If you woke up this morning hoping to apply for the American Express Business Platinum Card and obtain 75,000 Membership Rewards points for $399, you might have found yourself facing an unwelcome surprise. That’s because two changes were made to this card, overnight:

-

The annual fee is increasing from $399 to $499

-

The Business Platinum Card’s lounge access benefit is improving to a Priority Pass Select membership, meaning that the annual membership fee, as well as all lounge visits for the cardholder and one guest, are free

As of the time of writing, the terms and conditions for both of the above items have been updated on the public offer on the Amex website as well as the application links generated from referrals.

They’ve also hinted at a change to the referral bonus on this card that will take place on March 21, 2018. (Hint: it’s not a positive change.)

$499 Annual Fee

The annual fee increase is clearly negative, and it’s certainly a blow to people hoping to use this card to quickly accumulate points.

However, considering that you’ll be using the points to redeem for a trip worth thousands of dollars, it’s certainly possible to stomach that extra $100 outlay. If you’re really concerned about it, the option remains to offset all or part of the annual fee using points, at a relatively poor value of 1cpp – that is to say, you do have the option of using 50,000 Membership Rewards points out of your signup bonus to offset the annual fee, leaving you with 25,000 points for “free”.

It’s clear that ever since March 2016, when the signup bonus on this card shot up to 75,000 points (and the referral bonus up to 25,000 points a pop), the value proposition of this card has been heavily skewed in favour of the consumer. In particular, it’s been disproportionately beneficial to the “points-conscious” consumer, who obtains the card, meets the $5,000 minimum spend through creative means, hustles for referrals, and cancels before the first year is up only to reapply again.

Amex could’ve done many things differently in order to bring the value proposition back on their side a bit – like lowering the signup or referral bonuses, or, as per some of the vicious rumours that were swirling around, raising the minimum spending requirement to something higher than $5,000 – and I’m grateful they haven’t.

The Lounge Benefit

Meanwhile, they’ve drastically improved the lounge access benefit on the Business Platinum Card by changing the card’s Priority Pass membership to the unlimited Select variety, thus matching the benefit on the American Express Platinum Card. You won’t have to pay for the membership fee, nor for any lounge visits for yourself and one guest. Additional guests beyond that are US$27 each.

Previously, the annual membership fee was covered, but you had to pay US$27 per person per visit.

Now consider that there are some airports around the world where you can easily use Priority Pass to get over $100 in free spending at airport restaurants and bars. You might say that’s not a fair comparison, because not everyone will be visiting New York JFK, Miami, St. Louis, Denver, Portland, London Gatwick, Sydney, or Brisbane – quite an impressive number of airports where this benefit can be realized, to be sure – but even so, it’s easy to get over $100 in value when you have unlimited airport lounges at your fingertips along your travels.

Even if you routinely fly business class on points, and have access to lounges that way, there always comes a time when you’ll have a quick segment in economy class lined up. Now, between the Platinum Card and the Business Platinum Card, lounge access gets a lot simpler.

Almost@Home Lounge Helsinki

So overall, I’m ambivalent about these changes. It sucks to have to pay more for points, full stop. But I don’t think the fee increase to $499 alters the Business Platinum’s status as one of the premier points-earning cards in Canada, especially once you factor in the generous referral bonus of 25,000 points.

Meanwhile, the improvement to Priority Pass equals or even outweighs the annual fee increase, on paper. In a game where constant devaluations are the norm and are to be expected, I’d say that we’ve got off lightly on this one, because the changes could’ve been a whole lot worse.

And if you are fixated on the annual fee increase, one way to feel better is to go lounge-hopping on Amex’s dime next time you find yourself somewhere with multiple Priority Pass lounges 😉

Is There an Impending Change to the Referral Bonus?

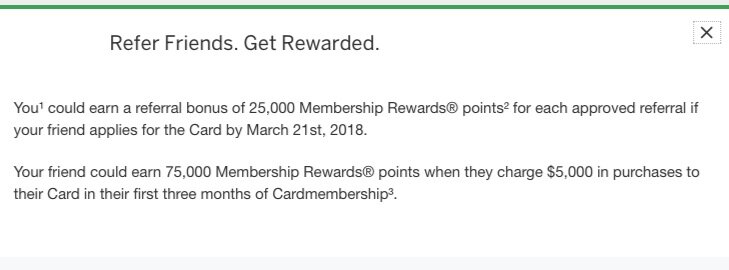

This, for me, is the most overwhelmingly negative part of what’s happening today. On the Refer a Friend section of my Amex page, I see the following language:

Notice the added language of “…if your friend applies for the Card by March 21st, 2018.” We’ve seen these words before, in the months leading up to the SPG Card and Business SPG Card dropping their referral bonuses from 10,000 Starpoints to 5,000 Starpoints.

It’s therefore safe to assume that we’ll be seeing a reduction in the referral bonus on the Business Platinum Card as well. I’d venture a guess to say that it’s going back to the pre-March 2016 levels of 15,000 points. That would be a killer blow, although understandable on Amex’s part, since 25,000 points per referral was clearly far too generous to be profitable.

What About Existing Cardholders?

I called Amex to ask what’s going to happen to existing holders of the Business Platinum Card, and I was told that you won’t be billed the higher $499 annual fee until it’s due the next time around. So if you’ve already paid your $399 for this year (or if you applied for the card when the $399 annual fee was still in the terms and conditions), you’ll have the opportunity to cancel anytime before your annual fee date next year if you’d like to avoid the next $499 charge.

Meanwhile, the improved Priority Pass benefit will be immediately available to cardholders as well, even if you’ve only paid $399 for the current membership year. To me, this is one of the few silver linings, particularly if you don’t currently hold the Platinum Card as well. Apparently the transition from the old Priority Pass membership to the improved Select tier doesn’t happen automatically but instead requires an “opt-in”, so it’s best to give Amex a call if you’d like to realize this benefit.

Note that this information was confirmed by two customer service representatives but not at the supervisor level, so it remains tentative as of now. Hopefully we’ll get more data points over the coming days.

Conclusion

Altogether, the annual fee increase accompanied by the strengthening of the Priority Pass benefit constitutes a fair change, in my mind. If the referral bonus drops as of next month (as I’m pretty sure it will), though, that will be a real blow, particularly because self-referring to the other American Express cards has gotten so lucrative these days.

Having said that, we all learned at some point that the game is constantly changing. The various valves of the system are constantly tightening and loosening, but the points continue to flow, and our job as eager travellers is to continually adapt, learn, and maximize.

I have had this card a few times – do you think I could get it again? I don’t see any one time bonus language

Hi Ricky – I was thinking of the following. Can you please let me know if it is possible? Say I spend 5K (by buying something expensive for 2K), so I get 75K points. Next I convert 75K points to Aeroplan Miles. Thereafter, I return the expensive 2K product to the store? Now I dont think Amex can deduct the points as they have been converted to Miles already, and Aeroplan miles technically falls beyond Amex’s jurisdiction.

Hi Sudin,

That’s a good way to get banned by Amex – either that, or they can simply clawback the welcome bonus, leaving you with a negative 75K MR balance, and then bill you for that at a 1cpp rate (if you’re lucky). I wouldn’t recommend it.

Ricky

I just signed up for this literally the day before the change happened and was approved. I was confused the next morning when I logged on and saw the $499 fee. I am assuming I got the $399 annual fee and associated perks bonus points etc. I wonder if Amex will still come to the table with the full priority pass select membership. Once my card arrives and I activate it, that will be my first call. I would and will happily pay the $100 difference to have that extra perk.

You’ll definitely get the full Priority Pass benefits (even existing cardholders are getting that), but if you applied when it was $399 you should be charged $399, not $499. I think you have a strong case for arguing that you should have the original $399 fee honoured, providing it was the case that there was the $399 language on the application page the moment you clicked Apply.