Changes Coming to MBNA Rewards Credit Cards in August 2021

MBNA is making a few changes to their flagship credit cards, the MBNA Rewards World Elite Mastercard and its entry-level counterpart, the MBNA Rewards Platinum Plus Mastercard. These changes will take effect on August 31, 2021, so existing and prospective cardholders alike will want to take note.

We haven’t written much about these cards before, so I figured now is as good a time as any to introduce them. Let’s see how the new earning rates and perks stack up, and if these cards might fit into your credit card strategy.

What Are MBNA Rewards?

We focus mostly on co-branded credit cards and transferable points, because those rewards usually have the most disproportionately-high value. Indeed, MBNA itself offers co-branded cards with Alaska Airlines and Best Western Rewards.

Many of our favourite credit card issuers also have an in-house rewards currency, which can be used for a wider range of travel redemptions but not at as high value. In that sense, the MBNA Rewards program is akin to TD Rewards, CIBC Aventura, or Scotia Rewards.

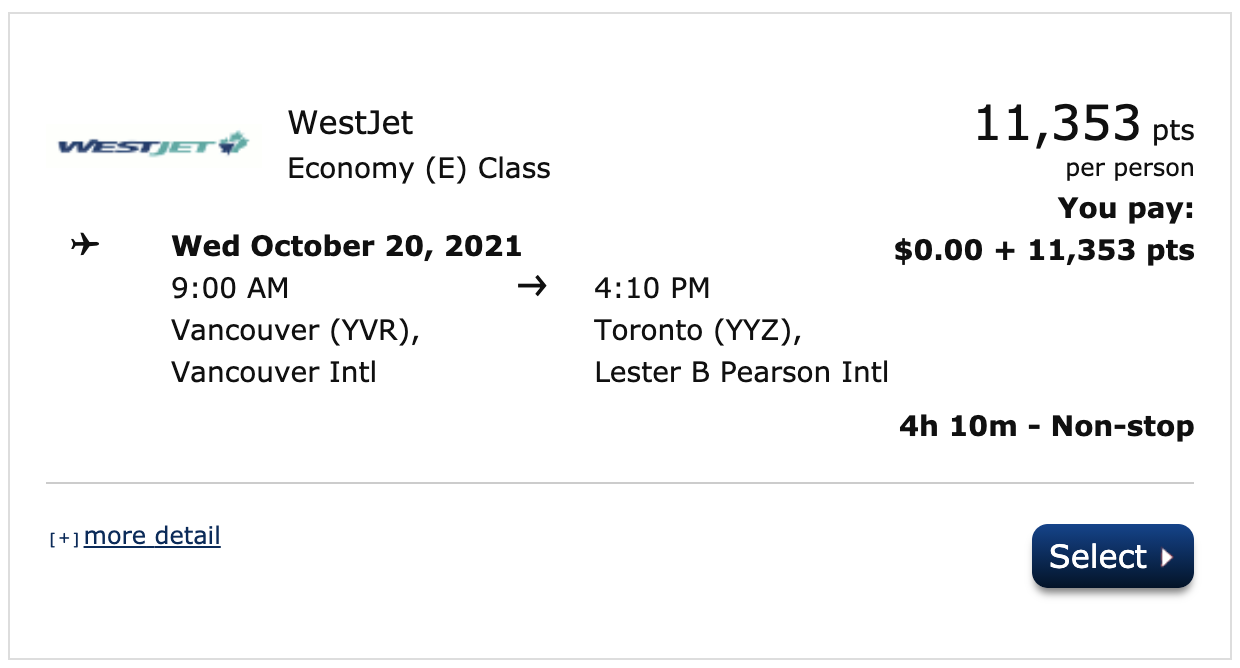

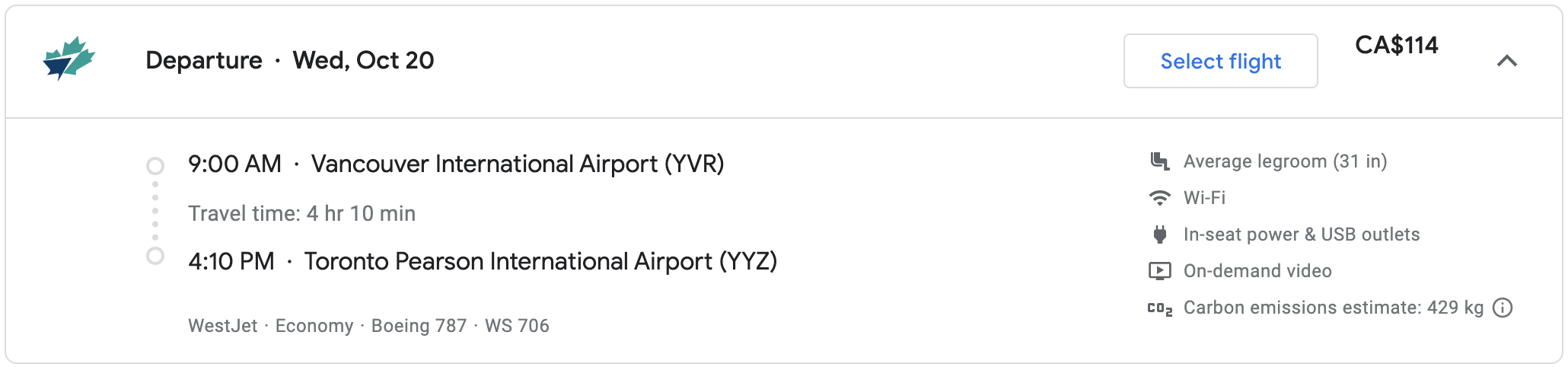

MBNA Rewards points can be redeemed for all sorts of travel, including flights, hotels, car rentals, cruises, and vacation packages. You can redeem for any travel booking offered by their online travel agency at a flat rate of 100 points = $1, or 1 cent per point.

As there’s no way to get outsized value for these points, and it’s easy to cover flights and hotels with other loyalty programs, I’d recommend using MBNA Rewards to fill in the gaps with other travel essentials.

Otherwise, you can use your rewards for cash back, at a rate of 120 points = $1, or 0.83 cents per point, on the Rewards World Elite card, or a pitiful 200 points = $1, or 0.5 cents per point, on the Rewards Platinum Plus card. You can also redeem for merchandise, but as always, you’ll get very poor value that way.

MBNA Rewards World Elite: New 5% Categories + Birthday Bonus

Previously, the MBNA Rewards World Elite Mastercard earned at a flat rate of 2 points per dollar spent, equivalent to a 2% rate of return. For a $120 annual fee, not many other cards had such a strong rewards rate on uncategorized purchases.

Going forward, the annual fee is staying the same. The card is dropping its base rate to 1 point per dollar spent, while introducing a category rate of 5 points per dollar spent on groceries, restaurants, digital media (including e-books, movies, and music), memberships (such as gym memberships), and household utility purchases. You’ll earn bonus points on up to $50,000 spent in those categories per calendar year, after which the category rate drops to the base rate.

Does that sound familiar? 5x points on $50,000 spent per calendar year on groceries and restaurants is the exact same as you can earn with the Scotiabank Gold American Express Card. If you routinely hit that limit early in the year, you might do well to get both cards. With the MBNA card, you’ll benefit from wider Mastercard acceptance, although Scotia Rewards are a bit easier to redeem for full value for any refundable travel expense.

This is certainly an exciting change for big eaters and heavy Mastercard users. Compared to the recent changes to the BMO CashBack World Elite Mastercard, you’ll have a lot more runway for grocery spend with MBNA. BMO caps the 5% category at $500 spent per month, whereas with MBNA you’ll have more than eight times that limit.

However, it’s the other features that set the card apart. Digital media purchases would seem to cover both recurring and one-off buys, so you’ll earn more rewards whether your style is subscriptions or à la carte. Memberships is a unique offering, as a stand-in for your recurring expenses.

As for rewards on utilities, the card crushes the competition in a category where some other cards offer a meagre bonus. If you have high utility bills and can maximize your rewards there, this is now the best card worth getting just for that category.

MBNA is also introducing an innovative birthday bonus. Every year, you’ll receive bonus points, calculated based on the number of points you’ve earned in the 12 months preceding your birthday month.

You can earn 10% more points, up to 15,000 extra points. Basically, this bumps the card’s earn rates to 1.1 and 5.5 points per dollar spent, up to $150,000 or $30,000 spent depending on the category. Just note that the previous year’s bonus points will be deposited into your account sometime during your birthday month, while regular rewards will post in real time.

For now, the card’s welcome bonus remains the same. You’ll earn 20,000 points upon spending $2,000 in the first 90 days, plus an additional 10,000 points for opting for paperless statements, for a total welcome bonus of 30,000 points.

Finally, the Rewards World Elite card is significantly beefing up its insurance coverage:

- Mobile device insurance up to $1,000, a welcome change which is quickly becoming the industry standard. (This coverage was added on June 24.)

- Travel medical insurance for trips up to 21 days for people under 65 years old. Before, the card didn’t offer any medical insurance.

- Flight delay and trip interruption insurance, on trips paid for with the card or its points.

- Delayed and lost luggage insurance, previously not offered.

- All previous benefits, including rental car burglary coverage (which is rather uncommon), common carrier accident insurance, and purchase protection.

Perhaps most importantly, all authorized users will now be fully covered by the same insurance as the primary cardholder. There is a new $50 fee for the first authorized user, but no fee for subsequent cards.

First-year value

$200

Annual fee: $120

• Earn 20,000 points upon spending $2,000 in the first 3 months

• Earn 10,000 points on approval

Earning rates

Key perks

- Discounts on car rentals

- Travel insurance

Annual fee: $120

• Earn 20,000 points upon spending $2,000 in the first 3 months

• Earn 10,000 points on approval

Earning rates

Key perks

- Discounts on car rentals

- Travel insurance

MBNA Rewards Platinum Plus: Insurance Coverage & Bonus Categories Adjusted

The MBNA Rewards Platinum Plus Mastercard is MBNA’s no-fee, no-income-requirement in-house rewards card. As an entry-level product, it punches above its weight, with 2 points per dollar spent on groceries, restaurants, and gas, 1 point per dollar spent on everything else, and a strong insurance package (by no-fee card standards). Compared to its peers, the card’s benefits are better and more useful than the entry-level cards offered by the Big 5 banks.

The changes on the Rewards Platinum Plus are a bit of a mixed bag. I’d say it’s a win for if you have the card to spend, but a loss if you have it for the perks.

First the good news: the card is streamlining its categories with the changes on the Rewards World Elite card. It’s dropping gas from the bonus categories, while adding digital media, memberships, and utilities. Along with groceries and restaurants, both cards will have the same five bonus categories, with the Rewards Platinum Plus as the “lite” version.

The Rewards Platinum Plus will earn 2 points per dollar spent on its bonus categories, the same as before. The annual limit for bonus points in each category is being bumped up from $5,000 spent to $10,000 spent.

On balance, I think this is a reasonable trade-off. There are quite a few good credit cards for gas, whereas MBNA’s creative new categories and generous limits make for a well-rounded no-fee product.

The card is also getting a birthday bonus. It works the same way as the one on the higher-tier card, just with an annual maximum of 10,000 bonus points.

Now for the downside: the card is losing almost all meaningful insurance coverage. The only one that remains is the extended warranty for purchases made with the card, a benefit that you can easily find on just about any credit card.

Rental car coverage and common carrier accident insurance are now gone. That’s an especially big blow, as MBNA quietly offered coverage on award tickets whose fees were paid with the card. That benefit was unheard-of for cards with no annual fee or no income requirement.

The one saving grace is the addition of mobile device insurance, on the same terms as the Rewards World Elite’s policy. That’s indeed an awesome benefit on a credit card with no annual fee – pay for your phone with the card, and you won’t have to think twice about keeping the card active for as long as you need the coverage.

Finally, the welcome bonus is staying the same – mostly. You’ll earn double rewards on the bonus categories in the first 90 days, for a rate of 4 points per dollar spent. If you max out your annual category cap during that period, you can rack up quite a haul of points rather quickly.

In a way, the welcome bonus has improved. The category caps have doubled, and there are now five of them instead of three. In total, you have an opportunity to earn 4 points per dollar spent on $50,000 of spending (in the appropriate categories), whereas before the maximum spend eligible for the bonus was only $15,000.

Relative to the Rewards World Elite, however, the Rewards Platinum Plus has lost its comparative advantage. Before, you could actually earn a bigger welcome bonus from the lower-tier card by finagling the spending categories. Now, though, the higher-tier card earns 5x points on the same categories year-round, a superior choice whether you’re a new or existing cardholder.

Overall, it looks like MBNA has decided to consolidate its in-house rewards products into a coherent family, marking a clearer delineation of the value you get as a premium cardholder. Indeed, it was very strange that the entry-level card used to be more lucrative in some situations!

50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

First-year value

$105

No annual fee

• Earn 5,000 points upon spending $500 in the first 3 months

• Earn 5,000 points on approval

Earning rates

Key perks

- No annual fee

- Travel insurance

No annual fee

• Earn 5,000 points upon spending $500 in the first 3 months

• Earn 5,000 points on approval

Earning rates

Key perks

- No annual fee

- Travel insurance

My Experience with MBNA Rewards Credit Cards

Among my roster of way too many credit cards, I actually have both of them. My MBNA Rewards Platinum Plus Mastercard is a downgrade from my first Alaska Airlines credit card, and I got my MBNA Rewards World Elite Mastercard as part of an “app-o-rama”.

Cards on the table: neither of these are very important in my wallet. I spend a grand total of $1 per year on the Platinum Plus to keep it active, and I’ve barely spent much more than that on the World Elite since meeting the $2,000 minimum spending requirement. Whenever I get around to redeeming my rewards, it’ll be an afterthought.

I assumed a 2% return on uncategorized spend might cover for a weakness in my credit card portfolio, but truthfully, I’m more excited by 1.25 Membership Rewards on my Amex Business Platinum, spending my way to status with my Aeroplan cards, or building my cryptocurrency holdings with 3% back as CRO.

I don’t shop at Mastercard-only merchants often enough to hyper-optimize there, and when I do, I’m more than happy with the value I get for 1 Alaska mile or 3 HSBC Rewards points.

While Visa and Amex cards typically have strong bonus rates for popular merchant categories, most Mastercard issuers have weak category rates but a higher base rate. I think there’s a compelling advantage there for uncategorized spend, but lately many of those cards are shifting towards a high/low earning model to compete with Visa and Amex.

I see that as an unwelcome change overall, and unless Mastercard issuers improve their award redemption options, I’ll struggle to find excuses to use their products.

Conclusion

The MBNA Rewards credit cards are getting some adjustments to their earn rates, category limits, and insurance coverage this month. MBNA is creating a bit more of a value gap between the World Elite and Platinum Plus tiers, and although the top-tier option is a clear winner, even the entry-level card is still appealing for many.

MBNA has taken a couple of no-frills products and brought them up to par with their peers, but I wouldn’t say they’ve tried to aggressively surpass the competition. With so many quality offers on the market, for both rewards and insurance, you’ll have to consider whether an MBNA Rewards card would be valuable or redundant for you.

There’s really quite a range of outcomes – they could be your ideal one-stop shop, round out the gaps in your crowded wallet, or take up residence in your sock drawer.

First-year value

$105

No annual fee

• Earn 5,000 points upon spending $500 in the first 3 months

• Earn 5,000 points on approval

Earning rates

Key perks

- No annual fee

- Travel insurance

No annual fee

• Earn 5,000 points upon spending $500 in the first 3 months

• Earn 5,000 points on approval

Earning rates

Key perks

- No annual fee

- Travel insurance

Comments

Create a free account or become a member to comment.