It was recently pointed out to me that I don’t give RBC Avion the attention it deserves on this platform, and upon reflection I’d tend to agree. After all, we don’t have many flexible, transferrable points currencies here in Canada, so we gotta cherish and maximize the ones we do have. American Express Membership Rewards is the leading player in that arena, but RBC Avion delivers solid value with a very respectable selection of transfer partners as well.

What Is RBC Avion?

“Avion” is the name for RBC’s line of premium travel credit cards. It includes the RBC Visa Infinite Avion, as well as the Visa Platinum and Visa Infinite Privilege versions of the card (targeted towards lower- and higher-income segments of the population, respectively).

The actual rewards program that the credit cards are associated with is technically known as RBC Rewards, although pretty much everyone calls it “RBC Avion” or “Avion points” as well.

While it’s true that Canada’s Big 5 banks don’t exactly enjoy a reputation of delivering tremendous value in their rewards programs, there are certain qualities that make RBC Avion a cut above the rest…

Generous Signup Bonuses

For the longest time, the RBC Visa Infinite Avion was the Canadian rewards credit card that never had a decent signup bonus.

TD, CIBC, BMO, and Scotia were mixing things up with first-year fee waivers and eye-popping bonuses of 25,000 or even 30,000 points, and RBC would always sit idly by with its standard offer of 15,000 Avion points for $120 in annual fee, complacent in the fact that its supposed leading reputation would entice enough people to become “Avioners” as it were.

That’s changed in recent years. Around 2017 was when RBC first upped the ante when it came to their flagship credit card product, launching an offer of 25,000 Avion points with the first year free. Since then, promotional offers have come and gone at a regular pace.

At the moment, the best available offer is for a total of 20,000 Avion points: you’ll get 15,000 points upon first purchase, and then a further 5,000 points after spending $1,000 in the first three months. The annual fee of $120 is waived for the first year. Click here to access it.

Wide Range of Transfer Partners

This is what truly elevates the work of the marketing team at Royal Bank Plaza above their more run-of-the-mill counterparts over at TD Centre or First Canadian Place: the ability to transfer points from RBC Avion to frequent flyer programs. In particular, RBC Avion points can be transferred to:

British Airways Avios at a 1:1 ratio

Cathay Pacific Asia Miles at a 1:1 ratio

WestJet Rewards at a 1:1 ratio (1 RBC Avion point = $0.01 in WestJet Dollars)

American Airlines AAdvantage at a 10:7 ratio (10 RBC Avion points = 7 AAdvantage miles)

Taken together, this set of transfer partners can be quite powerful if you know which program best fits your travel goals. British Airways Avios is perhaps the most useful program of them all, since there are so many “sweet spots” nestled within its unique distance-based redemption structure.

Based in the West Coast? Vancouver to Tokyo in Japan Airlines economy class for 25,000 Avios one-way is a sweet bargain, as is Seattle or Bellingham to Hawaii on Alaska Airlines for just 12,500 Avios one-way.

Torontonians can fly to Dublin for just 13,000 Avios off-peak in economy class or 50,000 Avios in business class, while Quebec residents enjoy one of the greatest Avios sweet spots of all starting from next August, when the new Montreal–Dublin route can be booked for as little as 31,750 Avios in business class.

Moreover, Avios is one of those currencies that you can never have too many of, since they’re useful no matter where in the world you’re travelling, particularly in Oneworld strongholds such as Latin America (LATAM), Western Europe (British Airways/Aer Lingus/Iberia), the Middle East (Royal Jordanian/Qatar Airways), Australia (Qantas), and East Asia (Cathay Pacific/JAL). Starting at just 4,500 Avios for a short-haul one-way flight, you never know when you might need to use your Avios to book a regional flight or two.

Cathay Pacific Asia Miles is a program that’s unnecessarily complex in many ways, but there are a few sweet spots that are worthy of attention.

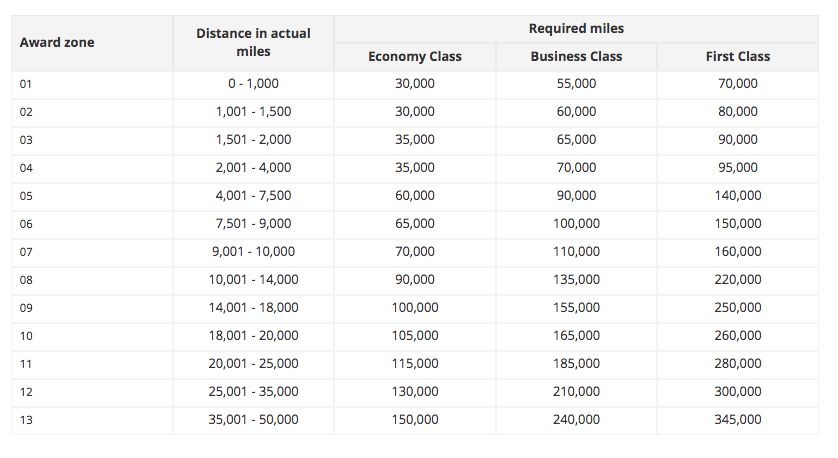

Their Oneworld multi-carrier chart is one particular gem; while following the below award chart, you must include either two Oneworld carriers excluding Cathay Pacific OR three or more Oneworld carriers including Cathay Pacific, and you get to have up to five stopovers and two open-jaws.

That’s right – five stopovers and two open-jaws. These routing rules put even the Aeroplan Mini-RTW to shame, although of course there are several intricacies that need to be studied in order to book something as well. This is definitely worthy of its own dedicated post, so look out for one soon.

WestJet Rewards provides coverage for travel within North America, since WestJet Dollars can be redeemed 1:1 towards the cost of a WestJet ticket. You can also use WestJet Dollars towards the program’s Member Exclusive Fares, which are discounted fares on WestJet’s partners (Delta, Air France/KLM, and Qantas) that can only be booked using WestJet Dollars.

Lastly, American Airlines AAdvantage is a major US frequent flyer program that we Canadians don’t have much access to. Indeed, besides transferring RBC Avion points at a 10:7 ratio, the only other way to earn AAdvantage miles would be through US credit cards or by transferring points through Marriott.

AAdvantage’s sweet spots have mostly been killed off over the years in a series of devaluations, and the ones that do remain tend to be accessible through Alaska miles as well, which are much easier for Canadians to earn. Nevertheless, AAdvantage is still a key program for the aspirational flyer, since it’s one of the best ways to book to some of the world’s most luxurious flight experiences, such as Qatar Airways QSuites and Etihad Airways’s First Class Apartments.

On the whole, RBC Avion’s four major transfer partners open up a wealth of possibilities. Whether you’re travelling domestically or internationally, and whether you’re looking to gallivant around the world or chase after premium cabins, you’re certain to find some compelling use for RBC Avion points through their airline partners.

Outside of transferring to frequent flyer programs, other uses of Avion points are less compelling. Nevertheless, you can head over to my dedicated guide to the RBC Avion program to discover more about these options, such as RBC’s proprietary flight redemption chart.

Up to 50% Points Transfer Promotions

To sweeten the deal even further, RBC routinely puts on promotions in which you get an extra chunk of points when transferring to partners. This is most frequently seen with British Airways Avios and WestJet Rewards.

Conversion bonuses to Avios seem to arrive at least twice a year, and most often they fall in the 30% range. In fact, one such promotion is ongoing right now and lasts until the end of the year. So if you applied for the current signup bonus of 20,000 Avion points, you could convert those into 26,000 Avios, which is enough for a round-trip between Toronto and Dublin on Aer Lingus!

We occasionally see conversion bonuses to Avios of up to 50% as well, although those are rarer – the last one was two years ago in December 2016.

WestJet Rewards also gets the occasional transfer bonus, which tend to be more modest in the range of 10% to 20%. Generally speaking, I’d say the relative strength of the Avios program means that their transfer bonuses provide much better value than the WestJet ones, but if you do travel frequently with WestJet then the extra WestJet Dollars during these promotions would certainly come in handy as well.

As far as I know, we haven’t seen a transfer bonus to American Airlines AAdvantage in a good five years or so, while Cathay Pacific Asia Miles has never seen a transfer bonus in the past. There’s also the occasional bonus for transferring RBC Avion points to other rewards programs like Hudson’s Bay Rewards, but those don’t make up for the relatively poor value of redeeming your Avion points that way in the first place.

Conclusion

While American Express Membership Rewards is no doubt the leading transferrable points currency in Canada, RBC Avion is a great diversification option as well and shouldn’t be overlooked. The Avion-branded credit cards routinely offer higher signup bonuses these days, and the breadth of airline transfer partners and the regularity of Avion and WestJet transfer bonuses make Avion points a surprisingly versatile currency to hold.