Finance has evolved a lot over the past centuries.

The Greeks were the first to mint coins so merchants could use a common medium of exchange. In the Middle Ages, the infamous Knights Templar invented modern banking deposits by inventing promissory notes exchangeable at any chivalrous chancellery. Later, the Dutch invented fractional reserve banking, a facet of all modern finance.

Jumping forward to the present day, one of the more recent breakthroughs in the global financial revolution has been the credit card, which allows customers to spend a creditor’s money while promising to pay them back.

Of course, nothing in this world is free, and credit card issuers expect to make money back on any that they lend, and the most common way that lenders recoup their investments is by collecting interest on outstanding balances.

Today, let’s take a look at the enigma of credit card interest.

What Is Credit Card Interest?

Credit card issuers make money in one of two ways. The first is via interchange fees, also known as swipe fees, whereby merchants who accept credit cards are charged a set fee based on the size of the transaction.

Swipe fees are an easy way for issuers to make money because most merchants nowadays take credit cards; however, this method is not nearly as lucrative as the other way that credit card issuers make money.

Charging fees to cardholders on their unpaid balances, through the dreaded credit card interest, makes lenders large sums of money. In fact, the sums are large enough that the interest paid by customers who carry a balance, in turn, pays for the rewards we derive from our Miles & Points hobby.

Credit cards are unsecured lines of credit, which is a fancy way of saying that they are backed by nothing more than the credit card issuer making an educated guess (based on factors such as income and credit score) that the borrower will be able to repay any money loaned to them.

However, because the issuer usually doesn’t require collateral, such as a vehicle, home, or a deposit of cash, before agreeing to lend the money, they want to mitigate the risk of a cardholder absconding with the funds by charging a higher interest rate than secured lines of credit.

If a borrower has previously run into financial difficulties, they may not be granted an unsecured credit card. Rather, they’d instead be required to open a secured credit card that necessitates they provide a cash deposit or other collateral.

Important Terms

Before continuing, it’s important to get a clear definition of some credit card terminology that’s often thrown around, but that’s not always clearly defined.

The first term is “annual percentage rate” or “APR.” This term refers to the annual percentage of interest you’ll pay on your credit card. While APR can mean something slightly different with other financial products, in the context of credit cards, it refers to the interest rate.

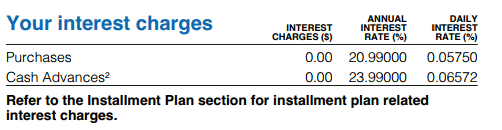

The second thing to note is that credit cards often charge different APRs for different types of transactions, with the two most common types of transactions being purchases and cash advances.

Purchases are when you pay for a product or service in an everyday fashion, and these transactions usually incur a lower interest rate, as well as an interest-free grace period (more on that later).

Cash advances, on the other hand, include transactions such as when you withdraw money at an ATM using your credit card or when you buy cash-like products. What defines a “cash-like product” can vary wildly between banks, but this category usually includes money transfer services, such as Wise, and gaming and gambling purchases.

These types of transactions usually incur higher interest rates, and they don’t enjoy an interest-free grace period, so interest begins accruing immediately.

Finally, it’s also important to know about balance transfers. These are a method by which to consolidate debt or to borrow money via a credit card at a reduced promotional interest rate (usually 0%) for a set period of time before being subjected to the product’s normal cash advance interest rate.

How Much Interest Do Credit Cards Charge?

In Canada, there are many types of credit cards for many different categories of credit card holders. Interest rates vary greatly depending on the perks and benefits of a given card, with products featuring lower interest or better rewards often being granted to more creditworthy borrowers.

As any Miles & Points enthusiast knows, the nicer the rewards, the higher the annual fee tends to be.

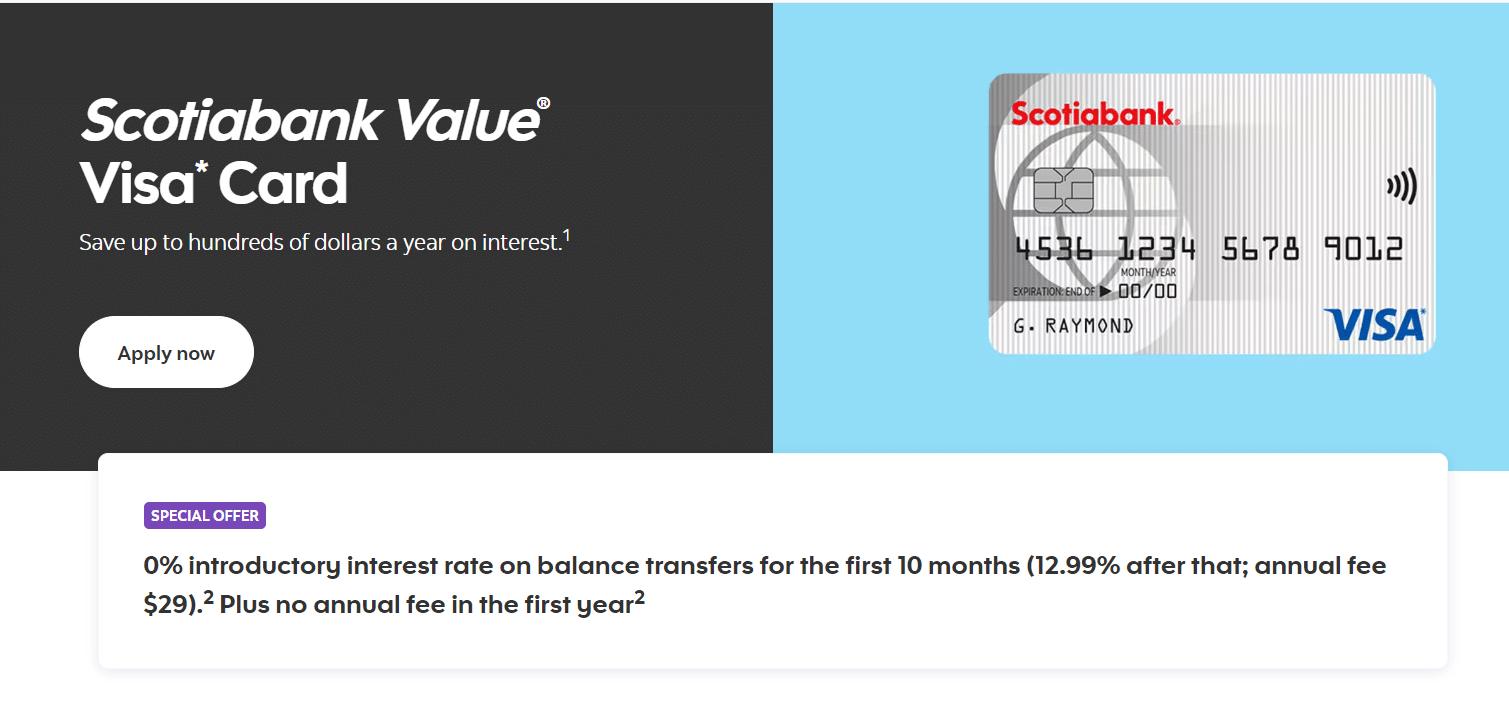

Low-interest credit cards, such as the Scotiabank Value Visa Card, feature a uniform 12.99% APR for both purchases and cash advances, but require a $29 (CAD) annual fee.

However, right now, the card offers a balance transfer for 0% interest for 10 months, plus the first year’s fee waived, for a 1% balance transfer fee, demonstrating a fairly standard offer for products within this lower-end category.

In the middle of the landscape are the vast majority of Canadian credit cards, ranging from no-frills offerings such as the American Express Green Card to the venerable TD® Aeroplan® Visa Infinite* Card. Credit cards in this category all charge 20.99% interest on purchases and 22.99% on cash advances.

Notably, even the high-end Visa Infinite Privilege family of cards fall into this category.

At the top end is a special category of products consisting entirely of the American Express charge cards. These cards feature both “Due in Full” and “Flexible Payment” options.

The due-in-full type of charge will incur the wrath of Amex in the form of 30% APR, while the flexible payment option is subject to the typical 20.99%. Given these rates, you’ll definitely want to pay the due-in-full balance no matter what!

Interestingly, there is also a newer category of high-fee, low-interest reward credit cards such as the Scotiabank Platinum American Express Card, which features both a $399 annual fee and 9.99% APR on interest and cash advances.

How Does Credit Card Interest Work?

Before getting into the details of credit card interest, it’s important to remember something: credit card interest is neither simple nor intuitive.

Banks and other financial institutions that issue credit cards make hundreds of billions of dollars every year off credit card interest, and its complexity is part of what makes it so profitable. After all, who hasn’t splurged on something silly at least once without fully understanding the math of what the final cost would be?

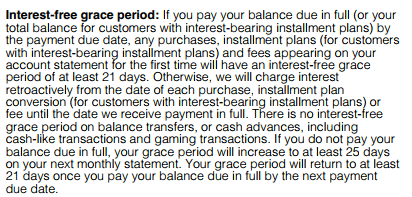

With that out of the way, it’s time for the good news: In Canada, most credit cards have a 21-day grace period. This means that the balance on your credit card statement won’t accrue interest in the first 21 days after the date it’s been generated.

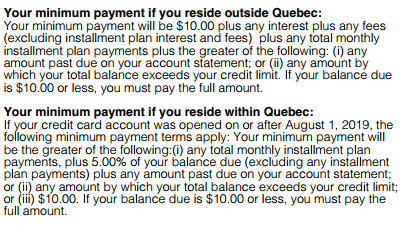

Also, it’s good to note that your minimum payment is always due 21 days after the statement is issued, so ensure you always pay at least this amount by then.

If you fail to make the minimum payment within these 21 days, you could be subject to a late fee or, worse, an increase in your interest rate. Most Canadian credit cards will hike your interest rate to 25.99% APR after one missed payment and 27.99% after two. Given this, you definitely don’t want to miss a minimum payment!

The American Express charge cards with the scary 30% APR on delinquent due-in-full amounts usually offer 28 days from when the statement is issued to pay the charges – essentially a full extra week to clear the account balance.

Now that we’ve got some base knowledge, let’s look at how credit card interest is calculated.

A credit card bearing the typical 20.99% APR has a daily interest rate of 0.0575%, and this interest rate must be disclosed on your credit card statement by law.

The amount of interest you’ll pay is calculated by multiplying this daily interest rate by your average daily outstanding balance over the period of your billing statement, noting that most billing statements include 30 days.

To calculate your outstanding balance, add up the balance from each day and divide this total by the number of days in the statement period.

For example, if you have $1,000 outstanding, but can only afford to pay $500, then it’s best to pay that $500 on the first day of the statement period, if at all possible.

By doing this, you’ll have an outstanding daily balance of $1,000 for that first day, followed by a balance of $500 for the next 29 days. This results in a total of $15,500 ([1000 × 1] + [500 × 29]), and when you divide that $15,500 total by the 30 days in the statement period, you’ll see your average daily balance is $516.66.

Multiple this average daily balance by the daily interest rate of 0.0575% and you’ll have the daily amount of interest that’s being generated by your outstanding balance: $516.66 × 0.0575 = 29.7 cents or $0.297.

Then multiply this by the number of days in the statement period (30) and you’ll get the total interest being charged: 0.297 × 30 = $8.91 in interest charges.

Now comparatively, if you instead had paid the $500 on the 21st day as you’re required to do in order to avoid late fees or increases to your interest rate, your average daily balance would come out to $850.

This higher average daily balance would then generate 48.875 cents (or $0.48875) in interest per day. This means that for the full thirty days of the statement period, you would incur $14.66 in interest, or over a 60% increase in interest charges when compared to paying the $500 earlier.

Common Misconceptions About Interest Rates

There are a few very common misconceptions about credit card interest rates.

The first is that an APR is a solid amount calculated by the year. I used to believe this myself, and hopefully the above calculations have shown that if you’re carrying a balance, when you pay your bill can have a big impact on how much interest you wind up paying.

Another common misconception that many folks have run afoul of is thinking that there isn’t much difference between a transaction and cash advance.

In the era of high credit card acceptance and tap-and-go payment terminals in every business, people often mistakenly assume that cash advances don’t incur interest. This is incorrect: cash advances begin to accrue interest instantaneously.

This means that a credit card statement could be processed wherein you have some interest charges to pay after taking out money at a foreign ATM (something many travellers will do for security and convenience), while at the same time purchases have accumulated no costs.

This makes paying bills on time even more important.

Lastly, many folks assume that there is no compounding interest in Canada.

Compounding interest is when a financial institution charges interest on top of your interest charges, and as it stands, currently most banks don’t factor accumulated interest into your daily balance.

However, some banks, most notably TD, have been charging compounding interest for a few years now. Once again, this makes it even more important to pay off balances on time and in full.

Now, if you can’t pay off your credit card bills in full, it’s always better to pay towards your credit card earlier in the month, or to make multiple payments over the course of the billing cycle. This will reduce your average daily balance and thus reduce the interest paid.

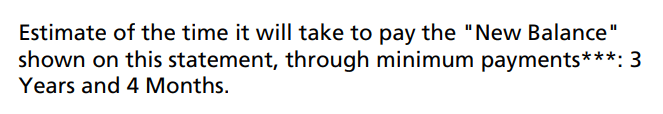

Finally, an important detail to note is that all credit card statements must show you how long it would take you to get out of debt by paying only the minimum amount. This information can be seen in an example from a recent statement for one of my cards.

As can be seen, a relatively low balance of about $370 would take years to pay off if you’re only paying the minimum required amount, so make sure you’re reducing the balance more fervently over time.

Conclusion

Everyone in the credit card game has heard that “the interest will ruin them” at least once in their life, and given the calculations above, it’s pretty clear that it definitely can. Given this, it’s important to keep on top of bills and aim to pay in full whenever possible.

The good news, however, is that with fiscal discipline and responsible credit usage, these unsecured payment solutions can be enormously beneficial to every consumer. Not only do they give customers 21 days of interest-free flexibility, but they also have features such as insurance, and our favourites, the rewards programs for Miles & Points.

Until next time, pay more than the minimum.