Starting March 3, 2026 in Alberta and May 26, 2026 across the rest of Canada, you’ll earn and redeem Scene+ points at participating Shell gas stations on fuel, car washes, and eligible convenience purchases.

AIR MILES earning and redemption at Shell will end the day before those dates, with no conversion of miles to Scene+ points.

This shift lands on the same week BMO announced that AIR MILES will transition to its new Blue Rewards program in summer 2026, keeping balances intact but retiring the AIR MILES brand.

Let’s walk through what this means at the pump, how the earn rates work, and which cards you might want to use going forward.

In This Post

Earning Scene+ points at Shell

Once the partnership goes live, Shell will award Scene+ points on almost everything you would expect at a gas station. You’ll earn:

- 1 Scene+ point per litre on all grades of fuel

- 1 Scene+ point for every dollar you spend on car washes and eligible convenience items at participating stations

You can earn by scanning your Scene+ card at the pump or inside the store, by paying through the Shell app after linking your Scene+ account, or by paying with an eligible Scotiabank card that is connected to Scene+ and Shell Go+.

On top of the base earn, Shell adds a bonus layer when you link your Scene+ account to Shell Go+. In that setup, you earn 10% more Scene+ bonus points on fuel, car washes, and eligible convenience purchases, and you earn an additional multiplier when you buy Shell V-Power NiTRO+ Premium Gasoline.

I’m quite glad that there are no minimum requirements like the AIR MILES structure at Shell, with 1 mile per 10 litres of premium, 1 mile per 20 litres of regular, and 1 mile per $5 in-store. The Scene+ model should feel less fussy.

What Savings Can You Get at the Pump?

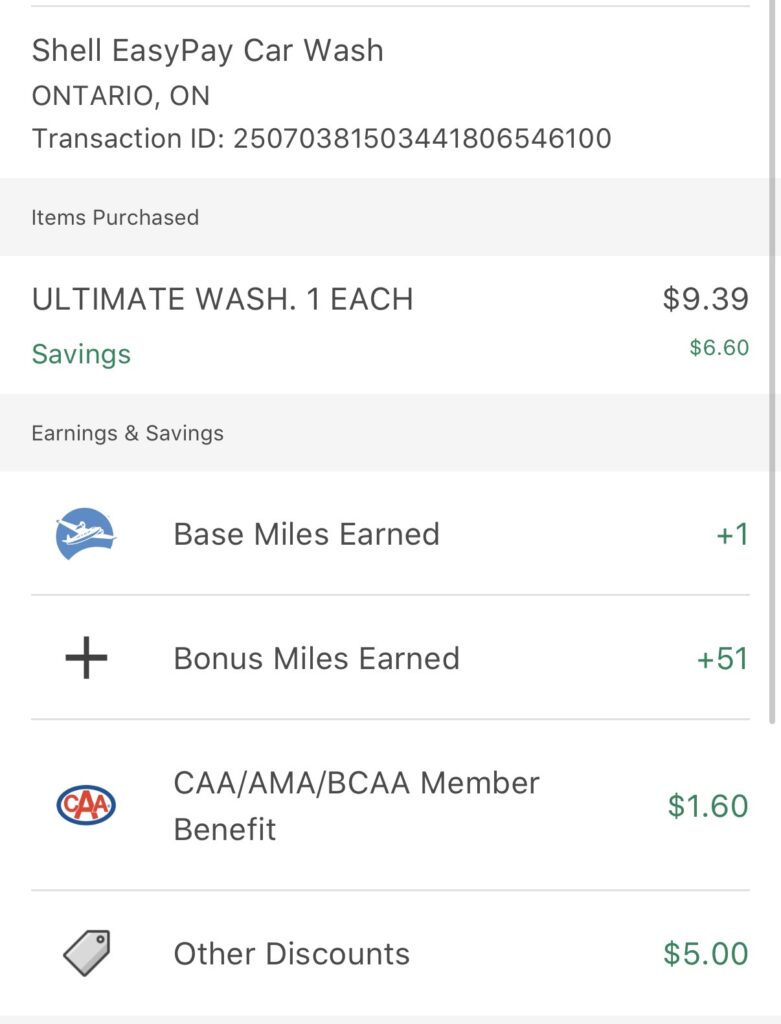

Previously, BMO cardholders were able to get 2 cents per litre off all Shell fuels and an even richer discount on V-Power when their BMO card was linked to their AIR MILES profile.

Surprisingly, you did not actually have to pay with a BMO card to get the discount, as long as it was properly linked in the background.

In the new world, Scotiabank and Tangerine step into that role. Shell has confirmed that eligible Scotiabank credit and debit cards, as well as eligible Tangerine credit cards, will unlock instant savings at the pump once they are linked in Shell Go+.

When you pay with the linked card, or its token in your mobile wallet, the discount is applied right at the pump while you also earn Scene+ points and Shell Go+ bonuses.

On top of that, CAA members can save 3 cents per litre at participating Shell stations, and this CAA discount can be stacked with Scene+ earning, Shell Go+ bonuses, and eligible Scotiabank or Tangerine instant savings when everything is set up correctly.

The precise cents-per-litre discount from Scotiabank and Tangerine has not been published yet, so we cannot say whether it will be better, worse, or roughly equivalent to the old BMO setup.

For now, it is safest to think of it as a nice rebate layered on top of the roughly 1% return you get from Scene+ points, with the final verdict reserved for when Shell and the banks publish actual numbers.

Which Credit Card Should You Use at Shell?

There are really two questions to answer here: which cards unlock Shell’s official savings, and which cards give you the best return on the spending itself.

If you want to keep things clean and “on script,” an eligible Scotiabank Scene+ card paired with Shell Go+ will likely be the flagship combo.

A card such as the Scotiabank® Gold American Express®* Card, which earns 3 Scene+ points per dollar spent on gas, lets you earn from three directions at once.

You get base Scene+ points from Shell on the litres and in-store purchases, you get the Shell Go+ bonus on top of that, and then you earn your usual credit card Scene+ points on the full transaction amount, all while triggering instant pump savings once those go live.

- Earn 25,000 Scene+ points upon spending $2,000 in the first three months

- Plus, earn an additional 20,000 Scene+ points upon spending $7,500 in the first year

- Earn 6x Scene+ points at Sobeys, IGA, Safeway, FreshCo, and more

- Plus, earn 5x Scene+ points on groceries, dining, and entertainment

- Also, earn 3x Scene+ points on gas, transit, and select streaming services

- Redeem points for a statement credit for any travel expense

- No foreign transaction fees

- Enjoy the exclusive benefits of being an American Express cardholder

- Annual fee: $120 (waived for the first year)

For many drivers, that level of stacking is more than enough. You fill up, tap one card or phone, and walk away knowing you have squeezed a decent amount of value out of an otherwise boring expense.

If you are more aggressive about card strategy, you may look at this and quietly wonder whether you can still play the same game that existed under BMO: linking one card to trigger a discount, then paying with a different, higher value currency earning card.

Under the old arrangement, you could have a BMO card linked to Shell for the price break, but still pay with something like an RBC® ION+™ Visa‡ Card to earn 3 Avion points per dollar spent on gas.

- Earn 7,000 Avion points upon approval^

- Earn 14,000 Avion points upon spending $1,500 in the first six months^

- Earn 3x points† on qualifying grocery, dining, food delivery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming and digital subscriptions†

- Earn 1 extra Moi Rewards point for every two dollars spent at Metro, Food Basics, Super C, Jean Coutu, Brunet and Première Moisson when you scan your Moi card and pay with your linked RBC Card (minimum purchase required).¹¹

- Mobile device insurance†

- Annual fee: $48†

We do not yet know whether Shell’s new Scotiabank and Tangerine setup will allow the same kind of separation between “linked card for discounts” and “payment card for points.”

The FAQ language leans in the direction of needing to pay with the linked card or its digital wallet version to trigger the instant savings and automatic earn and redeem behaviour.

If that is how it actually works at the pump, then the optimal play will be to pick the Scotiabank or Tangerine product that best fits your overall strategy and simply use that at Shell.

If, however, the implementation ends up letting you link a card for the discount but charge the transaction to a different card, then opportunities open up again.

In that scenario, you might well link a Scotiabank or Tangerine card purely to unlock the discount and automation, but still route the actual charge to a card like RBC® ION+™ Visa‡ Card at the terminal to earn 3 Avion points per dollar on gas. It is worth keeping that idea in your back pocket, but it is not something you should rely on until the new system is fully live and tested.

Either way, Shell Go+ is the control centre. Whether you are leaning into Scotiabank’s own cards, testing Tangerine, or eyeing hybrid setups, everything runs through that app and the links you set up inside it.

How Can You Redeem Scene+ Points at Shell?

Redeeming at Shell follows the standard Scene+ formula you might already know from grocery stores or Cineplex.

You redeem in increments of 1,000 Scene+ points, and each block of 1,000 points wipes $10 off your Shell transaction.

You can apply that discount to fuel, car washes, or eligible in-store purchases, and then pay the remaining amount with cash, debit, or credit.

The nice part is that you continue to earn Scene+ points on the full pre-redemption value of your eligible purchase. If you use 2,000 points to take $20 off a $60 fill-up, you earn Scene+ as if you had paid the full $60, not just the $40 that actually leaves your bank account.

If you’re an eligible Scene+ member, you can redeem points in increments of 1,000 for $10 off your purchase of fuel, car wash, or eligible convenience items at participating Shell locations.

You choose how many points to use (at least 1,000 per transaction and in increments of 1,000 points unless otherwise permitted) and pay the remaining balance with cash, debit or credit. You will continue to earn points on the full value of your eligible purchase.

You do need a properly registered Scene+ account to redeem. If you pick up a physical Scene+ card at Shell and never complete the registration online or in the Scene+ app, you can still earn points on eligible purchases, but you will not be able to burn them at the pump or access targeted offers until your account is confirmed.

Because Shell uses the same 1,000 equals 10 structure as the rest of Scene+, you do not have to worry about getting worse value at the gas station than you would get at the grocery store. If you prefer to lower your fuel bill instead of your food bill one month, you can. The math does not punish you for it.

When Does It Begin?

The timing of the transition depends on where you live. In Alberta, Shell starts offering Scene+ on March 3, 2026, and March 2, 2026 is the last day you can earn or redeem AIR MILES at Shell.

In the rest of Canada, the cutover happens later in the spring. You can continue to use AIR MILES at Shell through May 25, 2026, with Scene+ taking over on May 26, 2026.

There is no conversion of AIR MILES into Scene+ points as part of this change. Your AIR MILES balance stays inside the AIR MILES ecosystem and will later be moved into BMO’s Blue Rewards program on a one-to-one basis.

That means you should think of Shell as simply leaving the AIR MILES orbit and joining Scene+, rather than any kind of merger between the two programs.

If you have been in the habit of using AIR MILES Cash for Shell fuel, it is worth planning a few redemptions before your region’s cut-off date so you are not left wishing you had emptied your balance at the pump while you still could.

After that, you will be looking at a clean split: fuel rewards at Shell come from Scene+, while your historical AIR MILES balance continues its life under Blue Rewards with other partners.

How do I personally look at Shell and Scene+?

On a personal note, this partnership ticks a lot of boxes for me. Shell is already my favourite gas station, mainly because the app is so well developed.

I can pull into a bay, select the pump in the app, pay on my phone, and start fuelling without speaking to anyone or even taking my wallet out.

The same goes for car washes. Being able to run the whole process from my phone, including using Apple Pay inside the Shell app, makes the experience feel a lot smoother than hunting for a card at the till.

Scene+ is also my favourite fixed-value points currency in Canada. I like that I can use points against so many different types of travel purchases, and that I can often redeem directly with the travel provider instead of being locked into a single portal or a quirky reward chart.

If I have a pile of Scene+ points, I know I can point them at a grocery bill, a movie night, or a random hotel booking and get the same value.

Putting those two together, I am genuinely excited for this partnership. My usual habit of fuelling up through the Shell app now has the potential to feed a points balance that is actually useful for the kind of travel redemptions I like to make.

Conclusion

Shell Canada joining Scene+ is a meaningful shift in the loyalty landscape. Your fuel, car washes, and convenience purchases at Shell will now build the same points balance you may already be growing at the grocery store, the movies, or on travel, with Shell Go+ and eligible Scotiabank or Tangerine cards adding extra juice.

For AIR MILES collectors, losing Shell as an earn-and-burn partner may sting, even if balances are preserved under Blue Rewards.

For Scene+ fans, it is a clear win. In any case, 2026 is the year to double-check where you fill up, which card you tap, and which program your litres are feeding, so your gas bill quietly pulls its weight in your overall points strategy.