The Tims® Mastercard is one of two cards with no annual fees offered by Tims Financial, the financial services division of Tim Hortons. The card is issued in collaboration with Neo Financial and Mastercard. The card not only rewards coffee runs at Tim Hortons, but it also offers accelerated earning on groceries, gas, EV charging, transit, taxis, and rideshares. In all, it’s a card geared for everyday use for those deeply loyal to Tim Hortons.

Bonuses & Fees

As a welcome bonus, the Tims® Mastercard offers a $50 Digitial gift card upon first purchase.†

The card has no annual fee, making it a good choice to keep open as a free primary or backup credit card, all while helping you build your credit.

Note that the card has a minimum $50 security fund deposit required.

Earning Rewards

The Secured Tims® Mastercard has the following earning structure:

- 12 Tims Rewards Points per dollar spent when you scan for Tims Rewards†

- 2 Tims Rewards Points per dollar spent on qualifying grocery purchases, gas and transit†

- 2 Tims Rewards Points per dollar spent on qualifying gas†

- 2 Tims Rewards Points per dollar spent on qualifying transit, taxi, and rideshares†

- 1 Tims Rewards Point per $4 spent on all other qualifying purchases†

Redeeming Rewards

After you've earned them, Tims Rewards Points may be redeemed towards products at Tim Hortons at the following rates:

- Classic Donuts, Specialty Donuts, Hashbrowns, and Cookies: 300 points

- Brewed Coffee, Tea, Dream Donuts™, Dream Cookies™, Bagels, and Baked Goods: 400 points

- Hot Chocolate, French Vanilla, Iced Coffee and Wedges: 600 points

- Real Fruit Quenchers, Cold Brew, Classic Iced Capp®, Box of 10 Timbits®, Yogurt, Frozen Beverages and Espresso Drinks: 800 points

- Breakfast Sandwiches and Soups: 1,100 points

- Farmer's Wrap, BELT®, Lunch Sandwiches and Chili: 1,300 points

- Loaded Bowls & Wraps: 1,800 points

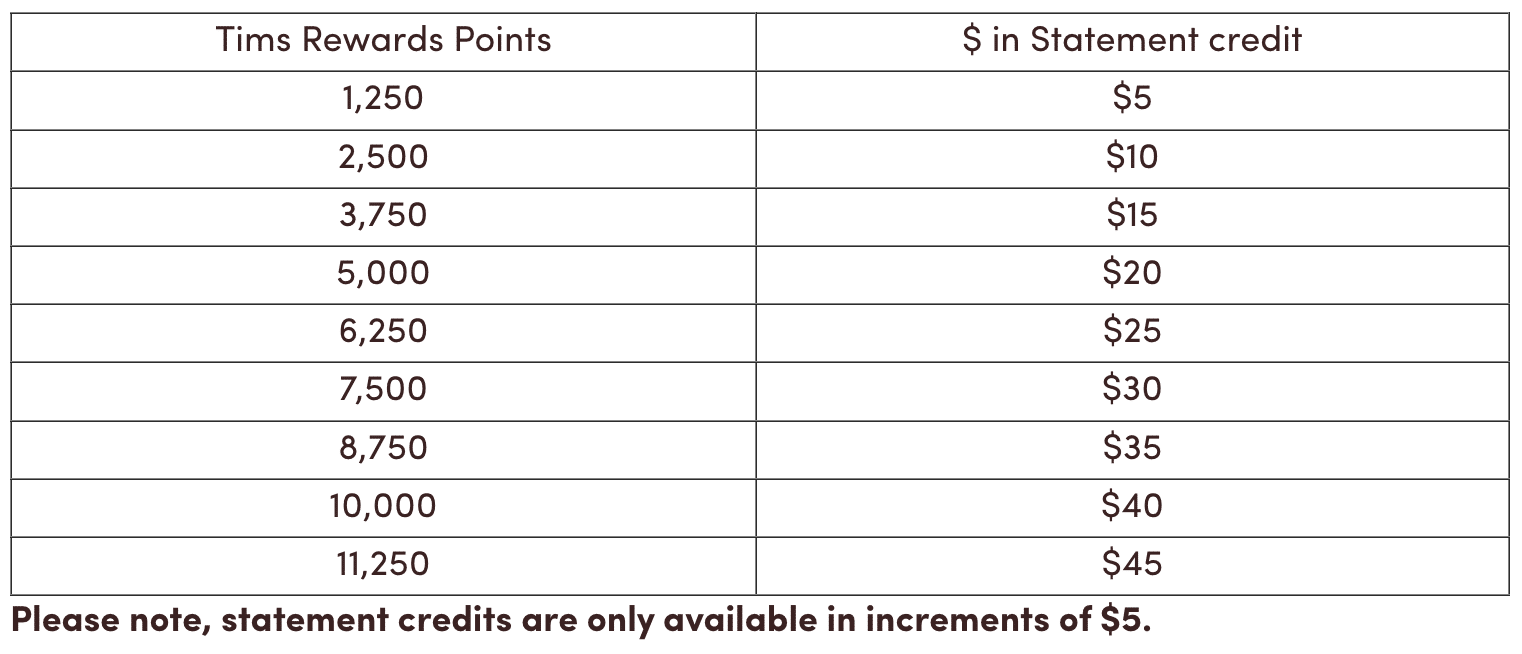

When used on statement credits, each Tim Rewards Point yields a value of 0.4 cent per point.

Note that you may only apply for one statement credit per seven days, up to a maximum of $45 each time. Say you apply for a $30 statement credit on a Monday, the next time you’ll be able to apply for a statement credit will be the following Monday.

Moreover, a statement credit must be applied against an eligible purchase, and it must not exceed the purchase being applied for. For example, you may not apply a $45 statement credit on a $40 purchase.

When used on statement credits, each Tim Rewards Point yields a value of 0.4 cent per point.

Note that you may only apply for one statement credit per seven days, up to a maximum of $45 each time. Say you apply for a $30 statement credit on a Monday, the next time you’ll be able to apply for a statement credit will be the following Monday.

Moreover, a statement credit must be applied against an eligible purchase, and it must not exceed the purchase being applied for. For example, you may not apply a $45 statement credit on a $40 purchase.Perks & Benefits

As a card with no annual fee, the Tims® Mastercard understandably has limited perks and benefits. Some of the benefits cardholders may receive in addition to having the ability to redeem their Tim Rewards Points up to $45 per week† is the ability to get up to 2% back on essentials† which is a benefit if you use this card on a frequent basis, for example if you spend $250 on groceries, that is 1,250 points that you can receive and redeem for a $5 statement credit. Another benefit for Tims® Mastercard cardholders is the ability to get up to 6% back at Tims†. For those who frequent Tims locations and spend $100 can receive 1,500 Tims Reward Points that can be redeemed for a $5 statement credit with additional points to spare.

Insurance Coverage

The Tims® Mastercard offers limited insurance coverage on retail purchases but not on travel. Its extended warranty coverage lengthens the manufacturer's warranty for most items purchased up to one year. Repairs, replacements, or reimbursements are limited to $1,000 maximum per incident. Meanwhile, its purchase protection coverage allows items purchased with the card to be repaired, replaced, or reimbursed up to $1,000 per incident. The protection is valid for 90 days after purchase.

†Terms and conditions apply. Tims Financial is not responsible for maintaining the content on this site. Please click on the Apply Now link for the most up to date information.