The Secured Tims® Mastercard is one of the two cards with no annual fees offered by Tims Financial, the financial services division of Tim Hortons. The card is issued in collaboration with Neo Financial™ and Mastercard.

As the name suggests, it’s a secured credit card suitable for those who are building or rebuilding their credit. Applying for the card doesn’t involve a hard credit check.

As the card helps you build your credit, you’ll be rewarded on not only your Tim Hortons coffee runs but also your everyday purchases. The card offers accelerated earning on groceries, gas, EV charging, transit, taxis, and rideshares.

Bonuses & Fees

As a welcome bonus, the Secured Tims® Mastercard offers a $20 Digitial gift card upon first purchase with a new Tims Mastercard.†

The card has no annual fee, making it a good choice to keep open as a free primary or backup credit card, all while helping you build your credit.

Note that the card has a minimum $50 security fund deposit required.

Earning Rewards

The Secured Tims® Mastercard has the following earning structure:

- 12 Tims Rewards Points per dollar spent when you scan for Tims Rewards†

- 2 Tims Rewards Points per dollar spent on qualifying grocery purchases, gas and transit†

- 2 Tims Rewards Points per dollar spent on qualifying gas†

- 2 Tims Rewards Points per dollar spent on qualifying transit, taxi, and rideshares†

- 1 Tims Rewards Point per $4 spent on all other qualifying purchases†

Note that there’s an annual cap of $20,000 in purchases on accelerated earn categories, after which all purchases will earn 1 Tim Rewards point per $4 spent. The annual limit is counted per calendar year, regardless of when the card is applied for and activated.

To earn accelerated rewards on your Tim Hortons purchases, you must use your Secured Tims® Mastercard to pay and also scan your Tims Rewards physical card or app barcode.

This is because of the 12 Tims Rewards points in total that you’ll earn per dollar spent at Tim Hortons, 10 points are earned by scanning your Tims Rewards card or barcode alone. The remaining 2 points are earned by using your Secured Tims® Mastercard.

To make your transaction more seamless, you may link your Secured Tims® Mastercard to the Tim Hortons app and use the “Scan to Pay” feature.

Redeeming Rewards

Tims Rewards Points may be redeemed towards products at Tim Hortons at the following rates:

- Classic Donuts, Specialty Donuts, Hashbrowns, and Cookies: 300 points

- Brewed Coffee, Tea, Dream Donuts™, Dream Cookies™, Bagels, and Baked Goods: 400 points

- Hot Chocolate, French Vanilla, Iced Coffee and Wedges: 600 points

- Real Fruit Quenchers, Cold Brew, Classic Iced Capp®, Box of 10 Timbits®, Yogurt, Frozen Beverages and Espresso Drinks: 800 points

- Breakfast Sandwiches and Soups: 1,100 points

- Farmer’s Wrap, BELT®, Lunch Sandwiches and Chili: 1,300 points

However, as a special feature of the Secured Tims® Mastercard, you may also use your Tims Rewards Points as statement credits against eligible purchases you’ve made.

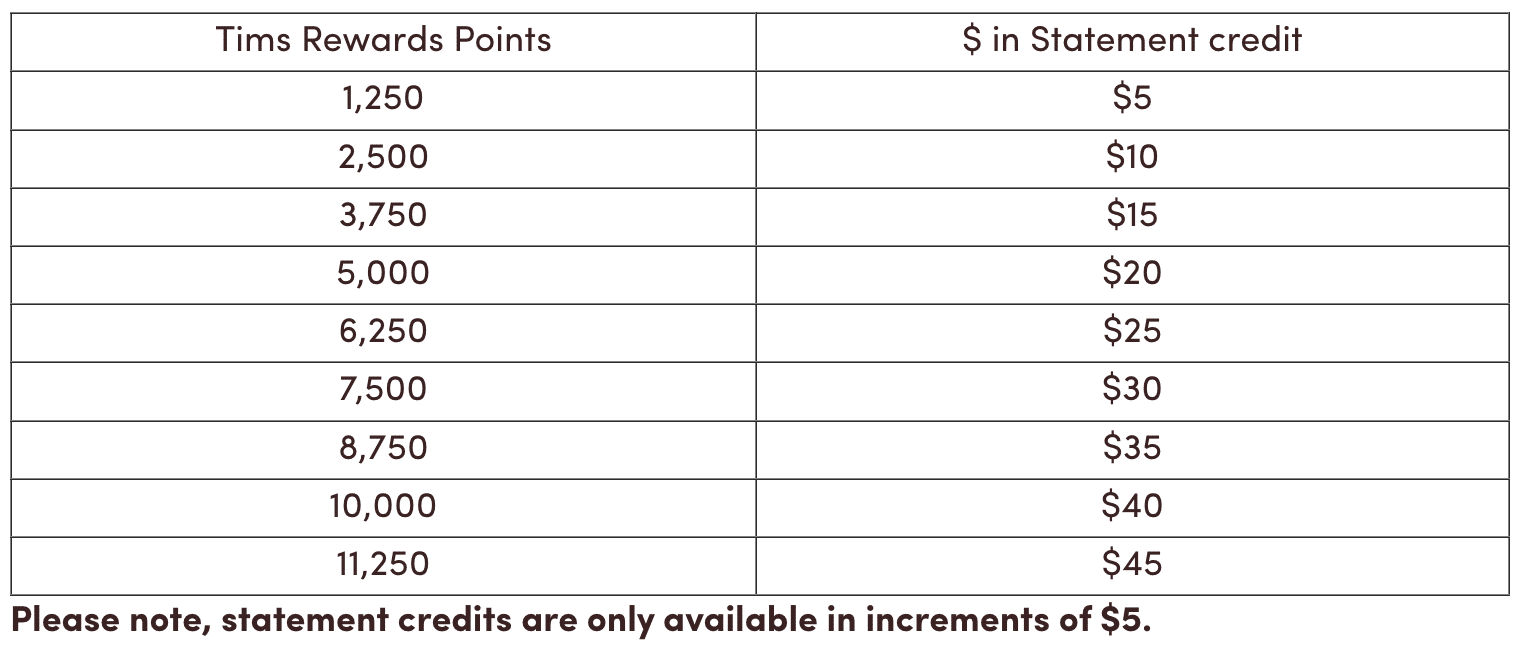

The Tims Rewards Points-to-statement credit conversion is as follows:

When used on statement credits, each Tim Rewards Point yields a value of 0.4 cent per point.

Note that you may only apply for one statement credit per seven days, up to a maximum of $45 each time. Say you apply for a $30 statement credit on a Monday, the next time you’ll be able to apply for a statement credit will be the following Monday.

Moreover, a statement credit must be applied against an eligible purchase, and it must not exceed the purchase being applied for. For example, you may not apply a $45 statement credit on a $40 purchase.

Perks & Benefits

As a card with no annual fee, the Secured Tims® Mastercard understandably has limited perks and benefits.

Some of the benefits cardholders may receive in addition to having the ability to redeem their Tim Rewards Points up to $45 per week† is the ability to get up to 0.8% back on essentials† which is a benefit if you use this card on a frequent basis, for example if you spend $625 on groceries, that is 1250 points that you can receive and redeem for a $5 statement credit.

Another benefit for Secured Tims® Mastercard cardholders is the ability to get up to 4.8% back at Tims†. For those who frequent Tims locations and spend $104 can receive 1,250 Tims Reward Points that can be redeemed for a $5 statement credit.

Insurance Coverage

The Secured Tims® Mastercard offers limited insurance coverage on retail purchases but not on travel.

Its extended warranty coverage lengthens the manufacturer’s warranty for most items purchased up to one year. Repairs, replacements, or reimbursements are limited to $1,000 maximum per incident.

Meanwhile, its purchase protection coverage allows items purchased with the card to be repaired, replaced, or reimbursed up to $1,000 per incident. The protection is valid for 90 days after purchase.