For many years, Scotiabank has maintained close ties with Cineplex and the SCENE loyalty program by issuing SCENE co-branded credit and debit cards.

As of December 13, 2021, the Big 5 bank and the cinema giant have taken their relationship to the next level by combining their respective points programs: Scotia Rewards and SCENE have merged to become Scene+.

Everything’s largely staying the same, and the features of Scotia Rewards program that we’ve come to appreciate will still be around.

However, there are a few minor changes to take note of, as well as a few mildly interesting new opportunities that arise.

Scotia Rewards Has Become Scene+

The Scotia Rewards and SCENE loyalty programs have merged to become Scene+.

Scotia Rewards points have been phased out, and the Scotiabank travel credit cards will simply earn Scene+ points instead. Your existing Scotia Rewards points and SCENE points have all been converted to Scene+ at a 1:1 ratio:

- If you currently have a Scotiabank credit card but didn’t have a SCENE account, a new Scene+ account has been created for you automatically to house your old Scotia Rewards points.

- If you previously had a SCENE account, that’ll become your Scene+ account, and your Scotia Rewards points will have transferred over by now.

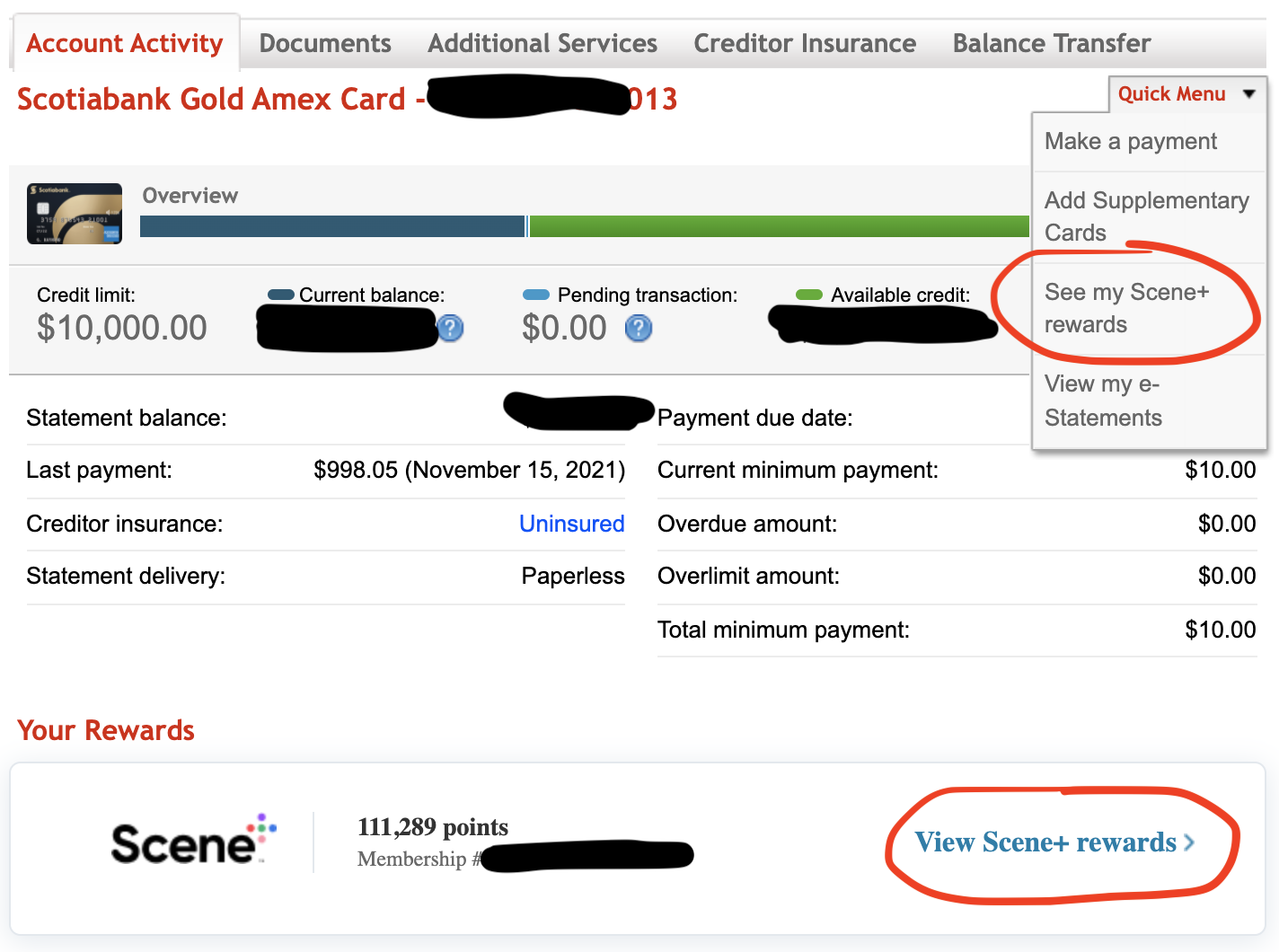

The migration process was seamless for our team member Josh, who has two active Scotiabank credit cards but has never had a SCENE account.

You can access your Scene+ account for the first time by following the links from Scotiabank’s online banking portal:

You’ll be prompted to create a Scene+ password, but your email address and profile information will be populated from Scotiabank.

Going forward, you’ll be able to earn Scene+ points in the exact same ways that you could earn both Scotia Rewards points or SCENE points: by making purchases with an eligible Scotiabank credit card or debit card, or by seeing movies at Cineplex.

Earning rates and welcome bonuses on Scotiabank’s credit cards haven’t changed at all, so you’ll still get a strong 5x return on groceries, dining, and entertainment with the Scotiabank Gold American Express Card, for example. Also, card designs aren’t changing at this time.

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

50,000 Scene+ points

First Year Free

|

50,000 Scene+ points | $575 | Apply Now |

|

80,000 Scene+ points

$399 annual fee

|

80,000 Scene+ points | $261 | Apply Now |

|

45,000 Scene+ points

$150 annual fee

|

45,000 Scene+ points | $220 | Apply Now |

|

40,000 Scene+ points

$199 annual fee

|

40,000 Scene+ points | $176 | Apply Now |

|

5,000 Scene+ points

$0 annual fee

|

5,000 Scene+ points | $60 | Apply Now |

Scene+ Is a Third-Party Loyalty Program

Here’s an important distinction to make: Scene+ isn’t Scotiabank’s in-house rewards currency like Scotia Rewards was before; instead, it’ll be treated like a third-party loyalty program for most intents and purposes.

The practical implications of this include:

- Instead of having a separate Scotia Rewards account for each Scotiabank credit card that you hold, all the points earned from different Scotiabank credit cards will be pooled into a single Scene+ account going forward.

- If you were to cancel a Scotiabank credit card, you previously had 60 days to redeem your Scotia Rewards points or they’d be forfeited. Now, these points will remain safe with Scene+ even if you cancel your card.

- The points you earn from your Scotiabank credit card may post to your Scene+ account along with your monthly statements, rather than instantly after each purchase (as is the case with most co-branded credit cards).

This arrangement also makes Scotiabank unique among Canada’s Big 5 banks as the only bank that doesn’t issue their own in-house rewards currency.

Scotiabank now has no counterpart to RBC Avion, TD Rewards, CIBC Aventura, or BMO Rewards. Technically speaking, they only have co-branded Scene+ credit cards, even though they function very much like an in-house rewards currency and are joint-owned by Scotiabank along with Cineplex.

Use Scene+ Points for Any Travel Purchase

Scotia Rewards points were considered one of the most powerful secondary points currencies that a Canadian traveller can collect. Fortunately, that isn’t changing with Scene+.

They’re of secondary importance because their redemption value is limited to 1 cent per point (cpp) against travel purchases. If you have 40,000 Scene+ points from signing up for the Scotiabank Gold American Express Card, you can only redeem them for stuff that’s worth $400 – and not a cent more.

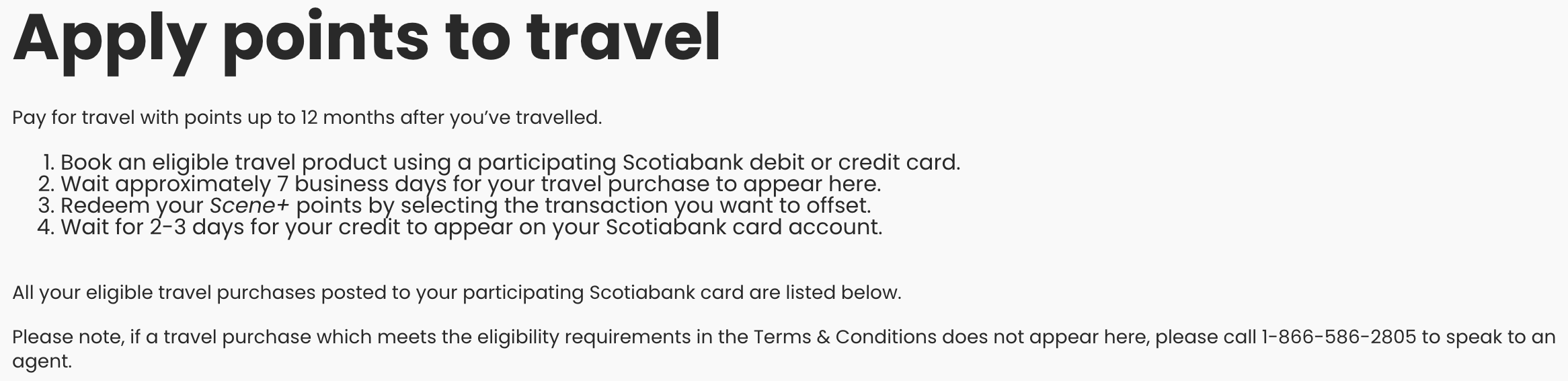

On the other hand, they’re powerful because it’s extremely easy to redeem them for 1cpp. Simply pay for travel using your Scotiabank credit card, and you can redeem your points as a statement credit against any travel purchase.

Unlike rival in-house points programs from TD, CIBC, and BMO, there’s no need to book through a dedicated portal or anything like that. This also allows you to redeem your Scene+ points at 1cpp towards stuff that can’t otherwise be booked on points in the traditional sense, such as car rentals, train tickets, cruises, or (despite some initial technical difficulties) public transit or rideshares.

To use Scene+ points this way, you need to make a minimum redemption of 5,000 points (against $50 in travel expenses). Also, unlike with Scotia Rewards before, it seems you can no longer apply points to partially cover a single transaction, which may be an inconvenience as you try to redeem against larger purchases.

Earn 3x Scene+ Points on Hotels and Car Rentals

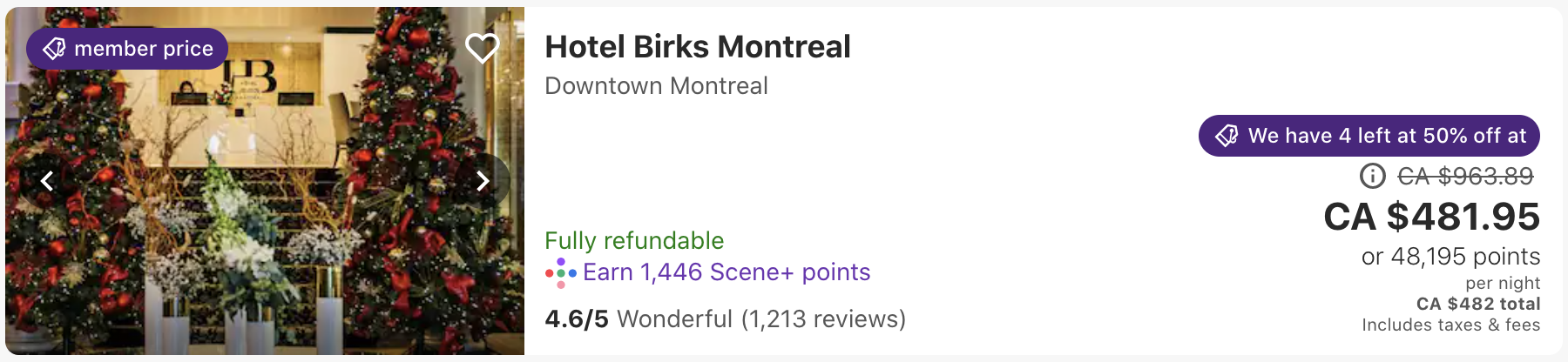

With the sun setting on Scotia Rewards, you’ll now have access to the new Scene+ Travel portal powered by Expedia.

You’ll earn 3x Scene+ points on hotels and car rentals booked through Scene+ Travel, in addition to the credit card rewards you earn for making a travel purchase.

As long as the price you see with Scene+ Travel is the same as what you’d otherwise pay, it could make sense to book through Scene+ Travel for an extra 3x Scene+ points (equivalent to a 3% return) on top of the points you earn from your credit card.

Keep in mind that booking chain hotels through third-party travel agencies is rarely a good idea. You’re usually better off booking directly with a loyalty program like Marriott Bonvoy or Hilton Honors to earn points, rack up elite qualifying nights, and enjoy your elite benefits.

Even if you’re staying with a non-chain property, you could book luxury hotels through third-party booking services like Virtuoso or Amex Fine Hotels & Resorts, or cheaper properties using Hotels.com for an average 10% return.

On the other hand, booking car rentals through Scene+ Travel could be a good idea for that extra 3% return.

However, you’ll still want to weigh this against booking directly with the car rental agency for elite status benefits, or against booking portals that you could use – for example, Aeroplan Elite Status members are entitled to 3x Aeroplan points on car rental bookings made through the Aeroplan portal, so that would be more valuable than Scene+ Travel’s 3x Scene+ points.

Nevertheless, it’s a useful option to have around for Scotiabank credit card holders.

Other Ways to Earn Scene+ Points

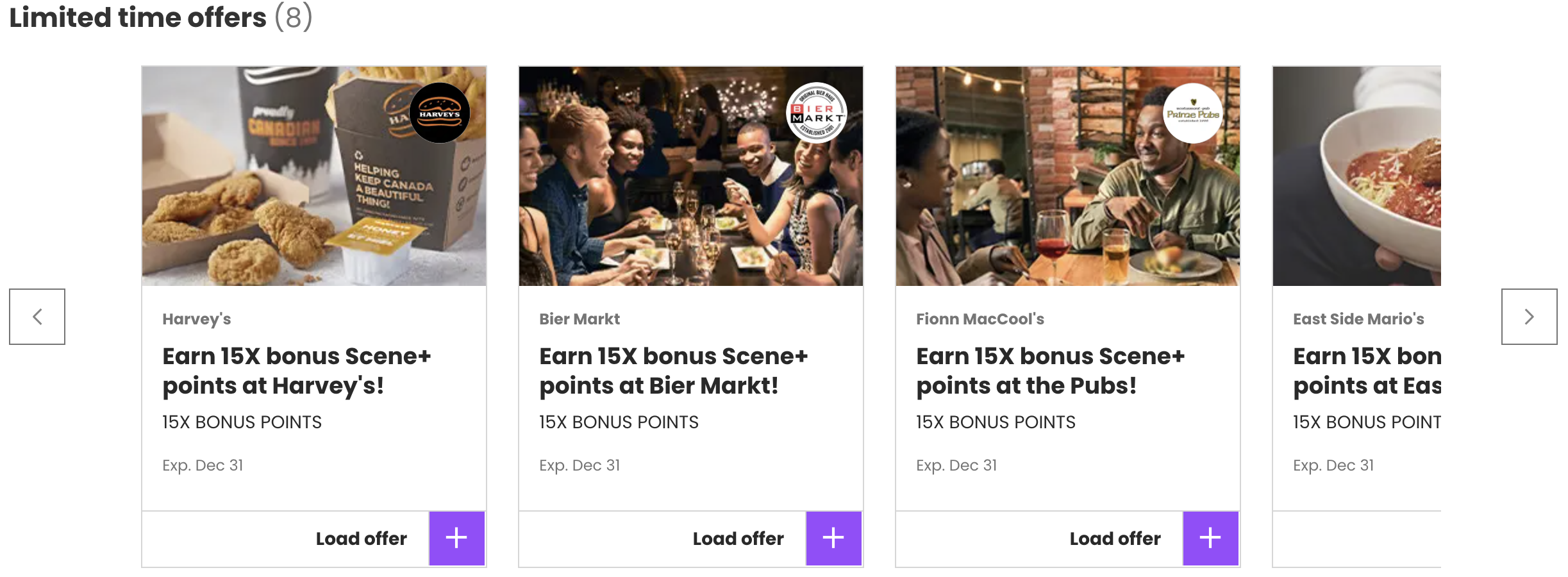

Scene+ has introduced Scene+ Offers, individual partnerships with specific merchants where you can earn bonus rewards.

I’d say these offers are more akin to RBC Offers or Neo and Brim‘s rewards programs, rather than Amex Offers. Still, it’s worth checking to see if there’s any extra value you can get here.

You can use these offers as a Scene+ member even if you don’t have a Scotiabank credit card. Note that the 15x rates are relative to the base rate of 1 point per $3 spent that Scene+ members earn at partner merchants, so really it amounts to a 5% return.

However, if you do have a Scotiabank credit card, these offers are separate from credit card rewards, and the bonus points earned will stack with them. So with 5x rewards on dining from your credit card, plus a 5% return with a Scene+ Offer, you could get 10 points per dollar spent in total.

Here’s an example of the terms and conditions from a Scene+ Offer:

* 15X Scene+ points bonus offer is valid on purchases made by December 31, 2021 only, at participating Bier Markt restaurants. Valid for one time use only. Once you have loaded your offer, you will be directed to a confirmation page. Scene+ members only need to present their Scene+ membership card at the time of payment to earn 15 Scene+ points for every $3.00 spent on the purchase of food and beverages (excluding alcohol where required by law), less all taxes, gratuities and service or delivery charges, to a maximum of 5,000 bonus Scene+ points per transaction. Valid for dine-in and walk-in/take-out orders only. Members must ensure that they receive the confirmation page when loading the offer. In the event of a dispute, Scene+ is not responsible for issuing bonus points to any member that does not receive the confirmation page. Only one (1) bonus points offer per transaction. Cannot be combined with any other offers including but not limited to free appetizers, two can dine, discounts and specials/ feature menu items. Scene+ membership cards are limited to earning Scene+ points on a maximum of three (3) transactions per day across all participating Recipe restaurants. Some restrictions and limitations may apply. ®Trademarks of Recipe Unlimited Corporation, used under license.

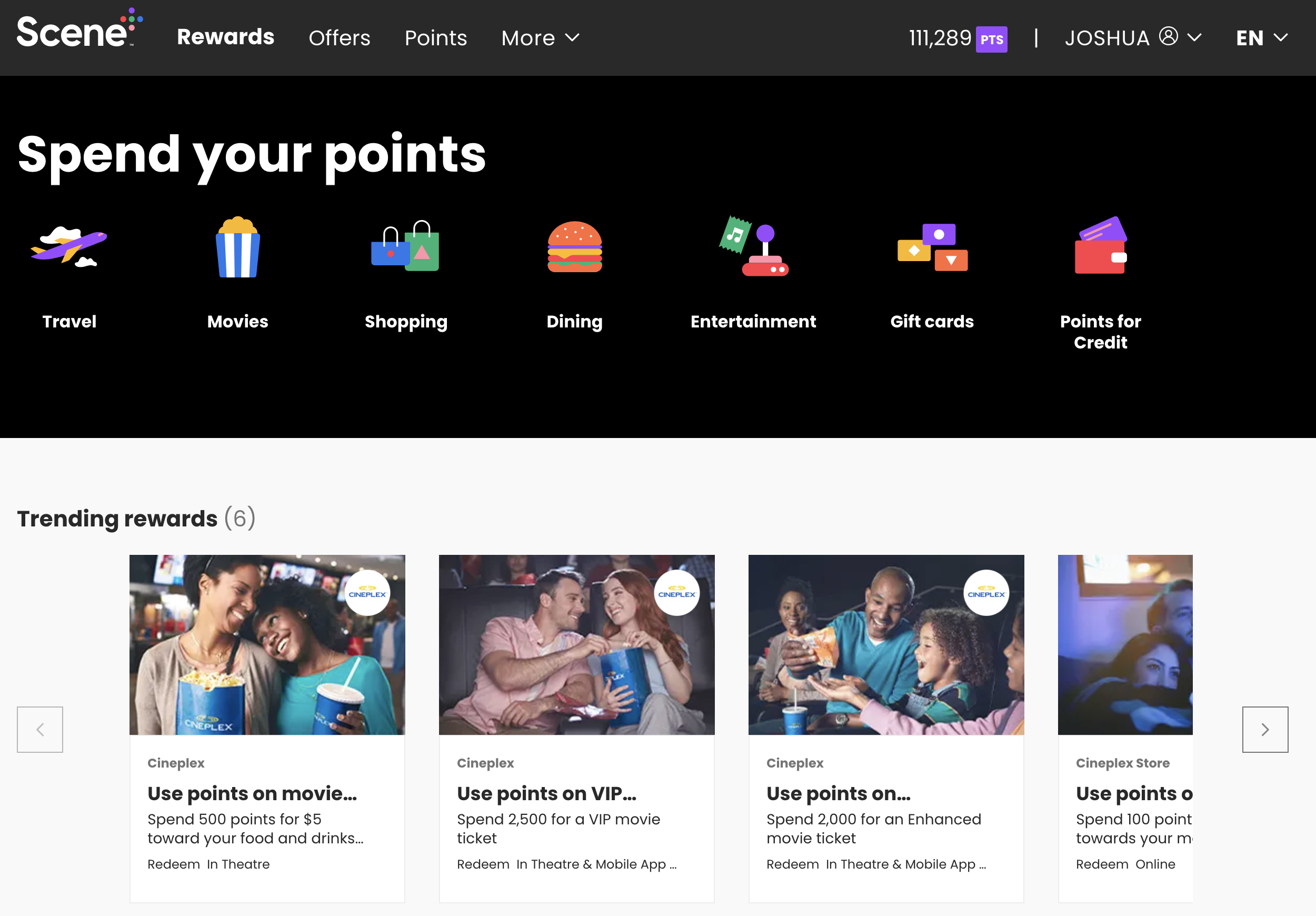

Other Ways to Redeem Scene+ Points

In addition to statement credit for travel expenses, you can also redeem points at 1cpp via Scene+ Travel. You can pay with a mix of cash and points, making this a good way to use up a leftover balance that you’re unable to use for a statement credit.

Aside from that, there are a few other ways to redeem Scene+ points, but the value is always best if used for travel. Here are a few other ways you can use your rewards:

- Cineplex movie tickets

- Gift cards

- Apple and Best Buy merchandise

- Statement credit against non-travel purchases (0.33 cents per point)

Occasionally you may find redemptions at 1 cent per point, but never more. Since it’s easy enough to use points for a refundable booking, I don’t see any advantage to using them for anything other than travel.

Conclusion

Scotia Rewards and SCENE have merged to become Scene+. You can find all the details on the Scotiabank website.

The changes are mostly cosmetic in nature, with both programs rolling into one but continuing to function as they did before. Like Scotia Rewards before them, Scene+ points will remain useful for offsetting the costs of travel outside of flights and hotels.

If I’m being honest, I do wish Scotiabank and the other Big 5 banks outside of RBC would take the leap of making their rewards programs even more interesting by adding a couple of airline or hotel transfer partners one of these days – but in the absence of greater competition among the Big 5 banks, I’m just relieved that Scotiabank hasn’t taken a step backwards as they tweak their strong program, albeit one of secondary importance.

When you use the refund hotel trick, when the scene points are refunded to you via statement credit.. which credit card will it be? (If you have more than one card)

What happens with the yearly bonus points we used to get through Scotia Rewards for the credit cards? I see no mention of them anymore anywhere.

Will Scotiabank approve you for more than one Rewards or Scene+ card at a time? Can I hold two? Will they approve me for two cards?

A payment of $998.05 …

Such a curious amount to pay your bill 😉

Not really. If you always pay your bill in full, the cumulative sum is always going to be random number with decimal places. For instance, you gas up 10 times, the sum is going to be pretty random; and to pay it in full, the payment will be whatever the number. In his case, $998.05. Why so surprised?

Great post! How do I add my existing scene card to the Scotiarewards program so they become one account instead of them opening a new Scene account for me?

Doesn’t make sense to have 2 Scene+ accounts

How do we merge our accounts?

It’ll happen automatically.

That seems like a recipe for disaster. I can’t see how the accounts will be linked… and how will they know which account is mine? I have had so many problems with Scene and ScotiaRewards separately. They re-issued my Scene account number recently. My bank account and the scene Scene account are using different emails. I don’t want them to randomly create me another account. Maybe you can press Scotia and Scene for more information regarding the merger of accounts.

“their redemption value is limited to 1 cent per point (cpp) against travel purchases.”

I think another benefit of this merger is Scotia Reward folk will now be able to redeem for other things for 1cpp besides travel. I think I saw 500 points for $5 off Cineplex concessions and other $5-10 options for food. Nothing special, but at least another equal avenue to burn points (and you could book travel to other cards instead)

A good shout – something we sometimes gloss over because you could always effectively do this with the refundable hotel trick, but it’s now easier as you mention.

So here’s a unique situation that I have, and maybe you know what will happen:

P2 and I have a joint Visa Rewards account with Scotiabank. We churn the Amex and Visa cards individually and then our points are automatically pooled into the joint account.

Any idea to whom those points will go? Or any idea if this will end the possibility of pooling points via a joint account?

Thanks!

Applied for Scotia Gold Amex Rewards through the referral link here not too long ago…. Just a quick question that was not mentioned, I’m assuming 5x food and grocery for Scotia Gold Amex is still intact?

Earning rates will not change.

Awesome as always! Is the Amex/Scotiabank Gold Rewards card considered a “credit card”? I’m fairly certain, but with 2 Aeroplan Reserve and 2 Bonvoy cards… I need to cancel one first to apply I think?

Scotiabank Amex Gold is not affiliated with AMEX bank. You don’t need to worry about how many cards you have with AMEX bank.

Sweet! Much appreciated.