American Express offers two very good credit cards to Canadians who wish to maximize their points earnings on dining: the American Express Cobalt Card, which offers 5 MR Select points per dollar spent on dining, and the American Express Platinum Card, which gives you 3 MR points per dollar spent.

Is it better to earn 5 MR Select points or 3 regular MR points when you’re eating out or hitting up the bars and pubs? As with most questions of this nature, the answer will vary quite a bit depending on your specific circumstances, so let’s get to the bottom of this.

A Brief History of Amex Dining Bonuses

Dining, which encapsulates spending at restaurants, coffee shops, and drinking establishments, was never a major multiplier category among American Express credit cards until the introduction of the Cobalt Card to much fanfare in September 2017.

The Cobalt, which caused a splash with its unprecedented 5x return on dining (in addition to groceries and food delivery services), was a product that was mainly targeted at the millennial crowd, a segment that Amex perceived to be frequently going out to eat and drink and would therefore highly value the increased rewards they earn.

However, a consequence that Amex might not have expected was the resulting imbalance between the elevated earning rates on the Cobalt Card, a product primarily geared towards younger customers with modest incomes, and those of its most high-end products like the Platinum Card, which at the time was only earning 1.25 MR points per dollar spent on all purchases.

Platinum cardholders, many of whom do indeed spend considerably on dining, felt justifiably aggrieved at the far superior return that was offered by a less glamorous product. And so, as part of the February 2019 updates to the Amex Platinum Card, the earning structure was changed from a flat 1.25x earning rate to a tiered structure that would offer 3x on dining.

That leaves the foodies, coffee lovers, and craft beer connoisseurs among us with a choice between the Cobalt and the Platinum: with both cards delivering strong earning rates on dining spend, which card do you chuck on the table when it comes time to pay the bill?

5x MR Select vs. 3x Regular MR

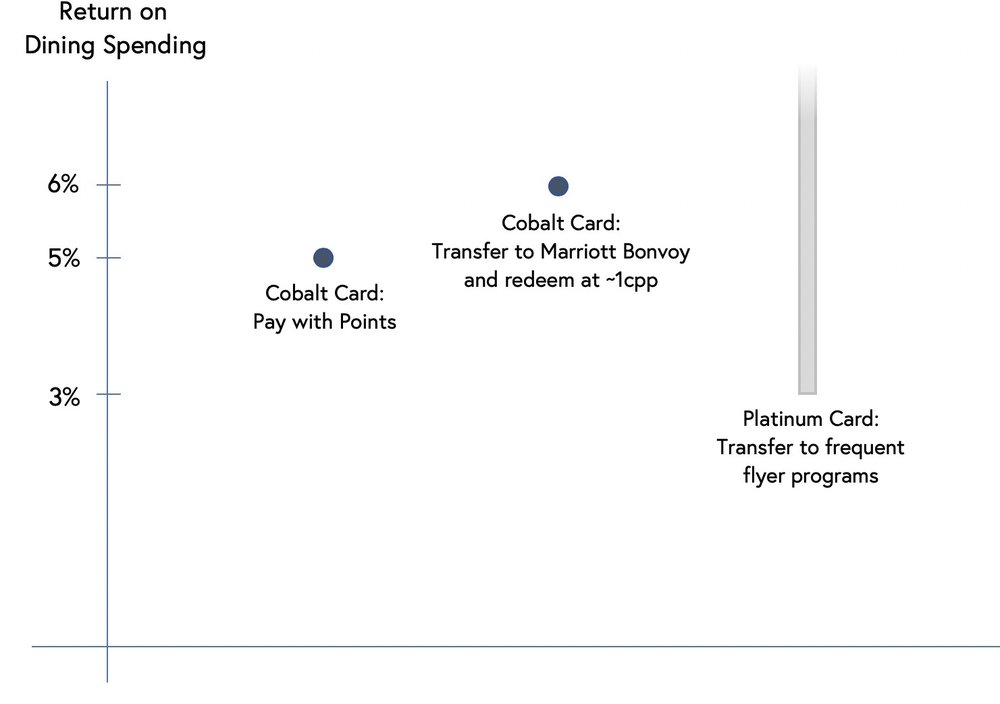

Let’s begin by looking at the earning rates themselves. The Cobalt Card’s 5 MR Select points per dollar spent is equivalent to, at a minimum, a 5% return on your spending in cash – think of it as a minimum 5% discount on your meal or drinks bill.

In addition, as I’ve discussed previously on the blog, MR Select points from the Cobalt Card can also be put to use through transferring to Marriott Bonvoy or booking trips via Amex Fixed Points Travel.

Of course, the above redemption methods are also available to the regular MR points you earn on the Amex Platinum Card. Therefore, with some quick maths (5 > 3), if you were to redeem your points through any of these methods, it would be ideal to maximize your dining spending on the Cobalt Card instead of the Platinum Card.

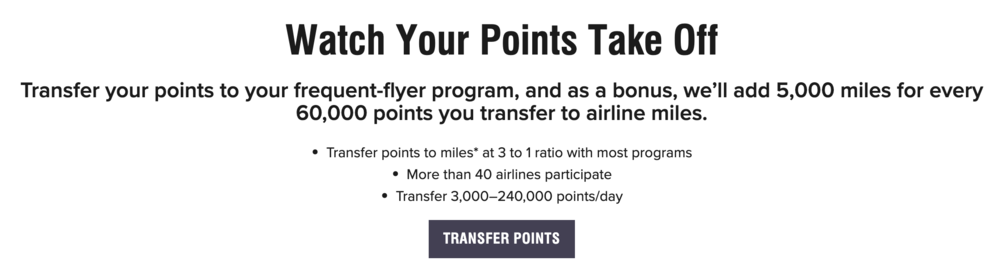

But the key factor to the decision-making is that the Platinum Card’s regular MR points have the ability to be transferred to airline frequent flyer programs, like Aeroplan or British Airways Avios at a 1:1 ratio, and this is where it’s possible to do much better by using the Platinum instead of the Cobalt.

After all, if we view the Cobalt Card’s 5x points earnings as equivalent to a 5% return, then you’d be doing better with the Platinum Card as long as you transferred your 3x MR points to Aeroplan and redeemed them at a value of 1.66cpp or greater. That’s a value that should be achievable even if you’re redeeming Aeroplan miles for only a North America round-trip flight in economy class, and if you’re shooting for higher-value redemptions like an Aeroplan Mini-RTW, then you’ll far surpass 1.66cpp without even blinking an eye.

Consider a more optimistic view of the MR Select points from the Cobalt Card. Let’s say that we could achieve a 6% return on your dining spending by transferring the 5 MR Select points to Marriott Bonvoy at a 1:1.2 ratio, and then redeeming Bonvoy points for hotels at a value of 1cpp (which I’d say is about average for Marriott Bonvoy).

Even then, the Platinum Card’s 3x earnings will remain the better option as long as you manage to get at least 2cpp in value from your Aeroplan miles. I’d say that 2cpp is a worthy target when you redeem miles for flights within North America or for flights in economy class, and premium class redemptions will continue to outstrip 2cpp quite easily.

Looking purely at the numbers, then, I’d say that the ability to transfer points to airlines makes the Platinum Card’s return of 3 MR points a clear winner compared to the Cobalt Card’s 5 MR Select points on dining spend.

Should You Get Either Card Just for Dining?

These decisions aren’t usually made in a vacuum, though. The above analysis will apply to you if you have both the Cobalt and Platinum cards and plan to continue holding onto both in the future. But I’d venture to guess that relatively few people are in that position – given the considerable overlap in the two cards’ earning category bonuses, I’d say that most people would be best-served by choosing one product between the Cobalt and Platinum to use for the long-term.

Therefore, we should look at how the overall value proposition of each card moves the needle as well. Looking at the annual fee, for example, the Cobalt’s annual fee of $120 (charged as $10 over twelve monthly statements) is far lower than the Platinum Card’s effective annual fee of $499 ($699, offset by an annual $200 travel credit).

Don’t forget that while the Platinum’s 3x regular MR points can deliver better value through transferring to airline partners, the Cobalt’s 5x MR Select points can in fact be transferred to airlines as well, in a roundabout way via Marriott Bonvoy. Once you’ve spent $10,000 on dining (and groceries and food delivery, for that matter), you’ll have earned 50,000 MR Select points, which can transform into 60,000 Marriott Bonvoy points and, in turn, 25,000 airline miles in the frequent flyer program of your choosing.

That’s not too far off from the 30,000 Aeroplan miles or Avios you would’ve earned by putting that $10,000 spending on the Platinum Card instead – certainly a small enough difference that it makes the far lower annual fee on the Cobalt Card seem quite attractive.

Meanwhile, the Platinum Card does have quite a few factors counting in its favour as well. These might include the higher signup bonus of 60,000 MR points (compared to the Cobalt’s 30,000–40,000 MR Select points) or the Platinum’s significant travel benefits, like complimentary Priority Pass membership and elite status with several hotels chains.

There’s also the recent development that the Cobalt now limits its 5x earnings to the first $30,000 in eligible purchases per year, whereas the Platinum imposes no such limit. If you spend truly significant amounts on dining every year (perhaps you’re on the office social committee and can easily rack up huge restaurant bills when throwing parties), then this is another factor to keep in mind.

I’d say that if you’re looking for a credit card to maximize your dining spend, your choice must take into consideration which card’s overall value package is better suited to your needs.

If you won’t be making much use of the Platinum Card’s ancillary benefits, then you probably fit within the Cobalt Card’s intended target audience, and it’ll be a very competitive product for earning points on food and drinks.

On the other hand, if you do find value in being a Platinum cardholder (that sweet signup bonus of 60,000 MR points can’t hurt either), then in my view it’ll be the best credit card out there for all your dining expenses.

Conclusion

Thanks in large part to the ability to transfer points to airline partners, the Platinum Card’s 3 MR points per dollar spent on dining expenses outperforms the Cobalt Card’s 5 MR Select points per dollar spent on the same purchases. As always, though, you should weigh up the overall value packages of both cards – the Cobalt’s lower annual fee vs. the Platinum’s stronger travel benefits – when deciding which card to get.