Recently, we’ve seen the American Express Platinum Card reward cardholders with a $200 credit for spending on everyday essentials, like groceries and food delivery.

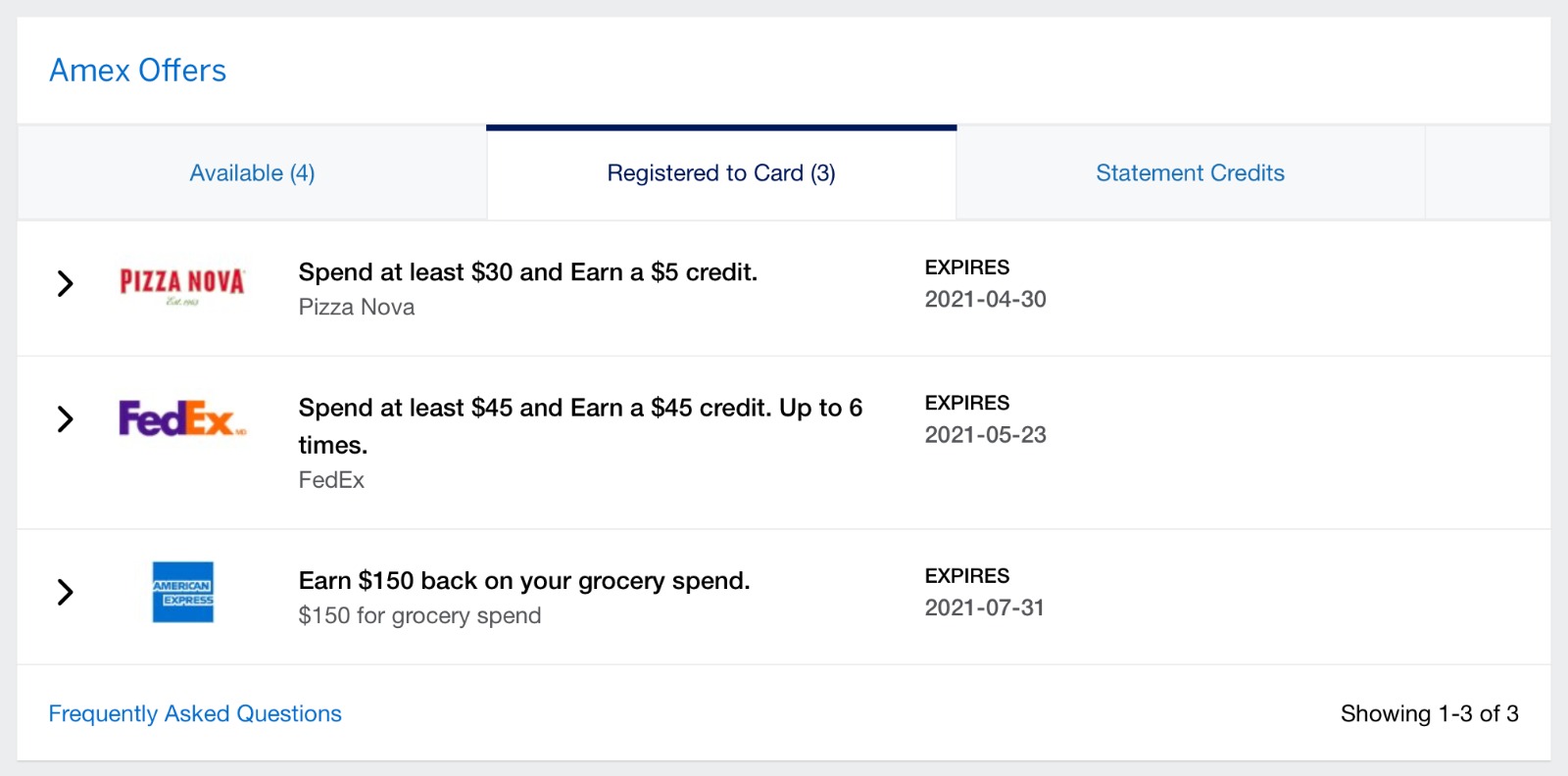

Now, Amex has extended a similar offer to another one of its premium cards, the American Express Aeroplan Reserve Card. Check your Amex Offers for $150 back on $150 spent on groceries from now until July 31, 2021 – as good as a cash credit!

$150 Towards Groceries

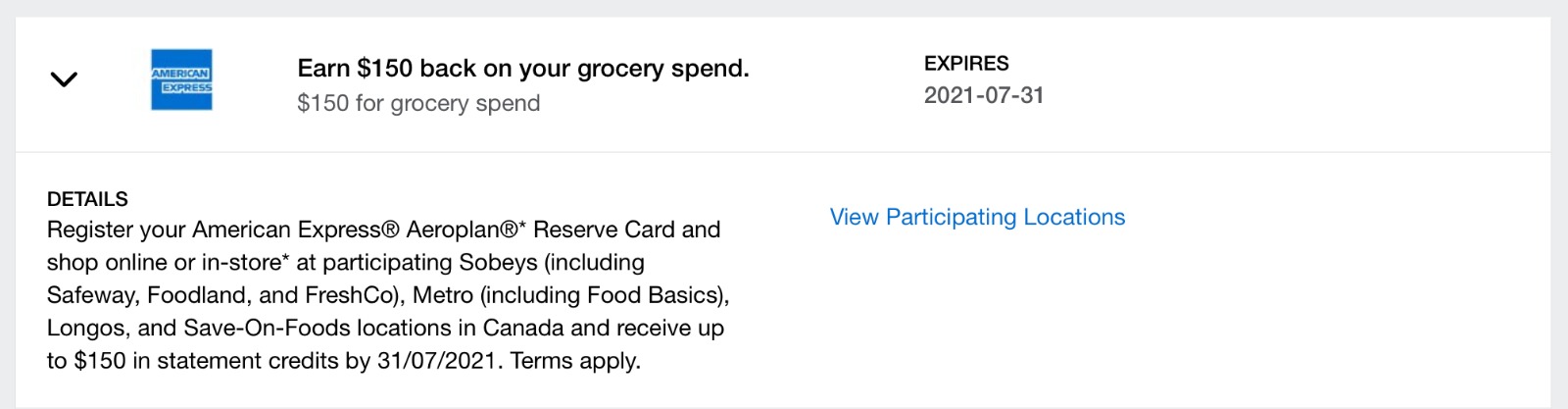

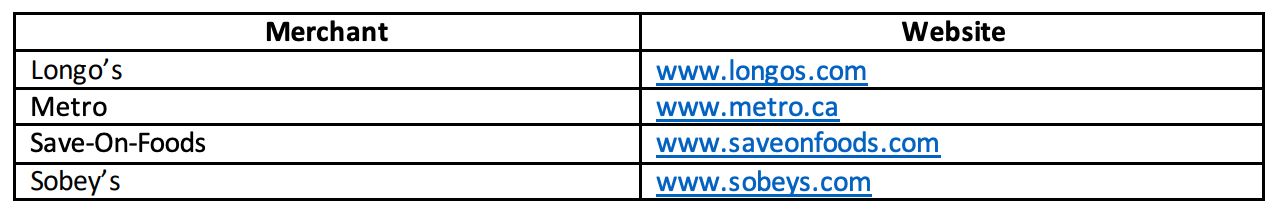

The offer is valid at four participating retailers: Sobeys, Metro, Save-On-Foods, and Longo’s, as well as their subsidiary brands.

Unlike the offer on the Platinum Card, Uber Eats transactions won’t be eligible, but the addition of Longo’s should expand your shopping options. It’s truly a grocery store credit, not an all-around eating-at-home credit.

Any purchases made at these retailers will earn a statement credit of the equivalent value, up to a maximum of $150 in total credits across each Aeroplan Reserve Card. You can spend $150 all at once, or broken up into smaller transactions.

Note that the offer specifies that only “participating” locations of these retailers are eligible, but if you click on the “View Participating Locations” link, it just brings you to a PDF file with all of the retailers’ names and their respective websites:

I’d say it’s safe to assume that all in-store locations will count, as well as any online purchases you make. It’s basically a $150 credit with no strings attached, which is a great gesture by American Express to continue adding value to the hyped-up relaunch of one of their flagship credit cards.

Offers like this one can help offset your credit card annual fee. For those of you keeping score against the Aeroplan Reserve Card’s $599 annual fee, so far we’ve got a $100 first-year statement credit, now a $150 grocery credit, and possibly even more depending on which application link you used.

By my count, that’s brought the annual fee down to $349 or less – dare I dream to hit First Year Free with more credits yet to come on a top-of-the-line card?

I am a little bit disappointed to see that grocery delivery and meal kit services aren’t included, especially with COVID-19 cases rising again, but for most people it should be an easy credit to use without requiring you to deviate from your regular routine. All four participating grocery chains accept American Express and have good coverage across Canada, so you should have no trouble cashing in when you go shopping.

Furthermore, based on data points from the similar offer on the Platinum Card, the following Sobeys subsidiaries should also be eligible:

- Foodland

- Safeway

- Sobeys Urban Fresh

- Sobeys Extra

- FreshCo

- Lawton’s Drugs

- Thrifty Foods

- Needs

- IGA

- Price Chopper

The same is true for the following Metro subsidiaries:

- Metro Plus

- Super C

- Marche Richelieu

- Food Basics

- Metro Corporate Store

The terms and conditions of the offer do specify that the credits will be applied to your account “within 90 days after 31/07/2021”. However, the rebate will usually show up within a few business days of competing your purchase.

Also: Earn Up to 25,000 Bonvoy points on the Amex Bonvoy Card

There’s another new Amex Offer making the rounds for targeted cardholders with the American Express Marriott Bonvoy Card. From now until August 31, 2021, you’ll have the opportunity to earn up to 25,000 Bonvoy points by spending on the card.

However, the offer does come with a significant ongoing spending requirement. You’ll earn 5,000 Bonvoy points for every $2,000 you spend. That means you’d have to spend $10,000 to earn the full bonus.

As you choose which cards you use for your grocery purchases, I’d definitely start with the Aeroplan Reserve Card – $150 of free money is a no-brainer.

After that, the American Express Cobalt Card would be a better choice. For $10,000 in spending in the 5x grocery category, you’d earn 50,000 Membership Rewards Select points, which can be transferred to 60,000 Bonvoy points.

Compare this to 45,000 Bonvoy points earned for spending $10,000 on the Amex Bonvoy Card (25,000 for this bonus offer, plus 20,000 for the regular rate of 2x points on all spending), and it’s no contest: Cobalt reigns supreme, as it often does.

Outside of grocery stores, 45,000 Bonvoy points is a pretty solid return on $10,000 in general uncategorized purchases if you’re in between signup bonuses. Still, you’d probably do better by allocating this spending towards a minimum spend requirement on a different credit card.

Therefore, I’d only recommend prioritizing this offer if you have an excess spending volume compared to how many minimum spending requirements you’re willing and able to juggle on new credit cards.

Conclusion

It’s exciting to see one of the best recent Amex Offers making its way to other cards.

The $150 grocery credit on the American Express Aeroplan Reserve Card may not be quite as juicy as the $200 on the American Express Platinum Card – indeed, the latter is the flagship product, and naturally its cardholders get the best of the best – but it’s great that Amex is going the extra mile to take care of all of its premium cardholders.

As Amex keeps pumping value back at its top clients, it can only benefit us as cardholders. With these signs that we can expect similar rebates on many of their top products, the decision about which premium card to keep isn’t as obvious. But I’d say that’s a good thing, as it gives us more choice to pick a product with a particular set of benefits that meet our needs, with confidence that we’ll get similar value either way.

Make sure you activate the offer on the Amex website or app before you hit the stores!

I received my Aeroplan Reserve Card last week but have no offer for $150 credit for grocery. Am I missing something?

I signed up on April 10th and they told me today that it only applies to accounts opened prior to April 1…not what customer service had told me back then.

Just received this card but no grocery offer.

Any DP’s on if these kids of offers hit new accounts? I received and started using my card 3 weeks ago .. No offers of any kind yet… Guessing I won’t see this one.

Is this credit for existing cardholders only?

Thanks for the heads up. Just registered cards.

I wonder “Chinese Save-On” PriceSmart would be accepted?

You can just buy a $150 gift card at Save-on-Foods and use it at Price Smart Foods. This is a pretty trivial problem to overcome.

The promotion suggests that it is valid at Sobey’s discount grocery store chain, FreshCo.

But FreshCo does not accept AMEX cards?

They started taking amex recently

Hi Josh, great article!!

Suppose I spend $150 on actual groceries and received my $150.00 statement credit back. Will my $150.00 charge count toward my Amex monthly minimum spending requirement MSR?

Yes it will! The credit is treated like a payment, not like a refund. Never hurts to overspend just in case though, to be sure you’ll get the bonus.