BMO has announced a number of changes to the insurance coverage on many of its credit cards, which take effect as of July 6, 2023.

It’s a bit of a mixed bag of positive and negative changes; however, the most notable amendment is the upcoming loss of flight and baggage delay coverage for award bookings.

Upcoming Changes to Insurance on BMO Credit Cards

BMO has announced a number of changes to insurance coverage on many of its credit cards, which will take effect on July 6, 2023.

The changes affect the following credit cards:

- BMO Ascend® World Elite®* Mastercard®*

- BMO AIR MILES®† World Elite®* Mastercard®*

- BMO eclipse Visa Infinite Privilege* Card

- BMO eclipse Visa Infinite* Card

- BMO CashBack® World Elite®* Mastercard®*

- BMO World Mastercard

- BMO World Elite®* Business Mastercard®*

- BMO AIR MILES®† World Elite®* Business Mastercard®*

- BMO Rewards® Business Mastercard®*

- BMO AIR MILES®† No-Fee Business Mastercard®*

The complete details for changes to each card are listed on the BMO website; however, we’ll highlight the most notable ones below.

It’s important to note that any bookings made before then will be bound by the current coverage on the credit cards, even if the date of travel is after July 6.

So, as long as you make your booking prior to July 6, 2023, you’ll be bound by the current suite of coverage on your credit card, and the upcoming changes won’t affect your travel. However, any bookings made on or after July 6, 2023, will be bound by the amended insurance coverage.

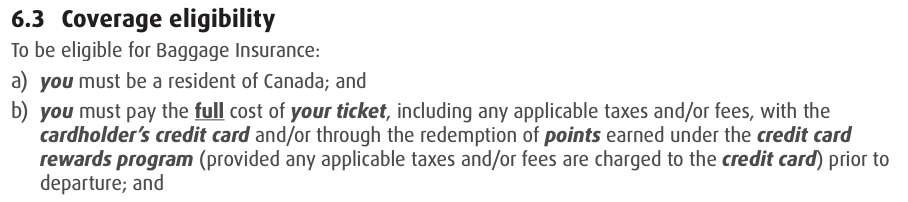

As a reminder, BMO’s suite of World Elite®†Mastercards currently covers award bookings from any program, since the language on the policies stipulates that you’re covered as long as you charge the full or partial cost of the trip to your credit card.

This means that by simply paying for the taxes and fees with an eligible BMO World Elite®* Mastercard®*, you’ll enjoy coverage for baggage and flight delays.

However, as of July 6, you’ll need to charge the full cost of your trip to a BMO credit card in order to be covered for flight delay or baggage delay insurance. This is a negative development for anyone who uses certain BMO credit cards to be covered for award bookings in the event of a baggage or flight delay.

Of the aforementioned credit cards, the insurance coverage on the BMO Ascend® World Elite® Mastercard®, the BMO eclipse Visa Infinite Privilege Card, and the BMO AIR MILES® World Elite Mastercard have the strongest overall packages.

Aside from the loss of flight and baggage delay coverage for award bookings, the most notable changes that will affect the BMO eclipse Visa Infinite Privilege* Card, and BMO AIR MILES®† World Elite® Mastercard® as of July 6, 2023, are as follows:

- Out-of-province and out-of-country emergency medical insurance coverage will increase from $2 million to $5 million per insured person, per trip

- Trip cancellation and trip interruption insurance will decrease from $2,500 to $1,500 per insured person for eligible expenses

- Car rental collision/loss damage will be extended to additional drivers whose names are listed on the rental car agreement

- Car rental accidental death & dismemberment and personal effects coverage will no longer be available

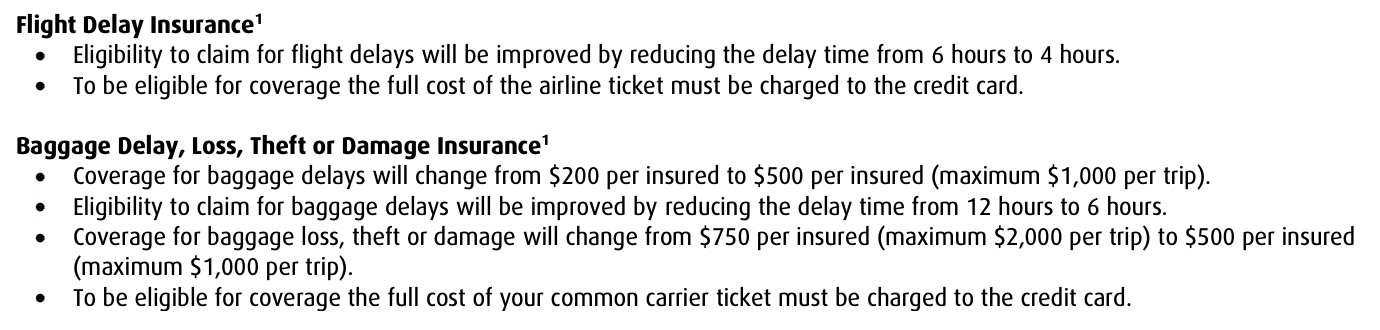

- Flight delay insurance will kick in after a delay of four hours instead of six hours

- Coverage for baggage delays increases from $200 to $500 per insured individual

- Baggage delay coverage kicks in after a delay of six hours instead of 12 hours

- Baggage loss, theft, or damage coverage decreases from $750 to $500 per insured

The most notable changes that will affect the BMO eclipse Visa Infinite Privilege* Card as of July 6, 2023, are as follows:

- Being diagnosed with an epidemic or pandemic disease will be added as a covered reason for trip cancellation/interruption insurance

- Car rental collision/loss damage will be extended to additional drivers whose names are listed on the rental car agreement

- Baggage loss, theft, damage, and delay insurance will only be included on your outbound trip. Essential items purchased due to a baggage delay upon returning to your home province or territory are not covered.

If you have any of the affected credit cards, be sure to give the changes a thorough read to see how you’ll be affected, if at all.

How to Ensure Insurance Coverage on Award Bookings

When these changes take effect, you’ll no longer be able to use any BMO credit cards to pay for the taxes and fees on an award booking and be covered for baggage and flight delays.

Once this happens, you’ll only be covered on award bookings that use the same points that you earn with the BMO credit card.

For example, you’ll continue to enjoy flight and baggage delay insurance on AIR MILES® bookings if you pay the taxes and fees with an AIR MILES® co-branded credit card.

Likewise, you’ll be covered for flight and baggage delays on a BMO Rewards booking if you pay for the remainder of the booking with a BMO Rewards credit card.

However, if you were to pay for the taxes and fees on, say, an Aeroplan booking with any BMO credit card, you won’t be covered for flight and baggage delay insurance.

Instead, you’ll need to pay with a different credit card altogether, such as the National Bank World Elite Mastercard or a co-branded Aeroplan credit card, to be covered for an Aeroplan redemption.

Generally speaking, the same holds true for any other award booking. Paying the taxes and fees on a WestJet Rewards redemption with a WestJet co-branded credit card will ensure coverage, whereas paying with most other credit cards won’t.

Therefore, it’s important to pay for the taxes and fees on an award booking with the right credit card. Otherwise, you might not be covered.

If insurance coverage for award bookings is important to you, consider adding the National Bank World Elite Mastercard to your wallet, especially since it has the best all-around insurance coverage for any Canadian credit card.

Of course, you may also enjoy protection through a private travel insurance plan, the Montreal Convention, EC261 (commonly referred to as EU261), or Canada’s Air Passenger Protection Regulations.

Conclusion

BMO has announced upcoming changes to the insurance coverage on many of its credit cards. While the changes are a mix of positive and negative across the board, the most notable amendment is the upcoming loss of coverage for flight and baggage delay insurance on most award bookings.

Be sure to give the changes a thorough read if you stand to be affected. The changes take effect on July 6, 2023, and until then, it’s business as usual.

Once again, any bookings made prior to July 6 will be covered by the current iteration of insurance, even if travel occurs after July 6.

† Terms and conditions apply. Please refer to the BMO Website for the most up to date information.