Business Platinum Card from American Express

130,000 MR points

A while back, a reader posted in the Prince of Travel Elites Facebook group about an interesting parallel he had noticed between concepts from economic theory and some of my ideas on how things work in the points & loyalty space.

That got me thinking: it’s not at all surprising that there’s a fair bit of overlap between the study of production and consumption of goods and services and, well, the pursuit of maximizing one’s consumption of every single good or service related to travelling the world. And wouldn’t it be fun to write about a few more of these parallels, so that I can actually put my economics degree to good use for once? 😉

That’s exactly what we’ll do in this article, beginning with some of the most basic economic ideas that are widely understood, before delving into some of the meatier concepts in the field.

The idea of opportunity cost is something that we should all be familiar with, as it underpins every decision we make in our daily lives. Whenever a certain choice is made, opportunity cost represents what you “give up” by not pursuing the next-best alternative choice instead.

When you spend $499 on a credit card annual fee, your monetary cost is the $499, but your opportunity cost is the value of the next-best thing you could’ve spent that $499 on – whether it takes the form of a new kitchen appliance, or the extra gains you could’ve earned by depositing the $499 into an investment account.

Fortunately, most of us already account for opportunity costs when we make decisions on a day-to-day basis.

When we sign up for that credit card with the high annual fee, for example, we do so knowing that we’ll get more value out of paying the fee than we would from buying a new kitchen appliance instead, because otherwise we wouldn’t have made the decision in the first place.

On the redemption side, however, I’ve observed that Miles & Points newbies may have a tendency to ignore opportunity costs and think of their points as “free”, whereas more seasoned practitioners know that this line of thinking is overly simplistic.

Points are always acquired at a cost (even if the objective of the game is to acquire them at as low a cost as possible), so one must always educate themselves on the full range of possible uses for their points, and carefully consider the next-best alternative uses, before making a redemption.

Another foundational economic principle is the idea of optimization. In many ways, it’s what the whole field boils down to: how to maximize one’s outcomes given a certain set of constraints.

In parallel, the pursuit of Miles & Points also boils down to a series of optimization problems that one must solve day after day, year after year: given a certain travel budget and a certain amount of time you’d like to dedicate to this stuff, what steps should you take to maximize your travel possibilities?

On the earning side, we prioritize the most valuable credit card signup offers for our precious credit inquiries, we maximize the bonus points and statement credit offers that come our way, and we use all sorts of spreadsheets and software to streamline the process.

On the redemption side, we seek to maximize value based on our own travel preferences, whether that means taking 16-segment Aeroplan trips to see as much of the world as possible, or booking a direct flight because we value the convenience, even if it may come at a cost.

We’ll chat up the front desk associates at the hotel or spend hours on the phone hanging up and calling again, just to secure the most optimal outcome over the range of all possible outcomes.

In general, I’ve found that points enthusiasts tend to be very keen, if not downright obsessed, about the idea of optimization in our pursuit of travel and our lives as a whole – and that’s the way we like it.

Everyone has heard of the principle of supply and demand, which determines the price of goods and services in a given market, and isn’t hard to see how this applies to the market of loyalty programs.

When there’s an increase in demand, the price increases as a result. Think about the most popular sweet spots in any loyalty program (i.e., highest demand), like the old Marriott Travel Packages before the transition to Marriott Bonvoy, or the good old days of the three-stop Aeroplan Mini-RTW: these are always the ripest for devaluation (i.e., an increase in price) when the program implements changes.

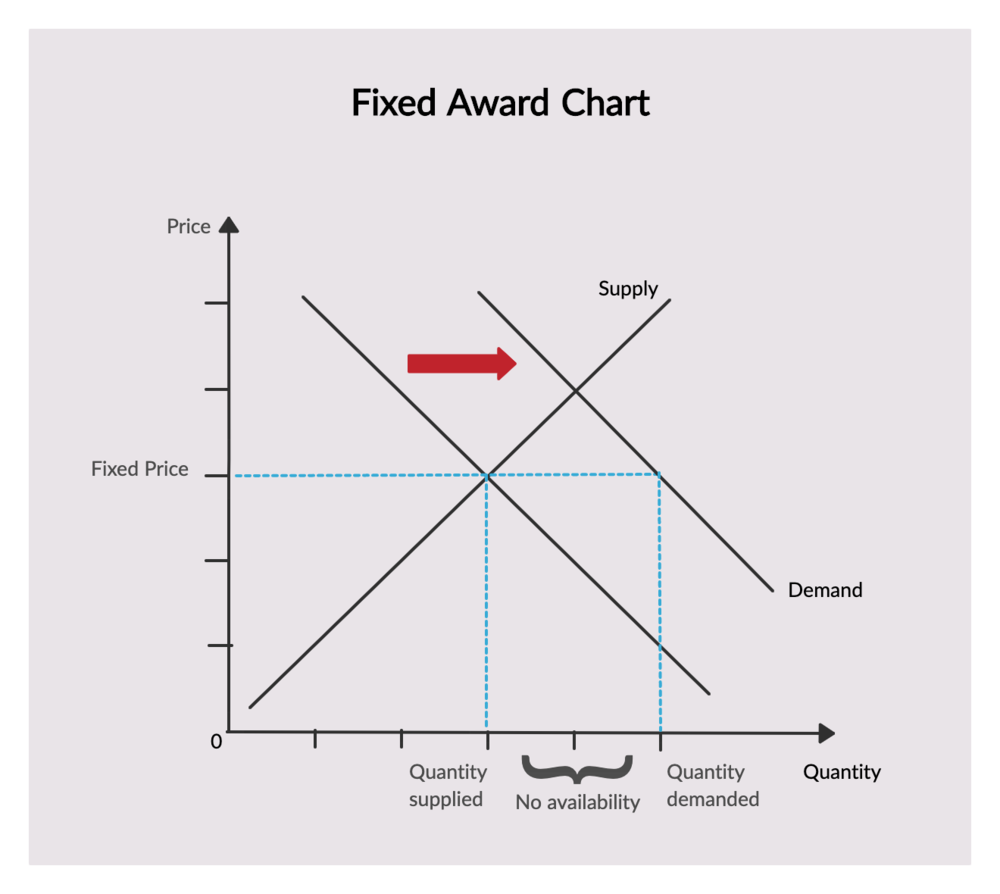

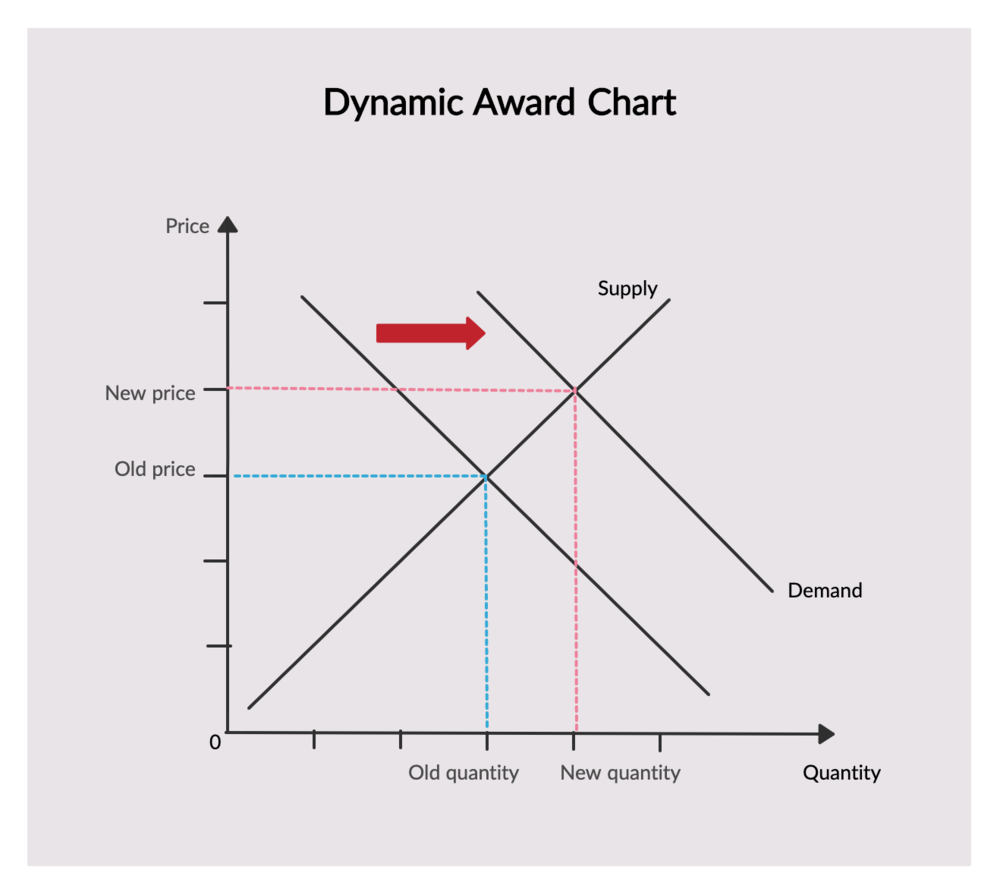

In fact, if we think about loyalty programs with a fixed reward chart vs. a dynamic pricing model, we see that the former program allows the price of a redemption to remain fixed even when demand is high, thus offering outstanding value for the users who are able to book their desired flights.

Other users, however, find that there is not enough supply to meet their excess demand, given the fixed price (i.e., there is no award availability).

With Air Canada’s new loyalty program moving towards a dynamic model for North American flights, the redemption price points will more accurately track the supply and demand (or in Air Canada’s own language, the “underlying economics”) of those flights.

That might be good news for some types of travellers, who are now able to book their preferred flights that previously weren’t being supplied, even if it’s at a higher price. For those of us who are on top of our game, however, the move towards a dynamic program inevitably makes it more challenging to capture maximum value.

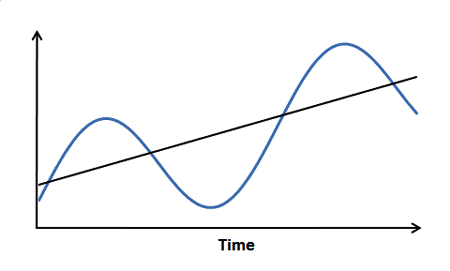

Just as supply and demand is a key principle in microeconomics (i.e., at the level of individual households and businesses, or in our case, individual loyalty programs), the business cycle is a key concept in macroeconomics (i.e., the economy, or loyalty landscape, as a whole).

The business cycle is also known as the “boom-and-bust cycle”, and is most commonly depicted graphically as follows:

The basic idea is very simple in the end: there are always ups and downs in the economy at large, with upswings very reliably following downswings and vice versa; however, the overall trend of the cycle (in the economy’s case, real GDP) is continually upwards.

“Hang on,” you might be thinking. “But don’t the loyalty programs only devalue and get worse over time?”

Of course they do. The true parallel here lies between the business cycle and the value of loyalty programs from the perspective of the banks and airlines.

Loyalty programs are insanely profitable for their operators, which is why they’re treated as such big business. A credit card issuer or airline might experience ups and downs in terms of the money that they can extract from the program year-on-year, but in the long run, loyalty programs are seen as key to driving future profits, as they have proven very reliably since they were first introduced in the 1980s.

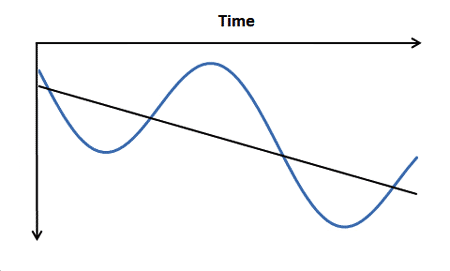

If we consider things from our perspective as consumers who seek maximum value from the programs, then it’d be prudent to flip the graphic upside down:

For the consumer, the long-term trend of the landscape is undeniably a downward one, but there will always be peaks along the way to capture outstanding value from playing the game.

This means two things: 1) disappointing news is typically followed by uplifting news, and vice versa (consider that we were quite upset when Marriott Bonvoy eliminated the meetings trick for earning elite nights, only to rejoice when Marriott made it possible to double-dip on elite nights via the US credit cards shortly after that), and 2) the best time to get started with Miles & Points was 10 years ago, and the second-best time is now.

The concept of comparative advantage is most commonly applied to the study of international trade. To put it simply, even though Country A might be more efficient than Country B in producing two different types of goods in absolute terms, it’s still in both countries’ best interest to respectively produce the good that they are comparatively better at (i.e., the good which they can produce at a relatively lower opportunity cost), and then trade with each other.

If that made your eyes glaze over, then think of it like this: imagine you’re the best lawyer but also the best babysitter in the community where you live.

You have an absolute advantage over everyone else in both law and babysitting, but your comparative advantage is practicing law, because it pays much better than babysitting. Even though you’re better than everyone else at babysitting, it’s optimal for you to dedicate all your time to practicing law and then trading your income for others to babysit instead.

How does this apply to loyalty programs? Well, it’s a very useful framework to think about the comparative attractiveness of different programs and their redemption sweet spots.

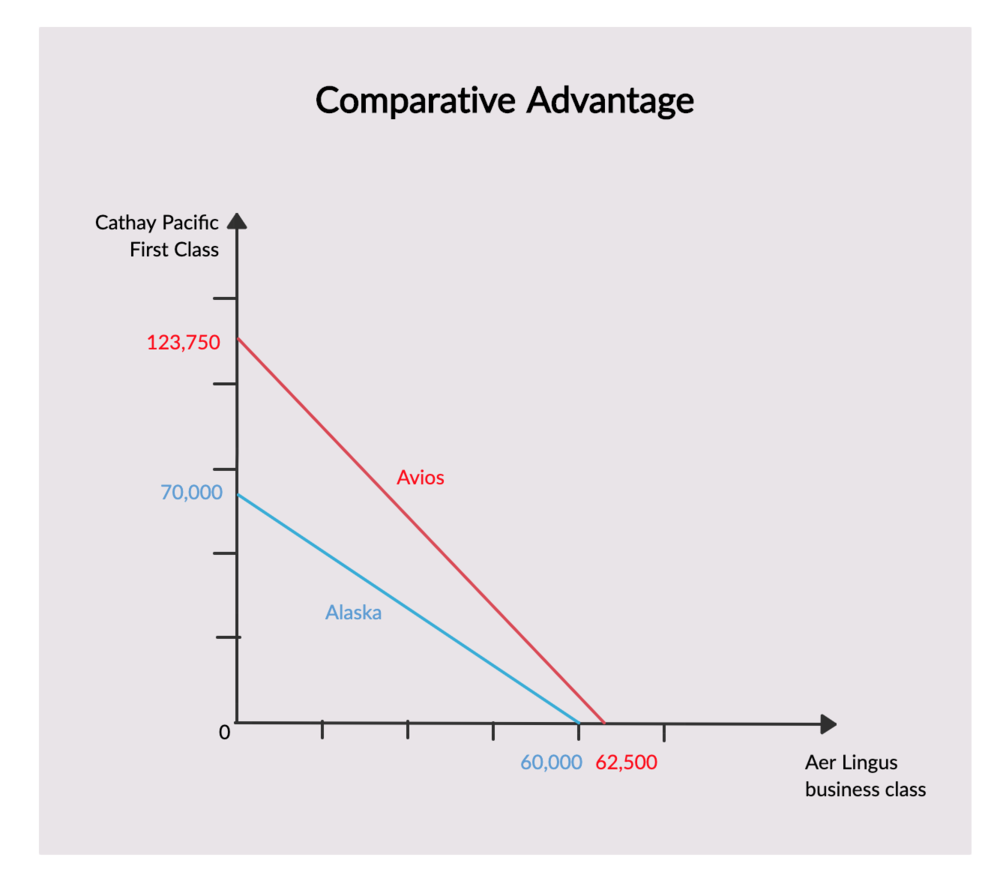

Consider the scenario in which a Vancouver-based traveller has points with both Alaska Mileage Plan and British Airways Avios, and they’d like to book two trips: a Vancouver–Hong Kong flight on Cathay Pacific First Class, and a Seattle–Dublin flight on Aer Lingus buiness class.

With Alaska miles, the two redemptions would cost 70,000 and 60,000 Alaska miles, respectively; with Avios, they would cost 123,750 and 62,500 Avios, respectively. We can think of these price points as the “cost” it takes for each loyalty program to “produce” each specific award.

Notice that the two Alaska price points are both lower than the Avios price points in absolute terms. From this, we might be tempted to draw the conclusion that our traveller should focus all their efforts into earning and redeeming Alaska miles for both trips – but we’d be mistaken.

A much better way to achieve our objectives would be to earn both currencies and use them towards the redemption in which that program has a comparative advantage.

By redeeming 70,000 Alaska miles for Cathay Pacific First Class, you are giving up 70,000/60,000 = 1.17 units of an Aer Lingus business class flight. Meanwhile, by redeeming 123,750 Avios towards Cathay Pacific First Class, you’re giving up 123,750/62,500 = a much higher 1.98 units of an Aer Lingus business class flight.

Alaska miles therefore have the comparative advantage in booking Cathay Pacific First Class, and should be put towards that use. A similar calculation would show that Avios have the comparative advantage in booking Aer Lingus business class (because that’d require giving up fewer units of a Cathay First redemption than using Alaska miles), and should therefore be put towards that use.

Thinking of sweet spots in terms of comparative advantages allows us to identify the strongest sweet spots across the entire loyalty landscape, such as Cathay First via Alaska Mileage Plan or the Etihad Apartments via Aeroplan, and achieve maximum value across all our points currencies – in the exact same way that countries around the world achieve optimal outcomes by focusing their production on their comparative advantages and trading with each other.

Okay, that was a lot of mumbo-jumbo (did anyone actually enjoy their trade classes?) – so let’s talk about something a lot more relatable.

The tragedy of the commons refers to the phenomenon of individuals taking advantage of a shared resource according their own self-interest, but depleting the shared resource and thereby acting against the interest of the wider community over time.

It can be generalized to a wide range of scenarios, from cows grazing on “commons” (i.e., a piece of common land, hence the name) to overfishing in a body of water, to the relentless exploitation of all the credit card bonuses, points-earning opportunities, and redemption sweet spots within the loyalty scene.

The thinking goes something like this: when someone first finds out about all the opportunities for travelling the world at a fraction of the price thanks to Miles & Points, it’s obviously in their best interest to pursue these opportunities.

But as more and more individuals graze at our common green grass of welcome bonuses and redemption tricks, the shared resource risks collapsing due to overuse, thanks to the principles of supply and demand that we covered earlier: credit card companies slash their bonuses and implement tighter eligibility rules, while airline and hotel programs close loopholes and devalue their reward charts.

Pictured: All of us.

Indeed, the tragedy of the commons might be a significant reason why we see the “business cycle” for loyalty programs is downward-trending in the long run: as more and more cows arrive to graze, the grass remains tasty, but gets less and less green over time.

What’s the solution here? Well, in the theory, the tragedy of the commons can be solved through two distinct means: regulation or cooperation.

In the absence of a regulatory body to oversee the Miles & Points community, then, I’d like to think that we as a community have done a decent job of self-censoring where necessary, keeping sensitive information within in-person circles, and bringing out the pitchforks when our favourite bloggers accidentally say too much. 😉

The field of economics has traditionally concerned itself with “rational actors”, basing itself (and indeed, priding itself) on the assumption that humans are rational beings that make decisions according to precise rules and logic.

This was also one of the reasons why I grew slightly disillusioned with economics as I studied it over the years: as appealing as models and equations are in an academic setting, they don’t always translate into the real world, where it’s commonly known that humans are anything but rational actors.

That’s why I’d like to end our little discussion here by drawing upon the subfield of behavioural economics, which has emerged in recent decades to address this weakness. The endowment effect and loss aversion are two closely-related concepts that I observe time and time again in Miles & Points – and that I myself am by no means immune to.

When I recently wrote about the Double Rewards promotion ending soon, Prince of Travel reader Jane captured the endowment effect very succinctly in her comment:

Great article. I find the cash out question an interesting psychological problem. Lots of people are hesitant to cash out their Amex points at 2 [cents per point] but at the same time very few people are interested in buying Avios or Aeroplan points at 2cpp (essentially the same thing).

This is the endowment effect in a nutshell: individuals are more likely to retain something they already own than acquire the same thing when they don’t already own it.

We can also frame this phenomenon in terms of loss aversion, which is our tendency to find greater pain in losing something than we find enjoyment in acquiring the same thing: by cashing in our points, we lose out on the opportunity to dream about the amazing trips we could’ve booked with those points, and we place a greater psychological emphasis on that sense of loss than the sense of enjoyment in gaining that ability to dream, even if they’re worth the same monetary amounts.

Loss aversion is also commonplace everywhere else you look in the loyalty landscape, and make no mistake about the fact that it’s something that the loyalty programs ruthlessly exploit to their advantage.

Think about the whole game of elite status and all of the mileage-running and mattress-running behaviour that it elicits among its loyal members. You might have a fully grown adult who’s a bastion of rationality in their work and home life, but dangle the carrot of free upgrades and extra-special treatment in front of their noses, and you’ll have them willingly spending an entire weekend away from their families flying around the country on turboprops.

All because the pain of losing elite status is felt more keenly than the pleasure of earning it in the first place, even if their actual travel patterns might not warrant going out of their way to earn that status – or else they wouldn’t need to mileage-run in the first place.

(Like I said, I’m just as guilty of this behaviour as anyone, having taken extraneous mileage-runs to Greece just to retain my Star Alliance Gold status with Aegean Airlines for two years in a row, until finally coming to my senses and letting it lapse in 2017.)

As you earn and redeem points to maximize your travel, keep a watchful eye out for the behavioural biases of the endowment effect and loss aversion, and make sure your human side isn’t leading you astray directly into the loyalty programs’ pockets.

Economics is ultimately the study of human decision-making, so it’s unsurprising that there are many parallels to be drawn between the micro and macro theory and the many decisions we make on a daily basis in our pursuit of Miles & Points – ceteris paribus, of course.

I hope you’ve found this article somewhat illuminating as we consider the many truths, trends, and transformations in our ever-shifting landscape, both in the rational ebbs and flows of the market and the irrational tendencies that we as humans often exhibit.

This article provides analysis of the industry trends based on economic science plus the methodology how to estimate and optimize points redemption for comparative advantage.

Thanks Ricky for being one of the leading experts in the field.

Great article Ricky! I often have thought of the same parallels as I navigate the Miles & Points game. Also, nice touch with the “ceteris paribus”, brought me back to my Econ classes 🙂

As a person with a minor in Economics, this was a fun read! I was surprised to see so many economic theories related to miles and points. Keep up the great posts!

I’m disagree. While I’m definitely like it best when Ricky shares offers, opportunities, reviews, and ideas, I’m not anti with articles like this. I will think it as a deep thought that Ricky has and want to share with us (like what best friends do) as a human and a blogger that I like. Good job as usual Ricky 🙂

Sorry, I’m with Jay. I don’t see the point of this article. I’m sure there are others like me who are here exclusively for offers, opportunities, reviews, and ideas. Theoretical musings offer no value to me.

But given that we’re in the midst of a global pandemic and Ricky no doubt needs some filler, I’ll let it slide 🙂

Appreciate the feedback + @Jay. I find the theoretical musings fun to delve into every now and then but realize that they aren’t everyone’s cup of tea. It’s why we need a wide variety of content so that there’s a little bit of something for everyone 🙂

A cool flashback to my undergrad microeconomics class. Interesting parallels Ricky, especially on the tragedy of the commons.

You in particular have got a big herd of cattle grazing at the field 😉

I would add ecological fallacy where people attribute the characteristics of the group to themselves. For myself, I focus on my goals. After all of it, focus in on what you want to do.

I agree with this one – people can be quick to get drawn into the luxury flights and fancy champagnes just because it’s a large part of our discourse in this space, but it’s important to remain true to your own travel goals as well.

Ricky, as a constructive comment, I don’t necessarily believe these articles (including Kirin’s recent one) add value to your site. Mainly because I believe in Specialization. 🙂

@Jay, I disagree. Ricky’s articles in this vein are clear, concise, and avoids cliches while still keeping it conversational. In my opinion, Kirin’s article was not concise or clear.

As for the content, I very much enjoy this kind of subject. I also enjoyed other ones such as the one on the ethics of churning. Ricky has the ability and the knowledge to see the activity from several perspectives and communicate it eloquently.

Just so people know: there are actually two Eric’s posting here

I’d also have to disagree, while many portions of this were factors many of us already consider, we all experience these psychological effects that are often self-detrimental. In my case it would’ve been prudent to recognize that the 2cpp amex promo existed in the same context as my ability to buy aeroplan points at under 2cpp. This would have effectively informed me to redeem all my amex points for 2cpp and purchase the same amount of aeroplan points for any future anticipated travel with aeroplan. This would prove almost strictly superior depending on my outlook for said points. I’m sure many across this ecosystem have shared similar experiences that Ricky has eloquently laid out for us. Also from an academic perspective this is interesting, so there’s that 🙂

I’d agree on Kirin’s recent one, as well-intended as it was – it felt like it just repeated ‘everyone hang tight’.

This one though I find interesting, and at least the section on comparative advantage has me re-evaluating my strategy, so I actually quite like it. Your mileage may vary?