TD Rewards is the in-house points currency offered exclusively by TD Bank. The rewards program allows TD Rewards credit card holders to earn TD Rewards Points.

The rewards program is available through three of TD’s personal credit cards: the TD Rewards Visa* Card, the TD Platinum Travel Visa* Card, and the TD First Class Travel® Visa Infinite* Card.

In this guide, we’ll go over how to access this program with a personal TD credit card, and how to earn and redeem TD Rewards Points for excellent value.

What Is TD Rewards?

TD Rewards is TD Bank’s in-house points currency that’s accessible through three personal credit cards and one business TD Rewards credit card.

Credit cards in the TD Rewards program earn TD Rewards Points, which are a fixed-value points currency that’s exclusive to the bank.

The fact that the currency has fixed value means that the value of the points doesn’t fluctuate, and instead its value is based on the way in which you choose to redeem them (more on this below).

TD Rewards Points can be earned exclusively through credit card welcome bonuses that you can access as a first-time cardholder when you get a TD Rewards credit card, and through spending on the same eligible card.

As you earn a welcome bonus and additional points through day-to-day spending, your TD Rewards account balance will grow.

These accumulated points can be redeemed several ways, with the fixed value of a single TD Rewards Point ranging from 0.25 cents per point to 0.5 cents per point (all figures in CAD).

This means that if you had 100,000 TD Rewards Points in your account, you could redeem these for a value of between $250 and $500, depending on which type of redemption you choose.

The most valuable way to redeem TD Rewards Points is for travel, which we’ll explore in detail below.

TD Rewards Points are a great points currency to collect if you’re someone who wants to be able to redeem points for travel, and especially if you often book your trips through Expedia.

TD Rewards Points are also a great currency to collect in addition to other airline and hotel points, since they’re useful in offsetting other travel costs, such as cruises, independent hotels, and short-term rentals that aren’t covered by brand-specific programs (e.g., Aeroplan, Marriott Bonvoy, WestJet Rewards).

Since TD Rewards Points are redeemable at a fixed value that’s tied to the cash value of the redemption, they’re not the best choice for aspirational travel like business class or First Class flights; however, they remain a valuable currency for other travel expenses.

TD Rewards Credit Cards

As we mentioned above, TD Rewards Points can only be earned through TD Rewards credit cards.

TD currently offers three personal credit cards for this program: the TD First Class Travel® Visa Infinite* Card, the TD Platinum Travel Visa* Card, and the TD Rewards Visa* Card.

To sort out which of the above three is best for you, let’s look at each of the personal credit cards’ features and eligibility requirements.

TD First Class Travel® Visa Infinite* Card

This is the TD Rewards program’s flagship card, offering the strongest earning rates and the best welcome bonus.

The card’s welcome bonus fluctuates depending on the bank’s current offer, often coming in around 100,000 TD Rewards Points and with an all-time high of 135,000 TD Rewards Points.

Given this, it’s ideal to time your application to coincide with an elevated welcome bonus, as this is a one-time opportunity for new cardholders.

The fees and eligibility requirements of this card are as follows:

- Annual fee: $139

- Supplementary cardholders: $50

- Minimum income requirement: $60,000 (personal), $100,000 (household)

- Estimated credit score needed: Good to Excellent

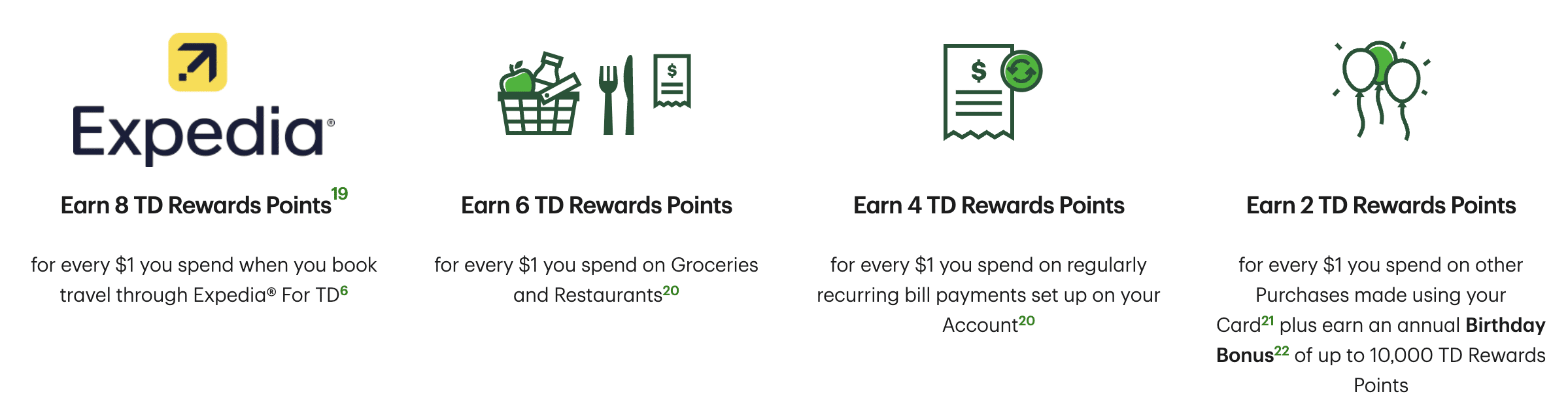

Since this is a premium credit card, you can enjoy elevated earning rates in specific categories, with earning rates as follows:

- Earn 8 TD Rewards Points† per dollar spent on eligible travel booked through Expedia® for TD†

- Earn 6 TD Rewards Points† per dollar spent on eligible grocery and restaurant purchases†

- Earn 4 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- Earn 2 TD Rewards Points† per dollar spent on all other eligible purchases†

As an example of the earning power of these rates, let’s imagine that you spend $500 on groceries and restaurants in a month.

Given the earning rate of 6 TD Rewards Points per dollar spent, $500 in spending within this category will earn you 3,000 points. These 3,000 TD Rewards Points can then be redeemed for between $7.50 and $15 in value, depending on the redemption path you choose.

This value is equivalent to a 1.5–3% return on your $500 in purchases ($7.50/$500 = 1.5%, $15/$500 = 3%).

Since TD Rewards Points can be redeemed for a maximum value of 0.5 cents per point, the return on spending you get is 4%, 3%, 2%, or 1%, depending on your purchase.

Plus, as an annual birthday perk, you can earn 10% of the TD Rewards Points earned in the previous 12 months back on your cardholder anniversary,† up to 10,000 TD Rewards Points per year.†

The TD First Class Travel® Visa Infinite* Card also comes with a range of perks and benefits.

For example, cardholders are eligible to earn a $100 TD Travel Credit† on accommodations and vacation packages of at least $500 booked through Expedia® for TD†, and can also enjoy car rental discounts at Avis and Budget to the tune of 10% in Canada and the US, and 5% internationally.†

Additionally, the card often offers a first-year annual fee rebate, and it comes with strong insurance coverage for travel and eligible purchases.

Overall, the TD First Class Travel® Visa Infinite* Card is best suited for individuals who meet the income requirements and who are looking to accumulate TD Rewards Points rapidly with the elevated earning rates.

More in-depth information about the TD First Class Travel® Visa Infinite* Card can be found in our dedicated guide for the card.

TD Platinum Travel Visa* Card

The TD Platinum Travel Visa* Card is the mid-tier card in the TD Rewards lineup, and it offers good earning rates and an enticing welcome bonus.

The fees and eligibility requirements of this card are as follows:

- Annual fee: $89

- Supplementary cardholders: $35

- Minimum income requirement: N/A

- Estimated credit score needed: Good to Excellent

Similarly to the TD First Class Travel® Visa Infinite* Card, the TD Platinum Travel Visa* Card also earns elevated rates in specific categories, just at a slightly lower rate than its premium counterpart.

These earning rates are as follows:

- 6 TD Rewards Points† per dollar spent on eligible Expedia® for TD†

- 4.5 TD Rewards Points† per dollar spent on eligible groceries and dining†

- 3 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- 1.5 TD Rewards Points† per dollar spent on all other eligible purchases†

To see these rates in action, let’s again imagine that you spent $500 on groceries and restaurants in a month.

With the 4.5 TD Rewards Points per dollar rate, $500 in spending within this category will earn you 2,250 points. These 2,250 TD Rewards Points can then be redeemed for between $5.60 and $11.25 in value, depending on the redemption path you choose.

This value is equivalent to a 1.12–2.25% return on your $500 in purchases ($5.60/$500 = 1.12%, $11.25/$500 = 2.25%).

In terms of perks and benefits, the TD Platinum Travel Visa* does not provide much, which is expected with a mid-tier card.

Cardholders can often enjoy a first-year annual fee rebate as well as car rental discounts at Avis and Budget to the tune of 10% in Canada and the US, and 5% internationally†. The card also provides some basic insurance coverage.

This card is best suited for individuals who would like to earn TD Rewards Points with elevated earning rates, but who don’t meet the eligibility requirements of the TD First Class Travel® Visa Infinite* Card.

More in-depth information about the TD Platinum Travel Visa* Card can be found in our dedicated guide for the card.

TD Rewards Visa* Card

The TD Rewards Visa* Card is the program’s entry-level, no-fee card. It offers the lowest earning rates of the three TD Rewards credit cards, and it typically comes with the opportunity to earn a modest welcome bonus.

The fees and eligibility requirements of this card are as follows:

- Annual fee: $0

- Supplementary cardholders: $0

- Minimum income requirement: N/A

- Estimated credit score needed: N/A

As can be expected with any no-fee credit card, the earning rates for the TD Rewards Visa* Card are lower than the other TD Rewards cards; however, there are still elevated rates in specific categories.

The TD Rewards Visa* comes with the following earning rates:

- 4 TD Rewards Points† per dollar spent on eligible Expedia® for TD purchases†

- 3 TD Rewards Points† per dollar spent on eligible groceries and dining purchases†

- 2 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- 1 TD Rewards Point† per dollar spent on all other eligible purchases†

To help understand the value of these earning rates, let’s look at the same monthly spend of $500 on groceries and restaurants as above.

Since you earn 3 TD Rewards Points per dollar in the groceries and dining category, $500 of spending within this category will earn you 1,500 points. These 1,500 TD Rewards Points can then be redeemed for between $3.75 and $7.50 in value, depending on the redemption path you choose.

This value is equivalent to a 0.75–1.5% return on your $500 in purchases ($3.75/$500 = 0.75%, $7.50/$500 = 1.5%).

In terms of perks and benefits, the TD Rewards Visa* Card comes with very little.

Cardholders can enjoy car rental discounts at Avis and Budget to the tune of 10% in Canada and the US, and 5% internationally†, and they will have access to some minimal insurance coverage, such as extended warranty, purchase protection, and Mobile Device Insurance.

The TD Rewards Visa* Card is best suited for individuals who are looking for a no-fee way to earn TD Rewards Points.

More in-depth information about the TD Rewards Visa* Card can be found in our dedicated guide for the card.

Redeeming TD Rewards Points

TD Rewards Points can be redeemed for travel, gift cards and merchandise, higher education, statement credits, and on amazon.ca,

We’ll focus on the travel options in the sections below since these are the most valuable options, and given that you’re on our website, they’re likely the options that most intrigue you.

That said, if you’re interested in learning more about the other available options, check out our Essential Guide to TD Rewards, which goes over each alternative in detail.

Redeeming TD Rewards Points on Expedia for TD

The most valuable way to redeem TD Rewards Points is by using them through Expedia for TD.

When redeemed this way, each TD Rewards Point is worth 0.5 cents per point, meaning that 100,000 TD Rewards Points can be redeemed for $500 worth of travel.

Expedia for TD is essentially the same as the regular Expedia platform, except it’s linked with your TD Rewards Points account, and you log in with your TD credentials.

To access Expedia for TD, simply sign in to your TD Rewards account, click “Expedia for TD” under the “Redeem” tab, and then click through to the Expedia for TD portal.

You can use Expedia for TD the same way you would use regular Expedia, allowing you to book flights, hotels, car rentals, and other travel purchases.

Notably, through this redemption avenue, you can also redeem your TD Rewards Points for cruises, tours, and Disney tickets.

After signing in to Expedia for TD, you can search for your desired hotel, cruise, tour, or whatever else you might like to book.

As an example, let’s say you’d like to redeem your TD Rewards Points for tickets to Universal Orlando Resort.

Once you’ve selected your purchase on Expedia for TD, look for “Use your TD Points” on the check-out page. From there, select the number of points you’d like to redeem and then proceed with your purchase.

The minimum redemption amount is 200 points (equal to $1), and you’re able to make the purchase with a combination of cash and points, allowing you to decide how much of the purchase you’d like offset with your TD Rewards Points.

When redeeming your points through Expedia for TD, you still need to pay the full purchase amount up front. The value from your redeemed points will be credited to your TD Rewards credit card statement after the purchase is completed and within 3–5 business days.

When booking through Expedia for TD, it’s important to remember that you’re booking through a third-party vendor (Expedia) and not directly with the airline, hotel, car rentals, etc.

For hotel bookings, this means that you won’t earn any hotel status benefits or accrue elite qualifying nights. For car rentals, you won’t earn things like Hertz points or free rentals through National Free Days.

However, you will still be able to accrue elite-qualifying points/miles with airlines as long as you attach your associated membership number to your booking at the time of purchase or add it at the check-in counter.

Most importantly, when booking a flight through Expedia for TD, be aware that any and all changes and cancellations must be pursued through Expedia for TD, and can’t be done through the airline.

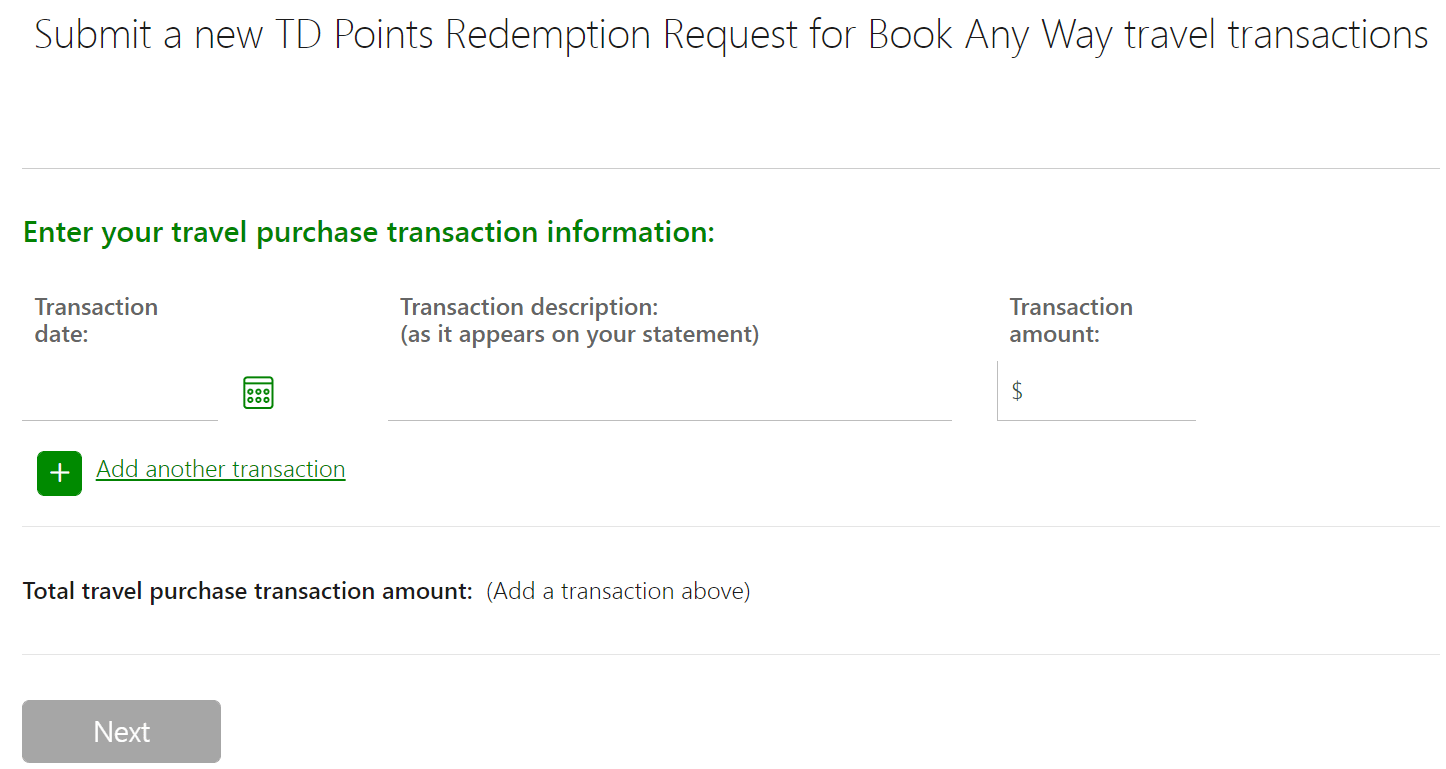

Redeeming TD Rewards Points with Book Any Way Travel

If you’d rather book travel directly with vendors (e.g., Hyatt, WestJet, VIA Rail) instead of using Expedia for TD, you can still get great value from your points.

When redeemed for purchases made outside of Expedia for TD, each of your TD Rewards Points is worth 0.4 cents. This means that 100,000 TD Rewards Points is worth $400 for travel booked using your TD Rewards credit card.

To redeem your TD Rewards Points through the Book Any Way option, all you need to do is charge the eligible flight, hotel, train ticket, etc. to your TD Rewards credit card.

Once the purchase has posted to your credit card account, you can redeem your TD Rewards Points to offset the cost by using the TD Rewards website or by calling 1-800-983-8472 within 90 days of the purchase date.

To redeem TD Rewards Points online, log in to your TD Rewards account and select “Book Any Way Travel” from the “Redeem” tab.

On the next screen, fill in the information about the transaction against which you’d like to redeem points.

You’ll need to have the purchase transaction date, its description, and the exact dollar amount before proceeding. This information can be found on your credit card account statement.

If you’d like to redeem points for multiple transactions at once, simply click on “add another transaction” and fill in the additional information.

Once you’ve submitted your request for redemption, you can expect to receive the value back as a statement credit within 3–5 business days.

While you won’t get the best value from your TD Rewards Points this way, this option does offer excellent flexibility as TD has one of the most generous definitions of an eligible “travel expense” in the industry.

Using Book Any Way, you can redeem your TD Rewards Points for the vast majority of travel expenses, including campsites, jet-ski rentals, and even theatre tickets as long as they were purchased while travelling.

Keep in mind though that in the cases involving more unique travel expenses, you may need to speak with a customer service representative in order to redeem your points.

If you’d like more details about how you can redeem your TD Rewards Points through other redemption methods, we’ve included more options and additional details in our Essential Guide for TD Rewards.

Alternatively, you can always check out the TD Rewards website to explore the program further.

Conclusion

TD Bank offers three personal TD Rewards credit cards that allow you to earn TD Rewards Points.

These points are a valuable currency that can be redeemed for almost all your travel expenses at a fixed value, making them one of the most flexible fixed-value currencies on offer in Canada.

If you’re looking for a credit card that earns points redeemable for travel expenses and you prioritize flexibility, the TD Rewards travel cards are great options to consider.

FAQs

Can I have a TD Rewards credit card if I don’t bank with TD?

Yes, you can. To pay your TD Rewards credit card bill without a TD bank account, simply search for TD as a payee within your online banking’s bill payment feature, and then add your TD credit card number as the account number.

Can I book travel for other people with my TD Rewards Points?

Yes, you can make a booking for someone else using your TD Rewards Points. To do so, go through the search and booking process as usual, using your friend/family member’s name and information in lieu of your own.

Do I have to redeem my TD Rewards Points for travel?

No. TD Rewards Points can also be redeemed for merchandise, gift cards, statement credits, higher education, and on amazon.ca.

Can I exchange my TD Rewards Points for cash?

TD Rewards Points can be redeemed for a cash credit towards your TD credit card statement at a rate of 400 points = $1 (CAD).