Chase Ultimate Rewards is arguably one of the best transferrable points currencies around. Chase offers generous welcome bonuses on their Ultimate Rewards credit cards, and there are quite a few options for redeeming Ultimate Rewards points for top value.

Earning Points Through Credit Card Welcome Bonuses

The easiest way to rack up Chase Ultimate Rewards points is through credit card welcome bonuses.

Chase offers some of the highest welcome bonuses on credit cards across all major banks, especially with their business credit cards. Currently, five personal and three business credit cards comprise the Chase Ultimate Rewards lineup.

Personal Cards

The two most popular personal credit cards are Chase’s flagship credit cards under the Sapphire brand.

The Chase Sapphire Preferred usually offers welcome bonuses that hover around 60,000 points, but historically, it has gone as high as 100,000 points. The card commands a modest $95 annual fee.

The Chase Sapphire Reserve, the more luxe version of the Sapphire card, commands a hefty $550 annual fee, with its welcome bonus reaching as high as 80,000 points in recent years.

The card’s high annual fee is justified by the other perks associated with the card, such as unlimited airport lounge access and an annual $300 statement credit towards travel purchases. With these benefits, the Chase Sapphire Reserve is often seen as a competitor to the Platinum Card by American Express.

Chase also has the Freedom lineup of personal credit cards. Despite being advertised as cash back cards, these cards do in fact earn Chase Ultimate Rewards points.

Both the Chase Freedom Unlimited and Chase Freedom Flex cards are very similar, and they typically come with 20,000 Ultimate Rewards points as a welcome bonus. As an added perk, they also come with an elevated earn bonus of up to 5% on specific categories, such as groceries.

The Chase Freedom Student card, meanwhile, comes with a much smaller welcome bonus of 5,000 points. It also comes with an additional 2,000 points every anniversary year your card is in good standing for the first five years.

None of these Freedom cards come with an annual fee, but they tack on a foreign conversion fee for transactions not settled in US dollars, which makes them disadvantageous to use for spending abroad.

Business Cards

Compared to the personal credit cards, the three Chase Ink business cards come with more generous welcome bonuses.

Chase’s most popular business card is the Chase Ink Business Preferred, which comes with a generous welcome bonus of 100,000 points after spending $15,000 in the first three months. Its annual fee is only $95.

Despite their names, Chase Ink Business Unlimited and Chase Ink Business Cash also earn Ultimate Rewards points. Both their welcome bonuses have generously been raised from 75,000 to 90,000 points recently, despite being no-annual fee cards.

Similar to the Freedom lineup, however, you’ll be charged a foreign exchange fee on all non-USD purchases.

There’s a fourth card in the Chase Ink Business lineup, the Chase Ink Business Premier card, but it’s actually a true cash back card, and you won’t be earning Chase Ultimate Rewards points with it.

It’s important to note that when applying for Chase credit cards, you must abide by the “5/24 rule”. The rule stipulates that you must have opened only five new personal credit cards in the past 24 months at most across all US banks. If you exceed the limit, you’ll automatically be declined.

Earning Points Through Credit Card Spending

After earning Chase Ultimate Rewards points through credit card welcome bonuses, you can pad your balance by using your cards for everyday purchases.

The amount of points you’ll earn depends on the card you use and the merchant classification. There are also promotions that come around from time to time, such as 5x points on qualifying Lyft rides available on some cards.

The earning rates on Chase credit cards that earn Ultimate Rewards points are as follows:

- Chase Sapphire Preferred

- 5 points per dollar spent on travel booked through the Chase Ultimate Rewards travel portal=

- 3 points per dollar spent on dining, streaming services, and online groceries (excluding Target, Walmart, and wholesale grocery stores)

- 1 point per dollar spent on all other purchases

- 1 bonus point per $10 spent on all purchases in the previous anniversary year

- Chase Sapphire Reserve

- 10 points per dollar spent on dining, hotel, and car rentals booked through the Chase Ultimate Rewards travel portal

- 5 points per dollar spent on flights booked through the Chase Ultimate Rewards travel portal

- 3 points per dollar spent on travel and dining purchases

- 1 point per dollar spent on all other purchases

- Chase Freedom Unlimited

- 5 points per dollar spent on travel booked through the Chase Ultimate Rewards travel portal

- 3 points per dollar spent on dining and pharmacies

- 1.5 points per dollar spent on all other purchases

- Chase Freedom Flex

- 5 points per dollar spent on rotating categories that change every three months

- 5 points per dollar spent on flights booked through the Chase Ultimate Rewards travel portal

- 3 points per dollar spent on dining and pharmacies

- 1 point per dollar spent on all other purchases

- Chase Freedom Student

- 1 point per dollar spent on all purchases

- Chase Ink Business Preferred

- 3 points per dollar spent on the first $150,000 in travel, shipping, internet, cable, phone, and advertising purchases each year

- 1 point per dollar spent on all other purchases

- Chase Ink Business Unlimited

- 1.5 points per dollar spent on all purchases

- Chase Ink Business Cash

- 5 points per dollar spent on the first $25,000 in office supplies, phone, landline, internet, and cable TV purchases each anniversary year

- 2 points per dollar spent on the first $25,000 in gas and restaurant purchases

- 1 point per dollar spent on all other purchases

Other Ways to Earn Points

There are a few more other ways to earn Chase Ultimate Rewards Points, but we’ll focus on referrals and Chase’s shopping portal.

Refer-A-Friend

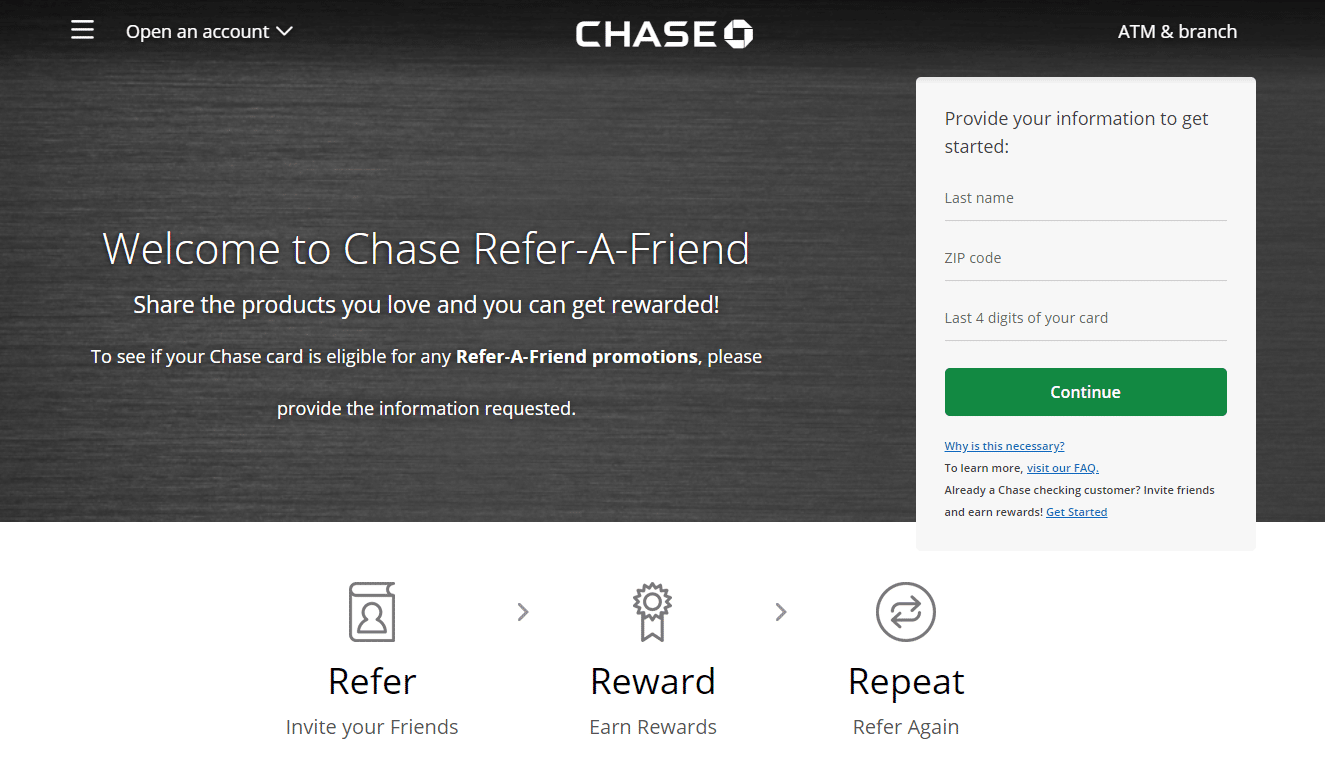

Referring someone to an eligible Chase credit card through your own dedicated referral link will earn you Ultimate Rewards points.

To see if you are eligible to refer, simply enter your last name, zip code, and last four digits of your credit card number at Chase’s Refer-A-Friend page.

Chase Freedom cardholders can earn 10,000 points per referral up to a maximum of 50,000 points, while Chase Sapphire cardholders can earn 15,000 points per referral up to a maximum of 75,000 points.

On the other hand, Chase Ink Business cardholders can earn 20,000 points per referral up to a maximum of 100,000 points.

Shop through Chase Portal

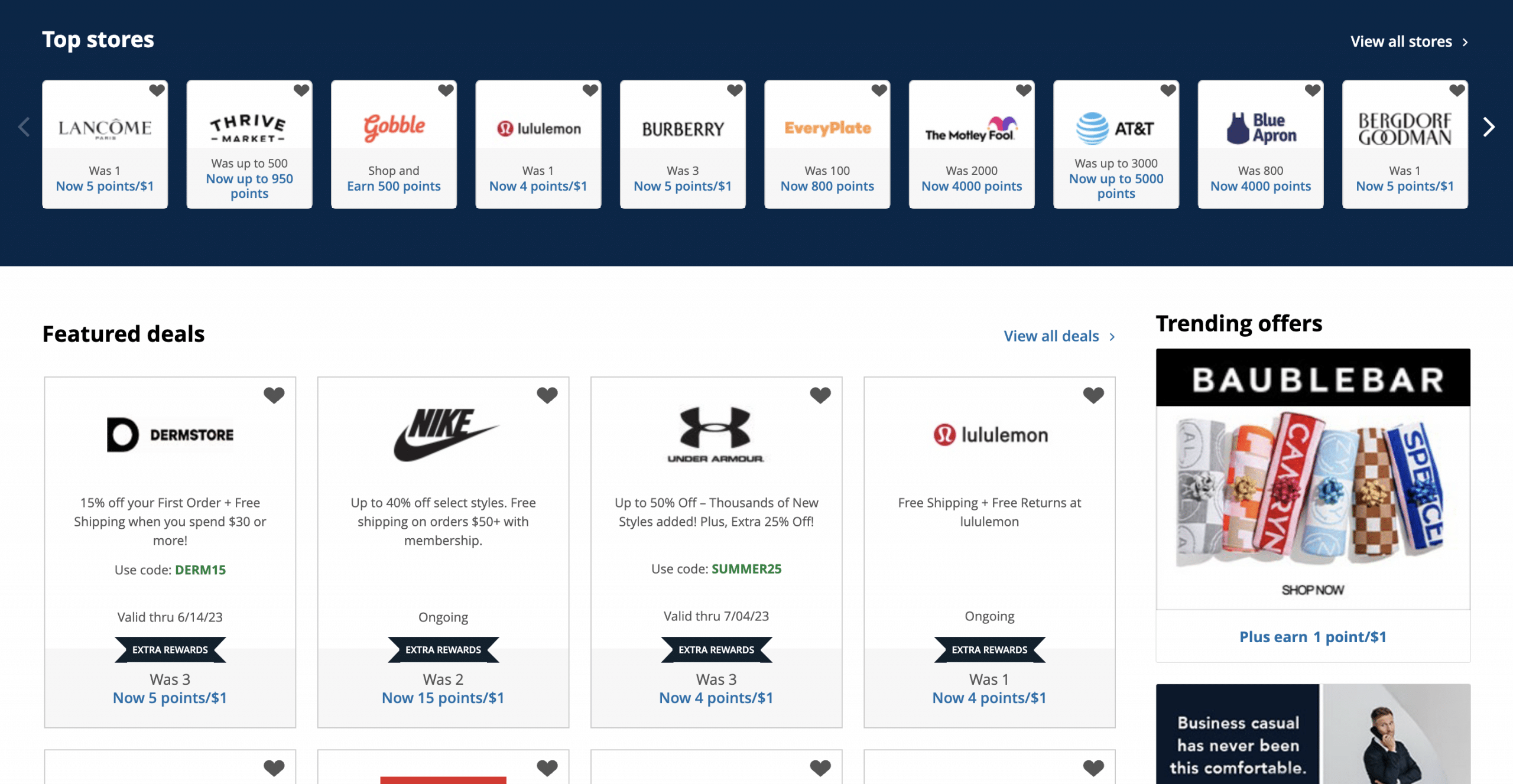

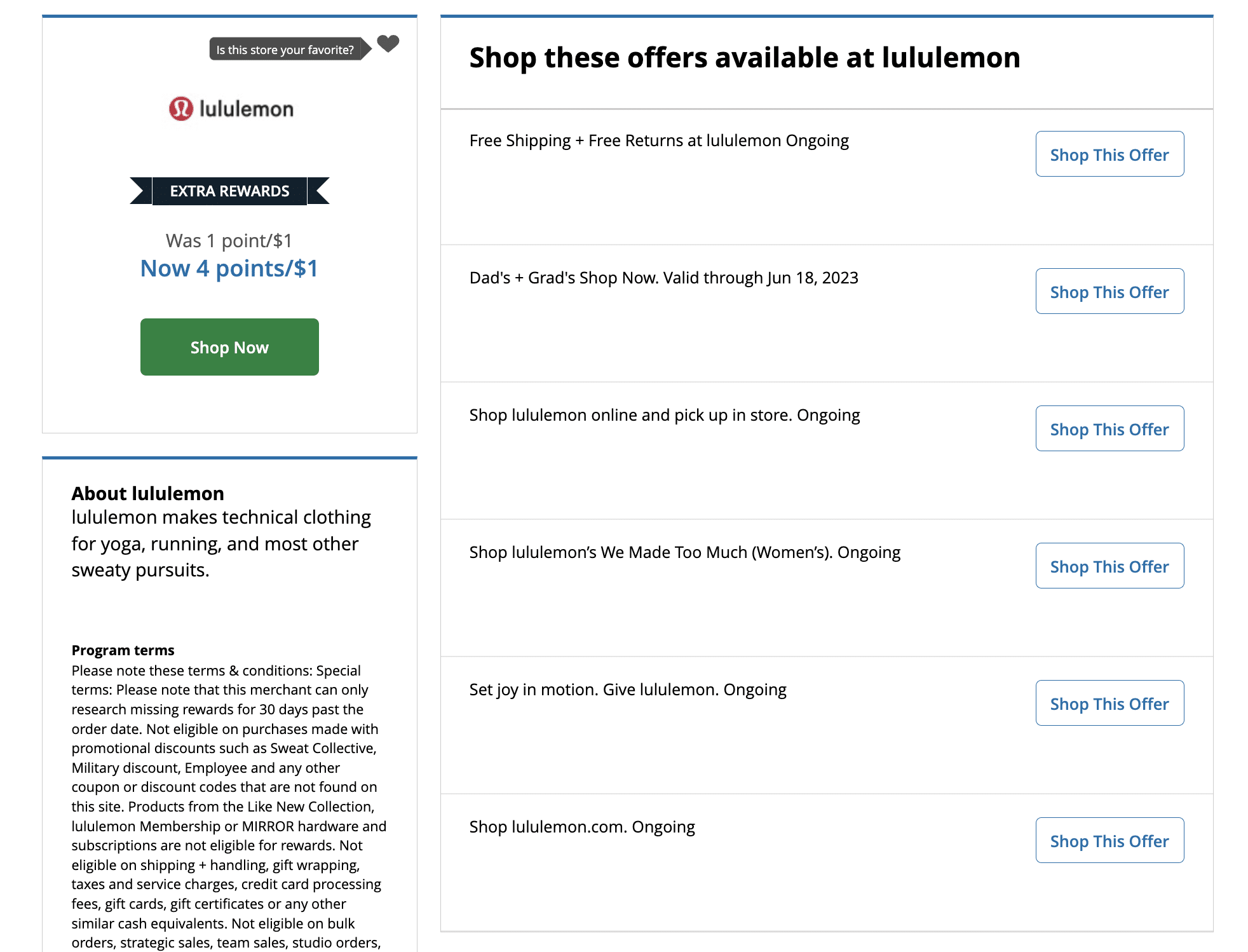

Lastly, you can earn more Chase Ultimate Rewards points by initiating your online shopping purchases through the “Shop through Chase” portal.

In order to earn points on online purchases, you’ll have to log onto your Chase account, navigate to the “Shop through Chase” portal, and choose the card you’d like to bank your points into.

On the portal, you’ll see which stores are available and how many extra points you’ll earn just by shopping through Chase’s dedicated affiliate link.

Redeeming Chase Ultimate Rewards Points

Now that we have looked at all of the ways you can earn Chase Ultimate Rewards points, the real fun begins on the redemption side.

Some of the best options include transferring points to airline or hotel loyalty programs, using the points to book travel through Chase’s travel portal, and redeeming points as statement credits.

Transferring Points to Other Programs

You can get the most value out of your Chase Ultimate Rewards points by transferring them to another loyalty program and booking hotels and flights.

At a rate of 1:1, you can transfer Chase Ultimate Rewards points to the following loyalty programs:

Airlines

- Aer Lingus AerClub

- Air Canada Aeroplan

- British Airways Executive Club

- Emirates Skywards

- Air France/KLM Flying Blue

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Hotels

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

There have also been promotions where you can get bonus points if you transfer to specific partners. Some of the best promotions in the past include:

- Air Canada Aeroplan: 30% bonus

- Air France/KLM Flying Blue: 25% bonus

- British Airways Executive Club: 30% bonus

- IHG One Rewards: 60% bonus

- Marriott Bonvoy: 50% bonus

- Southwest Rapid Rewards: 20% bonus

- Virgin Atlantic Flying Club: 30% bonus

On top of transfer bonuses that come and go, if you hold both a Chase Aeroplan Card and a Chase Ultimate Rewards card, you’ll get a 10% bonus when converting Chase Ultimate Rewards points to Aeroplan. Note that you must transfer at least 50,000 points in a single transaction, and there’s a cap of 25,000 bonus points per calendar year.

In terms of the best options for transferring points, World of Hyatt tends to be Chase’s most popular transfer partner, because World of Hyatt points aren’t as easy to earn as some of the others on Chase’s transfer partner list.

That being said, if you have a specific business class or First Class flight already in mind, then transferring your points to one of the airline programs could be your best choice, especially if you line up your transfer with a promotional bonus.

In addition, there are redemptions only possible with certain frequent flyer programs and redemptions that are considered “sweet spots”. Some examples include:

- Air Canada Aeroplan: arguably the best and most flexible Star Alliance program, where you can get great value on premium flights with its own flights as well as its partners

- Avianca LifeMiles and United MileagePlus: alternative programs to book Star Alliance premium flights

- British Airways Executive Club: great for short-haul one way flights in certain parts of Asia and Australia

- Emirates Skywards: one of the few ways to access Emirates First Class seats

- Singapore Airlines KrisFlyer: the only way to book Singapore Airlines Suite Class

- Virgin Atlantic Flying Club: a great program for booking ANA First Class

When you’re deciding which program to transfer your Chase Ultimate Rewards points to, you should also consider how easy or difficult it is to earn those points through other avenues, such as credit card welcome bonuses or by transferring from other banks’ programs.

Redeeming Points Through the Chase Travel Portal

Using Chase Ultimate Rewards points to book travel through the Chase Ultimate Rewards Travel Portal can also be a great option for redeeming your points. The portal allows you to book flights, hotels, car rentals, travel activities, and cruises.

Chase points can be redeemed for 1 cent per point, but there are a couple of exceptions.

If you have the Chase Sapphire Preferred or the Chase Ink Business Preferred credit cards, you’ll get a slightly higher value of 1.25 cents per point.

Meanwhile, if you hold the Chase Sapphire Reserve card, you can redeem your points at the highest rate of 1.5 cents per point.

This means that if you redeem 60,000 points, they’ll be worth $600 if you’ve banked the points with any of the following cards:

- Chase Freedom Unlimited

- Chase Freedom Flex

- Chase Freedom Student

- Chase Freedom

- Chase Ink Business Unlimited

- Chase Ink Business Cash

On the other hand, your 60,000 points are worth $750 with Chase Sapphire Preferred and Chase Ink Business Preferred, and $900 with the Chase Sapphire Reserve.

If you hold multiple cards that earn Ultimate Rewards points, you can easily and instantly transfer your points from one card to another to take advantage of a higher redemption value.

However, if you don’t have one of the three Chase cards that gives a higher value per point, it may make sense to wait until you’re able to sign up for one of them before redeeming your points since Chase Ultimate Reward points don’t expire as long as you keep one of your credit card accounts open. Don’t hold them too long though – devaluations are a sad reality of the game.

Also, it’s always sensible to compare prices on Chase’s travel portal with other travel booking options, such as airline award redemptions and other online travel agencies.

Certainly, there are situations where redeeming Chase Ultimate Rewards points through the travel portal makes more sense than transferring to a loyalty partner and redeeming there.

One example is buying tickets, especially last-minute ones, that would otherwise not be available through an airline program. While you’re not getting the best value off your Ultimate Rewards points, you could redeem them at a fair value to offset your purchase and lessen your out-of-pocket costs.

Redeeming Points as Statement Credits

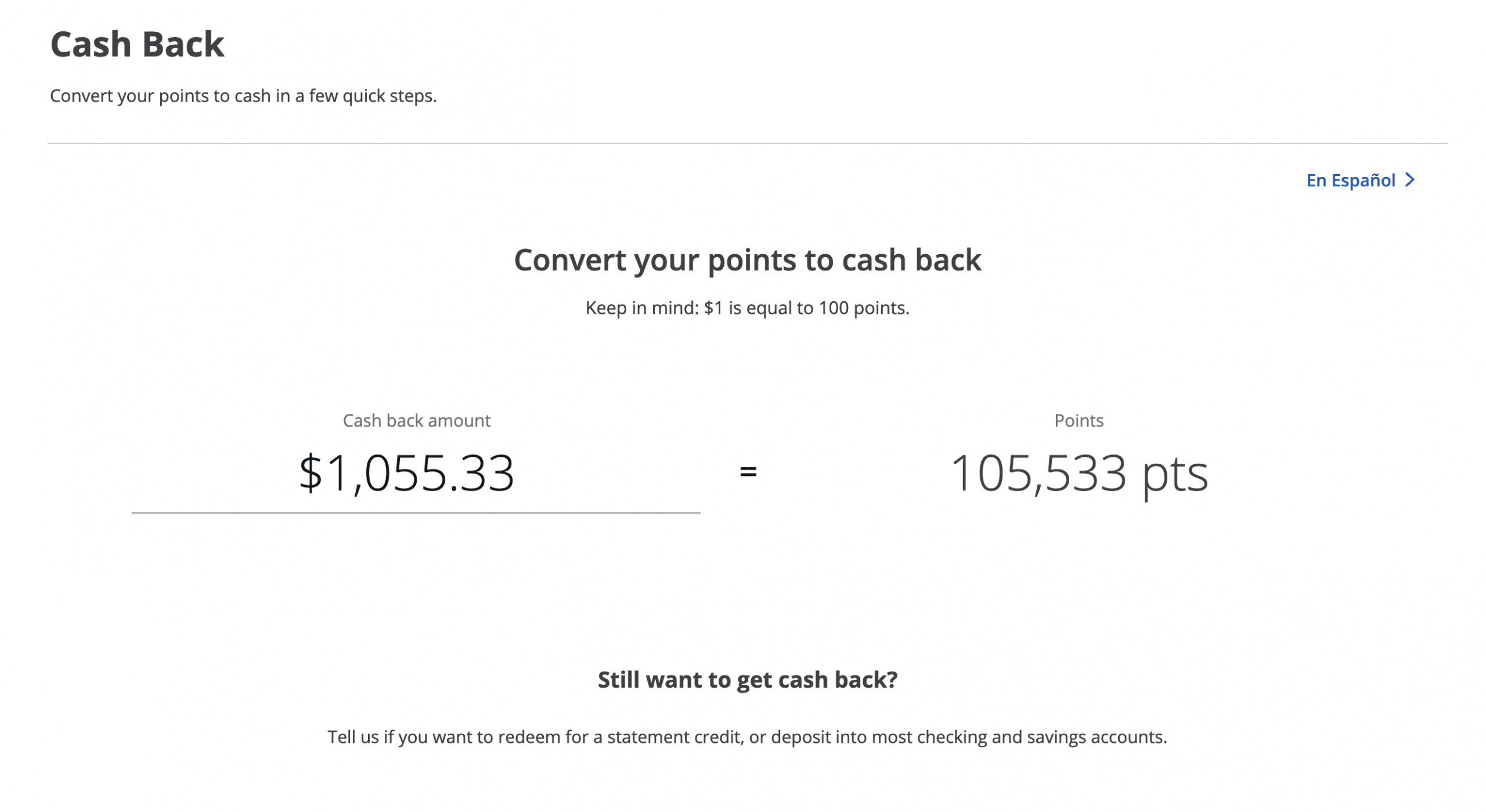

Chase Ultimate Rewards has two options for redeeming points for statement credits. The easier of the two is simply called “Cash Back”, which allows you to redeem any amount of points for money directly into your Chase Bank account or as a statement credit to your cards at a rate of 1 cent per point. Cash back redemptions may take up to three business days.

The better but slightly more complicated method is “Pay Yourself Back”, which allows you to offset previous purchases you’ve made in specific categories within the past 90 days.

Similar to redeeming points through Chase’s travel portal, the redemption rate you get for your points depends on which Chase credit card you have. The redemption rate generally ranges from 1 cent per point to 1.25 cents per point for most cards.

Rotating categories include gas, grocery, internet, cable, phone, shipping, dinning, and charity expenses. You can get a higher redemption 1.5 cents per point on charity contributions made with a Chase Sapphire Reserve Card.

Keep in mind that you can certainly derive better value out of your Chase Ultimate Rewards points by transferring them to travel partners, or booking trips on your own through Chase’s travel portal. However, if you don’t have any travel plans or if you’re wanting to redeem your points quickly, redeeming points for 1.25–1.5 cents per point through Pay Yourself Back isn’t a terrible option.

Other Points Redemption Options

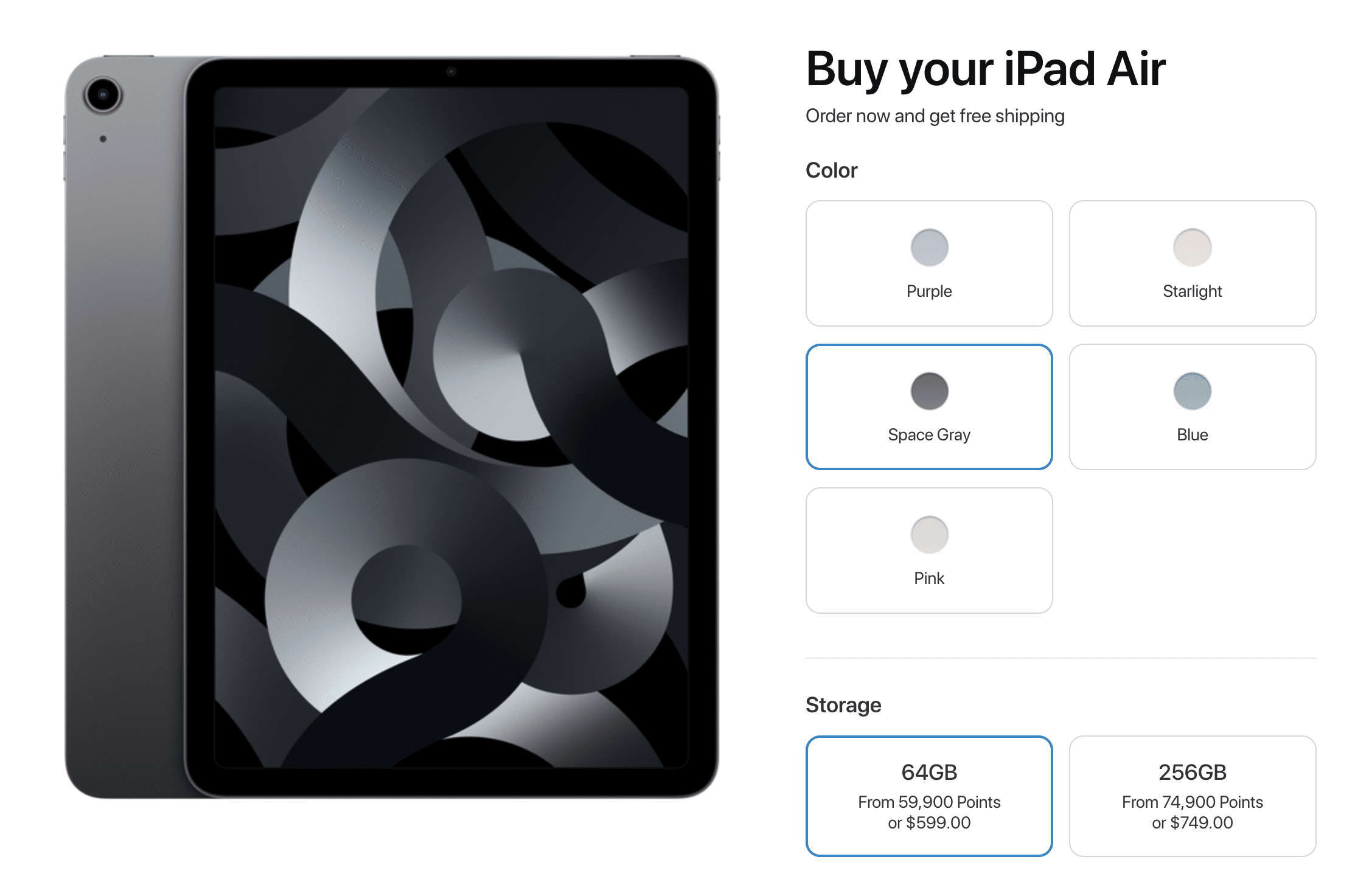

Ultimate Rewards points can be redeemed for Apple products at a rate of 1 cent per point, but you may find redemption promotions of up to a 50% bonus. Chase sells Apple products at par with Apple Store prices, so you’re not getting a terrible deal.

Proving their flexibility further, Ultimate Rewards points can be redeemed as rebates on PayPal purchases. However, redeeming this way yields a value of 0.8 cent per point, which is clearly subpar compared to the 1 cent per point that you may get from the cash back option.

Lastly, you can also redeem Chase Ultimate Rewards points for gift cards. Most gift cards can be redeemed at 1 cent per point, with some gift cards offering better promotional pricing periodically.

Conclusion

The Chase Ultimate Rewards program provides one of the best point currencies in the market. Plus, it presents huge earning potential through high credit card welcome bonuses and everyday spending earn rates.

Points earned can be redeemed through a number of options, with the most lucrative of them being the ability to transfer to a long list of airline and hotel partners. Notably, the list includes World of Hyatt, which doesn’t participate in many credit card transfer partnerships.

You can also redeem Ultimate Rewards points flexibly through the Chase travel portal, or if you don’t have immediate travel plans, you can redeem them as statement credits or even cash.

You should surely prioritize credit cards that earn Chase Ultimate Rewards points if you’re starting in the US market or if you’re planning to do so.