Bad news broke on September 16, 2022, when many Telus customers received an email stating that they’ll be charged a 1.5% service fee for using a credit card to pay their phone bill as of October 17, 2022.

This is a highly anti-consumer policy that serves only to line the pockets of the Canadian telecom giants, who are already some of the most overpaid in the entire world.

Even worse? These fees could set a dangerous precedent going forward for all Canadians who use any type of recurring subscription service.

Yet Another Telecom Fee

Canadians already pay some of the highest prices for cell phone services on the planet. It’s therefore baffling that an huge company such as Telus – which by the way is enormously profitable – would sue Visa and Mastercard over their interchange fees… and yet, that’s exactly what Telus did.

And they won, too. This 1.5% surcharge (plus GST) on top of your phone bill represents the Canadian Radio-television and Telecommunications Commission (CRTC) siding with the our telecom giants, in that interchange fees can be passed onto the end consumer of telecom services.

That’s why you’ll be paying the surcharge from October 17, 2022.

To add insult to injury, Telus didn’t even bother changing the header from “lorem ipsum” standard typeset.

Telus’s budget-oriented brand, Koodo, won’t be levying the fee, but to me it feels like this is only a matter of time. Similarly, Visa- and Mastercard-branded debit cards are exempt, as are prepaid credit cards – for now.

I suspect this first fee is just an initial step toward normalizing this type of surcharge, and it will not be the last.

Funnily enough, consumer protection laws are working as intended in Quebec, where this fee cannot be legally levied.

Maybe the rest of the country should catch up, because having the other 12 provinces and territories of our great nation subject to yet more price-gouging by these enormously successful cell phone giants isn’t fair.

Why Credit Card Surcharges Are Anti-Customer

Telus’s assertion that the credit card interchange fees are too high is bogus, because every other business in Canada has to pay these same fees.

Accommodations for interchange fees are already built into the final price of any good or service you purchase, including Telus’s cellular service packages.

Therefore, levying a 1.5% fee is designed solely to try and incentivize you to drop using a credit card for payment.

The first reason this is bad for consumers is because not using a credit card to pay for services weakens your bargaining position if things go wrong.

If you pay for a prepaid service via credit card, then it is in fact your issuer (such as Visa or Mastercard) who pays the merchant. Your issuer then issues you a statement detailing what you owe them, which you then pay to remain in their good graces.

This means that if there’s a third Rogers-level network outage, and your phone company has failed to provide its stated services but it attempts to charge you your bill in its entirety, then you are fully within your rights as a consumer to request a chargeback. This is where the credit card company will reimburse you.

More often than not, issuers side with consumers because your usage of the card earns them interchange fees, which is one of the main sources of revenue for any credit card issuer.

These are services you do not get if you pay with debit or make a direct payment out of your bank account. Instead, you’ll be dealing with a company that can state “we investigated ourselves and found no wrongdoing, so your refund is denied”.

The second reason this is a major anti-consumer move is something I’ve already covered: the question of precedent.

In theory, the maximum fee that could be levied is 2.4% instead of 1.5%. Telus is charging 1.5% for now, but that doesn’t mean this rate will last an eternity.

Similarly, while these charges may commence with Telus, there’s no telling what other companies might attempt to fleece consumers with similar surcharges.

Finally, while I definitely don’t recommend carrying a balance on your credit card, if you do once in a while pay a credit card late, you’re better off as a consumer doing so in a higher-interchange environment.

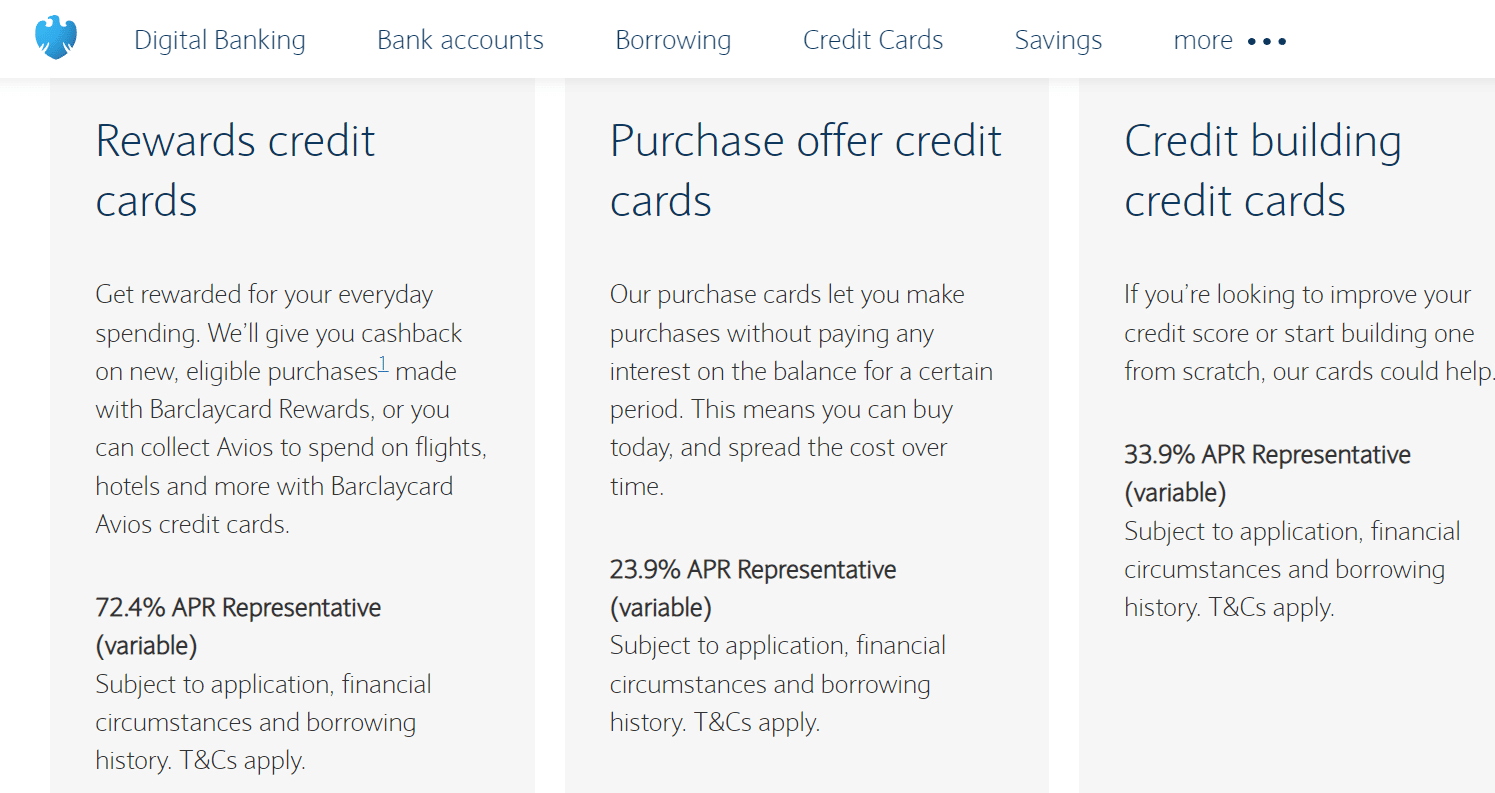

This is because merchant fees help keep down the interest that credit card companies charge to customers. Don’t believe me? Take a look at the stated “representative” APRs posted by Barclays bank in the United Kingdom, a low-interchange jurisdiction:

Don’t get me wrong, nobody wants to pay the 19.99% APR standard in Canada, but 72.4% is next-level ridiculous!

Vote With Your Wallet

When you choose to purchase a new phone, and agree to pay a company for the provision of its ongoing services, you are doing so as a free individual. Nobody (I should hope) is obligating you to go with one provider for your phone service or another.

Similarly, other services which use the now-ubiquitous subscription model are yours to select without being subjected to hidden fees or bogus fine print.

The same goes for the credit cards you use for recurring payments. I love the customer service that is provided by American Express, and the bonus 3x points on streaming services leads me to put my Netflix subscription onto the American Express Cobalt Card.

I choose to use Amex, and this particular card, because of the perks and customer service that the issuer offers me. If they didn’t offer me these incentives, I’d spend my money elsewhere.

Well, telecoms such as Telus tend to give customers much lousier service than American Express. Once they’ve got your money, they won’t be in any rush to help you get it back if they mess up in providing goods or services.

This is the polar opposite of credit card issuers, who have an incentive to assist you in getting your money back in the event a company doesn’t provide you what you paid for.

One might not love Visa, Mastercard, or American Express, but I’d way rather have one of them fighting against another giant corporation on my behalf than attempting to re-enact David and Goliath on my own. Therefore, these credit card surcharges should not be tolerated.

I invite you to vote with your wallet and move services over to companies that are willing to let you use your credit card without levying an unfair surcharge.

Doing so can protect your money and earns you rewards, instead of bolstering those that want to nickel-and-dime you, even when they’re already rolling in the dough.

Conclusion

This decision by the CRTC to permit Telus to further engage in price-gouging against customers is completely against the interests of the average Canadian consumer, and sets a dangerous precedent that other companies may follow.

The good news is that all customers have the right to use companies that give them the best services, and are not shackled to any one provider.

I’d encourage Telus customers to switch towards other providers to continue earning rewards and benefiting from protections on their credit cards without being subject to an extra 1.5% surcharge.

Until next time, don’t be afraid to say no to credit card surcharges.

I just got my notice today in regards to this surcharge. I have internet cable and phone with them and will now be looking for another provider

Great article! I have my phone plan with Telus and am planning on switching to another provider ASAP! Unfortunately, I’m locked in with my internet for another year.

This is such an unnecessary fee, it’s ridiculous, idk what they were expecting.

If you have Telus Internet, switch to paper billing to make them pay! I can be petty if they can!

It’s always a good idea to leave any telecom regularly. That way you get on their winback list and will get a call with a killer deal. I’m currently with Telus after leaving for $35 for 30gb a month. That’s worth way more than the credit card issue. Also, prepaid Visa and MasterCard are exempt. So I’ve moved my PAD to my Wealthsimple spend account and will still get 1% back. Also, PC money account gives 1% back in PC points. Minor inconvenience to send money to my WS account monthly.

Pay by automatic withdrawl. This month, from bank account “A”, then CALL and change the payment to account “B” for next month, then change back and forth every month, with a call. Their call center costs will skyrocket.

I am a Koodoo customer, and the option to pay with a credit card has not worked for the past two months.

The CRTC better squash this Sh!t before it gets out of hand!!

Just because you ‘can’ charge a fee doesn’t mean you should!. Interchange fees are part of business costs on with other operating expenses. If you are a high volume merchant, your merchant fee can be as low as 0.99% so Telus is likely making some money on these fees. Whats next? Is Telus going to charge us a fee every time we call customer service or visit a retail location? — Fortunately for me I already cancelled my Telus account years ago!

So if you get your monthly invoice electronically you get no discount, time to change to paper invoices, screw Telus, their mailing fees alone will be more than the 1.5% surcharge.

If I wasn’t locked in a 2 year plan with Telus, I’d move to Novus instantly. Sadly though, I doubt it’ll make any difference either way as it’s just a matter of time until the other carriers follow suit and price gouge everyone just like Telus (probably followed by other industries as well afterwards)

I reviewed my current internet plan and found Telus to be the best in my area so I am sticking with them. I did, however, adjust my plan to a higher speed plan with a total saving of $30 per month. I would not have even looked at my account had they not sent the 1.5% increase e-mail.

They are down $ from me, they locked me in for another 2 years but I’ll have a new wifi router so over all I think it worked out for me.

I’d be looking to switch providers ASAP if I was with Telus. I’d also be looking to make multiple cash payments in person at Telus stores in order to increase their costs of receiving payments. Screw them.

You cannot pay your bill at a Telus store!!

Good to know. Thanks. So much for my idea.

It will be interesting the way Bell and Rogers handles this. Telus is basically a mobile phone company, so the charge is just for your phone plan. The other two are massive and have numerous products people pay monthly with cards – mobile, internet, TV, streaming services, etc. If they do a blanket surcharge on all their products, consumers are basically screwed.

Telus at least out west provides everything that Bell/Rogers do – our internet is with them, and I know people who have internet/phones/cable/streaming/etc. all with Telus. We’re pretty rural so our only reasonable speed internet options are Telus or Shaw.

I reckon Rogers will wait a long time before ‘announcing’ any new fees since public anger at the numerous outages is still red hot lol. I think Bell might wait as well to see how many clients Telus loses to this new fee, but Bell is likely next in line to implement this fee, unfortunately. If you have a credit card that pays nicely on re-occurring bill payments, then you can either recoup or at least offset this fee. Scotia’s Momentum Infinite card pays 4%, so you still are ahead by 2.5% and have mobile device insurance.