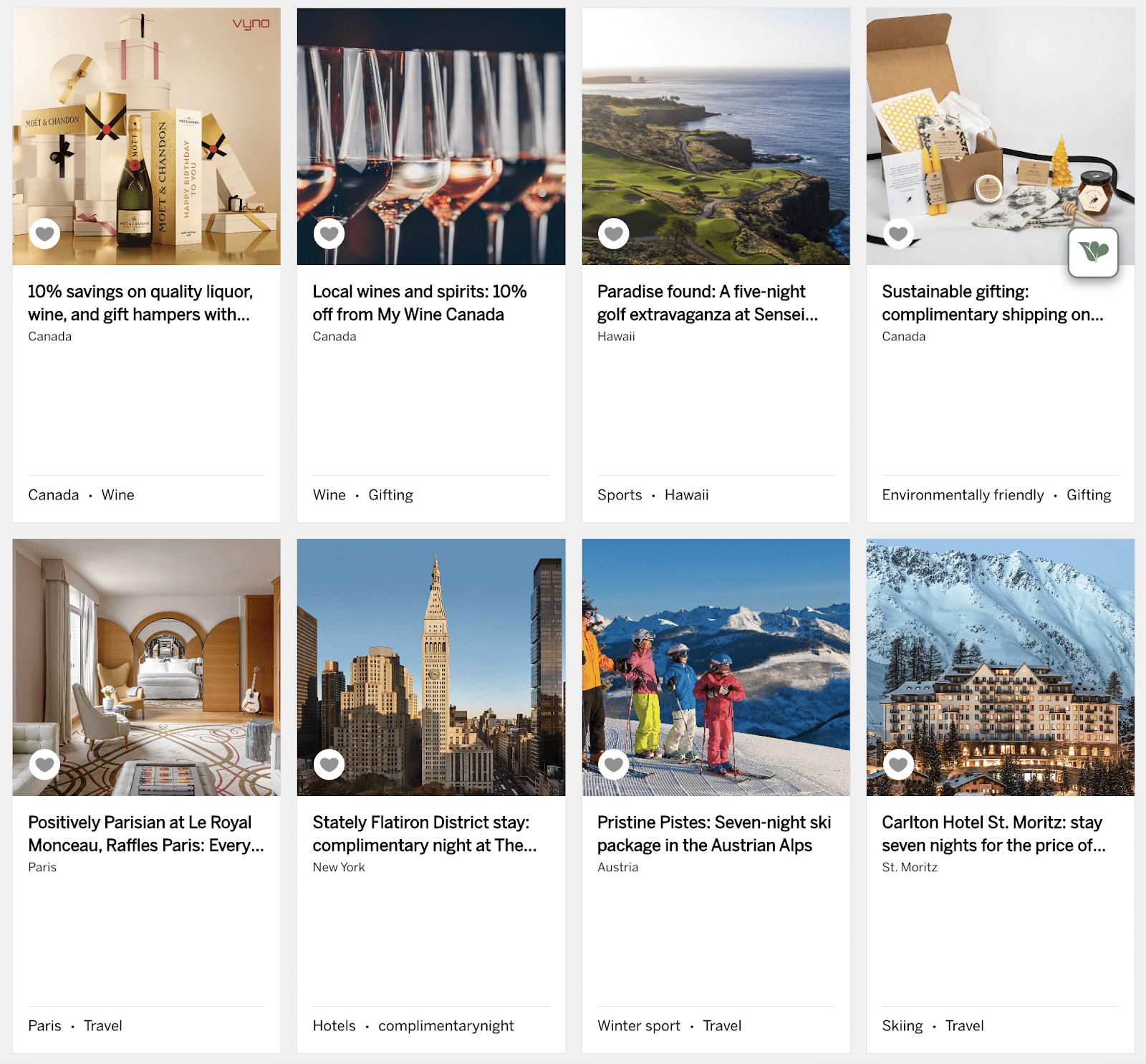

One of these is the complimentary concierge service, which Scotiabank provides in partnership with Ten Lifestyle Group.†

The concierge service assists you in booking restaurants, making travel reservations, and sourcing personalized gifts to name a few – not only within Canada, but also elsewhere in the world. As a matter of fact, the service has specialists for each geographic region, who provide personalized recommendations.

The service takes away the hassle of getting in touch with restaurants that are, for example, in a different time zone or that speak a different language.

In addition, the concierge service offers special perks, such as complimentary wine at select restaurants, experience credits at hotels and resorts, and exclusive VIP tickets for sporting events.†

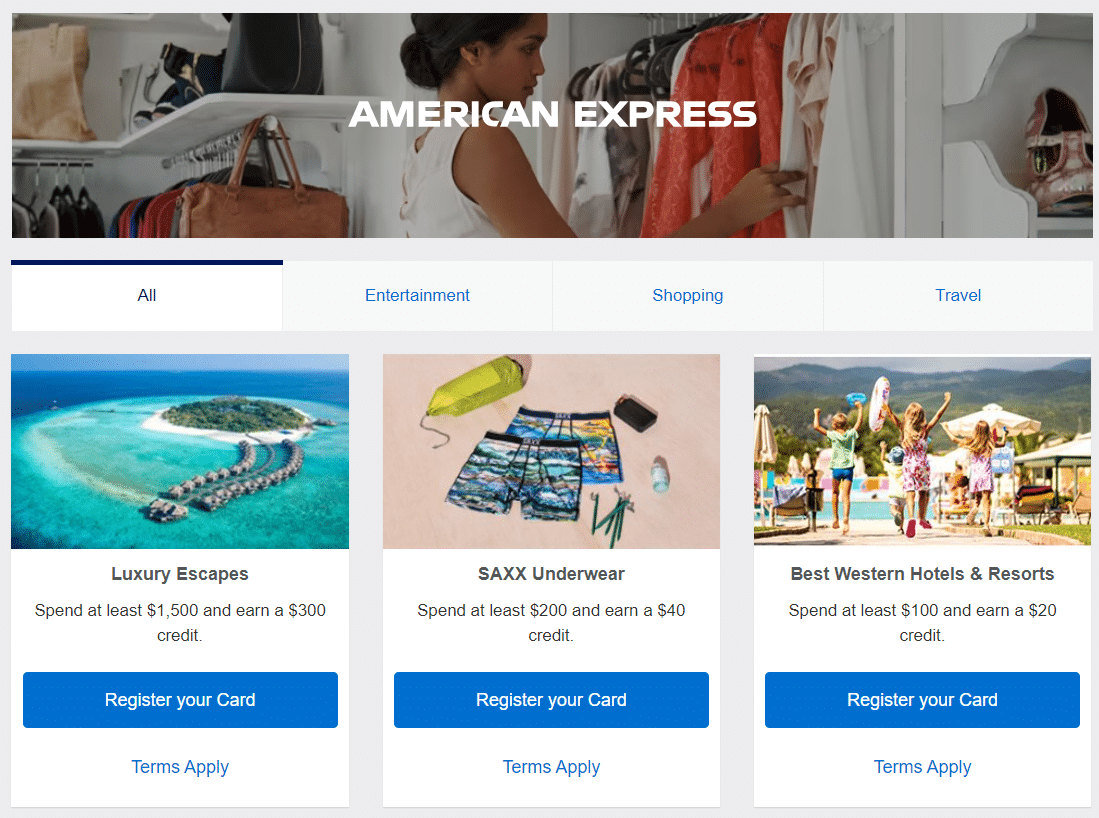

Amex Offers

American Express is known for its offers that feature the unique products and services of the businesses that accept the card. Fortunately, you won’t be missing out on these offers with the Scotiabank®* Gold American Express® Card, since you can register for Amex Offers through a dedicated portal.

Some examples of popular recent Amex Offers include a $150 statement credit when you spend $750 with United Airlines,† or a $100 statement credit upon spending $500 at Canadian Marriott hotels.† In both cases, you wind up saving up to 20% on flights or hotel stays.

Plus, if you’re able to take advantage of these Amex Offers and other exclusive offerings such as Amex Experiences over the course of a year, it more than warrants the card’s modest $120 annual fee, often with one or two offers alone.

Conclusion

The Scotiabank®* Gold American Express® Card has a number of standout features and benefits just waiting for you to maximize.

For one, you can earn more Scene+ points by leveraging the card’s welcome bonus, as well as its accelerated earn rates at other Scene+ partners.

Aside from the card’s generous earn rates, you can also maximize by taking advantage of its travel perks, such as no foreign exchange transaction fees, the complimentary concierge service, and the ever-lucrative program of Amex Offers.

No matter how you cut it, it isn’t hard to find plenty of value with the Scotiabank®* Gold American Express® Card.

† Terms and conditions apply. Please refer to the Scotiabank website for up-to-date information.

Hello T.J.!

Thank you very much for your article, very clear and enticing as usual.

I have had a ScotiaBank Amex gold card for a little over 2 years. But I am afraid I am under-using it.

Indeed, I do not know how to access the ScotiaBank concierge service, nor where you saw (and where I can see) the array of special concierge service offers that is displayed in your article. Can you please lighten my lantern? I thank you very much!