The New BMO eclipse rise Visa* Card

Bank of Montreal (BMO) has just launched the new BMO eclipse rise Visa* Card to round out its “eclipse” product lineup.

The BMO eclipse rise Visa* Card is now open for new applications, and below, we’ll go other the details about what you can expect in terms of annual fee, welcome bonus, perks, and benefits.

The New BMO eclipse rise Visa* Card

On December 14, 2023, BMO officially launched its newest credit card.

The BMO eclipse rise Visa* Card is the third eclipse product from Bank of Montreal, filling in the entry-level position, with the BMO eclipse Visa Infinite* Card and the BMO eclipse Visa Infinite Privilege* Card rounding out the lineup.

This card that has no annual fee and no minimum personal income requirement. The welcome bonus on the card is up to 25,000 BMO Rewards points in the first year, structured as follows:

- 20,000 points upon spending $1,500 (all figures in CAD) in the first three months of card membership

- 2,500 points if you redeem at least 12,000 points annually towards your statement credit using Pay with Points

- 2,500 points for paying your full credit card balance on time for 12 consecutive months

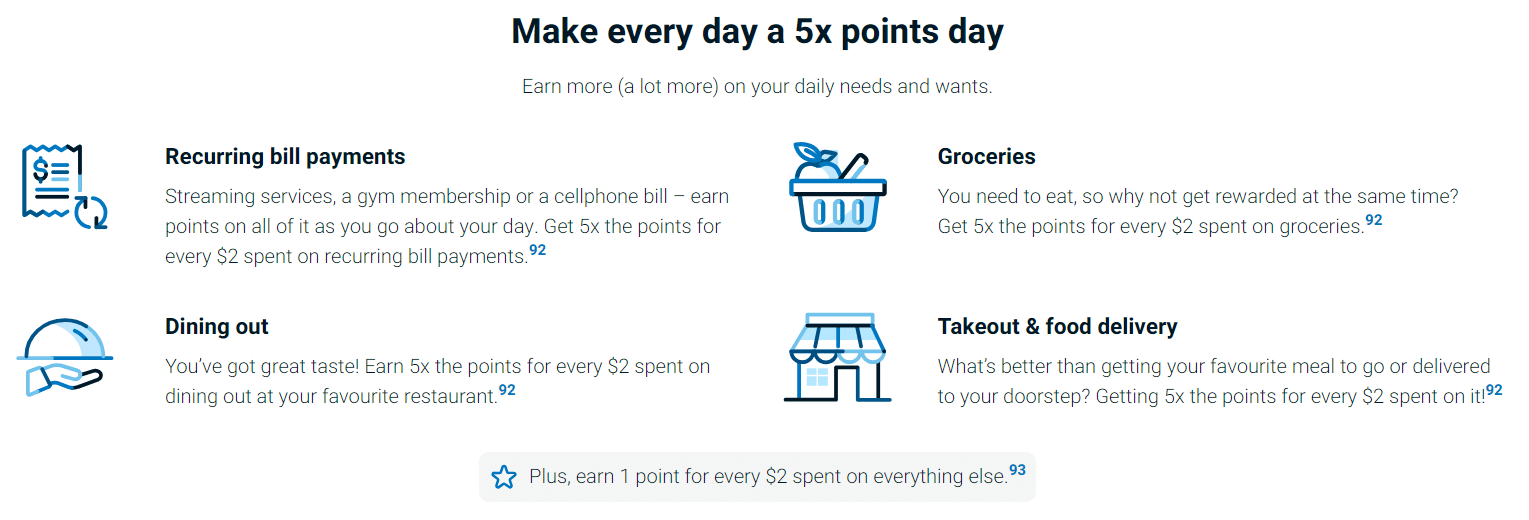

The earning rate for the BMO eclipse rise Visa* Card are as follows:

- 5 points per $2 spent on recurring bills, groceries, dining, and takeout

- 1 point per $2 spent on every other eligible purchase

The Essential Guide to BMO Rewards

Read moreIn terms of perks and benefits, the BMO eclipse rise Visa* Card offers fairly little, as you might expect from a no-fee card.

As a cardholder, among the perks you’ll receive are potential discounts on car rentals.

The card also comes with basic insurance coverage for your mobile device, covering you up to $1,000, and it extends some purchase protection and extended warranty opportunities.

How Does This Card Stack Up to Other BMO Cards?

The BMO eclipse rise Visa* Card is a no-annual-fee credit card that lets you collect BMO Rewards points. Beyond earning points, the card doesn’t offer much in the way of perks and benefits.

Within the BMO eclipse product line, there are two other cards on offer, so let’s take a look at how the new card compares against its higher-end counterparts.

First, the BMO eclipse Visa Infinite* Card has an annual fee of $120 and has a personal minimum income requirement of $60,000 and household minimum income requirement of $100,000.

This card earns BMO Rewards points and currently has a welcome bonus of up to 60,000 points, plus cardholders will receive a $50 lifestyle credit, and the annual fee is waived for the first year.

With the card, BMO Rewards points can be earned at a rate of 1 point per dollar spent on everyday eligible purchases, and cardholders can earn 5x the points on groceries, dining, drugstore purchases, gas, and travel.

The card also comes with the same mobile device insurance as the BMO eclipse rise Visa, covering you up to $1,000.

50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

BMO eclipse Visa Infinite* Card

Read moreNow, taking a look at the premium offering in the BMO eclipse product line, the BMO eclipse Visa Infinite Privilege* Card allows cardholders to earn BMO Rewards points and comes with stronger lifestyle and travel perks.

The card’s annual fee is $499, and the minimum income requirement is $150,000 in personal income or $200,000 in household income.

The card currently offers a welcome bonus of up to 90,000 points, structured as follows:

- 50,000 points after spending $6,000 in the first three months of card membership

- Additional 40,000 points 12 months after the card’s account open date and after you’ve spent a minimum of $100,000 within the year

Beyond the welcome bonuses, the BMO eclipse Visa Infinite Privilege Card earns BMO Rewards points at the same rates as the Visa Infinite Privilege card: 1 point per dollar spent on everyday eligible purchases, and 5x the points on groceries, dining, drugstore purchases, gas, and travel.

In terms of perks and benefits, the card provides a $200 annual lifestyle credit, a Visa Airport Companion membership with six complimentary lounge passes, airport perks such as Priority Security Lane at select Canadian airports, and access to the Visa Infinite Dining Series and Visa Infinite Wine Country.

The $200 lifestyle credit and the lounges passes and membership go a long way towards offsetting the $499 annual fee.

BMO eclipse Visa Infinite Privilege* Card

Read moreConclusion

As of December 2023, BMO has introduced the BMO eclipse rise Visa* Card, rounding out its eclipse Visa product roster.

The no-annual-fee card offers the ability to earn BMO Rewards points which can be used to offset purchases through BMO’s Pay with Points program.

Consider applying for the BMO eclipse rise Visa* if you’re looking for a card that doesn’t have an annual fee or minimum income requirement and that allows you to earn reward points on all your purchases.

† Terms and conditions apply please refer to the BMO Website for the most up to date information.

First-year value

$336

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners