Get the Amex US SPG Card Before It’s Gone!

If you haven’t gotten into US credit cards yet, or if you’ve dabbled with US credit cards but haven’t picked up the Amex US SPG Card, then this weekend is the time to take action.

That’s because the card is being permanently discontinued as of February 13, as the official introduction of Marriott Bonvoy on that date heralds huge changes in the co-branded credit card lineup down in the US.

On this date, the Amex-issued SPG Luxury Card and Business SPG Card, as well as the Chase-issued Marriott Rewards Premier Plus Card and Marriott Rewards Premier Plus Business Card, will all take on new Bonvoy-inspired names and designs. And with Chase taking up the mantle of the lower-tier personal credit card, Amex’s personal SPG Card has been deemed surplus to requirements and will be phased out entirely.

The Amex US SPG Card Offer

This means that next Wednesday will be your last chance to earn a mouthwatering signup bonus of 75,000 Marriott Bonvoy points after spending US$3,000 in the first three months. The annual fee of US$95 on this card is waived for the first year.

75,000 Marriott Bonvoy points is enough for five nights at a Category 3 hotel, three nights at a Category 4, two nights at a Category 5, or one night at a hotel up to Category 7. That’s a very compelling return for no money spent out-of-pocket.

Better yet, just like the Canadian-issued SPG Card and Business SPG Card, you’ll receive a free night certificate worth up to 35,000 Marriott Bonvoy points on every card membership anniversary. 35,000 points is equivalent to a Category 5 hotel, and these can easily retail for multiple times’ worth the US$95 annual fee, so it makes sense to keep this card long-term after you get it and use it to build your US credit history.

Get a discounted night every year at a Category 5 hotel, like the JW Marriott Rio de Janeiro

The card also gives you 15 elite qualifying nights towards Marriott Bonvoy elite status, although that can also be attained more easily via the Canadian-issued cards, and the 15-night credits from multiple credit cards don’t stack with one another.

Why is the offer worth grabbing before it’s gone? Well, consider the fact that Amex bonuses are strictly once-in-a-lifetime down in the US. That means that there’s still a hard upper limit to the pool of potential bonuses, even though that pool appears to be much larger than ours here in Canada.

In other words, while there are more Amex cards to choose from in the US with bigger bonuses on average, here in Canada we can (theoretically) rack up unlimited volumes of points through signing up for the same offer over and over again, whereas that’s not possible in the US.

When US cards get discontinued, then, that limited pool of bonuses grows ever smaller. So it’s important to take advantage of time-sensitive deals before they go away, because you’ll never be able to collect those 75,000 Marriott Bonvoy points again after February 13, and you can’t make up for it by hitting the other Amex US cards harder either.

How to Apply

The application channel will depend on where in the overall process of getting US credit cards you find yourself at the moment. If you’ve already established a US credit file, then it’s a simple matter of submitting an application on the Amex US website using your SSN or ITIN.

If you’ve done an Amex Global Transfer to a different card, but haven’t obtained an ITIN yet, then the most reliable way to do apply for the Amex US SPG Card would be to simply submit an application on the basis of your existing relationship with Amex US.

This will likely have to be done over the phone, since the online application form considers the SSN/ITIN field to be mandatory. In my experience, about three months’ worth of existing history with Amex US ought to be enough to get you approved for another card with them.

There was a brief period last year when it seemed as though you could do Amex Global Transfer multiple times in a situation like this (indeed, I had mentioned it in my late-2018 US credit cards update), but recent data points indicate that people haven’t been as successful with this in the days since then.

Lastly, if you haven’t established a relationship with Amex US yet, then now’s your chance to do an Amex Global Transfer directly to the Amex US SPG Card and nab that signup bonus while simultaneously getting your credit file set up south of the border.

As a reminder, the only criterion for Amex Global Transfer is to have a Canadian Amex card that’s been open and in good standing for at least three months. You call the Global Transfer team to initiate the process, and nothing happens to your Canadian cards along the way – you’re simply using your relationship with Amex Canada to “copy” your cardmember status over into the US.

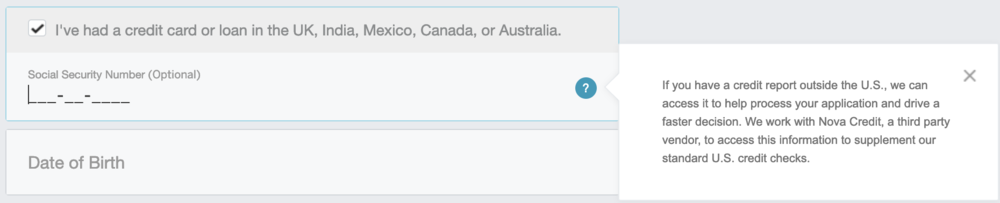

Another path to getting started with Amex in the States that’s come to my attention recently is Nova Credit – apparently a relatively new service that directly accesses your Canadian credit file on behalf of Amex US, and uses that to make a decision on your creditworthiness. You have the option of using Nova Credit when applying directly via the Amex US website.

Either way, right now is the perfect opportunity to get started with US credit cards if you haven’t already, given the imminent discontinuation of the Amex US SPG Card as well as the fact that it’s a great card to keep around forever for the purposes of building credit history.

What About US Mail Forwarding Services?

I’d also like to take this opportunity to talk about mail forwarding services. Unless you have family or friends south of the 49th parallel who are willing to let you use their address for your card-crunching needs, one of the key components of the overall US credit card strategy is using a mail forwarder to send your cards up here to Canada.

For a long time, MyMallBox in Delaware was the preferred option for many practitioners. They charged minimal fees, provided an easy-to-use web portal for tracking and forwarding your mail, and were not treated by the USPS as a Commercial Mail Receiving Agency.

Unfortunately, MyMallBox recently started refusing to forward credit cards in the mail, citing the fact that they’re considered “currency” and pointing to a section in their terms and conditions that forbids the forwarding of such material.

We can surmise that the Delaware-based service was probably originally intended for people doing cross-border shopping rather than hundreds of Canadians taking up “co-habitation” at 620 Centerpoint Blvd in order to sign up for US credit cards.

Most likely, the sheer number of people using MyMallBox for credit cards grew too burdensome, and the company thus began enforcing a part of their terms and conditions to which they were previously happy to turn a blind eye.

Nice digs ya got there, Canucks…

Now, the good news is that there are definitely still free forwarding services out there that can get the job done. The bad news is that I won’t be specifying any of them here, and that’s for two reasons.

First, I myself have been using 24/7 Parcel since the very beginning, who have been extremely reliable, although they do charge an annual fee for the mailbox of US$90. It was out of pure laziness that I hadn’t switched to free services like Shipito or MyMallBox, but that laziness turned out to work in my favour. Bottom line – there aren’t any free mail forwarding services that I can recommend from personal experience.

Second, I’ve learned in recent times that as the numbers grow here at Prince of Travel, certain opportunities can be thrown into disequilibrium when too many readers are sent chasing them, and can thus vanish into thin air. It happened with the Smashwords ITIN letter, it happened with my Toronto CIBC contact who could get people the Aerogold for Business hassle-free, and now it’s happened with MyMallBox.

As much as it may be unavoidable at times, I hate to contribute to a good opportunity’s downfall. In that spirit, then, instead of outright throwing out a new mail forwarding service for you to use, I’ll give you the following advice: spend some time on Google using search terms like “letter mail forwarding service US to Canada”, make a list of 10-15 providers, check their Commercial Mail Receiving Agency status on the USPS website, and contact them to ask if they’ll forward credit cards.

Conclusion

With the imminent arrival of Marriott Bonvoy, the US-issued Amex SPG Card is on its way out, and we’re in the final week of being able to take advantage of its sweet signup bonus of 75,000 Marriott Bonvoy points. Those of you with an existing US credit file would do well to pick up this card and add another “forever card” to help you strengthen your average age of accounts, whereas those of you who haven’t yet gotten started with US credit cards are now looking at the perfect opportunity to do so.

First-year value

$1,181

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge