The Best US Bank Accounts for Canadians

If you’ve been collecting points exclusively in Canada, the allure of US credit cards has probably piqued your interest. The vibrant American credit card market is full of high-value offers, and indeed many of them are accessible to us Canadians if we put in the work.

Opening a bank account in the US is an essential first step of your US credit card journey. Let’s take a look at some of the best US bank accounts available to Canadians, while considering the unique challenges that we face in playing the game from north of the border.

Canadian Bank Partners in the US

To pay your US credit card bill, you need a US dollar account at a US-based institution.

Now, Canada’s Big 5 banks – BMO, CIBC, RBC, Scotiabank, and TD – all offer Canadian-domiciled US dollar accounts. However, you generally can’t pay your US bills from these accounts for two reasons.

First, you can’t make a “push” payment, as a bill payment initiated by the bank. For the most part, Canadian banks and bill payment services don’t have US credit card issuers, or any other US billers, listed as payees.

Second, you can’t make a “pull” payment, as in a pre-authorized payment initiated by your US credit card issuer. The Canadian and US banking systems use different formats for routing numbers to facilitate inter-bank payments, and one won’t work with the other. US credit card issuers are only able to pull from US routing numbers.

You can also pay cross-border bills with a bank draft, but that method is prohibitively expensive, slow, and at a poor exchange rate.

Instead, it’s necessary to open a US-domiciled account, buy and transfer US currency at an acceptable rate, and make US-dollar payments to US payees from there.

Luckily, most of Canada’s major banks have counterparts over the border. If you already bank with one of them here, it’s easy to open an account with their American partner institution. You can apply as a Canadian, and you don’t need any US identification to be eligible.

These American divisions are targeted at Canadians who split time in both countries, have recently moved south, or otherwise have strong connections on both sides of the border. In any event, assuming you only use the account as a staging area for bill payments and don’t need extensive US banking features, any of these basic checking accounts will get the job done.

TD Bank

TD Canada Trust is partnered with TD Bank in the US. Their basic account, TD Convenience Checking, is free for anyone 23 or younger, or free with a minimum balance of $100.

This account includes unlimited everyday transactions, with a $15 fee for incoming wire transfers. The wire transfer fee for the initial deposit is waived if you fund the US account from one of your Canadian TD accounts.

Canadian clients can open an account by using TD’s Cross-Border Banking services. You can also see the balance of your US-domiciled accounts on your Canadian profile online, but you need to log into the US website to pay bills and view or change account details. It’s easy to move US currency online between your own TD accounts on either side of the border, although the transfer may take 1–2 days.

If you have trouble with TD’s online application, try opening a US-based account at a TD Canada Trust branch. Once your account is open, you can call the Cross-Border Banking phone line to complete the initial funding from your Canadian-based US-dollar TD Borderless Plan, and set up online access before your debit card arrives.

In some cases, TD sometimes freezes your account as a security measure if you try to update your address within 30 days of opening. To avoid this, you can initially use a Canadian address, and update it to your American address online a month later.

RBC Bank

RBC Royal Bank is partnered with RBC Bank (also known as RBC Georgia) in the US. Their basic account, RBC Direct Checking, has an annual fee of $39.50 (USD), covering 10 outgoing transactions (bill payments) per month. Each incoming wire transfer costs $15 (USD).

You can waive the fee for the first year by opening an RBC Bank credit card, such as the RBC Bank Visa Signature Black card. Note that while this card makes a good no-fee keeper as your oldest US credit card, it also counts against Chase’s “5/24 Rule” (where Chase won’t approve you for new credit cards if you’ve opened five or more personal credit cards in the past 24 months) without many benefits.

Canadians can open an RBC Bank account online. If you start with your Canadian address, you can change it immediately to your US one. You can link your Canadian- and US-domiciled accounts online, and instantly transfer funds back and forth.

CIBC US

CIBC is partnered with CIBC US. They offer a free checking account, but it’s only available if you have a US driver’s license, job, and social security number.

Instead, cross-border applicants can open a CIBC Bank USA Smart Account online, with verification by phone. There’s no monthly fee, and the account includes free bill payments and free incoming wire transfers.

Online transfers between your linked Canadian and US accounts are immediate. Also, you can create the account with your US address. No need to start with your Canadian one and update later.

BMO Harris

The Bank of Montreal is partnered with BMO Harris in the US. Their basic account, the BMO Harris Smart Advantage Account, has no monthly fee (if you choose paperless statements) and no minimum balance. It includes unlimited free bill payments and incoming wire transfers.

Canadians can open an account over the phone. Once you’re set up, you can easily change to a US address online. You can then seamlessly send money over the border from your Canadian login, usually by the next business day.

The account requires a minimum opening deposit of $25. This initial deposit is completed by money order. BMO Harris sends you a package, and you complete and return it by mail.

Scotiabank

Scotiabank doesn’t offer retail banking in the US. Boo, Scotiabank! If you primarily use them for your Canadian banking, I’d look to open an account with another bank here as you prepare for your US transition.

Choosing Your First US Bank Account

Each account has its strengths, but there’s not one that unquestionably stands above the rest. So what features should we look for when choosing a US bank account?

Most likely, if you’re keen to get your first US credit card quickly, you should stick with your primary Canadian bank and use their US partner. Once you’re set up, you can switch to a different one at any time.

RBC and CIBC are typically the fastest banks to attach a US address. It’s important to update your address as soon as possible, so you can use the bank to verify your identity when you begin applying for US credit cards.

Also, RBC and CIBC offer instant cross-border money transfers. This can be critical if your US-based account is running low and you’re scrambling to avoid missing a payment deadline.

On the other hand, banks often give poor rates on foreign currency conversions. You may prefer to buy US dollars from other online services at a better rate than what the bank offers. This would negate any benefit of the seamless integration at RBC and CIBC.

Depending on your funding method for your US bank account, you may receive money either as a domestic or international transfer. Domestic transfers usually use a US routing number and are included for free with basic bank accounts as an everyday transaction, akin to a cheque deposit.

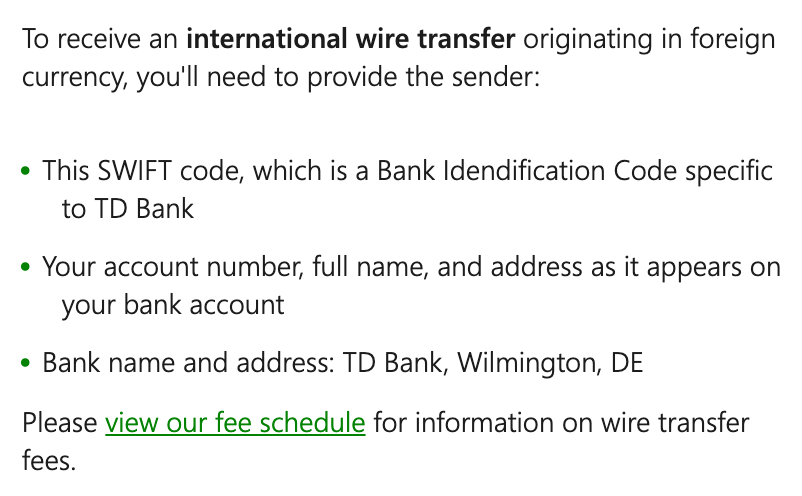

However, incoming international wire transfers often incur a fee. This is where CIBC and BMO shine if you expect to receive US funds this way. When sending money from Canada to TD Bank in the US, be careful to avoid using platforms that ask for a SWIFT code.

Day-to-day banking features, such as free ATM withdrawals and cheques, aren’t really that important to consider. There are other convenient ways to get cash while travelling, and it’s best not to choose a US bank account just for this – all you need is a no-frills bill payment vehicle.

In case you do need a feature like Zelle (basically the US version of Interac e-Transfer), the scales tip in favour of TD or BMO. They both offer more comprehensive US banking options, whereas RBC or CIBC are mostly aimed at cross-border Canadians.

Finally, you might also value customer service whenever foreign exchange is involved. The more moving parts there are in a system, the more likely something will go wrong. Few things are scarier than money in limbo.

There are many reports that TD’s teams, both at Cross-Border Banking and at TD Bank in the US, are highly competent and efficient at addressing any problems you might encounter.

However, for the long-term and on balance, BMO Harris might just be the most attractive option, with no monthly fees, no minimum balance, no incoming wire fees, and ease of use. The only drawback is that it’s not the fastest to set up.

Other US Banks

Once you’ve got a bit of US presence, it’s time to consider branching out to other institutions. You know, the ones that Americans actually use.

Chase

One of the most popular and lucrative credit card issuers in the US, the Chase ecosystem can nevertheless be a little delicate for Canadians to navigate.

Before approving a new client for premium cards, Chase likes to see responsible credit history. While the criteria aren’t precise, it’s generally advised to have at least a year on file with another issuer, at least two credit cards, and a healthy record of repayment on a card with a $10,000 limit.

However, due to their 5/24 Rule, opening new credit cards at any financial institution makes it temporarily harder to open Chase cards. But as Canadians, we need to start at other issuers to build our US credit history. We don’t have the luxury of starting young with Chase student cards to easily establish ourselves as clients.

Instead, we can build a relationship with Chase by opening a checking account. On your next trip to the US, you can do this at a branch with your Canadian passport – no ITIN necessary! There is some evidence to suggest that this may help with eventually getting approved for their premium credit cards.

The same principle could apply to any US credit card issuer that you’re interested in: see if you can open a bank account to strengthen your relationship.

US Bank Accounts with Welcome Bonuses

The US banking industry is incredibly competitive. It’s nowhere near as monopolized or centralized as our financial systems in Canada.

Instead, there are hundreds of institutions across the country, ranging from regional credit unions to banks like Chase that operate on a nationwide scale.

Fortunately for consumers, American banks of all shapes and sizes are often offering large cash bonuses on new checking accounts. The perks are almost as complex as the banking system itself, with all sorts of eligibility and qualification requirements.

As you delve deeper into the US rewards scene, you might want to explore any interesting opportunities available to you, depending on your location, identification documents, and US dollar cash flow.

Conclusion

A US bank account is necessary for Canadians with US credit cards, but not all cross-border banking arrangements are created equal.

It’s easy enough to get started with any of them, but there’s more to consider than simply defaulting to the American partner of your Canadian bank.

Over time, as your strategy develops, you can even look to expand your rewards ambitions to other American banks as well.

First-year value

$336

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Comments

Create a free account or become a member to comment.