The SimplyCash Preferred Card from American Express is one of the leading cash back cards in the Canadian market, due to a high flat earn rate and an excellent welcome bonus. Its lower-tier version, the SimplyCash Card from American Express, offers a smaller earn rate and a more modest welcome bonus.

As of October 12, 2022, both cards are undergoing changes.

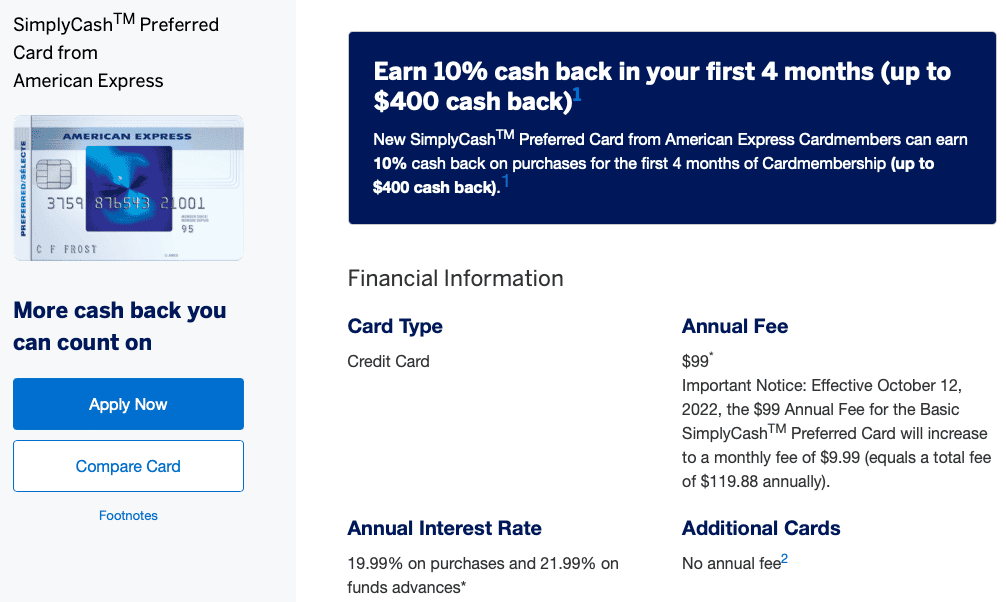

The SimplyCash Preferred Card will see its annual fee increased by 21% and changed to a monthly fee. In addition, both cards are seeing improvements in the earning structure, with the addition of category spending bonuses.

Let’s have a look at these largely positive changes.

SimplyCash Preferred Card: New $9.99 Monthly Fee

Back in July 2021, we saw Amex increase the monthly fee on the Cobalt Card from $9.99 to $12.99. Therefore, this kind of annual fee increase is not entirely unprecedented.

However, this is the first time we’ve seen American Express (or any Canadian card issuer, for that matter) change a card’s annual fee from being billed annually to being billed monthly.

The SimplyCash Preferred Card from American Express will soon be charging $9.99 monthly, equivalent to $119.88 annually, representing an increase of 21% over the current annual fee of $99 billed annually.

To complement the increase in annual fee, the earning structure will change in a very positive direction.

SimplyCash Preferred Card: New Earning Rates

Currently, the earning structure is a flat 2% cash back on all purchases. Beginning October 12, the new earning rates will be as follows:

- 4% cash back on eligible gas station purchases in Canada

- 4% cash back on eligible grocery store purchases in Canada, up to a maximum of $30,000 spent, equivalent to $1,200 cash back annually

- 2% cash back on all other purchases

These new earning rates are a huge improvement to the current flat 2% rate, and more of a pleasant change than I would expect. After all, when card issuers add categorized earning bonuses, the base earn rate typically goes down to offset this change.

In this case, Amex has maintained the 2% cash back on non-categorized spend, which is double the industry average of 1%, while adding additional bonuses for gas and groceries.

The SimplyCash Preferred Card’s $1,200 annual cap is significantly higher than competitors, such as the BMO CashBack World Elite Mastercard, which offers 5% cash back on groceries up to only $300 back annually.

After hitting the earning cap, cardholders will earn the base rate of 2% cash back.

Looking at the changes in totality, the enhanced earning rates on gas and groceries should easily cover the increase to the annual fee.

SimplyCash Preferred Card: Why Month-to-Month?

The SimplyCash Preferred Card won’t be the first Amex card to have a monthly fee instead of an annual fee. Introduced in 2017, the American Express Cobalt Card was meant to be the lifestyle card for millennials, designed by millennials.

This was clear not only in the bonus categories (5x on dining and 3x on streaming purchases, where young adults tend to spend money), but also in having a monthly fee instead of an annual fee, which was $10 per month at launch.

That made the fee easy to understand, as young people were very familiar with the paid monthly subscription model. Furthermore, $10 a month may seem less intimidating than $120 per year.

A base cash back rate of double the industry average, along with a simple low month-to-month fee structure, makes the barrier to entry for the SimplyCash Preferred Card almost non-existent for new graduates and any other potential new cardholders.

Furthermore, Amex has no income requirements, which could make the SimplyCash Preferred Card stand out amongst its Visa Infinite and Mastercard World Elite competitors.

Changes to the SimplyCash Card

The no-fee SimplyCash Card from American Express is also undergoing positive changes.

There will be no change to the annual fee, meaning that it will remain free, while the earning structure is improving.

Currently, the SimplyCash Card earns a flat 1.25% cash back on all purchases. As of October 12, 2022, the earning structure will be as follows:

- 2% cash back on eligible gas station purchases

- 2% cash back on eligible grocery store purchases, up to a maximum of $15,000 spent, equivalent to $300 cash back annually

- 1.25% cash back on all other purchases

It’s a breath of fresh air to see products get refreshed with only positive changes. The changes here are similar to those of the SimplyCash Preferred Card, just with noticeably lower cash back rates, which comes as no surprise as the SimplyCash Card has no annual fee.

These changes make it a decently competitive product in the current landscape, especially with 1.25% cash back as a base earn rate.

Conclusion

As of October 12, 2022, the SimplyCash Preferred Card from American Express will be increasing from $99 annually to $9.99 monthly. The earning structure will also change from a flat 2% cash back on all purchases to 4% cash back on gas and groceries, while maintaining 2% on non-categorized spend.

The lower-tier SimplyCash Card from American Express will remain a no-fee card. Its earning structure will change from a flat 1.25% cash back on all purchases to 2% cash back on gas and groceries, maintaining a 1.25% return on non-categorized spend.

Changes here are mostly positive, as the higher earning rates on the SimplyCash Preferred should easily offset the new monthly fee, while the SimplyCash will now have an improved earning structure with no change to its annual fee.

I was able to get $450 cashback offer trying a different browser. But these changes look great!

What will happen to cardholders who got the preferred card let’s say in August 2022 and have paid the full annual fee already?

My guess is your fee structure will change to monthly on your renewal year