Select travel providers around the world provide some additional benefits to shareholders when they fly, stay, or book with the company.

Some of us might have acquired our fair share of travel stocks over the past year when they’ve been relatively undervalued due to the pandemic, so I thought it’d be worth going over some of the most prominent examples of shareholder travel benefits.

Airlines

A few airlines around the world offer additional benefits to shareholders. Both of Japan’s mainline carriers participate in this practice, while there’s also a European airline that offers a backdoor channel to Star Alliance Gold for its investors.

ANA & Japan Airlines

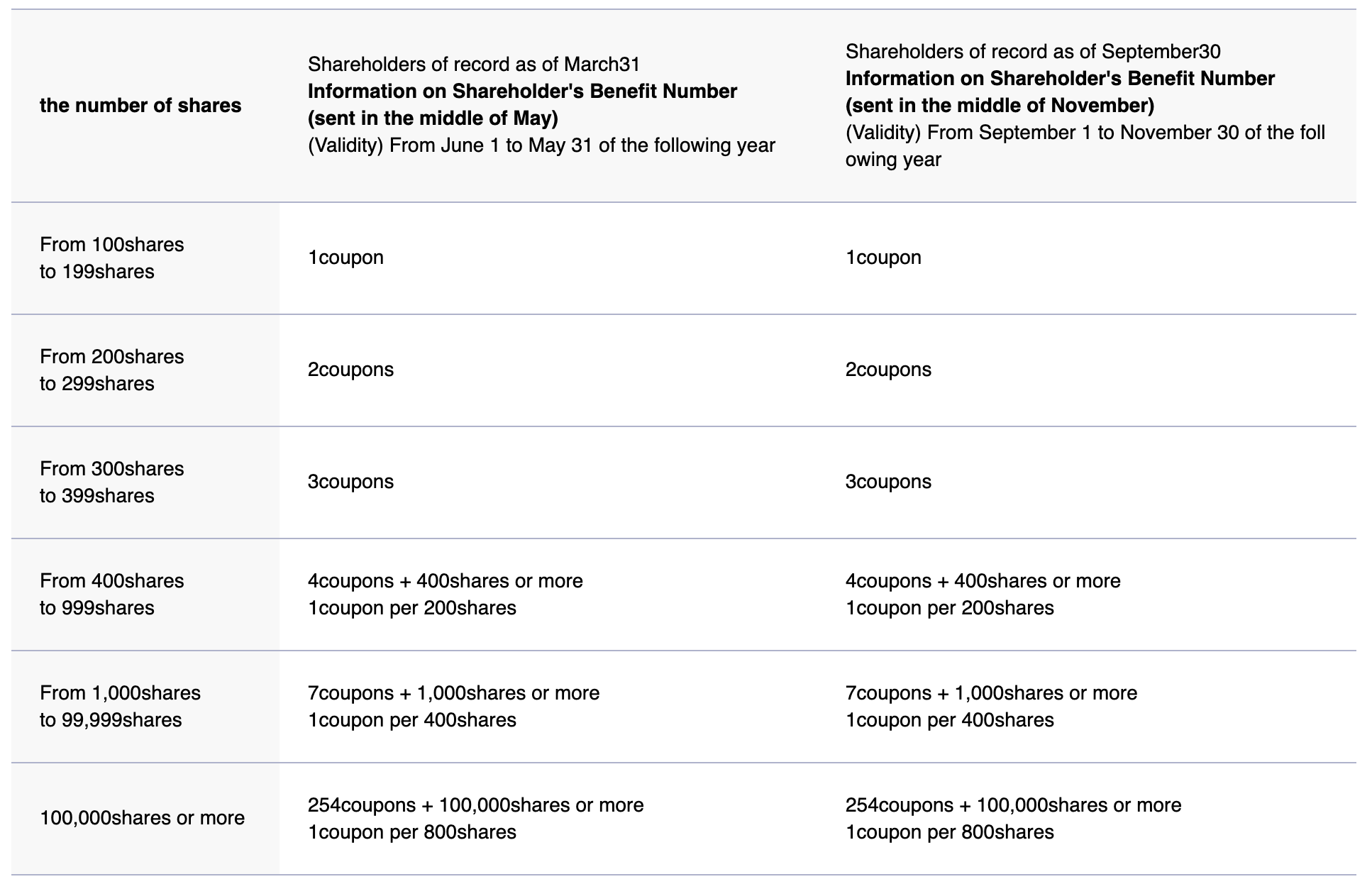

ANA’s shareholder benefit program is only available to members with registered addresses in Japan. A minimum holding of 100 shares is required; as of the time of writing, ANA’s stock price is trading at ¥2,518 (~$28), meaning that a minimum investment of ~$2,800 (CAD) is required to enjoy shareholder benefits.

In return, the shareholder is given one or more 50% discount coupons for use on any ANA one-way domestic flight. The minimum 100 shares earns you a single discount voucher, 200 shares earns you two vouchers, and so on:

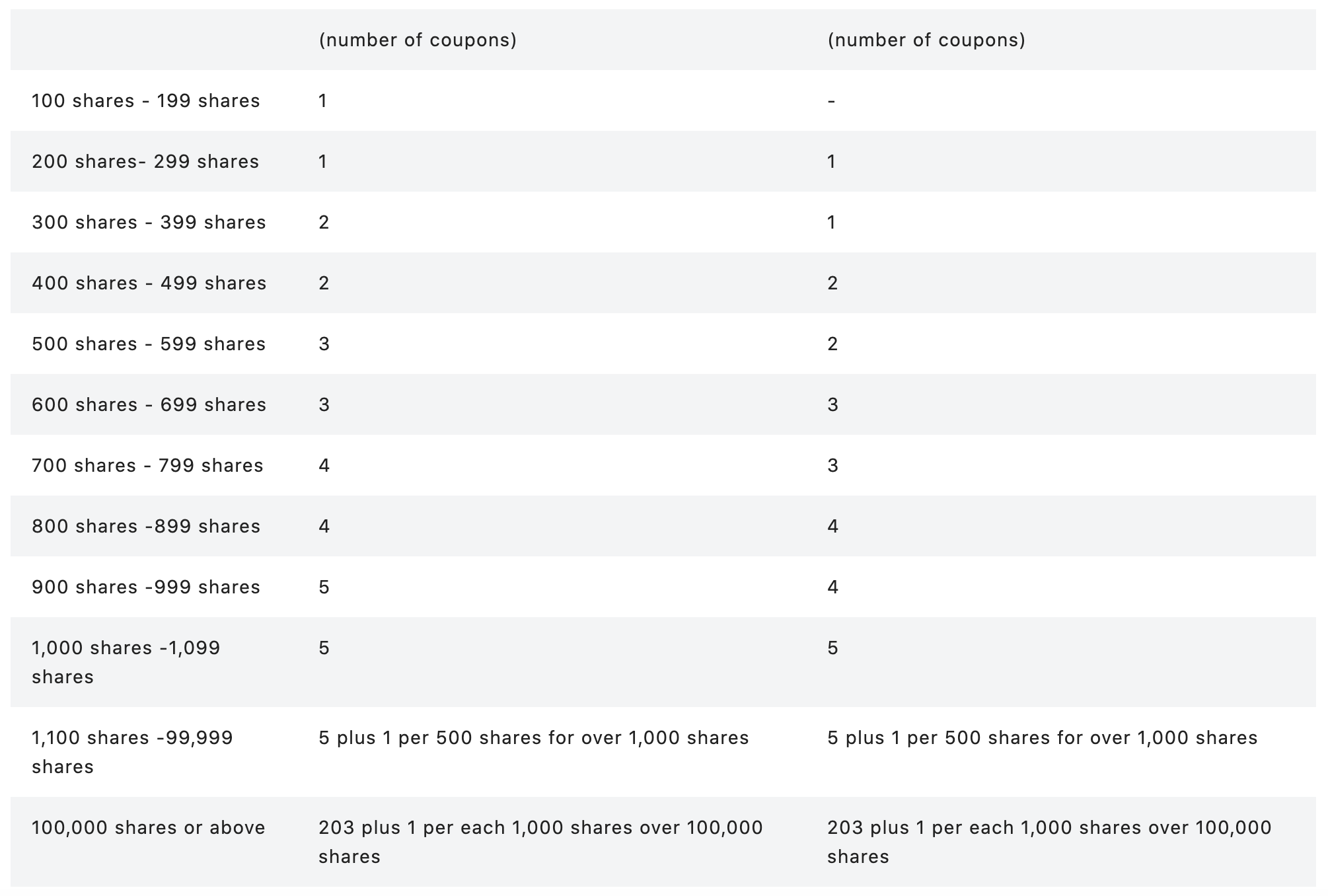

Meanwhile, Japan Airlines’s shareholder benefit program is almost exactly the same as ANA’s, requiring a minimum 100 shares to start earning 50% discount vouchers. As of the time of writing, JAL’s stock price is trading at ¥2,291 (~$26), so you’d need a minimum investment of ~$2,600 (CAD) to partake.

Again, your ownership level determines the number of 50% discount coupons you earn, which are redeemable on JAL one-way domestic flights.

Unlike ANA, Japan Airlines doesn’t specify that the shareholder’s address must be registered in Japan; however, my understanding is that you do need to be a resident of Japan to trade on the Tokyo Stock Exchange in the first place, so it’s a bit of a moot point.

Anyhow, one-way domestic flights within Japan aren’t very expensive in the first place, so I wouldn’t say it’s a great incentive to put your money into ANA or JAL stock unless you truly believe in their stock (perhaps as a result of a life-changing experience onboard one of their First Class cabins).

SAS

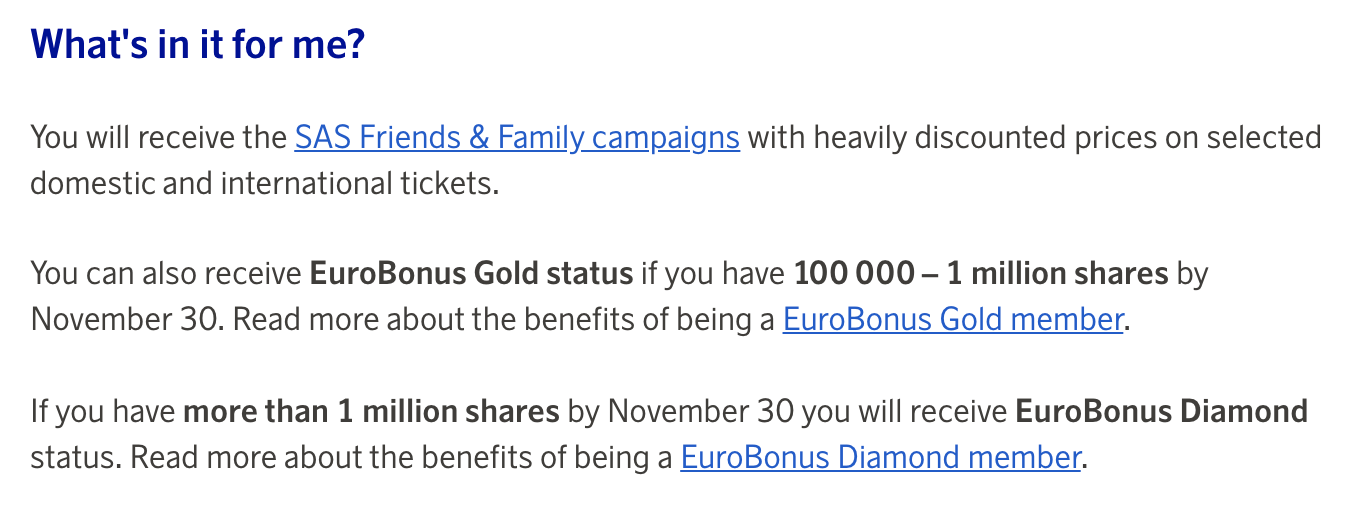

Scandinavian Airlines, which trades on the Nasdaq Stockholm, offers shareholders exclusive benefits in their EuroBonus loyalty program. As of the time of writing, SAS’s stock price is currently trading at 1.97 SEK ($0.29).

If you own at least 4,000 shares of SAS, you’ll be eligible to participate in SAS Friends & Family campaigns, which are seat sales and deep-discount promotions normally reserved for SAS employees and their friends and families. That can be helpful if you sometimes book cash fares with SAS, but otherwise isn’t too interesting.

However, if you own at least 100,000 shares of SAS – an investment of $29,000 (CAD) – you can earn EuroBonus Gold status, which is equivalent to Star Alliance Gold. And as long as you hold onto your shares, you’ll be able to enjoy Star Alliance Gold status year after year.

Of course, $29,000 is no small sum of money, and it isn’t wise to put that into SAS stock purely for the perpetual airline status. Instead, if you think the airline’s long-term prospects are favourable and you’re in a position to allocate $29,000 towards their stock, then Star Alliance Gold is a very nice perk to enjoy until you decide to sell.

(Note that SAS will only hand out a maximum of 5,000 Eurobonus Gold memberships to shareholders every year, and priority is given to those with larger holdings. So if everyone started holding 100,000 shares of SAS for Star Alliance Gold, then soon 100,000 shares wouldn’t be enough.)

Based on last year’s dates, it appears that November 30, 2021 will be the date on which you must hold SAS shares to be eligible for shareholder benefits in 2022. I must say, that does leave me wondering if you could buy 100,000 SAS shares on November 30 and sell them on December 1 if you wanted a “free” year of Star Alliance Gold.

Hotels

A few of the major hotel loyalty programs offer additional benefits for their shareholders, including one chain that Canadian travellers might find particularly interesting.

Accor ALL

Accor is the hotel chain that encompasses Fairmont Hotels & Resorts, the Canadian luxury hotel brand that boasts a strong presence in Canada.

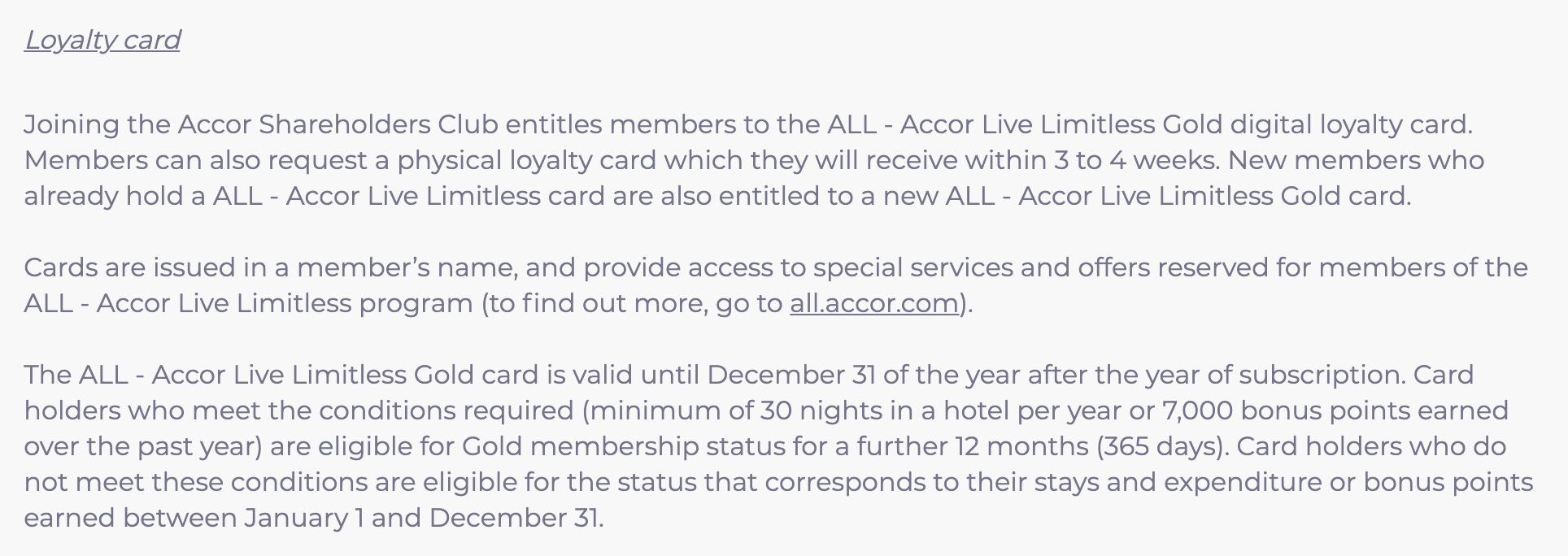

Unfortunately, there’s no meaningful way to earn and redeem Accor ALL points for outsized value, but the program does offer a shortcut to its mid-tier Gold status for anyone who owns 50 shares of Accor through the Accor Shareholders Club program.

As of the time of writing, Accor is trading at €32.05 ($47), so holding ~$2,350 (CAD) in Accor stock would earn you instant Accor Gold status until December 31 of the following year.

If you’re a Fairmont fan and you believe in the strength of the brand, then that might be a fairly realistic amount to invest – ideally in January of a given year, so that you can enjoy almost two years of Gold status.

Accor Gold status gives you a welcome drink, a room upgrade subject to availability, and early check-in or late checkout subject to availability. It doesn’t offer free breakfast or suite upgrades, but you can always ask and you might have a better chance as a Gold member.

Keep in mind that you can also earn Accor Gold status by signing up for the Ibis Business Card, which costs €90 ($132) per year. It’s up to you whether temporary stock ownership or a one-time €90 outlay is the better option, and whether either is worthwhile compared to the benefits of Accor Gold status.

Personally, I think both are good options if you plan on staying with Fairmont a couple times per year.

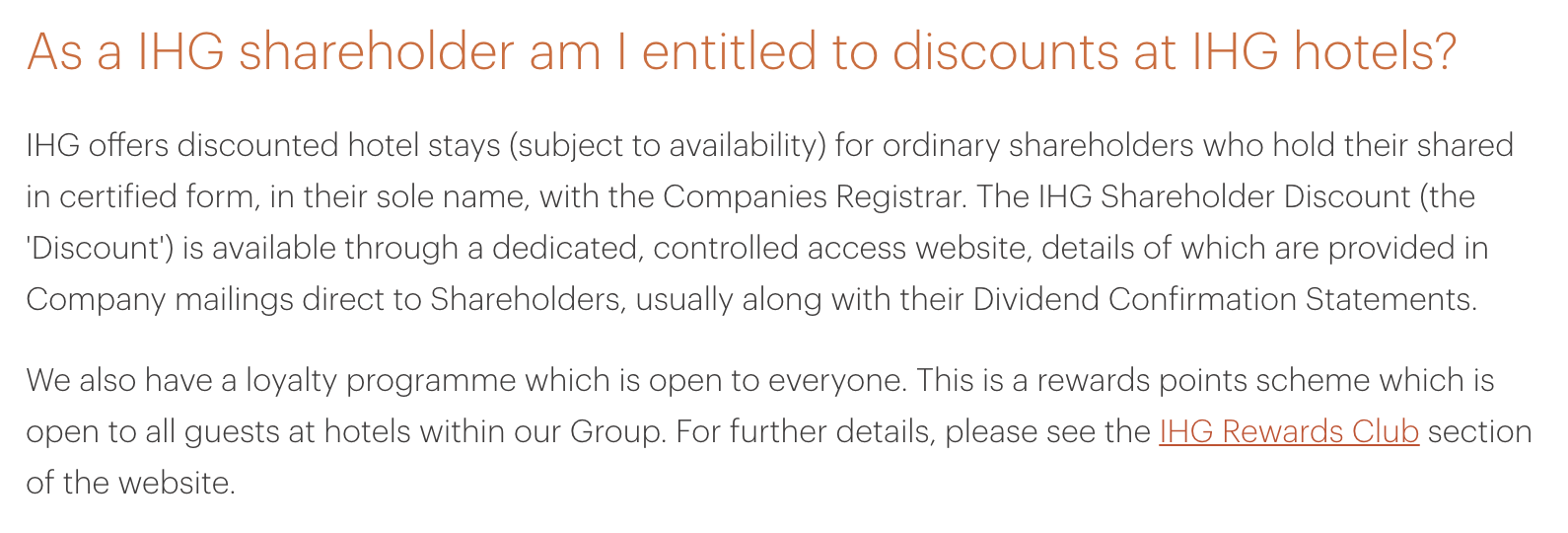

IHG Rewards

IHG mentions on their website that select benefits are available to any shareholder who holds at least one share of IHG stock. IHG is currently trading at US$67.95, so that would be the amount you’d need to put down to access IHG’s shareholder benefits.

However, those benefits seem to be cloaked in mystery, and it’s only through a FlyerTalk post by an IHG employee that we have a minimal understanding of what perks shareholders can expect. It seems to be a 15% discount off the Best Flexible Rate, with a rather unfavourable cancellation policy at that.

According to the IHG employee, simply booking the member advance purchase rate would probably land you within $5 of the shareholder discount rate, so it’s probably not worth bothering to buy a share of IHG stock unless you genuinely wanted to (perhaps as a result of their *ahem* industry-leading loyalty program).

Cruises

Compared to airlines and hotels, the major publicly-traded cruise lines offer much more formalized shareholder benefits, entitling anyone who holds at least 100 shares to a certain amount in credits to be used for onboard purchases.

These credits are generally reserved for the shareholder themselves and cannot be extended to others, and they apply on unlimited sailings as long as the passenger continues to hold their shares.

Carnival Cruises

If you hold at least 100 shares of Carnival (currently trading at US$25 per share), you’ll be entitled to onboard credit of up to US$250 for sailings of 14 days or longer. The full chart of shareholder credits is as follows:

You must submit your request for the onboard credit three weeks prior to the sailing date.

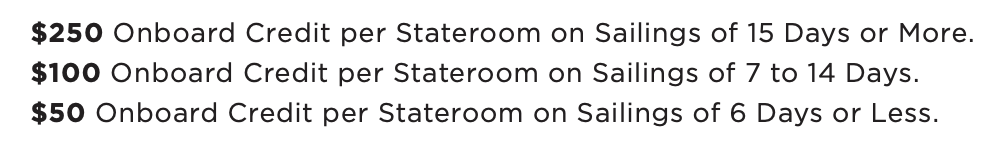

Norwegian Cruise Line

If you hold at least 100 shares of Norwegian (currently trading at US$27 per share), you’ll be entitled to onboard credit of up to US$250 for sailings of 15 days or longer:

You must submit your request for the onboard credit 15 days prior to the sailing date.

Royal Caribbean

If you hold at least 100 shares of Royal Caribbean (currently trading at US$80 per share), you’ll be entitled to onboard credit of up to US$250 for sailings of 14 days or longer:

You must submit your request for the onboard credit 2–3 weeks prior to the sailing date.

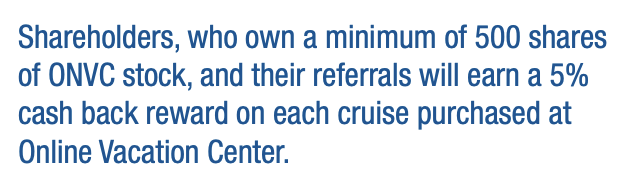

Online Vacation Center

This one’s a bit out of left field: Online Vacation Center, an online travel agency for cruises, also offers shareholder benefits of their own. Anyone who holds at least 500 shares in ONVC (currently trading at US$2.20) will earn 5% in cash back on any cruise purchased through Online Vacation Center.

If you have a spare US$1,100 lying around, enjoy cruising, and believe the company’s prospects are favourable, you could park your cash in Online Vacation Center stock and earn a perpetual 5% discount on your sailings.

In fact, the fixed 5% cash back return makes it possible for us to calculate a breakeven point even if you were to treat the US$1,100 as a one-time expense rather than stock ownership – you’d be coming out ahead if you anticipate spending at least US$22,000 on cruises that can be booked through Online Vacation Center in the future.

Conclusion

I really do like the concept behind shareholder benefits by travel companies – if you’re a stock owner, you’re contributing directly to the long-term success of the airline, hotel, or cruise line, so it’s great to get a few benefits in return once you reach a significant level of stock ownership. It’s something that I wish more travel providers would consider adding as a component of their loyalty program.

For now, SAS, Accor, and the major US cruise lines are the most active in this space, and the Accor Shareholder Club in particular is something you might consider if you have a few Fairmont stays lined up.

Unfortunately, SAS’s Shareholder program requires you to:

3. Be a permanent resident in either Denmark, Norway or Sweden

Fascinating read Ricky. Way to think outside the box. Another reason why I like your articles.

Cool post Ricky! Didn’t know about these fringe benefits, I’ll be adding Accor to my equities watch list for some additional travel and hospitality exposure.

In January you also briefly touched on Travala, not sure if you’ve looked at their Smart Program but would fit into a similar bucket as these offers: https://www.travala.com/smart . They recently decreased the program value in April, used to be 12% APY, but the 8.04% APY is still reasonable. For the sake of an example, let’s assume price stays stable at a minimum of $2.50 (currently ~$5). This means Tier 1 would cost $625 USD and earn you $50.25/year, or $100.5 USD at current token prices. So at current prices you could probably get an annual room for free with that earn rate + the any potential upside from token appreciation. Tier 2-3 probably safely secures an annual room or 2. The Smart Discount and Loyalty are okay too, but pretty mild benefits IMO. Less than 6,000 users currently using the program, interestingly enough more than 50% are Tier 5. 6 months ago it was trading under a dollar, so I don’t doubt many got in before the token blew up in the current bull market. Here’s a pretty cool community dashboard: https://travala-dashboard.com , about 20% of bookings are currently being made with the Travala (AVA) token which is certainly significant, while only around 18% of tokens are participating in the Smart program. No affiliation, just one of my crypto holdings that I felt was relevant to this discussion.

I recalled that SPG also offered different Elite Status (when holding various numbers of Holiday Inn shares. Would you have some updates when it now merged under Marriott. Would be very interesting information for followers to know !

Are you sure it was Holiday Inn? Holiday Inn is under IHG rather than SPG/Marriott.