Brim Rewards: The No-Brainer Cash Back Program You’ve Been Sleeping On

I think it’s fair to say that when we talk about the best credit cards in Canada, we often default to the American Express family of products, and for good reason.

However, there’s a program out there that, while not as lucrative, is easy to understand and provides great value with a ton of benefits: Brim Rewards.

Brim Mastercard

Brim Rewards – Earning

Brim Rewards is, at its most basic, a simple and flexible cash back program. Essentially, you earn Brim points for every dollar you spend on your Brim credit card.

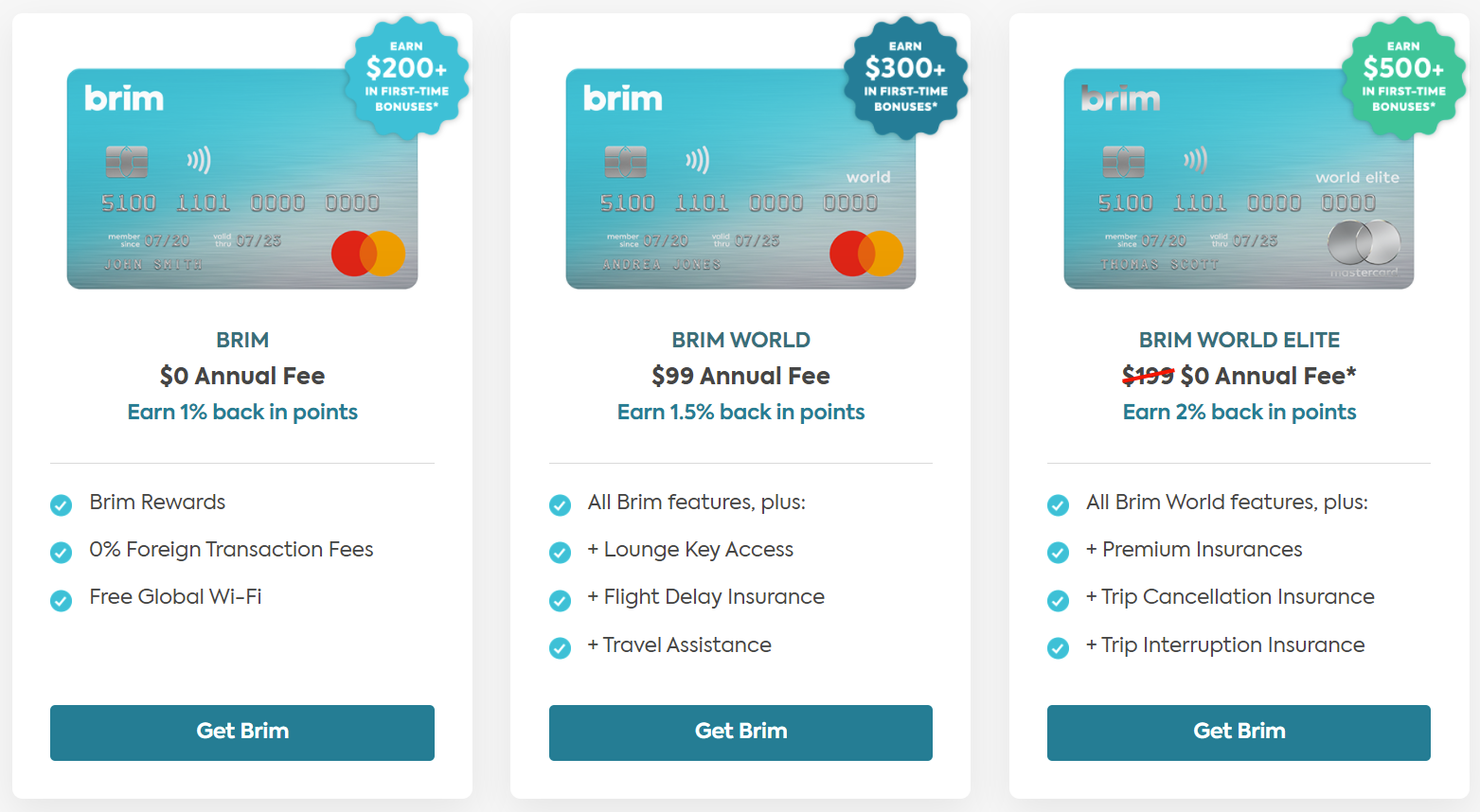

The earned amount is dependent on the card that you have within the Brim family of products, which count among Canada’s best cash back credit cards.

The most basic card, the Brim Mastercard, earns 1% in points, whereas the Brim World Mastercard earns 1.5% and the Brim World Elite Mastercard earns the highest 2%.

The only limitations on earning apply to the Brim World and the Brim World Elite, both maxing out at their points earning up to $25,000 in spend. After that, you return to 1% earn until the end of the year.

Every card comes with 1,000 points to start you off, which can be thought of as a signup bonus with a value of $10. This isn’t incredibly lucrative, so the focus with Brim cards would very much be their cash back earn rates and card features rather than the signup bonus.

Brim Rewards – In-Card Earning

In addition to the standard earning rates, Brim has also incorporated some additional ways to earn even more Brim points.

You can also earn bonus points for purchases with select retailers as long as you use your Brim card to pay for the transaction. This opens up the possibility of stacking your earning with the Brim card with something like Great Canadian Rebates (GCR).

As an example, if you were already contemplating testing out a service like Hello Fresh, you could navigate to GCR and click through to earn $10 on your first order. In addition to the bonus you would earn from GCR, if you used your Brim World Elite card to pay for the transaction, you would also earn an additional 2,000 Brim Points, worth $20. Add a coupon from a friend, and you’re likely looking at free week’s worth of meals. Not a bad deal.

I wouldn’t recommend that you look for things to buy to earn the bonuses, but rather that when you want to buy something, check back to the Brim site to see if there is an added bonus for using your card.

You’ll need a login to the Brim site to see the current offers; once you have an account, you can check out the current list of offers here.

Brim Rewards – eShop Earning

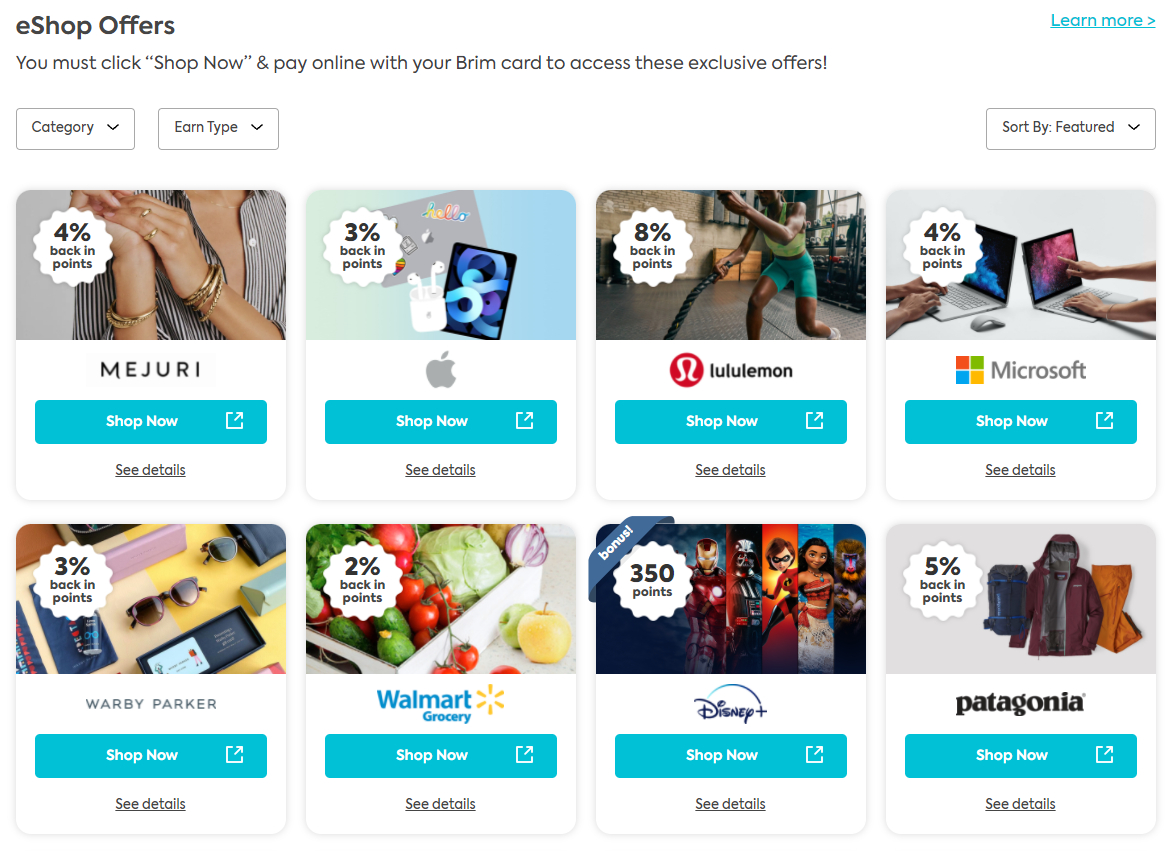

In addition to In-Card Earning, Brim Rewards also offers a way in which you can use their own shopping portal to earn additional Brim points.

Note that the offers listed are earned regardless of which credit card you ultimately end up paying with, meaning that you can stack the points earned through the portal with those you earn on the card.

I personally hold the Brim World Elite Mastercard, so if I were to purchase a new MacBook Air, I would receive 3% in points from the portal and 2% in points from the credit card, a net return of 5%, which is pretty good for a product that rarely goes on sale.

To me, using the portal in combination with the credit card can knock off a decent amount of money off a purchase I was already going to make. The other great thing about shopping through the portal is that unless it is specifically prohibited, points can be earned even if your receive an educational discount, like at the Apple Store.

Of course, don’t forget to compare the return against other shopping portals like the Aeroplan eStore at the time of purchase.

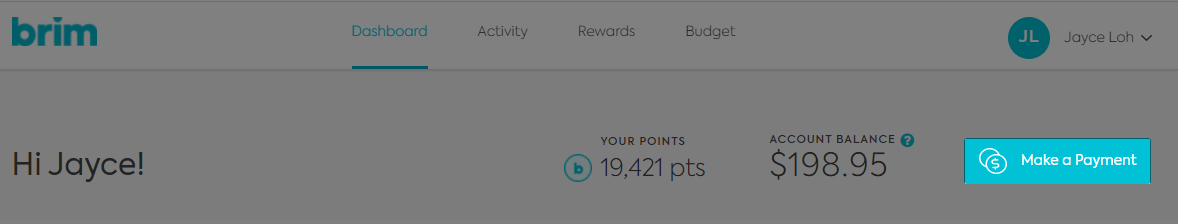

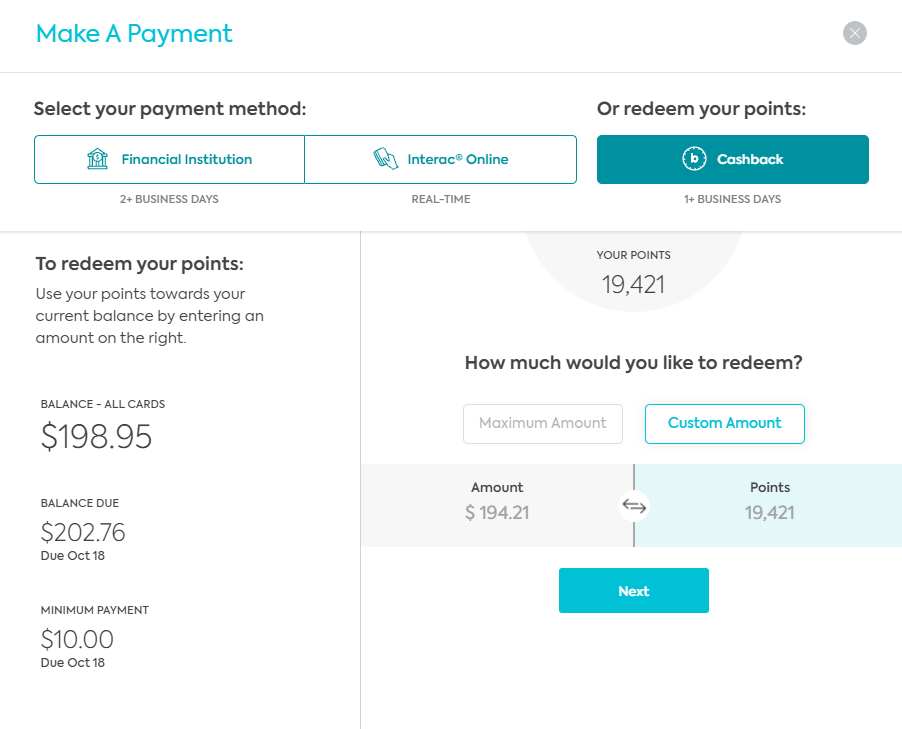

Brim Rewards – Redeeming Points

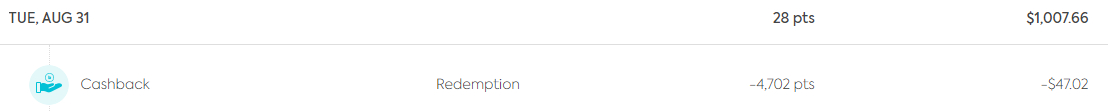

Redemptions with Brim Points are ridiculously easy. Simply log into your account, select Make a Payment, and choose “Cashback”.

Once you apply your points, the redemption immediately removes the points from your account, but it does take one business day for the reduction to show against your balance.

Brim Rewards – Flexibility

Why do I love the Brim Rewards program? Well, unlike many other cash back cards out there, you are not limited to a once-a-year redemption of your points (I’m looking at you, SimplyCash from American Express), nor do you need to apply your points to travel-related expenses to get the full value of your points (cough… cough… MBNA Rewards).

You can apply as many or as few points as you want, and there’s no maximum amount of times you can do it. If you wanted to redeem 1 Brim point for 1¢ off your bill, you are more than welcome to do so.

Quite frankly, in my opinion, Brim Rewards is one of the most freeing and flexible cash back program in all of Canada.

Brim Rewards – 0% FX Fees

What’s more, Brim cards also feature 0% foreign exchange fees when making purchases outside of Canada.

Most Canadian card companies hide a 2.5% markup on the exchange rate when you use your credit card abroad. With Brim, you pay the exchange spot price, no matter where you go in the world. This saves you a ton of money in the long run, as well as that inconvenient trip to the bank to try to get foreign currency.

While I do have multiple US credit cards with 0% FX fees at my disposal, I choose to use my Brim World Elite Mastercard when I am abroad. This is so I don’t have to worry about converting my Canadian dollars (and losing money in the process) to US dollars in order to pay my US-issued credit card.

Rather, I simply pay my Canadian based credit card knowing that the exchange rate I’ve paid was fair.

Brim Rewards – Free Boingo Wifi

In addition to the 0% FX fees, another feature that’s great to have when you travel is free Boingo wifi access, including wifi on planes that offer Boingo wifi. Airlines that use Boingo as their providers include WestJet, Austrian Airlines, China Airways, Air Europa, and Singapore Airlines.

I have used this feature on countless flights with WestJet, and the speeds are actually pretty good. WestJet blocks streaming on their onboard wifi, but you can certainly use it to research your destination, chat with friends, and catch up on some emails. When you are otherwise facing costs of upwards of $20+ for wifi on a flight, this feature is a welcome benefit.

While I haven’t tested it out, Boingo offers terrestrial wifi in a lot of locations around the world, meaning that if you have the Boingo app, you can seamlessly connect to wifi spots around the city you are travelling in, potentially saving you a lot of money on data charges.

The other great thing about this particular Boingo benefit is that it is available on even the basic $0 annual fee Brim card – even though most other Canadian Mastercard issuers will only include it on World Elite-level products.

Conclusion

I will readily admit that the Brim Rewards program is not the sexiest program out there, but it provides a simplicity and consistency that is hard to beat in a cash back credit card.

I have had one form or another of a Brim credit card in my wallet for over two years and it serves as a worthy backup option for stores that do not accept American Express and it’s definitely my go-to card for foreign currency transactions online and abroad.

Your best bet is to start off with the Brim World Elite Mastercard, as it currently has the first-year annual fee waived, and then switching to the no-fee Brim Mastercard after your first year.

No annual fee

Earning rates

Key perks

- 1.5% foreign transaction fee (vs standard 2.5%)

- Mobile device protection

No annual fee

Earning rates

Key perks

- 1.5% foreign transaction fee (vs standard 2.5%)

- Mobile device protection